Key Takeaways

-

New entrants can deliver health services efficiently and conveniently to consumers, but the closed-loop nature of new entrant models simultaneously introduces disintermediation.

-

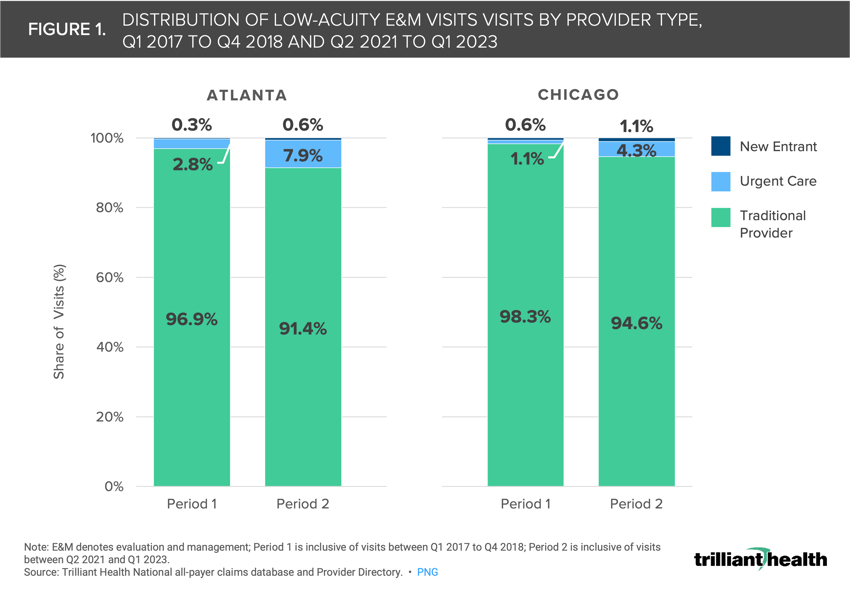

Despite the growing supply and convenience of new entrants, traditional providers continue to deliver most low-acuity care (i.e., outpatient/office and preventive care). However, the share of low-acuity services delivered by new entrants and urgent care facilities in Atlanta and Chicago, two markets with a relatively high concentration of new entrants, has increased slightly since 2017.

-

Compass+ Exclusive:

-

Analyzing Share of Low-Acuity Utilization by Care Setting

-

Medicare Advantage Utilization of Low-Acuity Care Settings

-

You are currently viewing the public version of The Compass.

To unlock additional analyses, upgrade your subscription to the Compass+ platform.

Last week, we analyzed CVS and Walgreens’ strategic investments in primary care and the extent to which new entrant models can successfully compete – and find financial success – in that market.1 These models focus on integrating low-acuity patient-provider interactions, prescription drug access and shopping for consumer goods within a single location. These models are designed to create a closed-loop transaction-based system and to disintermediate other providers of similar goods and services, particularly traditional primary care business models focused on longitudinal care coordination.2,3 As a result, retail-based primary care business models may impede a patient’s ability to navigate the broader healthcare system for higher acuity services they need outside of that closed-loop system (e.g., cancer treatment, surgery). Given these tradeoffs and the growing “Dr. Google effect”, we were interested in analyzing the impact of new entrants on patterns of low-acuity care utilization.4

Background

Over the past decade, new entrants have begun to offer direct-to-consumer options for low-acuity care. While these models cater to growing consumer demand for convenience, cost transparency and flexibility in healthcare, they have also introduced disintermediation. Accessible primary care is a critical bulwark against the continuing decline in the health status of Americans, as are care coordination and effective chronic disease management. While new entrants may offer an alternative to traditional primary care for certain low-acuity conditions, challenges arise when patients require care beyond the closed-loop system, resulting in “friction costs” such as time, money and potentially adverse health outcomes.

It is unlikely that new entrants can scale to replace traditional primary care, given that the U.S. would need an additional 218,000 primary care providers – inclusive of MD/DO physicians, nurse practitioners and physician assistants specializing in primary care – to meet the needs of every American under the new entrant model based on the patient panel of new entrants (an average of 584 patients per provider) versus traditional providers (944 patients per provider).5 While new entrants have increased sites of care by introducing alternate settings, national primary care utilization remains low, declining by 6.3% between 2021 and 2022.6,7

To gauge the impact of new entrants on low-acuity care delivery, we analyzed 1) where patients receive low-acuity and primary care services in markets with a relatively high concentration of new entrants, 2) how much care is being utilized and 3) any shifts in these patterns since the expansion of new entrants across the health economy.

Analytic Approach

Utilizing Trilliant Health’s national all-payer claims database and Provider Directory, we compared the distribution of in-person visits at locations rendering office or outpatient (CPT codes 99202-99215) and preventive (CPT codes 99381-99429) evaluation and management (E&M) services over two time periods – Q1 2017 to Q4 2018 (Period 1) and Q2 2021 to Q1 2023 (Period 2) – for patients ages 18 and older, excluding vaccination encounters. We identified markets where CVS, One Medical, VillageMD and Walmart have expanded care delivery assets: Atlanta-Sandy Springs-Alpharetta GA and Chicago-Naperville-Elgin IL-IN-WI. We grouped the provider organizations into three cohorts: new entrants, traditional providers and urgent care facilities. We also examined utilization trends specific to Medicare Advantage (MA) patients.

Findings

In both markets and both time periods, traditional providers delivered the majority of low-acuity E&M care, although the distribution varied by market. However, new entrants and urgent care facilities slightly increased their share of care in both markets over time (Figure 1). In Period 1, new entrants delivered 0.3% of low-acuity E&M care in Atlanta and 0.6% in Chicago. In Period 2, new entrants increased their share of care to 0.6% in Atlanta and 1.1% in Chicago. In Atlanta, the share of low-acuity E&M care at urgent care facilities increased from 2.8% in Period 1 to 7.9% in Period 2. However, new entrants still delivered less than 1% of low-acuity E&M care in Atlanta and approximately 1% of care in Chicago, or 1 in 100 visits in the market.

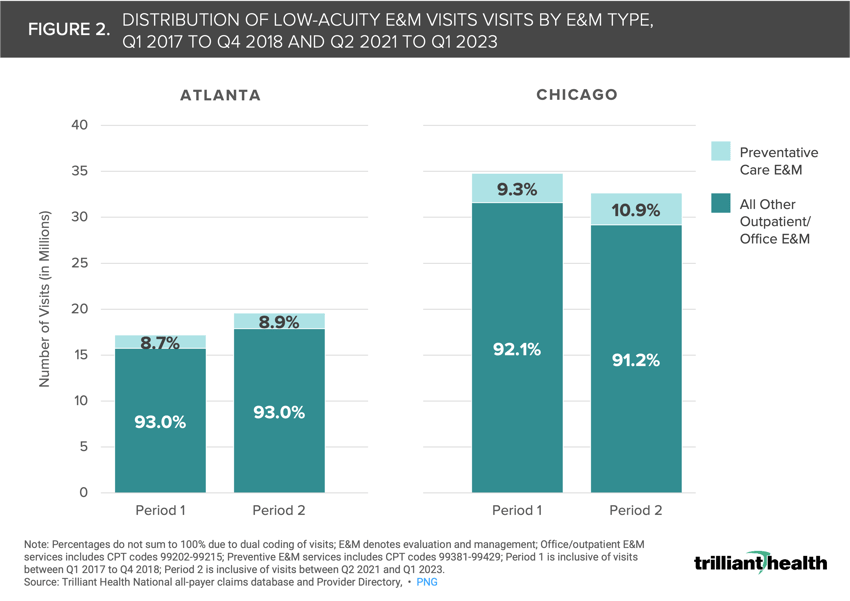

In both Periods 1 and 2, all other outpatient/office E&M visits constituted the majority of low-acuity E&M care in both markets (Figure 2). From Period 1 to Period 2, the share of preventive E&M visits nominally increased in share from 8.7% to 8.9% in Atlanta and 9.3% to 10.9% in Chicago. Changes in the volume of all low-acuity care varied by market, influenced by population sizes and migration trends. While Chicago has a larger population than Atlanta, its population declined by 0.5% between 2018 and 2022, while Atlanta’s population grew by 4.4%.8,9

Compass+ Exclusive:

- Analyzing Share of Low-Acuity Utilization by Care Setting

- Medicare Advantage Utilization of Low-Acuity Care Settings

Unlock the complete analysis with Compass+

Unlock the complete analysis with Compass+

Conclusion

While traditional providers still deliver most low-acuity E&M care, nearly one in 100 low-acuity encounters occur at new entrants in Atlanta and Chicago despite their scale in those markets. Notably, new entrants have not markedly impacted utilization of preventive primary care services. Despite the introduction of numerous new access points by new entrants and urgent care facilities, preventive visits still represent less than 10% of all low-acuity E&M visits.

Furthermore, despite slower growth or declines in the share of outpatient/office care, the increased proportion of preventive care at traditional providers in both Atlanta and Chicago during Periods 1 and 2 indicates that patients in these markets still prefer traditional providers for preventive services such as screenings, annual check-ups, and disease management. At the same time, patients are increasingly turning to new entrants and urgent care facilities for other low-acuity needs (e.g., flu symptoms, COVID-19 testing, medication refills). The stagnant utilization patterns for low-acuity care, despite the emergence of new entrant care settings, raise doubts about the ability of new entrants to scale, increase access and acquire patients from traditional providers.

With the rising prevalence of chronic conditions (e.g., type 2 diabetes) and higher-acuity conditions like cancer, as well as ongoing primary care provider shortages, accessible and affordable care is crucial. Moreover, the introduction of more options for both low-acuity and preventive care have not altered utilization patterns for patients, suggesting that accessibility and even affordability are not enough to encourage patients to seek out primary care. What steps can both non-traditional and traditional providers take to encourage patients to utilize preventive services? Will population health improve, or worsen, if additional access points for primary care are opened but more fragmentation is introduced?

Thanks to Austin Miller and Sarah Millender for their research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)