Studies Archive

Care Forgone During the Pandemic is Permanently Lost, and the Observed Rebound is Illusory

October 30, 2022Key Takeaways

-

Demand for primary care services is below pre-pandemic levels in 62% of metropolitan CBSAs.

-

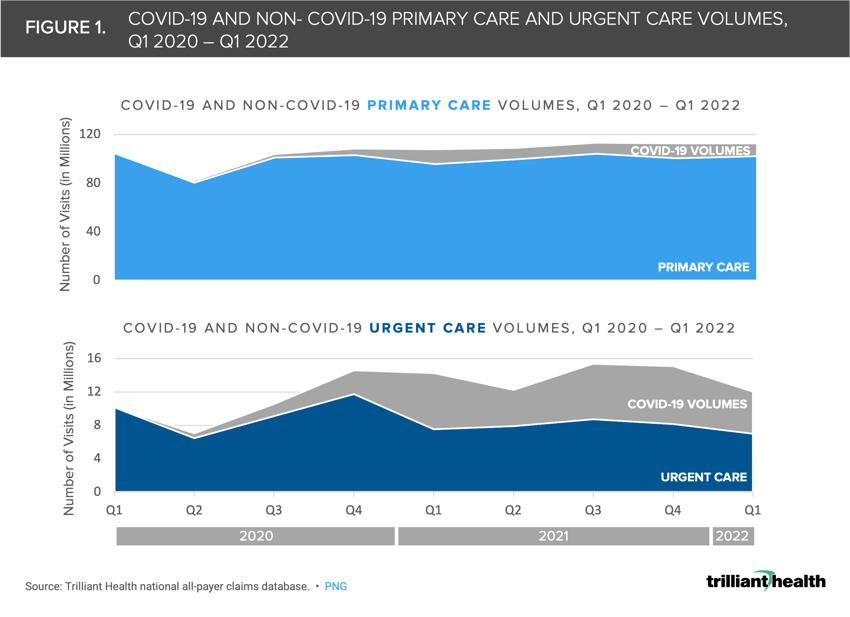

COVID-19-related care represented 47% of urgent care visits in Q1 2021, creating an illusory rebound in demand for healthcare services.

-

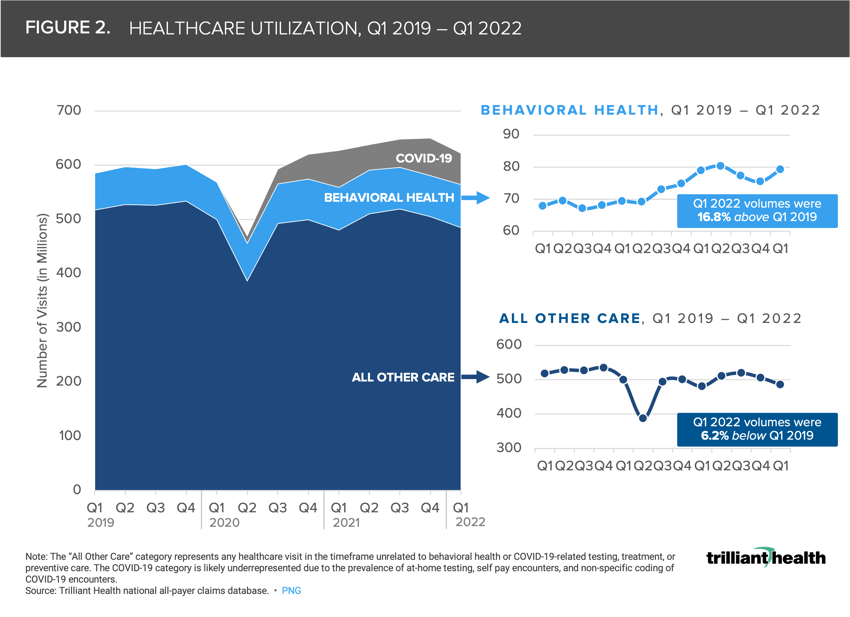

With COVID-19 omitted, behavioral health volumes are up 17% from Q1 2019, while all other healthcare encounters – broadly inclusive of inpatient, outpatient, and virtual encounters – are down by 6%.

Over the last two and a half years, much has been written about the delays in medical care due to pandemic-related disruptions. However, as individuals have resumed other activities like travel and in-office work, at what point does delayed care turn into forgone care? While "post-pandemic" care patterns are still evolving, data reveals that healthcare services that were previously thought to be delayed due to the pandemic have instead been lost. The impending end of the declared public health emergency will impact many of the pandemic-driven healthcare delivery and coverage exceptions tied to it, such as Medicaid eligibility for millions of Americans. With a declining commercially insured population and the disenrollment of millions of Medicaid beneficiaries, quantifying the magnitude to which Americans are seeking non-COVID-related healthcare services has never been more important.

While visit volumes appear to be trending above pre-pandemic levels, a closer look reveals that this is merely an illusion. When omitting care specific to the treatment, testing, and prevention of COVID-19, healthcare demand continues to track below pre-pandemic levels. However, not all sectors of the healthcare system are seeing this decline, as evidenced by the sustained increase in demand for behavioral health.

The Illusory Healthcare Rebound

COVID-19-related care is creating an “illusory rebound” in the return to healthcare. Although nationally urgent care volumes were 31% higher in Q1 2022 than in Q1 2019, the increase is primarily attributable to COVID-19-related testing and treatment (Figure 1). Notably, at the peak of the Omicron variant in Q1 2021, 47% of urgent care visits were attributed to COVID-19. Relatedly, despite a 0.2% increase in primary care volumes in Q1 2022 compared to Q1 2019, 62% of metropolitan CBSAs have not returned to pre-pandemic primary care volumes.

Increasing Behavioral Health Demand

Even with COVID-19 omitted, behavioral health volumes are up 17% from Q1 2019. In contrast, all other healthcare encounters – broadly inclusive of inpatient, outpatient, and virtual encounters – are down by 6% (Figure 2). This spike in demand for behavioral health care underscores the ongoing behavioral health crisis in the country, which cannot be met with the current supply of behavioral health providers.1,2,3,4,5 At the peak of the pandemic, over 40% of U.S. adults reported symptoms of anxiety and/or depression.6 From August 2020 to February 2021, the percentage of adults with symptoms of anxiety or depressive disorders increased by 5.1 percentage points (from 36.4% to 41.5%).7

By analyzing care patterns at the service line level, the differences in how Americans are returning to different sites and types of care in the post-pandemic era are stark. Additionally, not all markets are returning to healthcare at a similar rate, driven by a litany of factors beyond migration alone (e.g., affordability, fear, trust in the healthcare system). Despite the continual increase in consumer-centric, convenient provider options (e.g., CVS, Walgreens and Walmart), analyzing the utilization of non-COVID-19 care reinforces the extent to which patients have yet to fully "come back." Without strategies to re-engage patients across the health economy in accessing primary and preventive care, many health economy stakeholders will continue to experience volume and margin pressures. At the same time, delays in preventive care will likely manifest in more acute pathology when patients do eventually seek care.

This analysis is part of our deep-dive series into the 2022 Trends Shaping the Health Economy report.

For updated trend analysis, explore the 2025 edition of the Trends Report.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)