.png?width=4560&height=656&name=Website%20(8).png)

Research

Original, data-rich research that equips healthcare leaders with

authoritative insights into trends shaping the health economy.

authoritative insights into trends shaping the health economy.

%20(1).png?width=7120&height=5648&name=HPPT%20White%20Paper%20(3)%20(1).png)

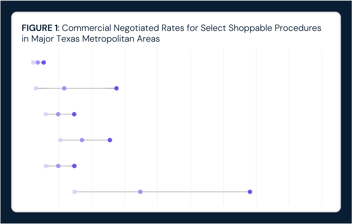

Health Plan Price Transparency

Leveraging Transparency in Coverage Data to Reveal Actionable Information on Commercial Negotiated Rates

This report analyzes health plan price transparency data to examine inexplicable differences in healthcare prices.

Intra-Market Rate Variation Can Lead to Spending Differences that Exceed $102M for a Single Orthopedic Procedure in Dallas-Fort Worth

Read More

In the Same Market, Medicare Episodes of Care Can Range Up to 80x

Read More

AI in Healthcare: Current Uses, Shared Challenges and Future Stakeholder Opportunities

Read More

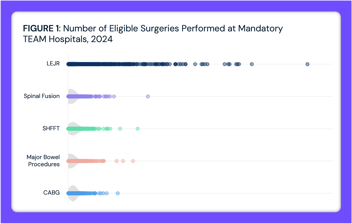

While Quality Is Relatively Comparable Across TEAM Hospitals, Financial Health Is Highly Variable

Read More

-2.png?width=354&height=224&name=Group%203%20(1)-2.png)

More Americans Are Dying at Home but Hospital-Based Deaths Remain Most Common

Read More

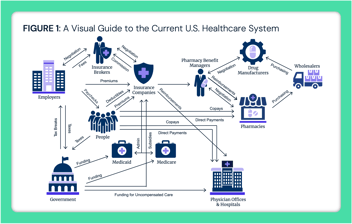

Middlemen in the U.S. Healthcare System: Shaping Costs and Complexity

Read More

.png?width=354&height=224&name=Group%201%20(14).png)

Primary Care Panels Vary in Size Based on Demographic Factors and Employment Structure

Read More

Potential Revenue Impacts of Elimination of the Medicare Inpatient Only List

Read More

Crunching the Numbers: Analysis of 2026 Healthcare Predictions

Read More

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)