Key Takeaways

-

Despite healthcare expenditures tripling between 2000 and 2021, the physical and mental health status of Americans is spiraling downward, particularly for younger age groups who represent most of the commercially insured market.

-

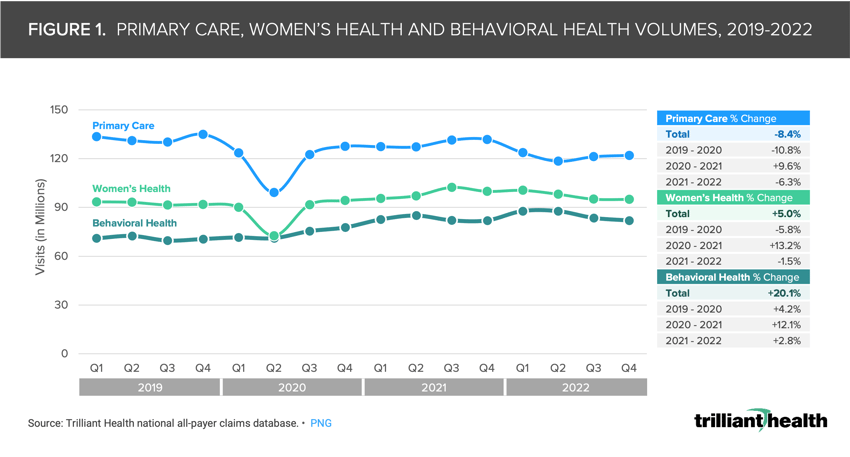

Since 2019, volumes for primary care have declined 8.4% while rising 20.1% for behavioral health, despite shortages in the behavioral health workforce.

-

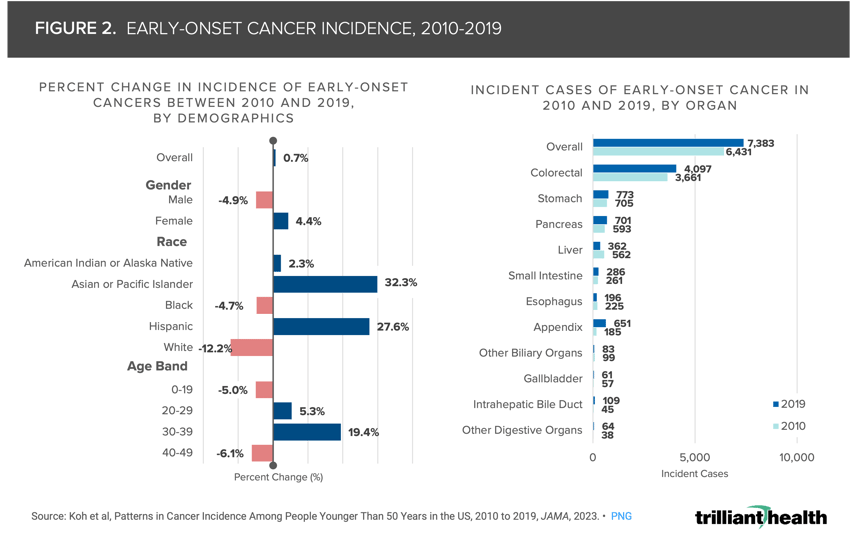

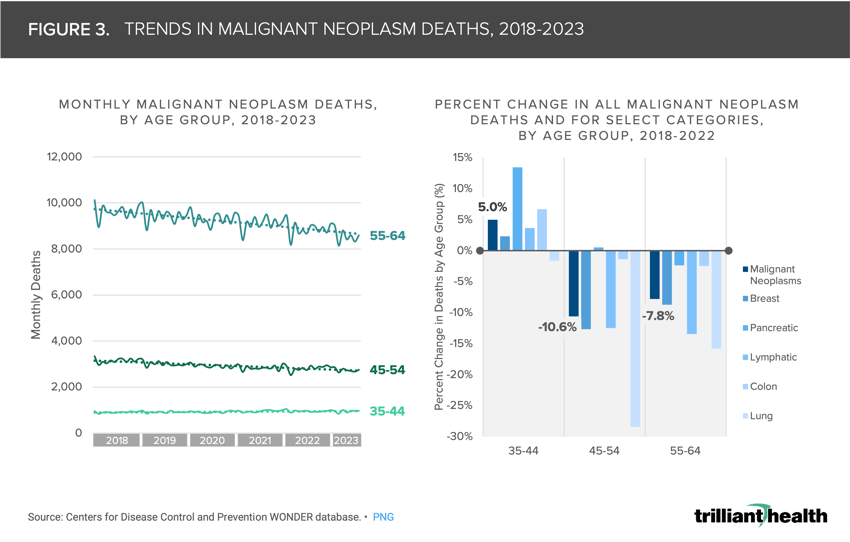

For adults in their 30s and early 40s, early-onset cancer rates increased by 19.4% between 2010 and 2019 and malignant neoplasm deaths increased by 5.0% between 2018 and 2022.

Despite healthcare expenditures tripling between 2000 and 2021 and the U.S. having a record low number of uninsured Americans in 2023, the physical and mental health status of Americans is spiraling downward, particularly for younger adults who represent most of the commercially insured market.1 For many reasons, primary care utilization – the care setting in which many preventive screenings take place – has declined since 2019, and this delayed care is one contributor of higher patient acuity.2 Beyond the population-level health consequences, a sicker population will have economic implications as well – with patients requiring more frequent, costly and complex services, a further catalyst for continuously increasing health expenditures.3

Primary Care Volumes Have Not Returned to Pre-Pandemic Levels

Total primary care volumes have still not returned to pre-pandemic levels, decreasing by 8.4% between 2019 and 2022 (Figure 1). In the same timeframe, demand for women’s health (+5.0%) and behavioral health (+20.1%) increased, with behavioral health experiencing consistent year-over-year growth. Delayed preventive care, coupled with increasing demand for behavioral health and constrained behavioral health provider supply, will logically result in increased morbidity and mortality. The implications of reduced primary care utilization are no longer theoretical, as evidenced by negative trends in the health status of younger Americans – including increasing excess and general rates of mortality, a growing share of pregnancies with preeclampsia and higher volumes of physical and mental health conditions (e.g., eating disorders, myocarditis, to name a few).

In contrast to a slight decrease in demand for primary care in the past few years, investments in the supply side of primary care services have increased significantly, particularly from large retailers such as Amazon and CVS. Even with this increase in supply, engagement among Americans in accessing traditional healthcare services is declining, as evidenced by the fact that 40% of Americans trust “Dr. Google” and a signal that new entrants are disintermediating the traditional patient care journey, two trends that we will discuss in more detail in the weeks ahead.

Cancer Mortality and Early-Onset Cancers Are Increasing for Younger Americans

Declining health status is particularly evident in oncology, as evidenced by the growing incidence of early-onset cancer, especially for adults ages 30-39, for whom incidence increased by 19.5% between 2010 and 2019 (Figure 2). Given that primary care – where most screening is coordinated – volumes declined by 6.3% from 2021 to 2022, the likelihood of diagnosing early-onset cancer may decline as well, in which case the result would likely manifest in later stage diagnosis and increased mortality (Figure 2). Across all age bands, colorectal cancer comprised over half of the incident cases.

Moreover, cancer mortality among younger adults is also growing, which is both counterintuitive and concerning since mortality typically increases with age. Instead, overall cancer mortality has been trending downward for years and continues to decline for older age groups. From 2018 to 2022, malignant neoplasm deaths increased by 5.0% for individuals ages 35-44 but decreased by 7.8% for individuals ages 55-64 (Figure 3). Malignant neoplasm deaths from pancreatic cancer saw the greatest increase for the 35-44 age group (13.4%).

Despite these observed trends in oncology, the settings of care for cancer treatment have not shifted dramatically. Notably, the share of cancer care delivered at National Cancer Institutes (NCIs) is only growing slightly (Figure 4). Despite signals of increasing prevalence of early-onset cancer, the share of oncology patients receiving care from NCIs in Florida and New York compared to community oncology sites has remained mostly flat but increased slightly from a 2019 quarterly average of 8.1% to a 2022 quarterly average of 8.6%.

These findings, in tandem with other data trends, such as recent investments by life sciences companies and the slow return to preventive care, may be a harbinger of more acute pathology and burden of disease, particularly in oncology. If so, the implications for every stakeholder from patients to providers and payers and life sciences will be significant. The continued underutilization of primary care will limit early diagnosis of high acuity conditions, which in turn may manifest in increased morbidity and mortality for a whole host of conditions, particularly cancer. A sicker younger population – particularly in the commercial market – will be more expensive and labor intensive to manage.

The declining health status of Americans is yet again another example of why the healthcare system is a “negative-sum game,” whereby the costs (i.e., health insurance, new entrants and telehealth access, etc.) invested into the system largely outpace the actual value or benefits (i.e., health status) received by patients or consumers. As the burden of disease intensifies, stakeholders across the health economy must explore ways to incentivize both the demand for and supply of primary care, while also developing treatments that can meet emerging patient needs in a manner that tangibly delivers value for money.

Update: for more data stories about the declining health status and other trends shaping the U.S. health economy, read the 2025 Health Economy Trends Report.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)