Research

Winning in an Outpatient World: Preparing for Potential Changes to Medicare’s IPO List

August 5, 2025This Playbook was last updated on November 24, 2025.

In this Playbook, learn more about the Medicare Inpatient Only (IPO) list, explore the possible impacts its removal could have on provider revenues and consider strategies to combat financial losses.

- Background

- How Might Providers Be Affected by the Elimination of the IPO List?

- How Can Providers Prepare for the Broader Shift From Inpatient to Outpatient Care Settings?

- Conclusion

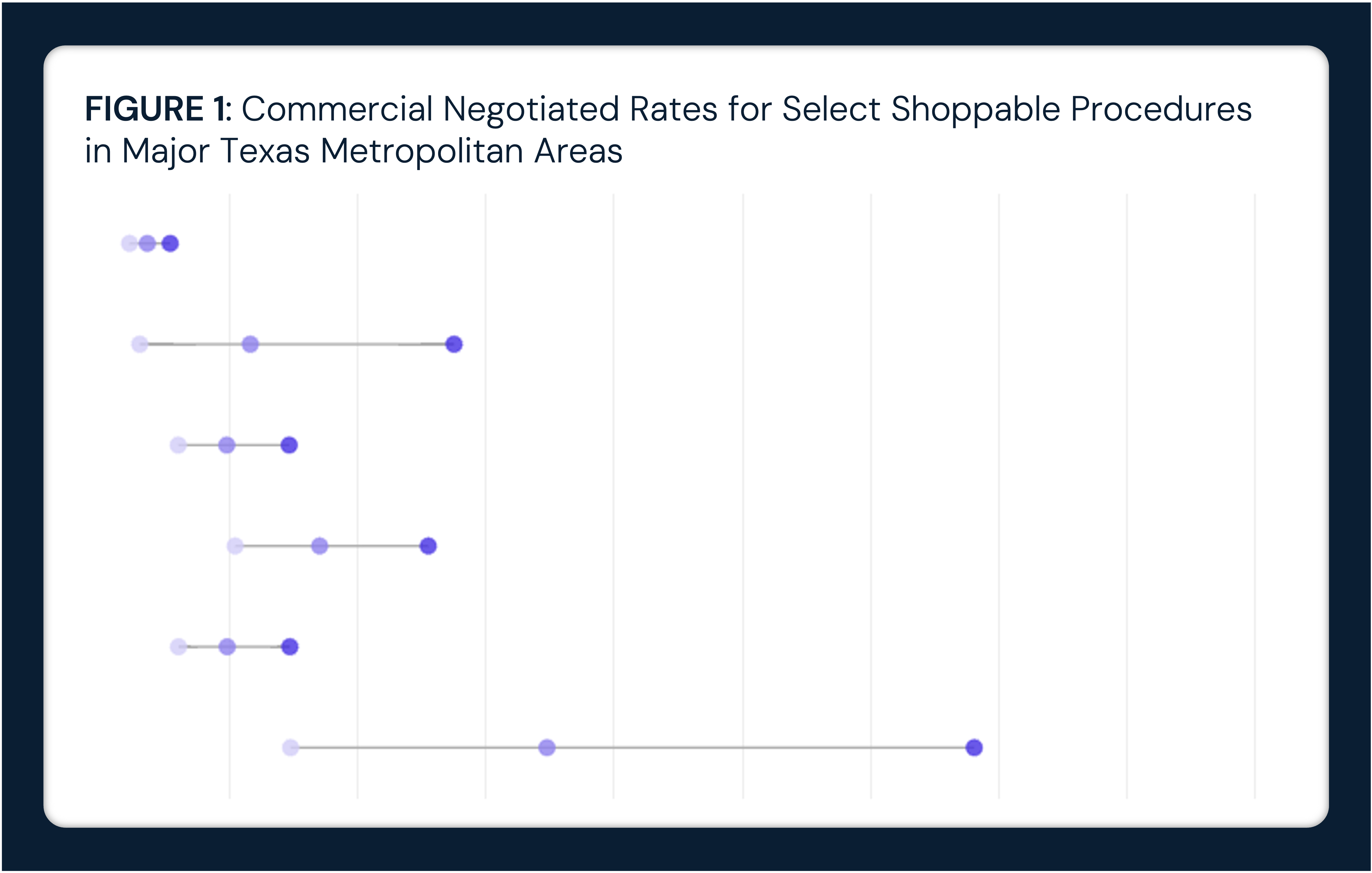

As healthcare delivery evolves, lower-cost care settings, such as ambulatory surgery centers (ASCs) and hospital outpatient departments (HOPDs), have emerged as viable alternatives to traditional inpatient care. These settings not only reduce costs but also align with consumer demand for greater convenience and accessibility. Advances in medical technology, changes in reimbursement models and the broader shift toward decentralized, consumer-centric care have accelerated the migration of procedures once exclusive to hospitals. Today, joint replacements, coronary stent placements and chemotherapy are increasingly performed in outpatient facilities, reducing costs and hospital resource utilization (Figure 1).

This transition is part of a broader cycle of innovation, where technological and clinical advancements enable treatments to move to lower-acuity settings. Historically, procedures that are now routine in outpatient facilities, such as orthopedic and cardiovascular interventions, originated in inpatient settings before advancements made their migration feasible. However, as inpatient demand declines in some areas, new complex procedures, like CAR-T cell therapy, emerge to sustain hospital-based care. This cycle raises critical questions: Will future innovations continue this pattern? Or will new advancements fundamentally disrupt the existing hospital-outpatient dynamic as healthcare systems face mounting resource constraints and evolving patient expectations?

One of the key drivers of the shift to outpatient surgical care has been the Medicare Inpatient Only (IPO) list, which designates procedures that Medicare reimburses only when performed in an inpatient hospital setting. In the CY 2026 Outpatient Prospective Payment System (OPPS) proposed rule, CMS proposed a three-year phaseout of the IPO list, beginning with the removal of 285 mostly musculoskeletal procedures. This proposal marks the most significant regulatory effort to expand outpatient eligibility since the Trump Administration’s initial phaseout plan, which was reversed by the Biden Administration in 2022. Though CMS has not finalized the policy, the reintroduction of IPO list elimination suggests momentum is building behind further deregulation of surgical site-of-service restrictions.

This renewed proposal coincides with broader bipartisan efforts to address healthcare cost growth through site-neutral payment reform, which would align Medicare reimbursement for the same services and procedures in outpatient settings. The current policy landscape includes legislation in states such as Indiana that would cap nonprofit hospital prices at a percentage of Medicare rates, signaling growing scrutiny of high-cost inpatient hospital services. While the IPO list’s future will be determined in the final OPPS rule later this year, the broader shift toward lower-cost outpatient and ambulatory care is expected to continue, with long-term implications for providers that rely heavily on inpatient revenue. Health systems must prepare for a reimbursement environment where site-neutral payments and shifts in surgical volume away from inpatient settings may become a defining economic challenge. Strategic responses may include service line reprioritization, new revenue diversification strategies and investment in outpatient capabilities to remain competitive.

Background

The Medicare Inpatient Only (IPO) list was established in 2000 as part of the OPPS final rule to identify procedures that CMS would reimburse only when performed in a hospital inpatient setting.1 The current list includes 1,731 procedure codes that CMS has determined require inpatient-level care based on complexity, expected recovery time, and patient safety risk.2 CMS reviews the IPO list annually and may add or remove procedures through the OPPS and ASC payment system rulemaking process.3

The IPO list has been a central focus of Medicare policy changes in recent years (Figure 2). During the Trump Administration, CMS began phasing out the IPO list, starting with the removal of total knee arthroplasty (TKA) in 2018, followed by total hip arthroplasty (THA) in 2020. In 2020, CMS finalized a plan to eliminate the IPO list entirely over three years, beginning with 298 musculoskeletal and spinal procedures. Concurrently, CMS expanded the ASC Covered Procedures List (CPL) by adding 267 new codes.4,5 However, in 2022, the Biden Administration reversed this direction, reinstating the IPO list and removing hundreds of codes that had been added to the ASC CPL, citing safety concerns and the need for further procedural review.6  Now, in the CY 2026 OPPS proposed rule, CMS has revived the plan to eliminate the IPO list, starting with 285 procedures. Of those, 271 are also proposed for addition to the ASC CPL. In addition, CMS proposed adding another 275 procedures to the ASC CPL, bringing the total number of newly eligible outpatient procedures in 2026 to 547. CMS also proposes to continue its policy of temporarily exempting removed procedures from medical review under the two-midnight rule, which shields hospitals from audits and automatic claim denials based solely on inpatient versus outpatient status during the transition. While the policy is not yet final, CMS’s intent to solicit input on future removals indicates that full elimination of the IPO list remains a likely policy direction.

Now, in the CY 2026 OPPS proposed rule, CMS has revived the plan to eliminate the IPO list, starting with 285 procedures. Of those, 271 are also proposed for addition to the ASC CPL. In addition, CMS proposed adding another 275 procedures to the ASC CPL, bringing the total number of newly eligible outpatient procedures in 2026 to 547. CMS also proposes to continue its policy of temporarily exempting removed procedures from medical review under the two-midnight rule, which shields hospitals from audits and automatic claim denials based solely on inpatient versus outpatient status during the transition. While the policy is not yet final, CMS’s intent to solicit input on future removals indicates that full elimination of the IPO list remains a likely policy direction.

Historical trends indicate that the removal of procedures from the IPO list corresponds with notable declines in inpatient volume. For example, inpatient admissions for Medicare beneficiaries undergoing total knee replacements declined by 17.9% in the year following their removal from the IPO list in 2018, while inpatient volume for total hip replacements fell by 35.0% after their removal in 2020 (Figure 3). As additional procedures are removed from the IPO list, utilization in ASCs and other outpatient settings is expected to increase. Although the IPO list applies specifically to Medicare, its impact extends beyond the Medicare population. Many commercial insurers reference Medicare policy when establishing their own coverage determinations.7 Among commercially insured patients, hip and knee procedures represent the fastest-growing category of ASC surgeries, with ASC volume increasing by 139.3% between 2019 and 2023.8

Although the IPO list applies specifically to Medicare, its impact extends beyond the Medicare population. Many commercial insurers reference Medicare policy when establishing their own coverage determinations.7 Among commercially insured patients, hip and knee procedures represent the fastest-growing category of ASC surgeries, with ASC volume increasing by 139.3% between 2019 and 2023.8

As Federal regulators and policymakers consider potential changes to the IPO list, hospitals and health economy stakeholders overall must prepare for the possibility of declining inpatient volumes and associated revenue impacts. Whether via regulatory action or general industry dynamics, the continued acceleration of more care shifting to outpatient settings is likely to continue to shape the financial landscape for all healthcare stakeholders.

How Might Providers Be Affected by the Elimination of the IPO List?

The financial impact of the ongoing shift toward outpatient care can be illustrated by examining hip and knee replacements, procedures that have already seen a significant transition to outpatient settings, such as ASCs.

Consider a current-state scenario where approximately 70% of hip and knee replacements (553K procedures annually) are rendered inpatient and 30% (237K procedures) occur in ASCs (Figure 4). For this example, average Medicare reimbursement rates are used to estimate financial impact. Medicare reimburses inpatient facilities at $18.2K per procedure, on average, and ASCs at $10.5K, on average, resulting in a total annual spending of approximately $12.5B. If in a future scenario the distribution shifts to 50% inpatient and 50% outpatient, total annual spending would decline to approximately $11.3B, representing a $1.2B annual reduction in spending. While a $1.2B decline in spending for joint replacements could appear less drastic when distributed across thousands of U.S. hospitals, the broader financial implications become more pronounced when considering similar shifts across hundreds to thousands of surgical procedures. If inpatient volumes decline for more surgical procedures currently included on the IPO list, hospitals — particularly those financially reliant on inpatient surgeries — could face substantial downward financial pressures.

While a $1.2B decline in spending for joint replacements could appear less drastic when distributed across thousands of U.S. hospitals, the broader financial implications become more pronounced when considering similar shifts across hundreds to thousands of surgical procedures. If inpatient volumes decline for more surgical procedures currently included on the IPO list, hospitals — particularly those financially reliant on inpatient surgeries — could face substantial downward financial pressures.

To assess the potential impact of eliminating the IPO list, an analysis was conducted to estimate Medicare reimbursement declines if procedure volumes shifted to outpatient settings, focusing on three procedures still on the IPO list: hysterectomies, coronary artery bypass grafts (CABGs) and colectomies. Annual Traditional Medicare volumes for each procedure were approximated using national all-payer claims. Average inpatient Medicare reimbursement rates were utilized to estimate financial impact. Given that Medicare does not have ASC reimbursement rates for procedures on the IPO list, estimates were derived for the three elected procedures by applying the inpatient-to-ASC reimbursement ratio for total joint replacements, where the ASC rate is 57.8% of the inpatient rate.

Each year, approximately 190K hysterectomies are performed within the Medicare population. Under the current state where Medicare will only reimburse certain hysterectomy procedure codes if delivered in an inpatient setting, where the reimbursement rate is $19.5K per procedure, on average, total Medicare spending would amount to approximately $3.7B (Figure 5). In a scenario where this procedure was eliminated from the IPO list and 30% of procedure volume shifted to ASCs — at an estimated reimbursement rate of $11.2K — total spending would decline to $3.2B. A 50/50 distribution between inpatient and outpatient settings would further reduce spending to $2.9B, while a more substantial shift — 70% of procedures performed in ASCs — would lower spending to $2.6B, representing a potential $1.1B reduction in Medicare reimbursement.  Each year, approximately 100K CABG procedures are performed within the Medicare population. Under the current state, where Medicare reimburses all CABG procedures in inpatient settings at an average rate of $56.9K per procedure, total Medicare spending amounts to approximately $5.7B (Figure 6). In a scenario where this procedure is eliminated from the IPO list and 30% of volume shifts to ASCs, at an estimated reimbursement rate of $32.8K, total spending would decline to $5.0B. A 50/50 distribution between inpatient and outpatient settings would further reduce spending to $4.5B, while a more substantial shift — 70% of procedures performed in ASCs — would lower spending to $4.0B, representing a potential $1.7B reduction in Medicare reimbursement.

Each year, approximately 100K CABG procedures are performed within the Medicare population. Under the current state, where Medicare reimburses all CABG procedures in inpatient settings at an average rate of $56.9K per procedure, total Medicare spending amounts to approximately $5.7B (Figure 6). In a scenario where this procedure is eliminated from the IPO list and 30% of volume shifts to ASCs, at an estimated reimbursement rate of $32.8K, total spending would decline to $5.0B. A 50/50 distribution between inpatient and outpatient settings would further reduce spending to $4.5B, while a more substantial shift — 70% of procedures performed in ASCs — would lower spending to $4.0B, representing a potential $1.7B reduction in Medicare reimbursement. Each year, approximately 150K colectomies are performed within the Medicare population. Under the current state, where Medicare reimburses all colectomies in inpatient settings at an average rate of $37.0K per procedure, total Medicare spending amounts to approximately $5.5B (Figure 7). In a scenario where this procedure is eliminated from the IPO list and 30% of volume shifts to ASCs, at an estimated reimbursement rate of $21.2K, total spending would decline to $4.8B. A 50/50 distribution between inpatient and outpatient settings would further reduce spending to $4.4B, while a more substantial shift — 70% of procedures performed in ASCs — would lower spending to $3.9B, representing a potential $1.7B reduction in Medicare reimbursement.

Each year, approximately 150K colectomies are performed within the Medicare population. Under the current state, where Medicare reimburses all colectomies in inpatient settings at an average rate of $37.0K per procedure, total Medicare spending amounts to approximately $5.5B (Figure 7). In a scenario where this procedure is eliminated from the IPO list and 30% of volume shifts to ASCs, at an estimated reimbursement rate of $21.2K, total spending would decline to $4.8B. A 50/50 distribution between inpatient and outpatient settings would further reduce spending to $4.4B, while a more substantial shift — 70% of procedures performed in ASCs — would lower spending to $3.9B, representing a potential $1.7B reduction in Medicare reimbursement. When considering these three procedures collectively, the aggregate financial losses could reach as much as $4.4B if 70% of volume shifts to outpatient sites, such as ASCs (Figure 8). Given that the IPO list includes nearly 1.8K procedures, the potential financial impact of widespread migration to outpatient settings could be substantially larger than $4.4B for the Medicare population alone.

When considering these three procedures collectively, the aggregate financial losses could reach as much as $4.4B if 70% of volume shifts to outpatient sites, such as ASCs (Figure 8). Given that the IPO list includes nearly 1.8K procedures, the potential financial impact of widespread migration to outpatient settings could be substantially larger than $4.4B for the Medicare population alone. Not all inpatient procedures will shift — or should shift — to outpatient settings, and clinical appropriateness will remain a key factor in payer and provider decision-making, even in the absence of regulatory constraints. However, the cycle of innovation suggests that as surgical techniques and technologies continue to advance, many procedures will gradually transition to outpatient alternatives. Though this shift will likely happen progressively, providers that proactively prepare for these changes will be better positioned to navigate system-wide shifts in reimbursement and care delivery standards.

Not all inpatient procedures will shift — or should shift — to outpatient settings, and clinical appropriateness will remain a key factor in payer and provider decision-making, even in the absence of regulatory constraints. However, the cycle of innovation suggests that as surgical techniques and technologies continue to advance, many procedures will gradually transition to outpatient alternatives. Though this shift will likely happen progressively, providers that proactively prepare for these changes will be better positioned to navigate system-wide shifts in reimbursement and care delivery standards.

How Can Providers Prepare for the Broader Shift From Inpatient to Outpatient Care Settings?

Given the growing emphasis on lower costs and greater accessibility, health systems can no longer afford to take a passive approach to the shift toward outpatient surgical care. Relying on the “status quo” is not a viable long-term strategy, particularly if the IPO list is eliminated, accelerating the migration of procedures to alternative care settings. Instead, a proactive strategy of investing in or partnering with ASCs can help health systems adapt to these changes while also diversifying revenue streams.

Some health systems are already making significant progress in alternate-site investments. While physician ownership still dominates the ASC market, ownership trends are shifting. Between 2022 and 2023, the share of independently operated ASCs declined from 70% to 68%, while hospital ownership of at least one ASC increased from 41% in 2019 to 48% in 2023 (Figure 9). Additionally, nearly all hospitals that own an ASC now operate more than one, with 47% of hospital-owned ASCs belonging to systems that own at least two facilities. Several large health systems have been particularly active in expanding their ASC portfolios. Tenet Health, through its subsidiary United Surgical Partners International (USPI), has emerged as the largest ASC operator, increasing its market share by 9.0 percentage points between 2019 and 2023 (Figure 10). HCA, another major ASC market entrant, also saw its market share rise by 0.3 percentage points during the same period. This trend is reflected in recent expansion efforts: of the ASCs announced, opened or under construction in 2024, nearly 70% were developed by hospitals or health systems. Notably, as they acquire ASCs, both Tenet and HCA are also completing multiple hospital sales, reflecting a growing belief that the future of healthcare delivery will not be sustainable in inpatient settings alone.9

Several large health systems have been particularly active in expanding their ASC portfolios. Tenet Health, through its subsidiary United Surgical Partners International (USPI), has emerged as the largest ASC operator, increasing its market share by 9.0 percentage points between 2019 and 2023 (Figure 10). HCA, another major ASC market entrant, also saw its market share rise by 0.3 percentage points during the same period. This trend is reflected in recent expansion efforts: of the ASCs announced, opened or under construction in 2024, nearly 70% were developed by hospitals or health systems. Notably, as they acquire ASCs, both Tenet and HCA are also completing multiple hospital sales, reflecting a growing belief that the future of healthcare delivery will not be sustainable in inpatient settings alone.9  While some health systems are adopting the strategy to construct and open new ASCs, others are pursuing partnerships and joint ventures to establish and manage outpatient surgical networks. For example, Ascension, a St. Louis-based health system, has centered ASC expansion at the core of its growth strategy, adding 21 ASCs between 2021 and 2024 and setting a goal of expanding to more than 100 facilities in the coming years.10 Similarly, Bon Secours Mercy Health has partnered with Compass Surgical Partners to develop more than 30 ASCs across multiple states.11 In the Pacific Northwest, MultiCare Health System has joined forces with Atlas Healthcare Partners to build and operate an ASC network.12

While some health systems are adopting the strategy to construct and open new ASCs, others are pursuing partnerships and joint ventures to establish and manage outpatient surgical networks. For example, Ascension, a St. Louis-based health system, has centered ASC expansion at the core of its growth strategy, adding 21 ASCs between 2021 and 2024 and setting a goal of expanding to more than 100 facilities in the coming years.10 Similarly, Bon Secours Mercy Health has partnered with Compass Surgical Partners to develop more than 30 ASCs across multiple states.11 In the Pacific Northwest, MultiCare Health System has joined forces with Atlas Healthcare Partners to build and operate an ASC network.12

Health system leaders are increasingly recognizing the strategic importance of ASC partnerships. A 2024 survey found that 60% of health system executives are considering joint venture partnerships for ASCs, signaling a broad industry shift toward outpatient surgical investments.13,14 As the regulatory landscape evolves and the financial implications of shifting surgical volumes become clearer, health systems that proactively invest in ASC strategies – whether through direct ownership or strategic partnerships – will be better positioned to thrive in an increasingly outpatient-focused healthcare environment.

Conclusion

The aggregate financial losses associated with the three procedures analyzed could reach $4.4B if 70% of their volume shifts to outpatient settings. However, these procedures account for only a fraction of all Medicare inpatient surgeries performed annually. Thus, the potential losses from the migration of Medicare surgeries to outpatient settings would be significantly greater than $4.4B. A harbinger of this reality, the number of Traditional Medicare inpatient surgeries declined by roughly 30% from 2018 to 2023. While impacted by multiple factors (e.g., Medicare Advantage enrollment growth), declining inpatient surgical volume is already occurring, and this shift will only be accelerated by the potential removal of the IPO.

The shift to outpatient care presents significant challenges, not only for health systems, but all health economy stakeholders. While payers could see savings as care transitions to outpatient settings, utilization could increase, potentially increasing their aggregate spending. Device manufacturers will also be affected by the overall lower reimbursement rates in outpatient settings, which will lower the amount providers are willing to pay for medical devices, pressuring manufacturers to reduce prices, potentially impacting their revenue and profit margins. All stakeholders will need to realign their strategies to meet the changing demands of patient care. In the negative-sum game of healthcare, competing effectively means winning key battles, cutting losses early, losing less frequently and losing by a smaller margin than the competition. However, achieving any of this requires a data-driven, forward-thinking approach. Without such a strategy, hospitals and their partners are poised to struggle as inpatient revenues decline.

The shift to outpatient care does not need to come at the expense of health systems. Although alternative care settings offer great promise to reduce costs and increase access, challenges persist, including care fragmentation and questions about long-term cost-effectiveness. Health systems that can offer a cohesive, flexible approach to healthcare delivery with both inpatient and outpatient care offerings will be best positioned to prioritize patient outcomes, optimize resources and adapt to the evolving healthcare system. Ultimately, proactive strategies, data insights and thoughtful integration will be essential to navigate these challenges ahead and ensure that the shift to outpatient care benefits all stakeholders.

- Strategy

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)