Studies Archive

Consumer Behaviors Are Starting To Manifest in Patient Decision Making

October 29, 2023Key Takeaways

-

As large retailers like Amazon, CVS, Walgreens and Walmart expand primary care services, patient choices increasingly reveal a preference for on-demand care outside of traditional care pathways.

-

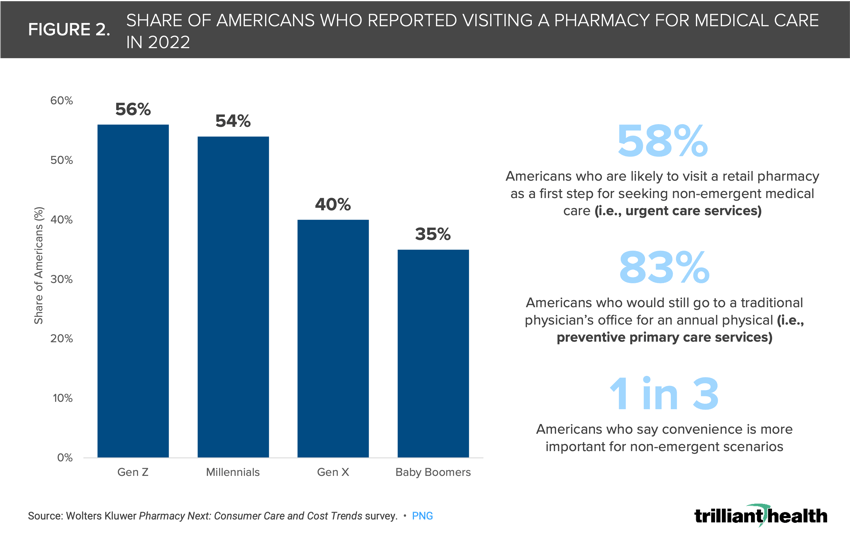

In 2022, more than half of Americans (58%) reported seeking non-emergent care from a retail pharmacy, with younger patient cohorts exhibiting a greater preference for this type of care, and a growing number of Americans cite websites as their most trusted source for health advice.

-

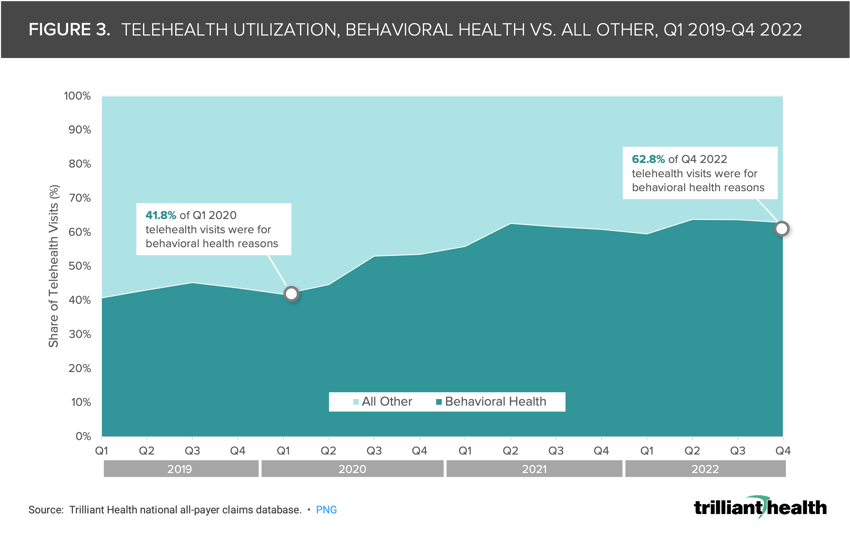

Although overall telehealth utilization has declined, the utilization of telehealth for behavioral health increased from 41.8% to 62.8% between Q1 2020 and Q4 2022, suggesting that consumers view telehealth as an appropriate substitute for low-acuity in-person behavioral health care, if little else.

In our 2023 Health Economy Trends Report, we examined the tepid projected demand trajectory for healthcare services over the next five years.1 As demand levels off, every health economy stakeholder, particularly providers, must understand both patient needs and preferences to compete effectively for a declining number of commercially insured patients.2

Historically, patients had limited choices of where they could receive care (e.g., hospitals, emergency departments or physician practices), so patient preference was less important. In contrast, American consumers expect convenient goods and services tailored to their unique preferences in every other part of their life. As large retailers like Amazon, CVS, Walgreens and Walmart expand primary care services and offer abundant choices for where and when patients receive care, patient choices increasingly reveal a preference for on-demand care outside of traditional care pathways (e.g., retail care, alternative medicine).

Traditional providers who are reluctant to align care delivery with patient preferences should at least understand patient preferences to compete with new entrants in a shrinking market of commercially insured patients. Likewise, traditional providers eager to innovate to align with patient preferences must understand that consumer loyalty requires more than expanded hours, additional sites and an EMR portal.

Patients Exhibit High Trust in “Dr. Google” and a Preference for Retail Pharmacy for Low-Acuity Care

Patients are consumers, and their approach to the healthcare system varies based on unique psychographic, demographic and behavioral characteristics. Consequently, it is impossible for a single healthcare provider or care setting to cater to the preferences and requirements of every individual.

As their options increase, consumers increasingly select care settings based on their preference and understanding of their clinical needs. For example, a patient might choose urgent care for cold/flu treatment based on convenience but opt for their primary care provider if symptoms persist, warranting a more comprehensive assessment. While many Americans still prefer traditional care pathways and sources of medical information, certain demographic groups prefer convenient care and health advice.

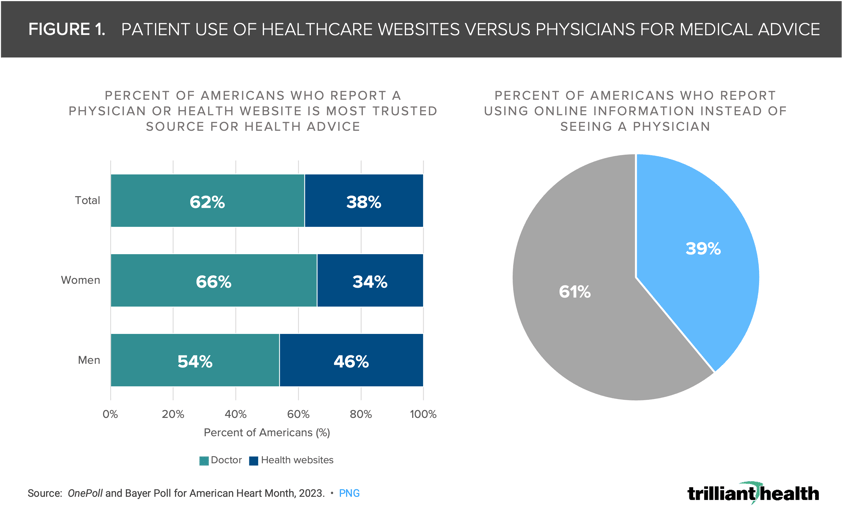

A growing number of Americans report high trust in online sources (i.e., “Dr. Google”). Nearly half of men (46%) cite websites as their most trusted source for health advice, compared to one-third (34%) of women (Figure 1). While most Americans cite a physician as their most trusted source for health advice, relying on online information increases the likelihood of encountering inaccurate, irrelevant or medically unsound health information.

Moreover, in 2022, 58% of Americans reported a likelihood to seek non-emergent care from a retail pharmacy (Figure 2). Notably, younger patients exhibited a preference for retail pharmacy, with 56% of Gen Z patients and 54% of millennial patients reporting receiving medical care at a pharmacy. These preferences are likely impacting the frequency with which patients seek medical care and contributing to higher patient acuity, two realities that are already manifesting in declining primary care volumes (-6.3%) and increased morbidity and mortality in individuals younger than 40 years.3

Consumers Do Not View Telehealth as a Substitute for In-Person Care

Despite a demonstrated preference for more convenient healthcare access, telehealth utilization signals that patients do not view telehealth as a substitute for in-person care for most conditions, except for behavioral health. Since 2019, telehealth utilization has increased consistently for the treatment and management of behavioral health conditions, rising from 41.8% to 62.8% between Q1 2020 and Q4 2022 (Figure 3). Tapering telehealth demand suggests that consumers largely view telehealth as an appropriate substitute for low-acuity in-person behavioral health care, if little else (e.g., chronic condition management or cancer treatment).4,5 Further confirmation of this trend is CVS/Aetna’s recent announcement to reduce the number of telehealth services for which it provides reimbursement.6

Post-pandemic telehealth supply far outpaces consumer demand, and further investment in telehealth capabilities for non-behavioral health conditions is misaligned with revealed patient preferences. For example, even in the most populous markets, telehealth utilization is slowing, and the rate of change varies by individual market. Analysis of the top ten CBSAs by population found that year-over-year telehealth utilization growth slowed from 2020 to 2022 in all but one market (Figure 4).

To compete in a healthcare market with abundant supply of quick, convenient and low-acuity care that generates low margins, stakeholders must consider patient preferences, which are increasingly trending towards convenience. Adapting to these shifts is vital, but not all innovations are equal. It is fair to question the strategy of any provider investing in telehealth other than for low-acuity behavioral health. It is impossible to design a health system that meets the diverse needs of all patients, which is why Amazon and Walmart cater to a very specific – and limited – number of clinical conditions that leverage their massive scale and consumer relationships.

In our next study, we examine how these new entrants have broadened patient options for care, but also have introduced more fragmentation in the healthcare delivery system.

Update: for the latest on this topic, including the rise of direct-to-consumer prescribing and diagnostics, read our 2025 Trends Shaping the Health Economy report.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)