Studies

Research studies with data-driven analyses of the health economy and its emerging trends

Featured Study

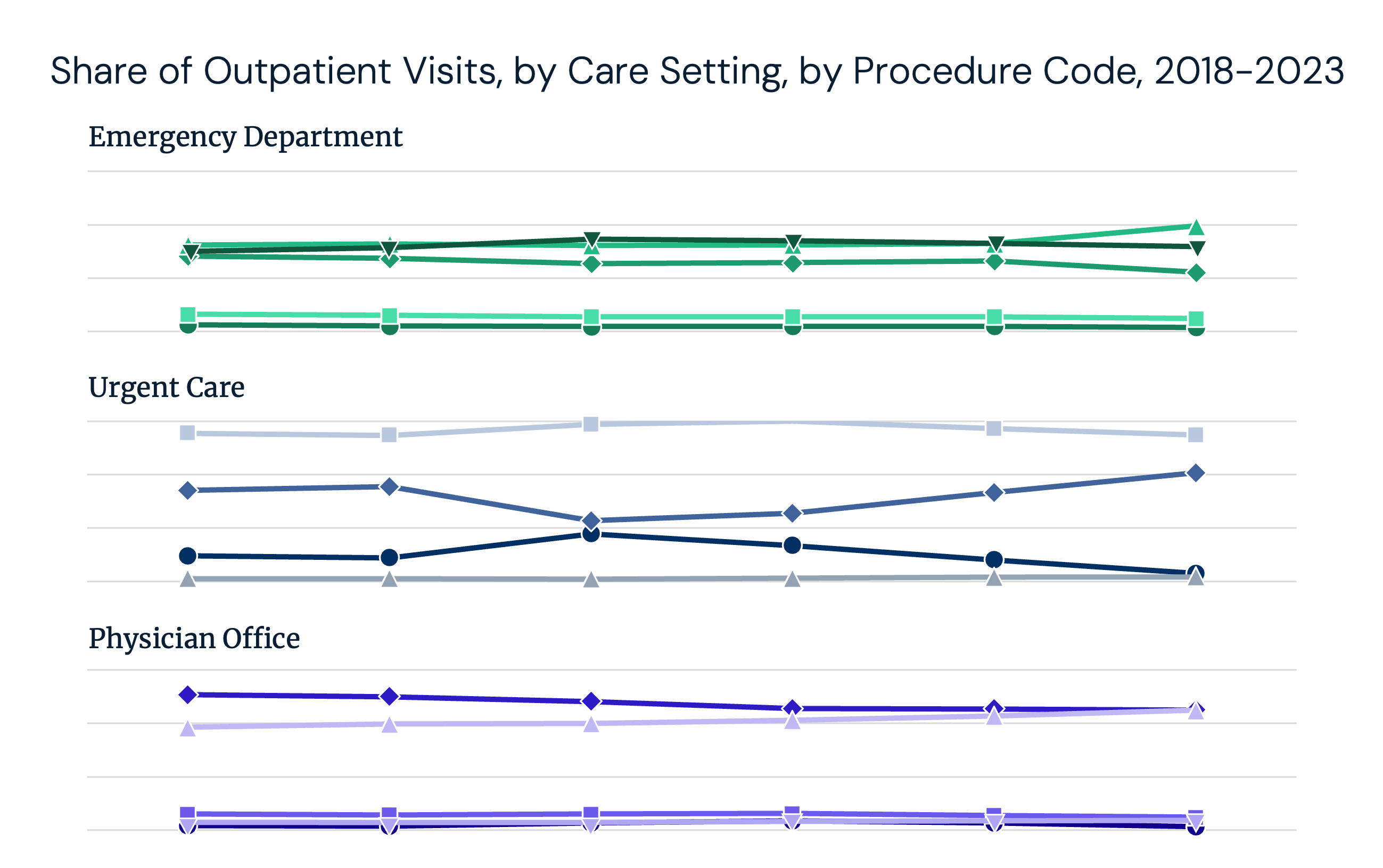

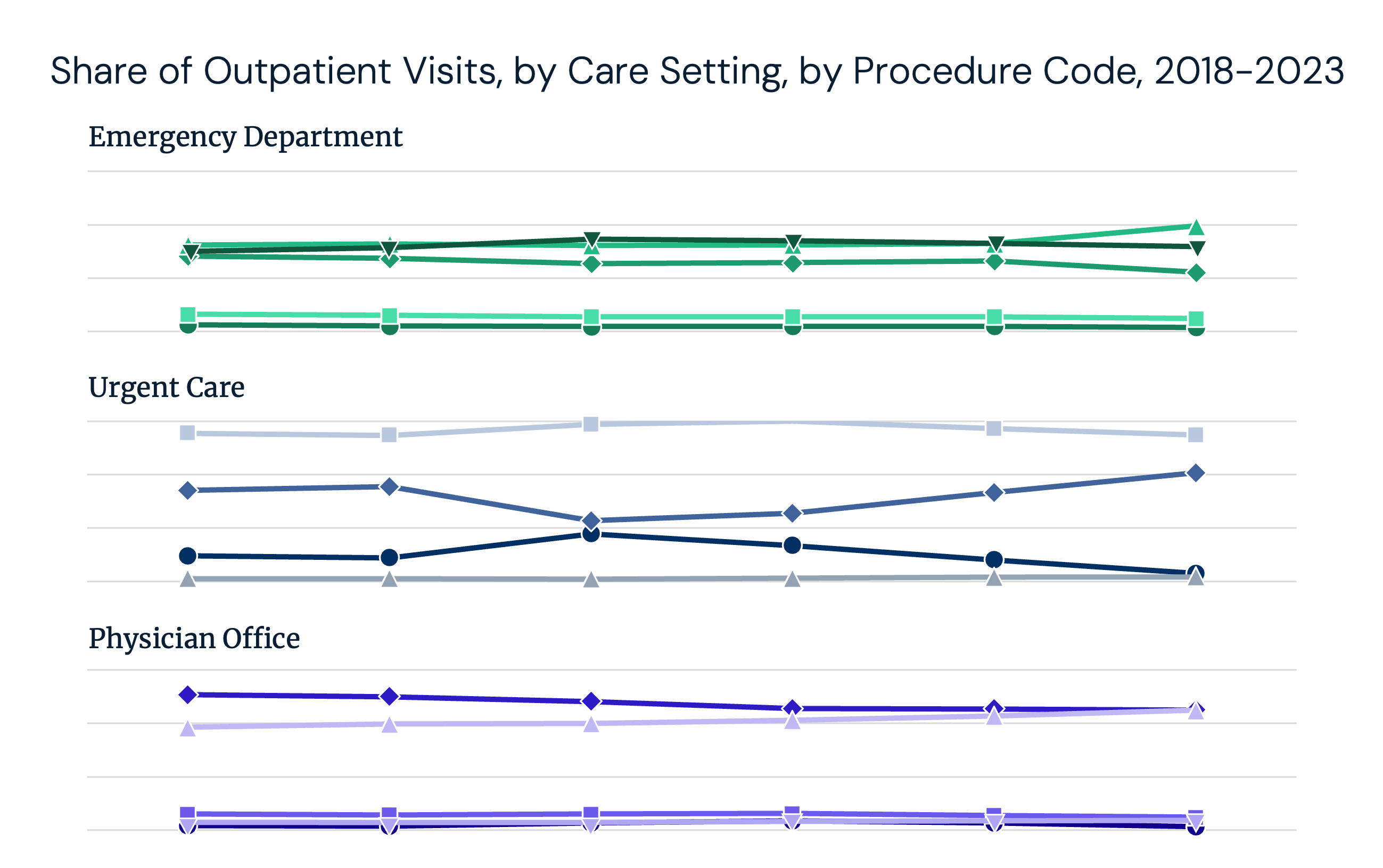

Changes in Coding Intensity Suggest HowUpcodingIs Happening Across Outpatient Settings

A measurable trend toward higher-acuity billing across several settings of care has raised concerns about “upcoding” – the implications of which extend beyond payer reimbursements.

Health economy trends.

Free in your inbox.

Track health economy trends with research from Trilliant Health’s research team.

Changes in Coding Intensity Across Outpatient Settings

Read the Study

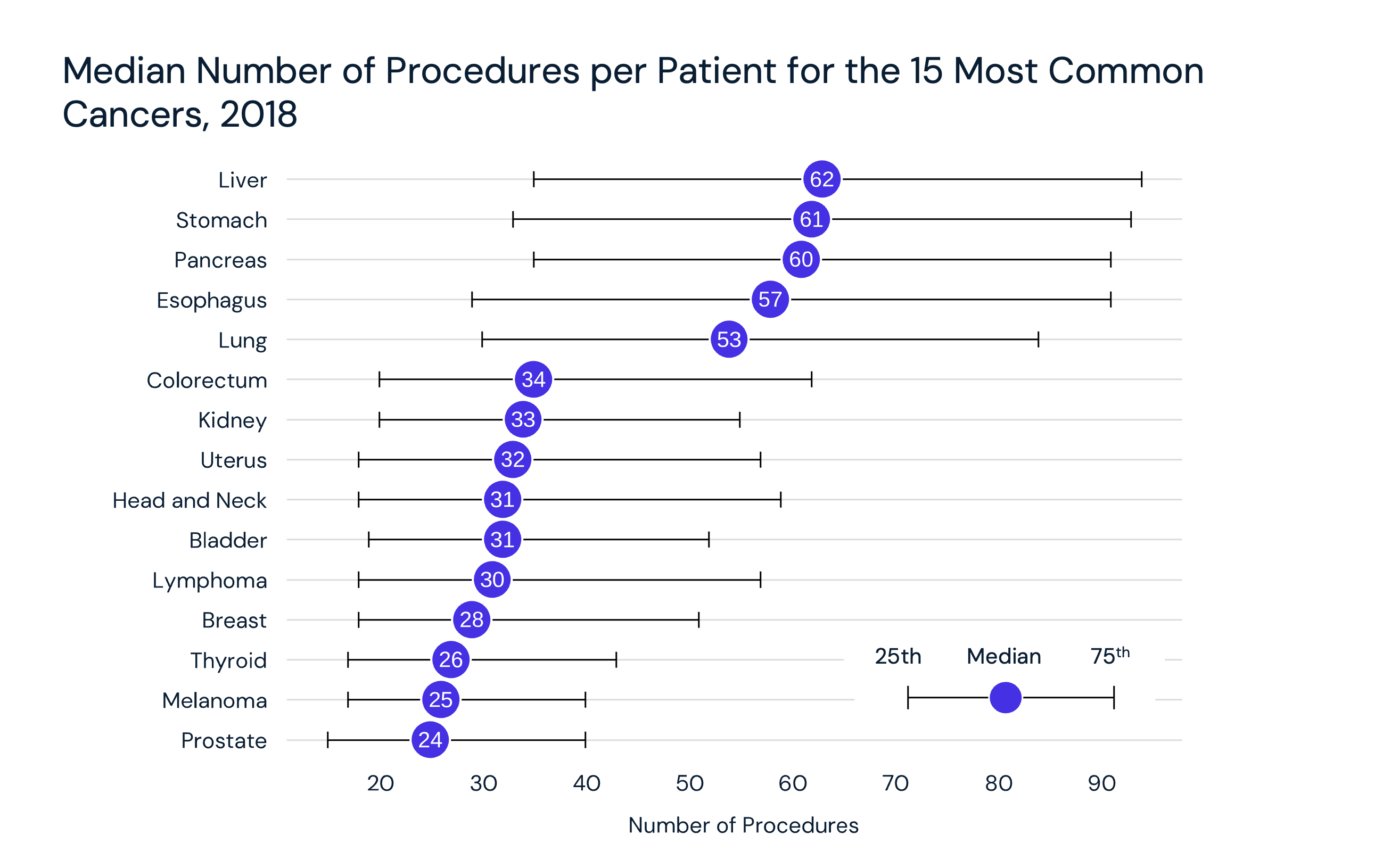

Outpatient Utilization Rates in Cancer Care Reflect Procedure-Specific Shifts

Read the Study

The 24 Data Stories That Defined 2024

Read the Study

2024 Trends Report Conclusion: Health Economy Stakeholders Who Focus on Value Optimization Will Establish a Competitive Advantage

Read the Study

Trend 8 of 8: Employers Are Better Equipped To Demand Value for Money

Read the Study

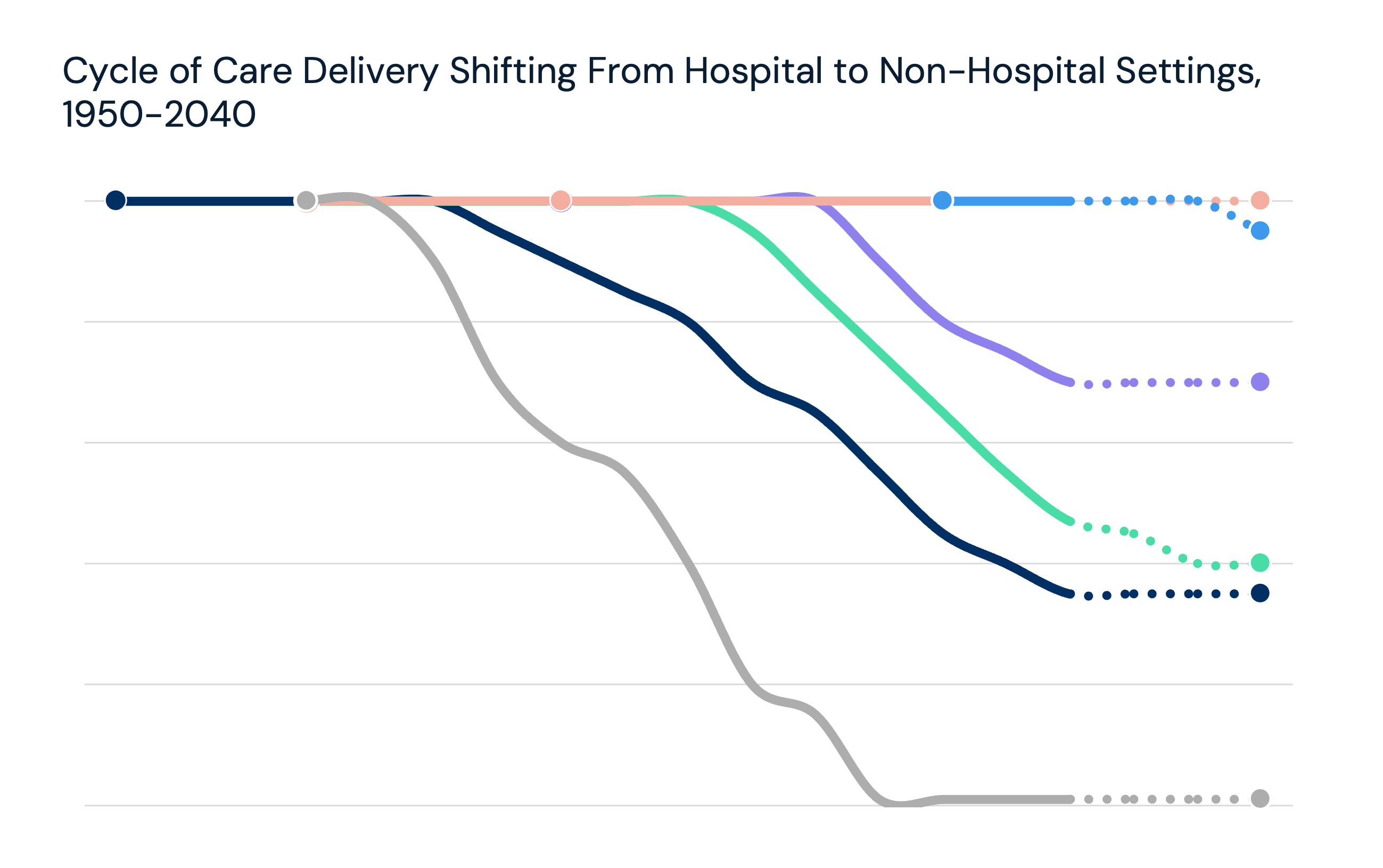

Trend 7 of 8: Lower-Cost Care Settings Can Offer Better Value

Read the Study

Trend 6 of 8: Forced Consumerism Due to Cost Shifting Has Fostered Fragmentation Without Corresponding Value

Read the Study

Trend 5 of 8: Supply Constraints Are Correlated With Inadequate Yield

Read the Study

Trend 4 of 8: The Value of Technological Advancements Is Uncertain

Read the Study