Studies Archive

Health Economy Stakeholders Who Focus on Value Optimization Will Establish a Competitive Advantage

December 14, 2024Key Takeaways

-

The U.S. health economy is disproportionately expensive and fails to deliver value, with health outcomes stagnating or declining despite healthcare spending reaching $4.5T in 2022. Stakeholders will be compelled to pivot from revenue-maximizing strategies to optimizing value.

-

Value optimization prioritizes long-term sustainability over short-term profit maximization, ensuring better use of resources while delivering care that balances affordability, safety and quality. Health economy stakeholders adopting consumer-centric care models and transparent pricing will gain a competitive edge.

-

Value optimization is widely applied in industries where customer satisfaction, operational efficiency and long-term profitability are critical. For instance, businesses like Costco, Southwest Airlines and Google use value optimization strategies to align pricing, product offerings and customer experiences with their broader goals, ensuring loyalty and sustainable growth.

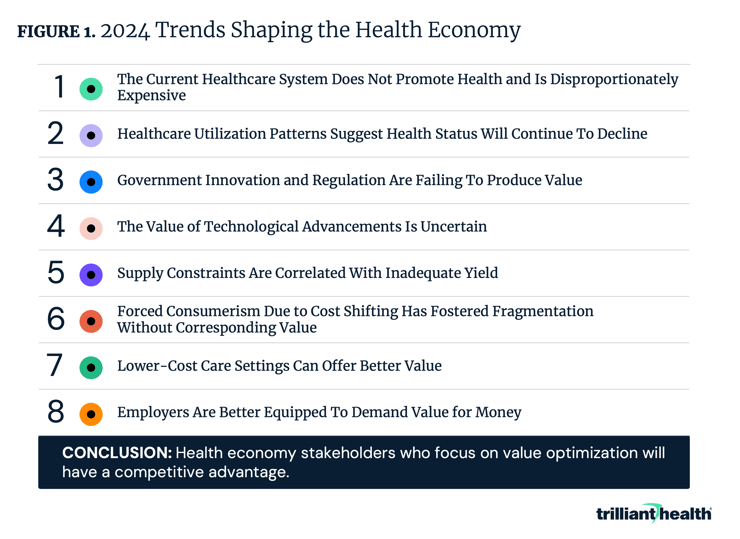

Over the last eight weeks, we revisited the key takeaways and provided a detailed overview of the 2024 Health Economy Trends Report.1 Each trend underscores the broader takeaway that the U.S. healthcare system is disproportionately expensive and does not deliver value. This year’s report highlights eight data-driven macro trends that are either intensifying or emerging, revealing the importance of optimizing value, as opposed to maximizing value (Figure 1). Looking to the future, health economy stakeholders who focus on value optimization will establish a competitive advantage.

The U.S. health economy, which is funded in large part by Federal programs, state Medicaid agencies and employer-sponsored health plans represents 45% of the global health economy.2,3 Although healthcare spending increased by more than 50% in the past decade, from $2.8T in 2012 to $4.5T in 2022, health outcomes have remained stagnant or declined. This raises a fundamental question: What is the return on society's massive investment in the U.S. health economy?

In economic terms, value measures the benefit derived from a good or service relative to its cost. For decades, consumer markets have emphasized value, enabling Americans to make informed purchasing decisions based on price, quality and convenience. Consumer-focused enterprises are faced with relentless pressure to offer more value, whether more features for the same price or the same features for a lower price or more features for a lower price. Health economy stakeholders rarely meet this standard.

In healthcare, cost, quality, safety and convenience are core components of value and exist on a continuum, with their relative importance depending on the care context. Quality is less relevant in an ankle X-ray but paramount in a craniotomy.

Although America’s per capita Medicaid spending is higher than any other country’s total per capita health spending, overall health outcomes in the U.S. lag behind comparable Organization for Economic Cooperation and Development (OECD) countries.4 Life expectancy has not improved meaningfully since 2000, has declined since 2019 and remains nearly four years below the average of OECD peers. Rates of obesity, diabetes and behavioral health conditions are at all-time highs, further straining the system and reflecting poor health. These outcomes reveal an unfortunate reality: The U.S. health economy prioritizes revenue generation over value creation.

The U.S. healthcare system operates outside the economic principles of a competitive market. Misaligned incentives lead stakeholders – from providers to life sciences companies – to focus on maximizing revenue, particularly from employer-sponsored Americans, without improving care quality or outcomes. Health plan price transparency offers a pathway to disrupt this “status quo” by introducing unprecedented competition centered on delivering value for money.

Value for money is different than value-based care, which is focused on the allocation of risk within a risk pool, not the reduction of the aggregate cost of the risk pool. In contrast, value for money emphasizes optimizing the relationship between price, quality and outcomes for the ultimate payer – whether it be employers, Federal and state governments or individual Americans. However, value for money remains elusive in the U.S.

To remain viable, health economy stakeholders must shift their focus from maximizing their revenue to optimizing value for their customers. In economic terms, value optimization is distinctly different from value maximization (Figure 2). Optimization involves making the best or most effective use of resources within given constraints, whereas maximization aims for the highest possible outcome without regard to limits.

Health economy stakeholders can deliver value for money to the customer – the employer – in one of three ways:

- Better than average quality at a price at or near the median market rate

- Average quality at a price that is below the median market rate

- Better than average quality at a price that is below the median market rate

There is no value for money proposition in offering worse than average quality at any negotiated rate, especially one that is higher than the median market negotiated rate.

What Are Practical Applications of Value Optimization vs. Maximization?

Value optimization is a strategic approach that emphasizes achieving the best outcomes across multiple dimensions, such as cost, quality, safety and convenience. It prioritizes making trade-offs to maximize overall efficiency and long-term value rather than striving for the highest possible returns at any cost, as seen in value maximization. This concept is widely applied in industries where customer satisfaction, operational efficiency and long-term profitability are critical. Businesses like Costco, Southwest Airlines and Google use value optimization strategies to align pricing, product offerings, and customer experiences with their broader goals, ensuring loyalty and sustainable growth.

For example, Costco’s low markup strategy fosters customer loyalty, while Southwest’s operational efficiencies enable affordable fares and Google’s ad relevance ensures sustained user engagement. Even so, these leading businesses are under constant pressure to deliver more value, as evidenced by Southwest’s decision to assign seats and Google’s declining market share in Internet search. Consumer-focused businesses, which many health economy stakeholders claim to be, never cease their efforts to create more value optimization by addressing constraints and aligning with customer needs.

Conclusion

The laws of economics dictate that when supply exceeds demand, prices must fall. As stakeholders adapt to transparent market pricing, providers offering substandard quality at high rates will lose market share. Looming policies such as site-neutral payments and price caps will accelerate this trend, forcing regression to the market rate and creating winners and losers in the process.

The U.S. health economy cannot defy economic basics indefinitely. Employers, bound by fiduciary duty, will increasingly demand better returns on their healthcare investments, forcing stakeholders to adapt or lose relevance. Those who succeed will be the ones who deliver better outcomes at the same cost, provide equivalent outcomes at a lower cost, or achieve the long-hoped-for goal of better outcomes at lower costs. Where is your organization least prepared in adapting to the future state of health economy with more pressure to justify price and compete on value? What is one “big idea” that you can explore in 2025 that can better deliver value for money, even if it means reducing your revenues? The future belongs to those who optimize value, not just for themselves, but for their customers. By embracing this transformation, stakeholders can create a health economy that is not only sustainable but also equitable and effective.

Update: for the latest trends, read the 2025 edition of our Trends Shaping the Health Economy Report.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)