Key Takeaways

-

Despite a growing burden of disease, demand for healthcare services for the next five years is projected to be tepid and could be further constrained by the emergence of therapeutics.

-

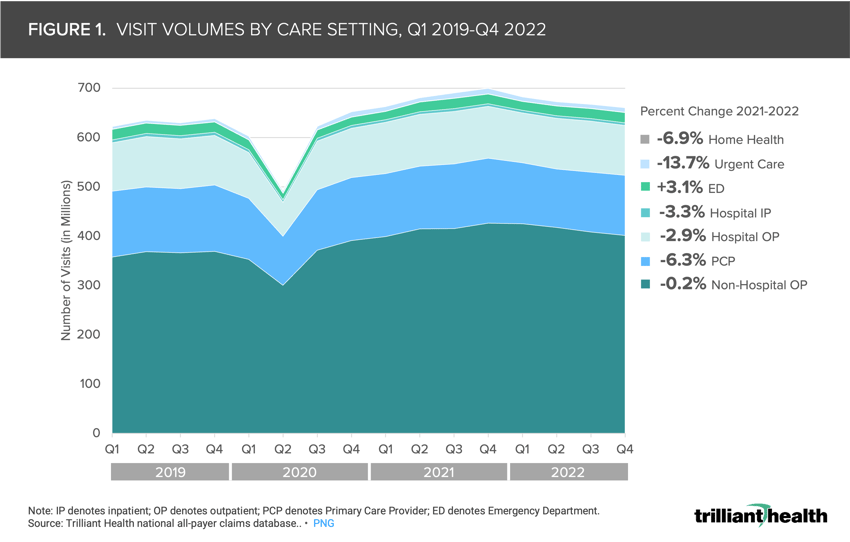

With the exception of emergency department volumes, which increased by 3.1%, visit volumes for care settings declined between 2021 and 2022, ranging from -0.2% (non-hospital outpatient visits) -13.7% (urgent care visits.

-

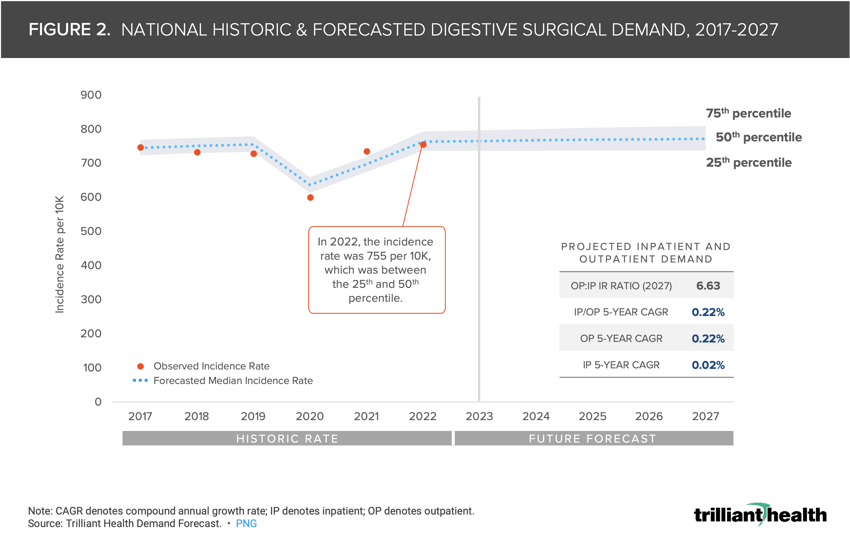

Of the five major service lines, digestive surgery has the highest projected demand growth rate. The national median incidence rate for digestive surgical services is projected at 0.2% CAGR between 2023 and 2027, with projected outpatient growth (0.22% CAGR) outpacing projected inpatient growth (0.02% CAGR).

As we have discussed previously as part of our detailed analysis of the 2023 Health Economy Trends Report, the physical and mental health status of Americans is unraveling, particularly for younger adults who represent most of the commercially insured market.1

It may seem logical to conclude that a sicker population would lead to increased demand for healthcare services, but demand is a function of both disease burden and population characteristics.

Despite a growing burden of disease – particularly in oncology, immunology and rare disease as signaled by the investments of several biopharmaceutical manufacturers – demand for healthcare is projected to remain tepid over the next five years, which will affect all healthcare stakeholders. Moreover, exogenous factors like emerging replacement therapies could further alter the demand trajectory for healthcare services.

(Update: for the latest replacement therapy trends, read the 2025 Health Economy Trends Report.)

Utilization Across Most Care Settings Declined From 2021 to 2022

In 2022, visit volumes declined across every care setting other than the emergency department (+3.1%) (Figure 1), reflecting that the observed “rebound” in 2021 was in fact attributable to increased testing and treatment for COVID-19. In turn, the decline in COVID-19 volumes explains the decline in both primary care (-6.3%) and urgent care (-13.7%) visits from 2021 to 2022, confirming that Americans have yet to return to preventive care at pre-pandemic levels. Even so, this downward demand trajectory predates the COVID-19 pandemic, with inpatient admissions declining since 2008.

Demand Is a Function of Disease Burden, Demographics, Consumer Preferences and Access

Demand for most types of surgery is projected to be flat or declining over the next five years. Of the five major surgical service lines – heart/vascular, OB/GYN, neuro/spine, orthopedic, and digestive – digestive surgical demand has the highest compound annual growth rate (CAGR).

Demand for digestive surgical procedures is projected to increase at a CAGR of 0.2% between 2023 and 2027 (Figure 2). In 2027, 7.7% of the U.S. population are predicted to require digestive surgical services. By 2027, the incidence rate is forecasted to be between 738 (25th percentile) and 809 (75th percentile). With respect to care setting, projected outpatient growth (0.22% CAGR) is outpacing projected inpatient growth (0.02% CAGR).

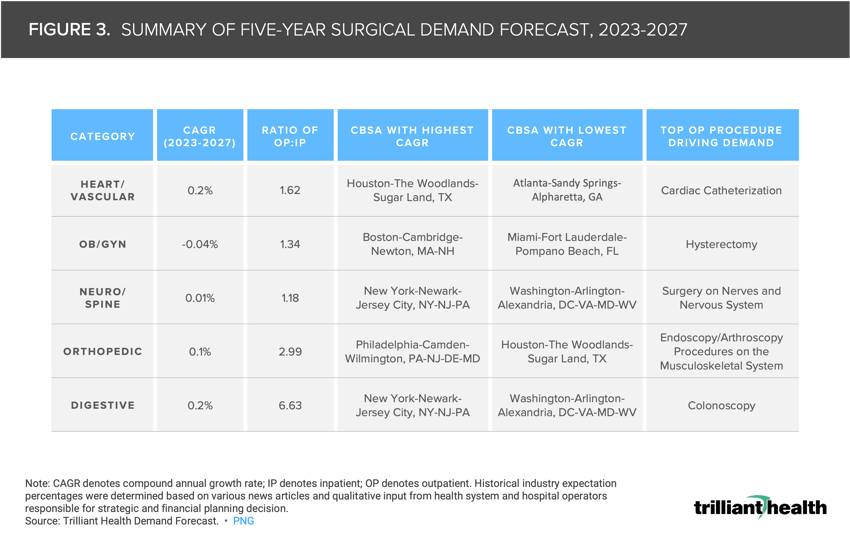

What is essential for health economy stakeholders to understand is that projected demand growth at the market level can, and often does, vary significantly from national demand forecasts. Between 2023-2027, the projected CAGR for major surgical service lines nationally ranges from -0.04 (OB/GYN) to 0.2% (heart/vascular and digestive), but the “winners” and “losers” at the market and service line level vary widely (Figure 3).

The Impacts of Tepid Demand Could be Compounded by New Therapies and Screening Guidelines

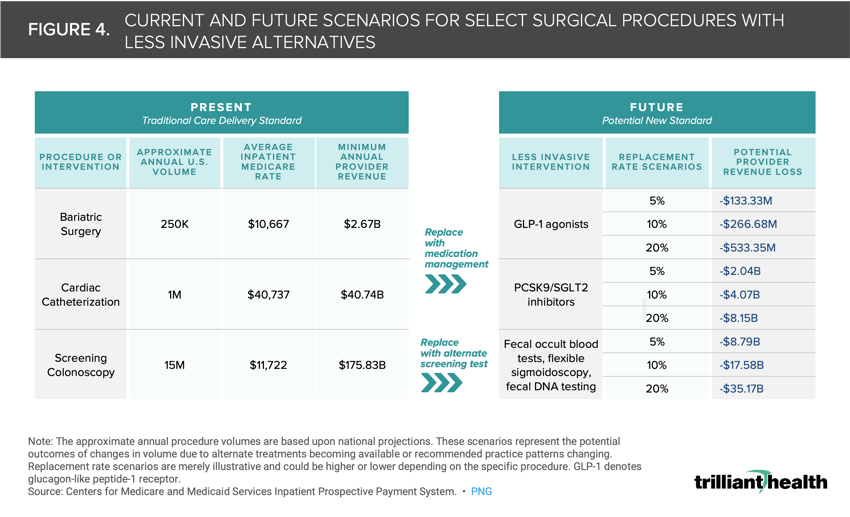

The emergence of both new therapies and new clinical evidence frequently translates into changes to clinical guidelines (e.g., screening) or practice patterns (e.g., medication management). As a result, healthcare strategists are advised to consider that some high-margin surgical procedures will be replaced with less invasive, patient preferred interventions. For example, even in a scenario where 5% of bariatric surgeries that would have typically been performed in a given year do not take place due to GLP-1 agonists, the potential surgical revenue loss could equate to as much as -$133.3M (Figure 4). Are providers prepared for the potential volume declines and corresponding revenue losses associated with replacement therapies?

Every health economy stakeholder will be affected by declining demand, particularly providers and device manufacturers. Notably, several large health systems, including Ascension, have announced the closure of inpatient maternity departments in small markets.2 Additionally, Walgreens announced the closure of 60 VillageMD clinics last week.3

Tepid demand combined with the emergence of new drug therapies could imperil traditional healthcare delivery in the U.S. As the number of options patients have for where, how and when they receive care increases, providers must either adjust to meet patient needs or prepare for volume declines and corresponding revenue losses. Consumer behaviors are increasingly highlighted in patient decision making, underscoring the importance for traditional and new entrants providers to adapt their strategies and communication to effectively acquire patients.

Maintaining a competitive advantage in a negative-sum game defined by declining demand will require data-driven insight into who, what and where will drive future demand for healthcare services. Ultimately, healthcare is local. Below is more information on which procedures and population segments will underlie surgical demand in the years ahead, and how these factors and demand projections vary by specific markets (e.g., Miami vs. Atlanta).

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)