It is no secret that telehealth utilization increased exponentially in the past year. Several researchers have attempted to quantify and characterize the magnitude of the telehealth spike, each leveraging a different calculation methodology. In our analysis of all-payer claims, we observe a 1015% increase in telehealth visits at the peak of the pandemic. As a result of the unprecedented increase in demand, we’ve seen health systems, payers, employers, and Wall Street financiers aggressively pursue telehealth expansion strategies based on (1) a belief that crisis accelerates existing trends, and (2) surveys indicating that both physicians and individuals who used telehealth during the pandemic are more likely to continue to use it.

Naturally, this would indicate a need to more precisely understand the post-pandemic demand for telehealth. Was the pandemic a catalyst to accelerate telehealth adoption as what economists define as a substitute good for in-person care or do consumers view telehealth as an inferior good to in-person care? Or is telehealth a commodity good, as Amazon and Walmart’s entry into telehealth might suggest?

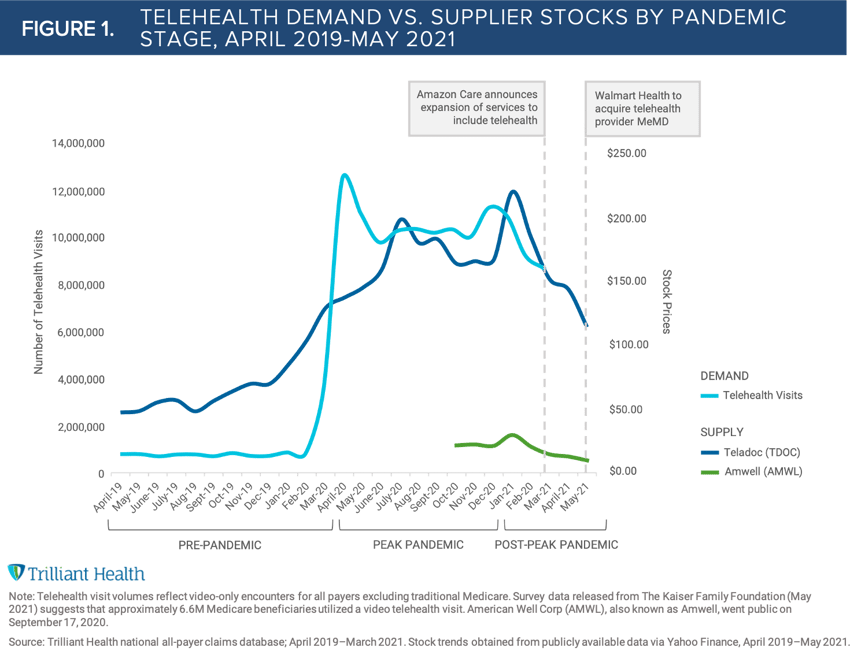

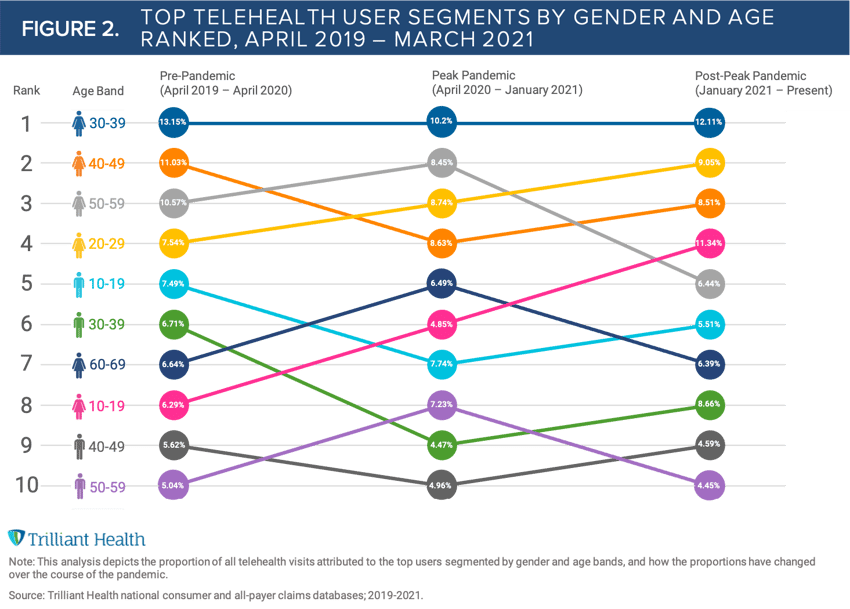

Did the COVID-19 pandemic accelerate the adoption of telehealth? Yes, but that growth is largely attributable to the law of small numbers, and utilization has already begun to taper (Figure 1). Did more individuals experience telehealth? Yes. But just because you used the service during the pandemic, does it mean you will continue to use the technology? Not exactly (Figure 2).

From October to December 2020 to post-peak months of January to March 2021, we have seen a 13.3% drop in telehealth visit volume. This decline is notable given some forecasts that telemedicine is a substitute good, one that consumers will increasingly and even rapidly adopt. Perhaps not surprisingly, the decelerating demand for telehealth services is similar to the trends in the stock price two of the largest tele-providers, Amwell and Teladoc. The laws of economics suggest that increasing supply in a market with flat demand will result in declining prices, and the entry of Amazon and Walmart into telehealth services will certainly create competitive pressures.

All to say, the post-pandemic demand for telehealth may not be as high as generally believed, and it is almost certainly utilized by discrete segments of the American population. To identify the specific drivers of future demand, we analyzed visit volume from the lens of who is consuming care in virtual mediums. For starters, approximately 38M Americans (12% of the population, excluding traditional Medicare beneficiaries) used telehealth last year. It is unlikely that individuals who did not try telehealth in 2020 will embrace it in the future. As previously discussed, we also know certain psychographics are more predictive of certain behaviors; in this case, self achievers and willful endurers are more likely to use telemedicine.

A detailed examination of telehealth reveals that 60% of telehealth users are women, consistent with pre-pandemic trends. Notably, more than 10M of the 38M people who utilized telehealth in 2020 were females between the ages of 30-39. By segmenting telehealth users by gender and age (Figure 2), we can ascertain potential demand shifts attributed to the pandemic. We find that telehealth utilization has changed in other age cohorts pre- and post-pandemic, with telehealth growing in popularity among women ages 20-29; and declining among women ages 40-49.

Over the past year, providers and policy makers have understandably focused on easing regulatory requirements for telehealth. As discussions continue around ways to expand parity and access, we must also consider the individual and their demand preferences. Even if aggregate telehealth visits remain at current levels or even increase, they will still be distributed over a relatively small segment of the total population. Successful telehealth strategies in a post-pandemic health economy will hinge upon a precise understanding of which population segments will drive future utilization and how best to appeal to their respective preferences in a supply-rich economy.

Supplemental Reading

- Medicare and Telehealth: Coverage and Use During the COVID-19 Pandemic and Options for the Future – Prior to CMS’s recent waiver (April 2021), video interaction was a prerequisite for classification as a telehealth visit. According to new survey data released by The Kaiser Family, 56% of Medicare beneficiaries who had a telehealth visit (between Summer and Fall of 2020) did so with a telephone (audio only).

- Takeaway: Factoring this survey data, we estimate approximately 15M Medicare beneficiaries had a telehealth during the peak of the pandemic, but only 6.6M were conducted via video. Applying the pre-waiver criteria to our all-payer claims analysis (which includes Medicare Advantage) to now include traditional Medicare, the total percentage of Americans who utilized telehealth in 2020 would be closer to 13% of the population (instead of 12%).

- Beware Amazon and the other Sirens of Telehealth – Commenting on Amwell leadership’s reaction to Amazon’s entry into telehealth, Trilliant’s President and CEO, Hal Andrews, outlines considerations for investing resources in an increasingly commoditized market.

- Takeaway: Telehealth suppliers like Amazon inherently have a competitive advantage given their core business model: efficiently matching supply to demand at scale. Health systems will be hard pressed to compete in a market where the overlap between consumer segments driving demand (i.e., commercially insured females ages 30-39) and Amazon Prime members is significant.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)