Studies Archive

Less Than One Percent of All Telehealth Visits Are for Oncology Care

February 12, 2023Key Takeaways

-

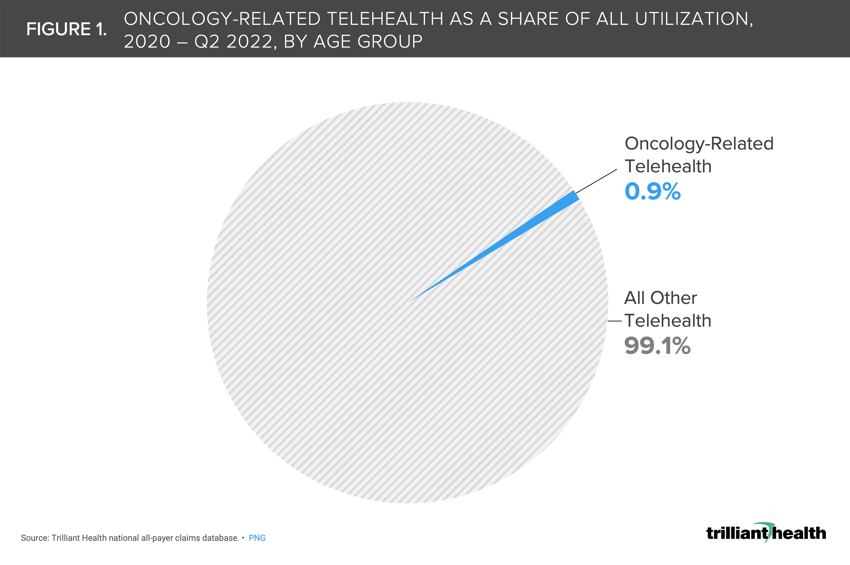

Among all telehealth visits between 2020 and 2022, less than 1% of visits were for oncology-related care.

-

A majority (72.8%) of these oncology-related telehealth visits were evaluation and management (E&M) encounters related to ongoing cancer care.

-

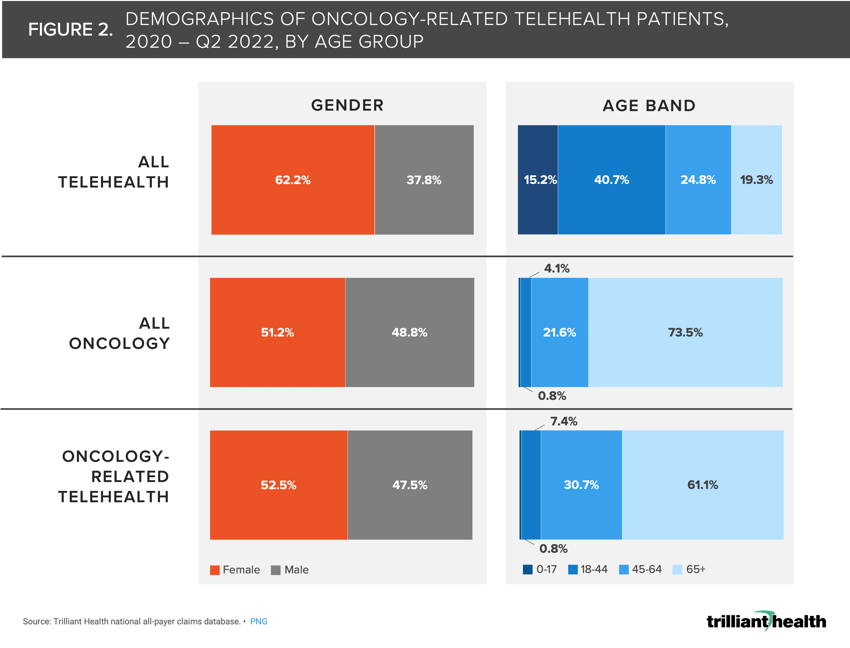

While the overall demand for telehealth skews towards women, the same gender disparities are not observed for oncology-related telehealth.

It is well established that telehealth utilization increased drastically in response to the COVID-19 pandemic.1 However, ongoing research has demonstrated that telehealth only functions as a "substitute good" for behavioral health treatment (e.g., psychotherapy). Behavioral health accounted for the greatest share of telehealth visits both pre- and post-pandemic, accounting for 57.9% of all telehealth visits in 2021.2

While telehealth is not a substitute for most in-person care, it can be a care extender within oncology, for which care protocols are characterized by frequent patient visits with an established physician. Conceptually, telehealth may also alleviate some of the emotional, financial and physical burden associated with receiving oncology care.3

Background

The high average cost of cancer treatment makes it a compelling opportunity for value-based payment models, as evidenced by CMS’s operation of the Oncology Care Model (OCM) from 2016 to 2022 and launch of the Enhancing Oncology Model (EOM) in summer of 2023.4 Because participating EOM practices must offer 24/7 access to care, telehealth is, from a cost perspective, superior to hospital emergency departmants. Investor interest in virtually enabled cancer care management and coordination platforms (e.g., Thyme Care, Reimagine Care) has grown in recent years, suggesting that venture capital firms see the same opportunity for lower-cost oncology care.5,6

Although research into the efficacy of telehealth for oncology is lacking, researchers have begun to study the direct (i.e., cost sharing) and indirect (e.g., lost productivity) cost implications of using telehealth for oncology in non-elderly patients. Researchers found that telehealth was able to save time, productivity, and money (for non-elderly cancer patients), equating to mean cost savings per telehealth visits ranging from $79 to $146.7

Given the lack of research into oncology-related telehealth, we seek to better understand the scope of oncology-related telehealth and the demographics of those patients, relative to telehealth patients writ large.

Analytic Approach

We examined three distinct patient populations between Q1 2020 and Q2 2022 to compare patient trends in all telehealth to oncology-related telehealth:

- telehealth patients, identified by synchronous or asynchronous telehealth visits for any reason;

- oncology patients, identified by visits with a primary visit reason specifically targeting malignant neoplasms and excluding benign indications; and

- oncology-related telehealth patients, identified by synchronous or asynchronous telehealth visits with a primary visit reason specifically targeting malignant neoplasms and excluding benign indications.

Among these patients, utilization was analyzed by gender and age (i.e., ages 0-17, 18-44, 45-64, 65+).

Findings

Among all telehealth visits between 2020 and 2022, less than 1% of visits were for oncology-related care (Figure 1). Additionally, a majority (72.8%) of these oncology-related telehealth visits were evaluation and management (E&M) encounters related to ongoing cancer care.

While demand for telehealth overall skews higher towards women, the same gender disparities are not observed for oncology-related telehealth. From 2020 to 2022, women comparably accounted for 51.2% of all oncology care volume and 52.5% of all oncology-related telehealth volume (Figure 2). However, women accounted for 62.2% of all telehealth volume. While the 65+ population accounts for just 19.3% of all telehealth volume, they are responsible for 61.1% of oncology-related telehealth volume–more closely resembling that age group’s 73.5% share of total oncology care volume.

Prior research found that the share of younger new patients seeing oncology providers is increasing over time, signaling worsening patient acuity.8 Given demand for telehealth overall skews younger, will demand for more availability of virtual cancer care services increase?9

Given the signals of worsening cancer acuity—stemming from reduced recommended preventive screenings and increasing share of new patients seeing oncology providers—what role will telehealth ultimately play in the cancer care continuum?10 While previously cited research touts its potential cost savings, more needs to be understood about the quality implications of virtual check-ins, in contrast to in-person visits. While virtual visits increase access to those with time and travel constraints, providers would need to ensure equal access to those services for all patients they treat.

Thanks to Austin Miller and Katie Patton for their research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)