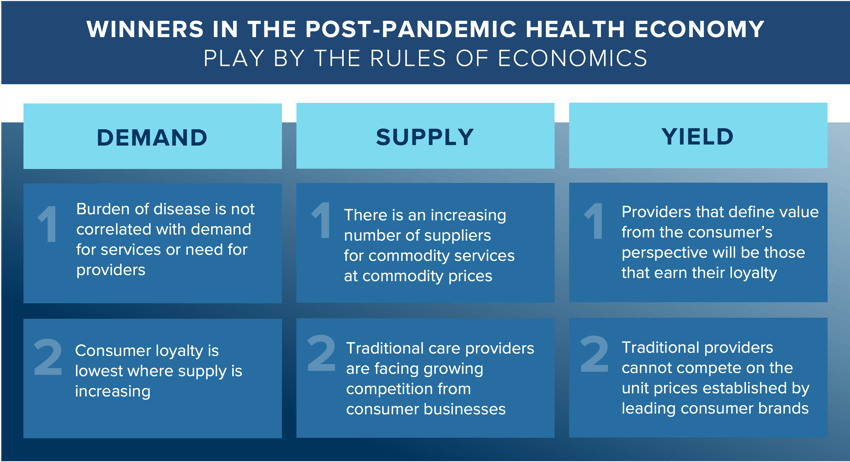

This week marks the final combined issue of The Compass and The Washington Compass for 2021. Many of you may recall that my rationale for starting this series was grounded in the fact that for decades, the U.S. health economy has operated as if the fundamental rules of economics – demand, supply, and yield – did not apply.

The central thesis underlying the commentaries of the last eight months is this: the mindset of disregarding the rules of economics is unsustainable, particularly for hospitals and health systems that operate in what game theorists call a “negative-sum game.”

While I have only scratched the surface in unveiling the data-driven trends shaping increasingly complex and competitive health economy, a few key principles have emerged from the analyses thus far.

DEMAND // refers to both the exogenous and endogenous factors that influence consumer preferences (e.g., location, price) and need for healthcare services (e.g., genetic predisposition).

-

-

Burden of disease is not correlated with demand for services or need for providers

Our industry has for far too long operated under the assumption that burden of disease is directly correlated to demand for healthcare services. Yet, analysis of both national and market-level data reveals fallacies in this widely held belief. Even in high population growth markets, demand is growing less than expected population due to the large migration of an overall younger demographic, requiring fewer surgical procedures.

Notably, we found that future demand will not be meaningfully impacted by either COVID-19 or the increasing obesity of Americans but rather by population migration and aging demographics. We forecast relatively flat demand across major surgical service lines, with an average growth rate between 0.7% to 1.9% year over year through 2025. Illustratively, we found that at the national level, average annual growth for both surgical and medical OB/GYN demand is projected to be 0.4%. However, at the regional level, there is wide variation, with the Midwest seeing a decline in both OB/GYN medical demand (-0.8%) and surgical demand (-0.7%), reinforcing that healthcare is local.

-

Consumer loyalty is lowest where supply is increasing

As consumer choice increases with more provider supply, consumers will gradually "split" their healthcare consumption across a number of brands. Healthcare providers that understand the psychology underlying the consumer’s decision-making process will be better positioned to earn the loyalty of healthcare consumers with abundant choices. Understanding the why behind consumer choice decisions is a competency that every stakeholder in the health economy have historically lacked. In studying other economies that have mastered the art of leveraging behavioral insights to build brand loyalty, psychographics are highly relevant. An individual's psychographic profile can inform their healthcare decision-making (e.g., vaccination, preferred sites of care, channel preferences). Additionally, although women typically utilize more healthcare services than men and make approximately 80% of the healthcare decisions for their families, they are slightly less loyal to provider networks than men. While the one-percentage point difference may seem inconsequential, the translation to an individual’s total share of care is significant. Ultimately, visibility into measures like consumer loyalty that can quantify those decisions will underly winning consumer engagement strategies.

-

SUPPLY // refers to the various providers of health services ranging from hospitals and physician practices to retail pharmacies, new entrants (e.g., Walmart, Amazon), and virtual care platforms.

-

-

There is an increasing number of suppliers for commodity services at commodity prices

In the aftermath of telehealth volumes spiking during the pandemic, a number of established companies have entered the market, joining early market entrants such as Teladoc and Amwell. The net effect, as previously written, is telehealth supply is already exceeding consumer demand. Whereas much of the current discussion in the industry has been around telehealth as a substitute good for select services, we must also consider that our patients, who are consumers, will always want the option to flex between modalities for a particular service. As the number of tele-enabled providers grows, we will inevitably see more suppliers competing for smaller, niche segments of corresponding demand. Perhaps not surprisingly, the decelerating demand for telehealth services is similar to the trends in the stock price for two of the largest tele-providers, Amwell and Teladoc. The laws of economics suggest that increasing supply in a market with flat demand will result in declining prices, and the entry of Amazon and Walmart into telehealth services will certainly create competitive pressures. Successful telehealth strategies in a post-pandemic health economy will hinge upon a precise understanding of which population segments will drive future utilization and how best to appeal to their respective preferences in a supply-rich economy.

-

Traditional care providers are facing growing competition from consumer businesses

Traditional healthcare providers (e.g., hospitals and health systems) are facing growing competition from new entrants, namely retail brands such as Walmart and Amazon. As more entrants expand the supply of available services, earning the consumer’s loyalty will be both increasingly important and challenging.

Primary care entrants (e.g., One Medical, Tia) and retail players (e.g., CVS, Walgreens, Walmart) pose stiff competition to traditional care providers. Health systems are already losing to these new competitors, with consumers increasingly obtaining primary care services outside of the health system network. Nationally, average demand for primary care services is projected to increase by 1.4% annually from 2021 to 2029. However, demand varies by state, ranging from 0.2% (West Virginia) to 2.6% (Idaho), influenced by factors such as population demographics, channel preferences, and migration patterns.

-

YIELD // refers to the intersection of demand and supply, which is also influenced by market factors such as policy regulations and reimbursement incentives.

-

-

Providers that define value from the consumer’s perspective will be those that earn their loyalty

Despite 50 years of health system consolidation, there is no dominant national hospital provider. Businesses like Amazon with a national customer base have a unique opportunity to expand their share of wallet with loyal customers. Notably, approximately 44% of Americans have an active Amazon Prime membership, while the largest U.S. health system, HCA Healthcare, serves just 1% of Americans. In an analysis of four major health systems, we found that no system delivered care to more than 21% of the consumers in their market, reinforcing the notion that healthcare consumers are not inherently loyal. In a separate analysis, our findings indicated that Medicare Advantage plans that proactively analyze the consumer attributes of their enrollees at the local market level will be more likely to retain and obtain loyal plan members. Inevitably consumers will seek healthcare services based on a multitude of factors (e.g., convenience, brand recognition, severity of illness, transportation, cost, network limitations). Every healthcare provider can improve consumer loyalty by developing evidence-based strategies that match provider supply and asset footprint with the needs and preferences of the individuals at the market level.

-

Traditional providers cannot compete on the unit prices established by leading consumer brands

Providers have felt price pressures for decades but are less prepared to engage with patients as consumers. Although healthcare was not the founding pillar of new retail entrants that are entering the healthcare space, their low unit prices and strong consumer loyalty uniquely position them to succeed in the post-pandemic health economy. The most significant threat from Walmart, CVS and Walgreens is increasing consumer options for low acuity services. These retailers offer a significantly lower (and transparent) price than traditional providers. Americans are increasingly concerned with growing healthcare costs, and the most price-competitive providers will appeal to price-conscious consumers. The inevitable increase of medically complex Medicare beneficiaries and decline in the commercially insured population compounded by the uncertainty of future payment rates will continue to heighten the financial pressures on health systems.

-

Healthcare is a negative sum game. While game theory is infrequently, if ever, openly discussed in our industry, nothing will have a more profound effect on the direction of the health economy in the next 20 years. I look forward to guiding us forward with more Compass data stories in 2022.

- New Entrants

- Cost of Care

- Patient & Provider Loyalty

- Healthcare Workforce

- Disease Burden

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)