Studies Archive

Analyzing the Operational and Financial Challenges of Retailers’ Entry into Primary Care

March 3, 2024Key Takeaways

-

The entry of major retailers like CVS and Walgreens into primary care represents a significant shift in the healthcare landscape, with implications for both financial viability and care delivery for traditional primary care providers. Large retailers are leveraging their existing business lines and consumer loyalty to capitalize on ancillary services, notably pharmacy sales.

-

Retailers have recently encountered obstacles in both scaling and integrating acquired primary care entities, necessitating rapidly evolving strategies to stem significant financial losses.

-

The introduction of transactional business models into primary care has potentially troubling implications for the financial performance of traditional primary care providers and clinical care coordination for every health economy stakeholder.

In our research, we have examined the impact of new entrants on healthcare and their long-term role within the health economy. As large retailers struggle to demonstrate the financial viability of these transactional primary care models, questions about whether primary care can be “reimagined” are emerging. The primary care business models, strategies and tactics of Amazon, CVS, Walgreens and Walmart offer valuable insights into their ability to compete effectively in this market, both in terms of financial viability and care delivery.

Background

Traditionally, primary care providers have served as the gateway into the U.S. healthcare system facilitating navigation through its uniquely complex system. However, despite its significant impact on care coordination, prevention, health promotion, and referral management, the primary care sector is not structured, positioned or incentivized to be profitable. Even the most efficient practices operate on slim margins, and recent reports revealed a median loss of over $249,000 per physician for system-affiliated physician practices.1

Therefore, primary care is often deemed a “loss leader,” facilitating more profitable downstream care through referrals. Nevertheless, several major retailers have acquired "value-based" primary care platforms in recent years, including:

- Walgreens’ acquisition of majority ownership of VillageMD for $5.2B in 2021.

- Amazon acquisition of One Medical for $3.9B in 2023.

- CVS’s acquisition of Oak Street Health for $10.6B in 2023.

These investments in primary care represent a significant shift in the healthcare landscape, with implications for both financial viability and care delivery for traditional primary care providers.

Large retailers are leveraging their existing business lines and consumer loyalty to capitalize on ancillary services, notably pharmacy sales. Retailers have recently encountered obstacles in both scaling and integrating acquired primary care entities, necessitating rapidly evolving strategies to stem significant financial losses. For instance, in a move to withdraw from "nonstrategic" markets as part of a $1B cost-cutting plan, VillageMD has already announced the closure of all clinics in Florida, Illinois, Massachusetts and Indiana, along with clinics in New Hampshire.2,3,4 With the goal of acquiring fully at-risk lives, many observers are surprised that Florida – where over one in five residents are Medicare-eligible – was deemed a nonstrategic market exit for 2024.5

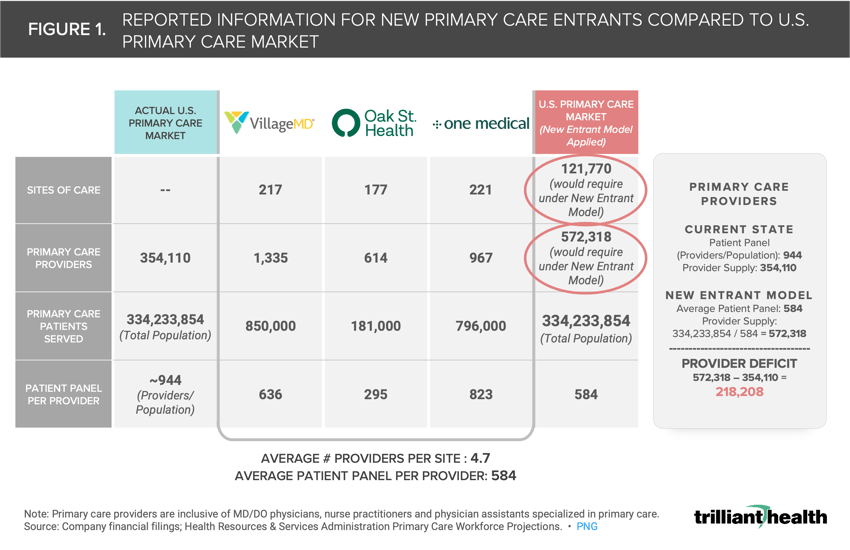

In terms of scale, it is unlikely that retail and direct-to-consumer (DTC) primary care models can scale to meet the needs of every American. Under a traditional primary care model, the typical panel is 944 patients per primary care provider (i.e., MD/DO physician, nurse practitioner, physician assistant specialized in primary care). In contrast, the patient panel for new primary care entrants is much lower, averaging 584 patients per provider. Scaled nationally to the U.S. population (334M), the new entrant primary care model would require a total of 572,318 primary care providers (Figure 1). Relative to the current state, this suggests that the U.S. would need an additional 218,000 primary care providers to meet the needs of every American under these “next generation” models. Additionally, the 8.4% decline in primary care utilization volumes from 2019 to 2022 creates additional uncertainty about the financial viability of these “next-generation” business models.6

Analytic Approach

To assess the performance of CVS and Walgreens following their acquisitions of Oak Street Health and VillageMD, we conducted a qualitative analysis of quarterly financial reports, analyst call transcripts, investor presentations and regulatory filings submitted to federal regulators.

Findings

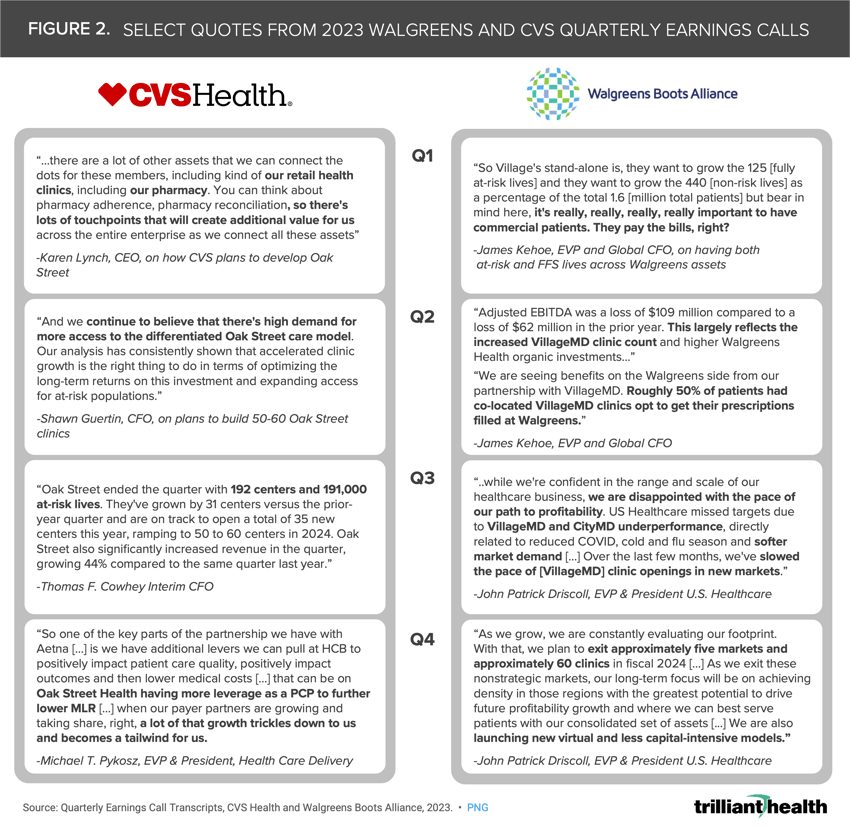

CVS Health finalized its acquisition of Oak Street Health for $10.6B in May 2023 despite Oak Street's reported net loss of $509.7M in 2022.7,8 Throughout 2023, CVS executives outlined their strategies for integrating Oak Street Health into the broader CVS enterprise, which already encompassed consumer goods, retail pharmacy, specialty pharmacy, pharmacy benefit management (Caremark), home health (Signify), low-acuity care delivery (MinuteClinic) and health benefits (Aetna). In Q1 2023, CEO Karen Lynch emphasized the importance of leveraging CVS's assets, particularly its pharmacy and retail clinics, to scale and integrate Oak Street, an implicit acknowledgment of primary care’s loss leader characteristics (Figure 2). In announcing the closing of the acquisition, CVS executives expressed confidence in Oak Street's "differentiated model," foreseeing high demand and announcing plans to open up to 60 new clinics in 2024, despite a ratio of less than 1,000 at-risk lives per clinic. Moreover, executives highlighted the strategic imperative of enrolling fully at-risk Aetna members, particularly those in Medicare Advantage (MA), into Oak Street to drive primary care growth.

Walgreens, on the other hand, acquired a majority ownership stake in VillageMD in 2021.9 Since then, VillageMD expanded its portfolio by acquiring Summit Health-CityMD for $8.9B, thereby broadening Walgreens' exposure to both value-based primary care (VillageMD) and fee-for-service (FFS) primary, specialty and urgent care models (Summit Health-CityMD).10 As we have extensively discussed, commercially insured Americans are the lifeblood of the U.S. healthcare system, a sentiment echoed by Walgreens leadership when discussing their aim to grow both fully at-risk and FFS patient populations: “it’s really, really, really important to have commercial patients. They pay the bills, right?” And, as we predicted, Rosalind Brewer's resignation as Walgreens' CEO and President on September 1, 2023, foreshadowed the challenges and shifts within the organization's healthcare strategy.11

Addressing growing operating losses, Walgreens executives emphasized the significant contribution of the VillageMD clinic count and highlighted the prescription-driving effect of co-located clinics and Walgreens pharmacies, indicative of the disintermediated, closed-loop system cultivated by retailers.12 Although the profitability of Walgreens' other business units, such as pharmacy, could offset operating losses from its primary care business, ongoing losses in its U.S. Healthcare segment recently prompted Walgreens to pause VillageMD growth and exit at least five nonstrategic markets, resulting in the closure of at least 60 clinics in 2024.

Comparing Financial Results with Pharmacy Growth

When examining the earnings and operational outcomes of the healthcare delivery segments within CVS and Walgreens, two distinct patterns emerge. In 2023, CVS's Health Services segment maintained positive operating income, albeit experiencing a nominal decline from Q2 2023 to Q4 2023 (Figure 3). Moreover, CVS prescription fills increased quarter-over-quarter, surpassing totals from 2022. Conversely, Walgreens' U.S. Healthcare segment closed the year with $566M in operating losses, and its pharmacy business concluded the year with 2.3% fewer prescriptions compared to 2022.

Conclusion

With CVS’s planned addition of up to 60 Oak Street this year, it will be informative to measure their success in scaling their value-based primary care operation as compared to Walgreens’ initial investments in VillageMD expansion. The projected impact of rising MA medical costs for CVS raises significant questions about the company's resilience and strategic positioning as both a MA payor and risk-based primary care provider.13 Similarly, it will be informative to monitor the impact of the closure of VillageMD clinics across “nonstrategic” markets on Walgreens' financial performance for 2024. The profitability of emerging "next generation" retail-operated primary care models is contingent upon the sale of ancillary services, notably pharmacy sales. While adding a fully scaled primary care operation is critical to creating the “closed loop” systems that these retailers seek, it appears they are facing the same challenges that traditional primary care operators have for years.

Additionally, whether retailers can – or even want to – integrate comprehensive services into transactional models is an open question. Amazon, CVS, Walgreens, and Walmart excel in consumer-facing transactional models but lack incentives and expertise to coordinate care. Furthermore, the transactional nature of most consumer-centric primary care models threatens to commoditize traditional relationship-driven healthcare practices. In contrast, Amazon’s One Medical subscription model has the potential to generate substantial returns by a lack of utilization by its members. The more success that large retailers realize from creating closed-loop systems like Apple’s app store, the more detrimental to the business models for traditional primary care providers and overall care coordination for Americans.

Thanks to Katie Patton for her research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)