Research

Patients Prescribed Drugs Like Ozempic® and Mounjaro® Have Increased Over 300%

May 14, 2023Key Takeaways

-

National spending for semaglutide, the peptide name for brand drugs like Ozempic® and Wegovy®, totaled $10.7B in 2021, the fourth highest across drug classes. Spending for semaglutide increased by 90.1% from 2020 to 2021, the highest percentage of the top 25 highest-spend drugs.

-

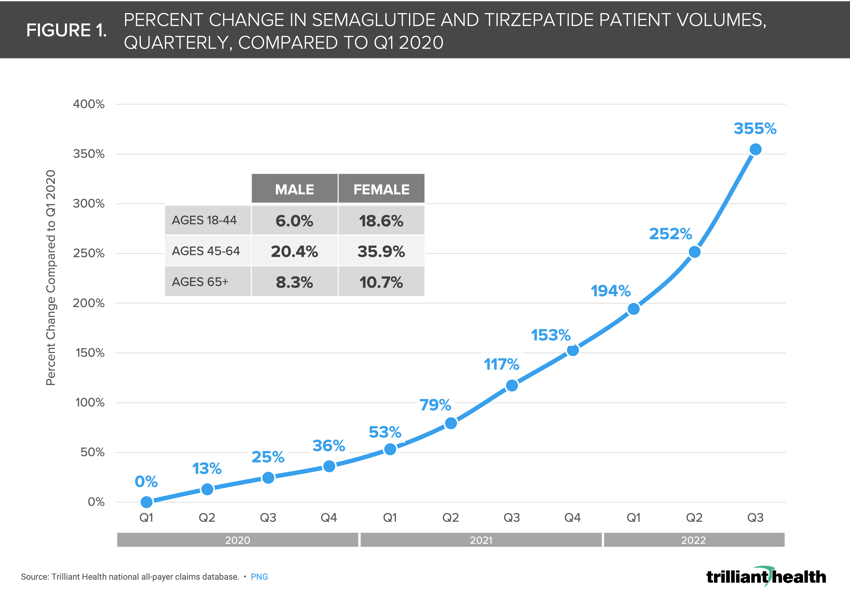

As of Q3 2022, patient volumes for these drugs increased 355% from Q1 2020, with the largest share of patients (35.9%) being females ages 45 to 64.

-

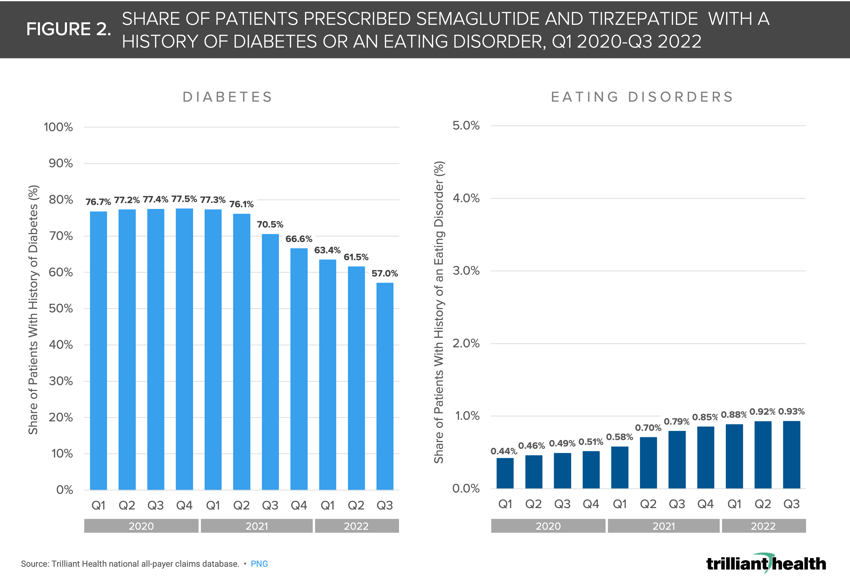

Although Type 2 diabetes is the primary indication for semaglutide, only 57.0% of patients taking these drugs had a past Type 2 diabetes diagnosis as of Q3 2022. Although less than 1% of patients had a prior diagnosis of an eating disorder, the share of those patients more than doubled, from 0.44% in Q1 2020 to 0.93% in Q3 2022.

-

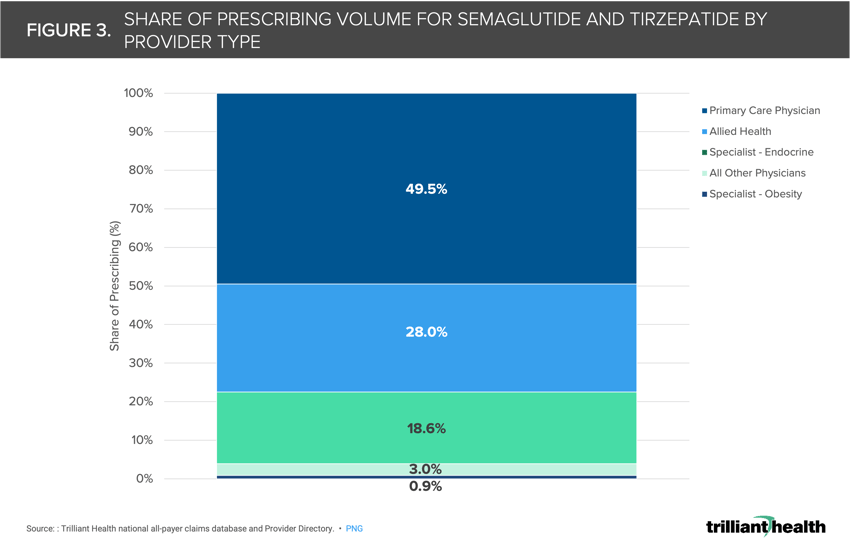

Primary care physicians (49.5%) prescribe these drugs most frequently, followed by allied health providers (28.0%) and endocrine specialists (18.6%).

Current demand for prescription drugs indicated for the treatment and management of Type 2 diabetes and obesity, specifically semaglutide, is unprecedented. National spending for semaglutide totaled $10.7B in 2021, the fourth highest among all drugs, increasing 90.1% from 2020.1 Given the supply challenges and cost of these drugs, additional information about patient demographics, prescribing patterns and the magnitude of on- vs. off-label use is needed.

Background

Semaglutide belongs to a class of drugs—GLP-1 receptor agonists—that have been used to treat Type 2 diabetes for almost 20 years. This injectable drug is sold by Novo Nordisk under the brand names Ozempic®, Wegovy® and Rybelsus®, all of which are in short supply.2 Ozempic® and Rybelsus® are indicated for long-term Type 2 diabetes management, while Wegovy® is indicated for long-term obesity management.3 However, off-label use of Ozempic®—the semaglutide drug with the most demand and least supply—is increasingly common.4 Another Type 2 diabetes management drug (tirzepatide) sold by Eli Lilly under the brand name Mounjaro® showed substantial weight-loss effects in a trial involving people with obesity who did not have Type 2 diabetes.5 Prior to the unprecedented demand for semaglutide, the most common treatment for obesity was bariatric surgery, an invasive and costly procedure—albeit a one-time cost compared to a lifetime of monthly semaglutide injections—for which commercial insurance coverage is uneven.

The combination of unprecedented demand for these drugs and America’s obesity crisis (41.9% of American adults) has catalyzed both the formation of telehealth companies (e.g., Sequence) and creation of business units within established telehealth companies (e.g., Teladoc, Ro) specifically targeting the obesity and weight management market.6,7,8 Notably, without insurance, these drugs cost between $892 to $1,300+ per month. When prescribed for off-label use, insurers are far less likely to provide coverage.9 The national cost implications for these drugs are significant given long-term use is required for drug efficacy.

Despite abundant media coverage on this topic, several factors have not been considered, including the share of prescribed patients with a history of Type 2 diabetes; the share of patients with a history of eating disorders; the markets with the highest increase in prescriptions; and the types of providers most commonly prescribing these drugs. Our research shows that the Phoenix metro area saw the greatest growth in Ozempic® prescriptions in Q1 2022 compared to Q1 2021.10 This finding suggests that while the increase in prescriptions is partially attributable to disease burden, other influences are likely at play. Thus, examining patient characteristics, provider prescribing behaviors and consumer preferences is critical to understanding the rise in prescribing amid the ongoing supply shortages.

Analytic Approach

Leveraging national all-payer claims data, we examined prescriptions for Ozempic® (first FDA approved in 2017), Wegovy® (first FDA approved in 2021) and Mounjaro® (first FDA approved in 2022) between Q1 2020 and Q3 2022. Across pay types, adult patients were segmented by age (18-44, 45-64, 65+) and gender. We then examined quarterly trends in the share of patients with a history of Type 2 diabetes or an eating disorder. While much of the discussion related to semaglutide use has focused on diabetes diagnoses, we were also interested in studying the relationship with eating disorders given the national spike in eating disorders across age groups within the same timeframe.11 Finally, using our Provider Directory we examined the share of prescriptions by healthcare provider type.

Findings

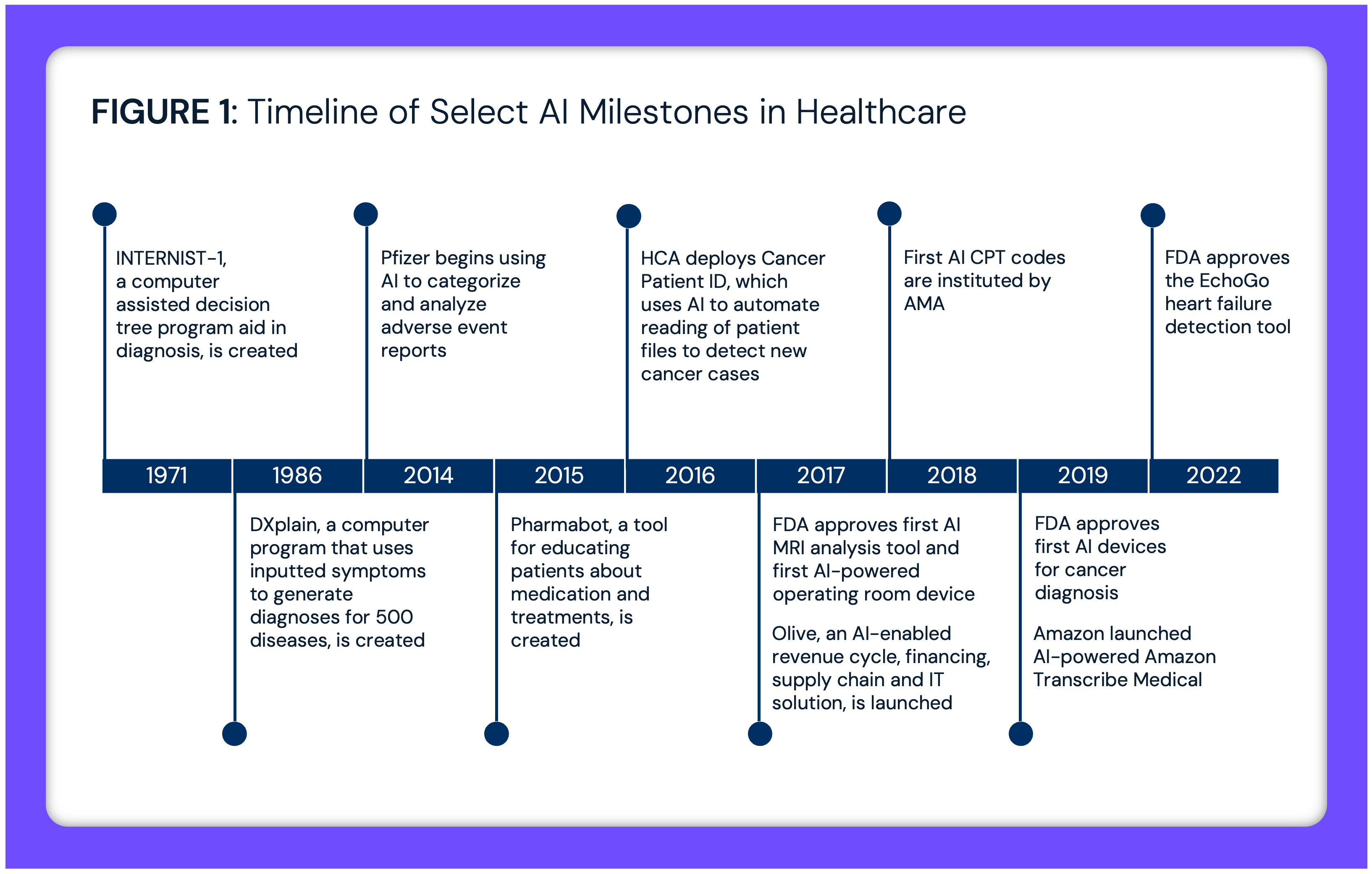

Patient volumes for the drugs included in the analysis have increased substantially quarter-over-quarter, some of which are correlated with FDA approval timelines. As of Q3 2022, patient volumes for these drugs had increased 355% from Q1 2020 (Figure 1). The largest share of patients (35.9%) are females ages 45 to 64.

While Wegovy® is currently the only drug approved for chronic weight management, the share of patients with a prior Type 2 diabetes diagnosis remained relatively consistent from Q1 2020 to Q2 2021, then consistently declined. In Q1 2020, 76.7% of patients who were prescribed these drugs had a prior Type 2 diabetes diagnosis, which declined to 57.0% by Q3 2022 (Figure 2). Although less than 1% of patients had a prior diagnosis of an eating disorder, the share of those patients more than doubled, from 0.44% in Q1 2020 to 0.93% in Q3 2022.

Primary care physicians (49.5%) prescribe these drugs most frequently, followed by allied health providers (e.g., nurse practitioners) (28.0%), and endocrine specialists (18.6%) (Figure 3).

The downstream impacts of the nationwide increase in demand for weight loss drugs remain to be seen. What are the clinical ramifications of prolonged off-label use of these drugs for potentially healthy, non-obese younger adult patients? To what extent will the health economy respond by increasing supply to meet demand (including off-label) or adjusting prescribing practice patterns and guidelines to temper or regulate demand to focus on patients with clinically necessary indications? While the share of patients taking these drugs with a history of eating disorders is small, to what extent could the sustained rise in eating disorders be correlated with the growing off-label use of drugs like Ozempic®?

In any event, with healthcare spending approaching 20% of U.S. GDP, widespread uptake of drugs costing $1,000 per patient per month will have a profound impact on national healthcare spending during a time where policymakers are focused on reining in costs.12 Given that the highest demand is in the non-Medicare population, health plans must determine whether to include these drugs in formularies, taking into account ongoing off-label use of these drugs. To what extent will health plans consider adjusting coverage provisions for such use?

Additional research is needed to further understand provider and patient behaviors underlying this broader trend. For example, is there a difference in the proportion of off-label use by provider type (i.e., primary care vs. endocrine specialist)? How many of these prescriptions are rendered via telehealth vs. in-person visits? To what extent does extended use of these drugs for both on-and-off label use increase or decrease the total cost of care for these patients?

Thanks to Austin Miller and Katie Patton for their research support.

- Studies

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)