Research

Medicare Advantage Utilization Remained Relatively Flat from 2022 to 2023, While Utilization by Care Setting Was Variable

July 21, 2025Study Takeaways

- From 2018 to 2023, aggregate MA healthcare utilization increased by 19.9% across all care settings but declined slightly by -1.1% from 2022 to 2023. From 2018 to 2023, enrollment in MA increased by 55.7%, suggesting some correlation between utilization growth and enrollment.

- Non-hospital outpatient care accounted for the highest volume of utilization over the period but declined by -1.2% from 2022 to 2023.

- In 2023, MA healthcare utilization by site of care varied among national MA plans. Physician visits as a percentage of total utilization varied from 32.2% for Humana to 68.8% for Anthem.

In January, the Centers for Medicare and Medicaid Services (CMS) issued the 2026 Advance Notice – an annual regulation that updates payment policies for Medicare Part C (i.e., Medicare Advantage (MA)) and Medicare Part D (i.e., Medicare drug coverage) – proposing a 2.23% increase in MA plan base payments for 2026, compared to last year’s 0.16% reduction.1,2 The final policies in the CY 2026 Rate Announcement are projected to result in an increase of 5.06% in MA payments to plans.

The MA market was volatile in 2024, driven by unfavorable 2023 financial results from several payers, mounting cost-containment pressures and program changes.3,4 In addition to financial challenges, MA plans have been scrutinized by consumers with respect to coverage denials and costs and by policymakers with respect to risk adjustment and prior authorization.5,6,7,8 MA plans attributed poor financial performance in 2023 to higher-than-anticipated care utilization, which prompted us to examine trends in MA healthcare utilization since 2018, by care setting.

Background

Over the past two decades, MA enrollment has grown substantially, increasing from 6.6M in 2000 to over 32.8M in 2024. MA enrollment now represents 54% of all Medicare enrollment and is expected to increase to 64% by 2034.9,10 MA payments totaled $393B in 2022, and spending is projected to grow 99.4% from 2023 to 2031, as compared to a projected 56.4% increase in spending for Traditional Medicare. The projected growth in enrollment and spending, coupled with reports of excessive MA healthcare utilization and declining financial performance for MA plans, underscores the need to analyze utilization patterns by care setting.

Analytic Approach

Leveraging national all-payer claims, we analyzed MA patients between 2018 and 2023. The analysis was limited to patients with at least three MA medical encounters in the period. The MA patient cohort was analyzed in aggregate and segmented into three age groups: ages 0-64 – which includes individuals under 65 with end stage renal disease or certain disabilities – ages 65-79 and ages 80 and older. We segmented all healthcare utilization associated with the patient cohort by nine care settings: non-hospital outpatient, hospital inpatient, hospital outpatient, physician office, emergency department, ambulatory surgery center (ASC), urgent care, home health and telehealth. Finally, trends in MA patient healthcare utilization in 2023 were examined for select payers with significant MA membership: UnitedHealthcare, Anthem, Aetna, Humana and Centene.

Findings

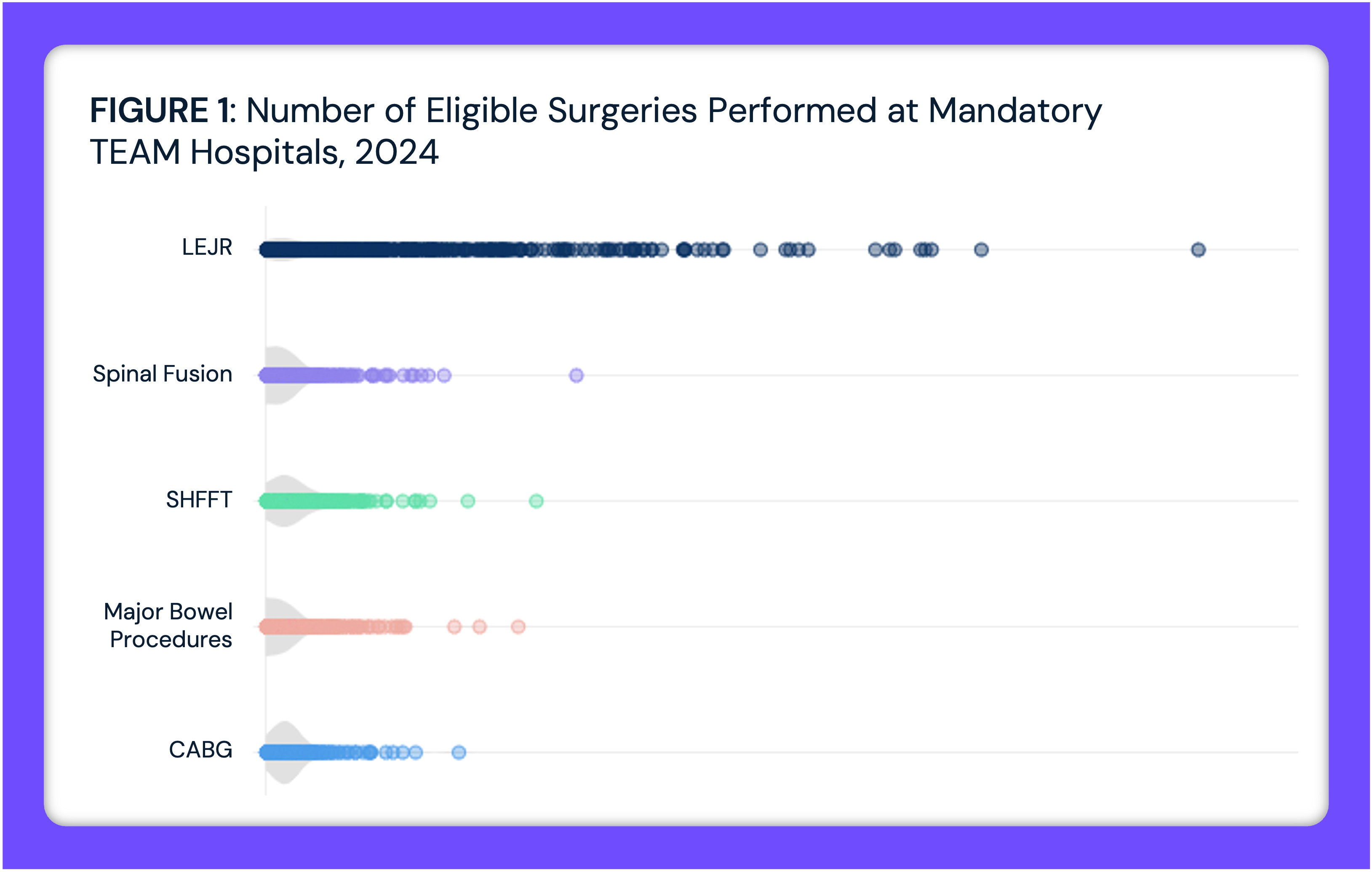

From 2018 to 2023, aggregate MA healthcare utilization increased by 19.9% across all care settings but declined slightly by -1.1% from 2022 to 2023 (Figure 1). This increased utilization is not surprising given the 55.7% increase in MA enrollment over the period, suggesting some correlation between utilization growth and enrollment growth. As a comparison, overall all-payer visit volume only increased by 1.9% from 2018 to 2023.

Non-hospital outpatient care consistently accounted for the highest volume of utilization over the period but declined by -1.2% from 2022 to 2023 (Figure 2). In contrast, physician office visits grew steadily over the period and also between 2022 and 2023 (2.6%). Despite increasing in 2018 and 2019, home health utilization decreased year-over-year from 2020 through 2023, dropping by 26.4% from 2022 to 2023. Hospital inpatient visits for MA enrollees in our analysis increased by 3.6% from 2022 to 2023 in comparison to a slight decrease in hospital admissions for Traditional Medicare beneficiaries during the period. Additionally, hospital outpatient (3.2%), emergency department (1.9%) and ASC (3.2%) visits increased modestly from 2022 to 2023 for the MA enrollees in our analysis. In contrast, urgent care visits declined by 8.5%, and telehealth visits declined by 16.0% in the same period.

📌 The graph below is interactive. Hover over the point(s) for more information.

Between 2018 and 2023, MA healthcare utilization changed notably across age segments and care settings. Non-hospital outpatient visits grew substantially from 2018 to 2023, with increases of 70.0% for ages 0-64 and 56.8% for ages 65-79, but a decline of 23.4% for enrollees ages 80 and older (Figure 3). This variation by age, in part, reflects simultaneous enrollment increases. Additionally, MA enrollees under age 65 are generally more medically complex relative to the rest of the MA population. However, there was a marked deceleration in volume growth from 2022 to 2023, as utilization grew by 1.0% for enrollees ages 0-64 and 3.2% for enrollees ages 65-79.

📌 The graph below is interactive. Hover over the bar(s) for more information.

In 2023, MA healthcare utilization by site of care varied across national payers. Physician visits as a percentage of total utilization varied from 32.2% for Humana to 68.8% for Anthem (Figure 4). Hospital outpatient visits ranged from 2.2% for Anthem to 11.6% for Humana. Emergency department visits ranged from 0.4% at Anthem to 2.0% at Humana.

Conclusion

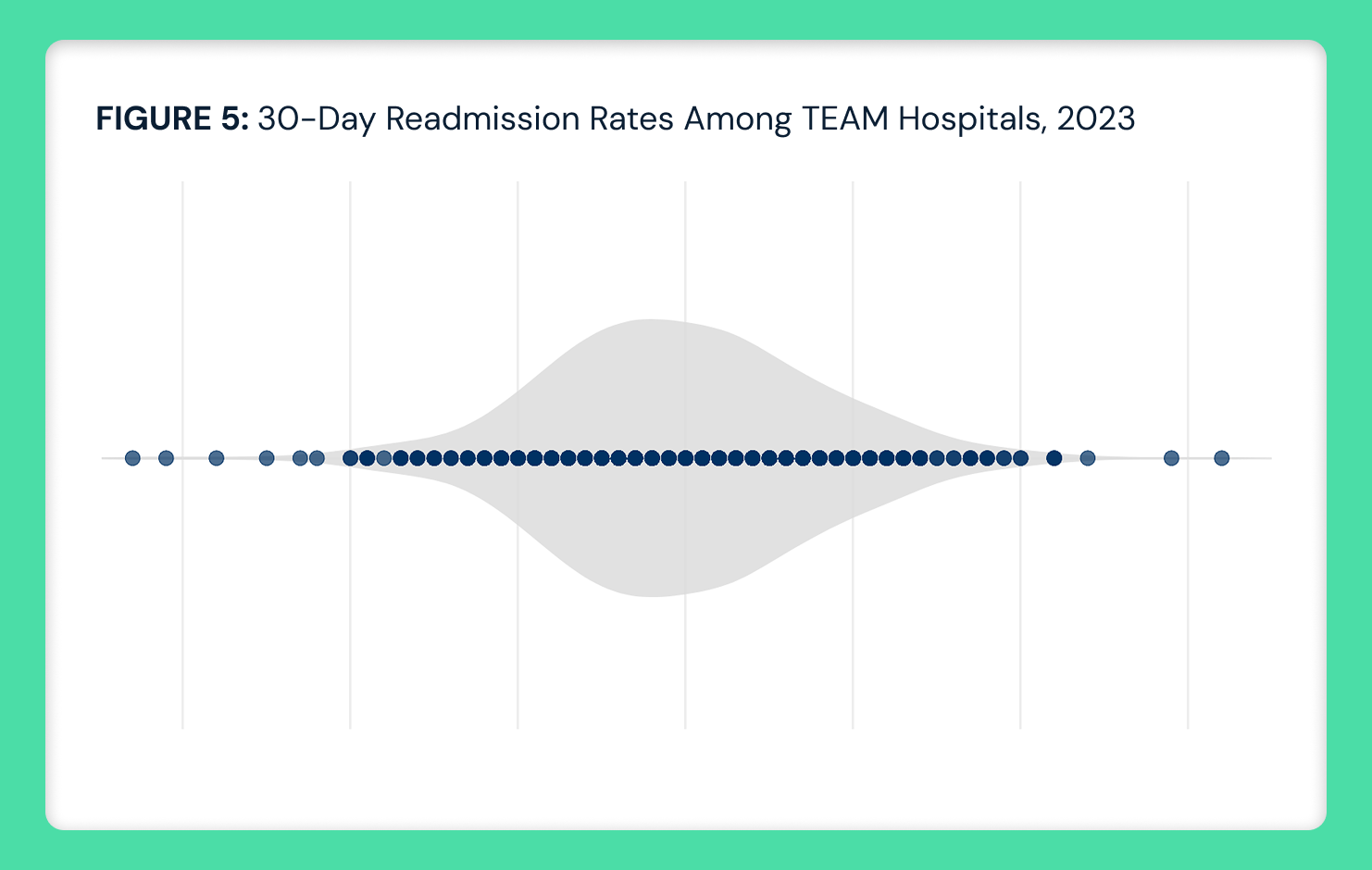

Longitudinal analysis of MA healthcare utilization provides important insight into the evolving MA market. While these findings broadly align with concerns raised about the financial challenges reported by MA payers, overall utilization remained relatively flat from 2022 to 2023, declining by -1.1%. There were decreases in utilization for some care settings (e.g., non-hospital outpatient, urgent care) and modest increases for other care settings, notably hospital inpatient, which is the costliest setting. While the 2023 financial performance of MA plans can be explained in part by utilization, the magnitude of that utilization increase relative to enrollment growth does not fully explain the financial results of certain payers.

With projected spending growth outpacing that of Traditional Medicare, and amid heightened legislative scrutiny over risk adjustment and prior authorization practices, the finalized 5.06% increase in MA plan payments for 2026 presents both an opportunity and a challenge for the Trump Administration. Policymakers will need to balance the need for cost containment with ensuring continued access to high-quality care. Additionally, ongoing reductions in supplemental benefits and plan offerings require careful attention, as these changes could diminish satisfaction and access to care. The inclusion of high-cost drugs like Ozempic in Medicare’s price negotiation list further illustrates the potential for reducing financial burdens while maintaining coverage.

- Studies

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)