Provider Needs Assessment

Match provider supply to market demand

Data-driven insights for strategic growth, network alignment and regulatory compliance

Explore the Dataset

Healthcare workforce planning is broken.

Many health systems rely on data that is sufficient for regulatory compliance but inadequate to inform strategic decision making. Flawed data obscures important market dynamics – leading to capital misallocation pursuing non-existent opportunities, whether entering markets with too much supply or too little demand. The most strategic health systems justify workforce decisions with evidence, not estimates.

Static directories are outdated and imprecise, creating an inaccurate view of provider supply

National benchmarks ignore the nuances of local market dynamics

Lengthy turnaround times make insights outdated before they are delivered

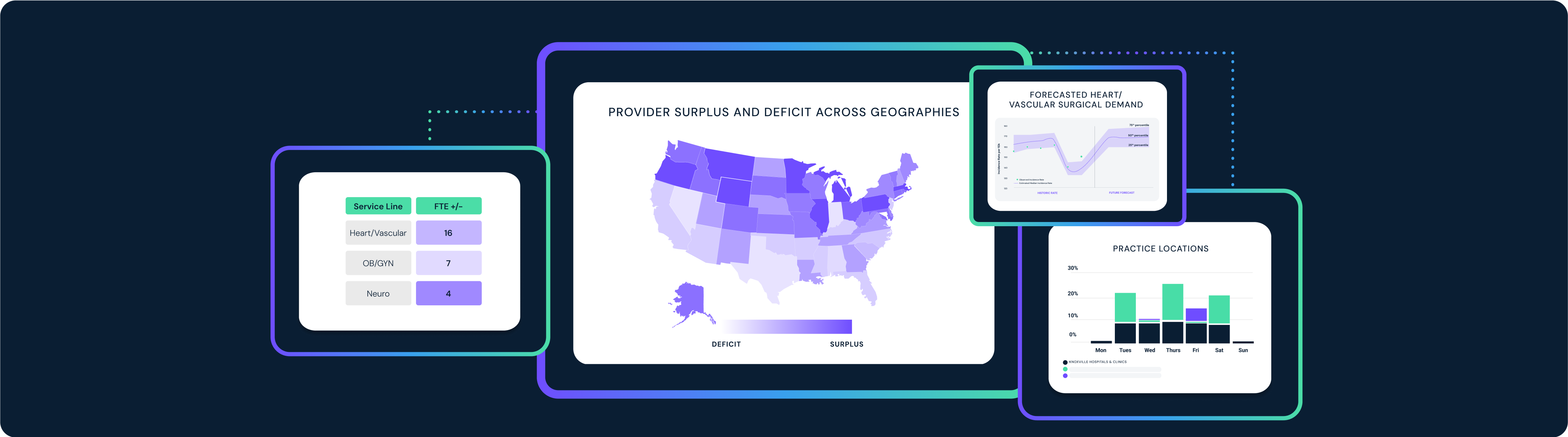

Right-size your network using real data

Understanding provider need is a balancing act – too few providers leads to lost revenue, while too many providers wastes precious resources. Find the right fit with real data, not guesswork.

Plan for tomorrow’s workforce

- Adjust Full-Time Equivalent (FTE) calculations based on provider age and practice locations

- Flag specialties at risk of retirement-driven gaps

- Guide recruitment with long-term workforce insights

Understand where care is delivered

- Understand care by practice location, not billing address

- Identify individual provider practice patterns across locations

- Avoid overstating clinical availability with multi-site views

Access near real-time provider data

- Review specialties based on current practice patterns

- Identify current provider affiliations, not outdated NPPES records

- Incorporate claims submissions to eliminate inactive or retired physicians from assessment

Use demand models tailored to your market size

- Apply benchmarks for rural, suburban and urban areas

- Reflect utilization with localized provider-to-population ratios

- Align workforce planning with local care dynamics

Pinpoint care gaps by geography

- Detect gaps at state, county and ZIP code levels

- Prioritize service line growth in areas of opportunity

- Identify opportunities for site expansion to meet local need

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)