Key Takeaways

-

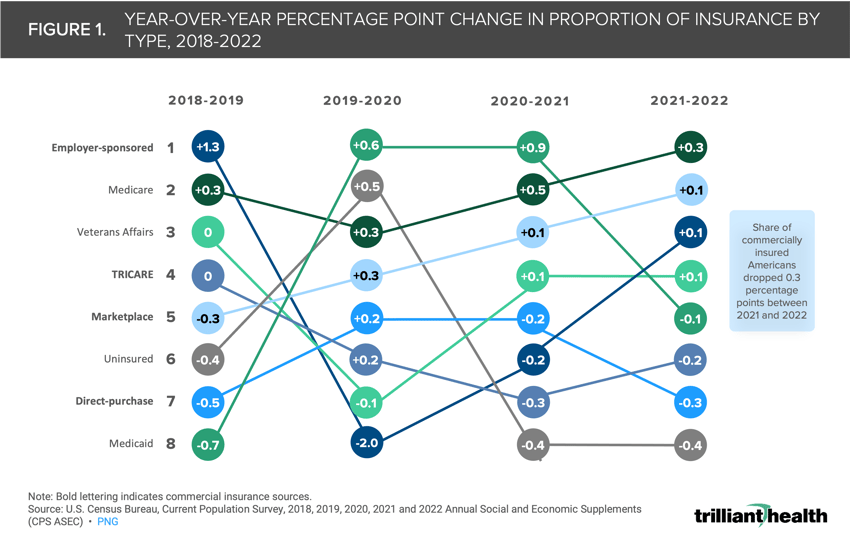

Between 2021 and 2022, the share of commercially insured Americans dropped 0.3 percentage points, while the publicly insured cohort grew by 0.4 percentage points.

-

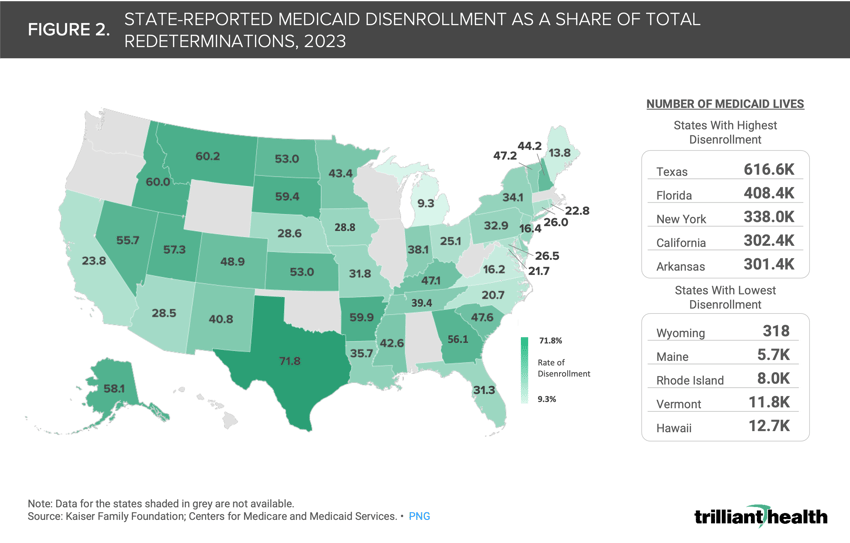

Medicaid redeterminations resumed across the country in 2023, with disenrollment rates ranging from 71.8% in Texas to 9.3% in Michigan.

-

Payer mix erosion impacts providers in every market, even HCA.

Earlier this week, we released our annual Health Economy Trends Report – a fact-based, data-driven national analysis of ten trends that will define the landscape, and subsequent challenges, for all players in the health economy. In the coming weeks, we will explore the trends in more depth, finding how each trend connects with the next, beginning with an analysis of the eroding commercially insured market.

The health economy represents 18.3% of the total U.S. economy, and commercially insured patients are its lifeblood, accounting for the majority of profitable revenue for providers, payers, medical device companies, life sciences and more.1 However, both the number and overall share of commercially insured Americans – those with employer-based, direct-purchased, ACA Marketplace or TRICARE insurance — continues to decline as a consequence of the steadily aging population, declining birth rate and coverage shifts stemming from the pandemic. As this population declines, the impacts will be felt by all stakeholders in the health economy.

Enrollment in Public Programs is Outpacing Commercial Insurance

While most Americans are commercially insured, the percentage of Americans with commercial health insurance has consistently dropped since 2019. From 2021 to 2022, the overall share of commercially insured Americans dropped 0.3 percentage points overall (Figure 1). Not even the growth in the share of Americans with Marketplace coverage (+0.1 percentage points between 2021 and 2022) and employer-sponsored insurance (+0.1 percentage points) was enough to offset losses in the share of lives covered by direct-purchase plans (-0.3 percentage points) and TRICARE (-0.2 percentage points).2 Meanwhile, the share of publicly insured Americans (Medicaid, Medicare and Veterans Affairs) has steadily increased since 2019. Between 2021 and 2022, this population grew by 0.4 percentage points, with share of Medicare alone growing by 0.3 percentage points. Much of this growth can be attributed to more Baby Boomers aging into Medicare and high Medicaid enrollment during the COVID-19 pandemic.3,4

Medicaid Redeterminations Will Redefine National Payer Mix

Millions of Americans lost Medicaid coverage during the 2023 redetermination, with high variation in disenrollment rates across the country (Figure 2). The disenrollment rate was highest in Texas (71.8%) and lowest in Michigan (9.3%). The Centers for Medicare and Medicaid Services (CMS) halted redeterminations in several states as millions lost coverage due to employment status and/or procedural disenrollment (e.g., missing forms, address changes, processing backlogs) during summer 2023, but the churn arising from redeterminations resuming after a three-year pause during the pandemic will still have downstream impacts for states and other healthcare stakeholders5.

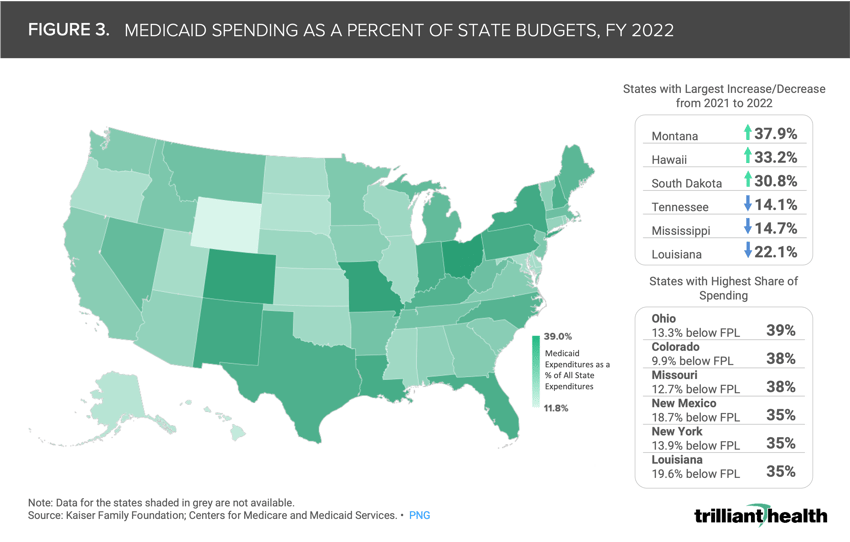

The extent to which the disenrolled become uninsured or gain marketplace or employer-sponsored coverage will further influence the payer mix of almost every healthcare provider and access to healthcare services for millions of Americans. Every state budget will also be impacted, which is particularly concerning in the 27 states where Medicaid spending represented more than 25% of total state spending in 2022 (Figure 3).

Every Provider Is Impacted by Eroding Payer Mix

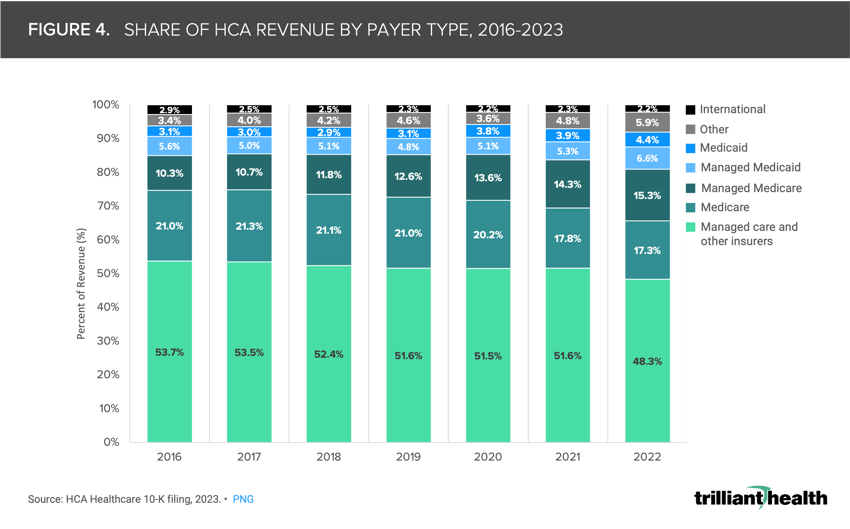

HCA Healthcare is the nation’s largest healthcare system, operates in some of the most attractive and fastest-growing markets in the U.S., and is unrivaled in terms of site selection. Even so, since 2016, the commercially insured share of HCA Healthcare’s revenue has declined 5.4 percentage points (Figure 4). It is impossible to know but equally incomprehensible to believe that any provider has out-performed HCA in terms of payer mix over the past six years. Unsurprisingly, shrinking hospital and health system operating margins clearly reveal that numerous providers are impacted by the decline in commercially insured Americans. Federal policymakers will increasingly have to consider whether Americans are well-served by hospital closures that will ultimately result from regulatory restrictions on provider consolidation that would otherwise eliminate wasteful duplication of unprofitable services.6

All health economy stakeholders should understand that a declining number of commercially insured Americans will inevitably result in decreased revenue from an increasingly unfavorable payer mix. This trend is not new, but high levels of Medicaid churn and a record low uninsurance rate could accelerate the contraction of the commercially insured market. This trend is further compounded by the fact that the health status of Americans of all ages, especially younger adults who make up the lifeblood of the commercially insured market, is declining – a trend we will explore in future research. All stakeholders in the health economy should consider that the status quo is their most formidable competitor and prepare for a less profitable “new normal.”

Update: explore the latest trends shaping the U.S. health economy in the 2025 Health Economy Trends Report.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)