Product Blog

Measuring Market Share Trends: A Step-by-Step Guide To Analyzing Service Line Performance

May 1, 2025thiTable of Contents

- Why Most Health Systems Fail To Measure Market Share Accurately

- How Accurately Tracking Market Share Informs Improved Strategic Planning

- What This Guide Will Reveal About Your Market Position

- Step-by-Step Guide: Measuring Market Share

- Key Takeaways

- Related Resources

Why Most Health Systems Fail To Measure Market Share Accurately

Market share is the most important metric of winning – or losing – in any competitive market. Measuring market share accurately is a best practice in a positive-sum market; in healthcare’s negative-sum game, it is mission-critical.

Every healthcare provider overestimates their market share, because no healthcare provider knows all their competitors. Additionally, most health systems focus on traditional hospital competitors, overlooking the growing number of ambulatory providers capturing significant visit volume.

Without a comprehensive understanding of every competitor in a market, healthcare providers are prone to make suboptimal strategic decisions.

An accurate understanding of the market is almost always sobering, because it reveals a hard truth: stakeholders don’t know their customers as well as they assume – and that knowledge gap is costing them.

However, for those who understand the importance of competing for commercially insured patients, an accurate understanding of market share is a catalyst for change.

How Accurately Tracking Market Share Informs Improved Strategic Planning

Comprehensive market share analysis is the foundation for effective strategy. By understanding market share at the service line level, a healthcare provider can:

- Identify emerging competitors before they significantly impact performance

- Understand which markets offer the best opportunity for growth and service line expansion

- Develop targeted interventions for service lines with declining share

- Allocate capital investments to areas with the highest return potential

What This Guide Will Reveal About Your Market Position

By following this guide, you will be able to answer the following critical questions with confidence:

- What is the total addressable market (TAM)?

- Is the market expanding or contracting?

- What is your market share percentage and trend?

- How does your market share vary by service line? By procedure type?

- How many competitors offer similar or substitute services?

This guide will enable you to answer each of these questions using Market Explorer providing the market visibility necessary to stay ahead of shifting dynamics, uncover growth opportunities and make evidence-based decisions.

Step-by-Step Guide: Measuring Market Share

To help you measure and analyze your market share, we’ll guide you through the following steps:

- Step 1: Defining Your Total Addressable Market

- Step 2: Measuring Your Market Share Trends

- Step 3: Identifying Driving Forces of Trends

- Step 4: Identifying Opportunities To Compete

- Step 5: Turning Insights Into Strategic Action

Each step is designed to give you the insights and tools necessary to make informed strategic decisions. Let’s break down each step in detail.

Step 1: Defining Your Health System’s Total Addressable Market (TAM)

To properly track market share, identify the geographic areas that define your primary and secondary service areas. Focus on utilization-based boundaries that reflect actual patient migration patterns for relevant services across both inpatient and outpatient settings.

Our team works directly with each customer to divide their entire service area into pre-defined markets, which can be explored individually within the application. Free users can access data at the state level.

Once your geographic markets are defined, our tools help you accurately assess your total addressable market by leveraging our comprehensive provider directory data. Because our data identifies all the competitors operating within each market – from hospitals to outpatient facilities – our products provide a more accurate understanding of market size and share.

In the Platform:

- Navigate to Market Explorer and select your geographic market from the dropdown menu.

- Apply service line and time range filters using the filter panel to focus your analysis.

- Review the Market Overview section to see your TAM across inpatient and outpatient settings.

- Observe the trend indicators to determine whether your market is expanding or contracting over time.

The Market Overview dashboard displays your TAM – in this example, 4.24M visits for the musculoskeletal (MSK) service line over the time period.

The Market Overview dashboard displays your TAM – in this example, 4.24M visits for the musculoskeletal (MSK) service line over the time period.

💡 Key Insight: Unlike traditional market definitions that overlook significant care delivery segments, Market Explorer captures all settings of care including hospital-based care, ambulatory care and non-traditional settings, providing visibility into your true competitive landscape.

Step 2: Measuring Market Share Trends

Now that you understand your TAM, the next step is to calculate your market share as a percentage of that TAM.

Understanding both your market share percentage and the overall TAM trend is critical. In a negative-sum game, "winning" often means losing less than your competitors.

Your visit volumes could decline as your market share increases, signaling a shrinking market where you are outperforming others – possibly due to competitor closures or stronger retention.

Conversely, slight volume growth with declining market share suggests an expanding market where competitors are growing faster, driven by new entrants, aggressive strategies or shifting referrals.

In the Platform:

- Navigate to the Market Overview dashboard in Market Explorer.

- Note the key metrics displayed at the top:

- Total Visits (4.24M in this example) shows your TAM for the service line.

- My Average Share (4.2% in this example) shows your portion of the market for the selected period.

- Examine the Visit Volume trend chart (left) to understand if seasonal variation has impacted the market’s expansion or contraction.

- Review the Market Share trend chart (right) to analyze your competitive position over time.

- Use these combined insights to determine whether your position is improving or declining relative to the overall market.

The example health system’s average share of MSK visits is 4.2%, but it has trend variation following Q1 2023.

The example health system’s average share of MSK visits is 4.2%, but it has trend variation following Q1 2023.

🤔 Analysis Question: How is your commercial payer mix trending? When one of our clients used Market Explorer to analyze orthopedic surgical volume in a key market across payers, they learned that while their overall market share was 2.8% and increasing, their commercial share was just 1.5% and declining. This insight drove targeted strategies to retain commercial patients and optimize referrals – opportunities they would have missed without deeper analysis.

Step 3: Identifying the Driving Forces of Your Market Share Trends

With a clear understanding of your market share by service line, you can now assess the “why” behind the trends. In this step, you can explore the specific procedure types driving the changes in your market share.

For example, you might see an overall increase in market share, but is that due to higher volumes of certain procedures while other key procedures are declining?

By identifying which procedures are contributing to your market share fluctuations, you will gain valuable insights into which areas are driving growth or causing losses, helping you better prioritize resources and interventions.

In the Platform:

- Navigate to the filters panel in Market Explorer.

- Apply procedure type and sub-type filters to focus your analysis.

- Repeat this exercise with different selection(s) of key procedures or procedure sub-types that align with your service line initiatives.

- Use these combined insights to determine how certain procedures are impacting your market position.

%20-%20Rectangle-1.png?width=1927&height=1000&name=Market%20Share%20-%20Image%203.1%20(Surgical)%20-%20Rectangle-1.png)

%20-%20Rectangle-1.png?width=1927&height=1000&name=Market%20Share%20-%20Image%203.2%20(PT)%20-%20Rectangle-1.png) The example health system’s average share is 14.2% of MSK surgeries (top) in the example market but only has 1.7% average market share for MSK PT/OT services (bottom).

The example health system’s average share is 14.2% of MSK surgeries (top) in the example market but only has 1.7% average market share for MSK PT/OT services (bottom).

🤔 Analysis Questions: Which procedure types are leaving your network, and where are they going? Are there specific competitors capturing these cases?

Step 4: Expanding Market Visibility: Identifying Opportunities To Compete

These insights give you a clear picture of your current market position, but if you want to compete in the health economy’s negative-sum game, there’s more work to be done. The next step is to identify where you can capture more market share.

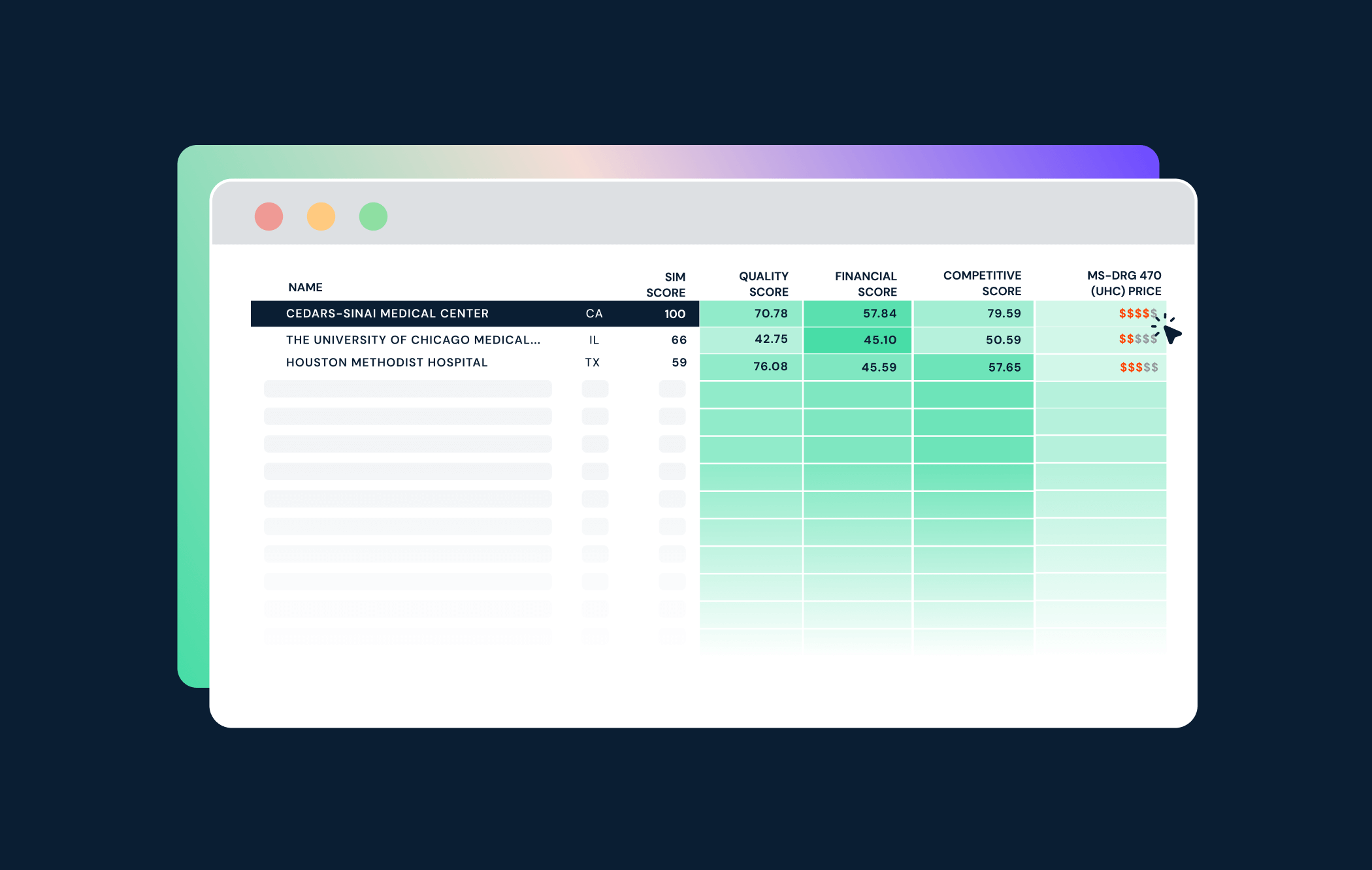

Understanding your competitors is critical – not only to pinpoint opportunities but also to quantify them. Knowing who holds the most market share allows you to prioritize strategic moves that can make the greatest impact.

Market Explorer eliminates competitive blind spots by providing a more detailed view of competitors in your market. By identifying how market share is distributed across competitors, Market Explorer helps gauge market concentration, identify organizations pulling volume from key service lines and prioritize competitive threats that most impact network performance.

In the Platform:

- Navigate to the Market Leaders dashboard in Market Explorer.

- Apply service line or procedure type filters using the filter panel to focus your analysis.

- Review the Leaders by Visit Volume section to see which organizations render the most care that aligns with your service line priorities.

- Select up to three competitors of interest to populate and compare monthly trends in visit volume and market share.

The example health system holds the second-largest market share for MSK surgeries among competitors in the market (Top). Users can explore competitor organizations by clicking on them to directly compare visit volumes and market share (Bottom).

The example health system holds the second-largest market share for MSK surgeries among competitors in the market (Top). Users can explore competitor organizations by clicking on them to directly compare visit volumes and market share (Bottom).

🤔 Analysis Questions: How are the providers in your market impacting your market share performance? What are the best opportunities for market share expansion?

Step 5: Turning Market Insights Into Strategic Actions

With a clear understanding of your TAM, market trends and competitive landscape, the next step is to turn insights into action. Consider the following to protect and grow your market share:

Strategic Actions:

- Analyze service line performance: Identify your highest-value and most vulnerable service lines by analyzing market share trends across different procedures and payer types with Market Explorer.

- Develop targeted growth initiatives: Create service line-specific strategies for physician recruitment, facility investment and marketing campaigns based on market share data.

- Present evidence-based recommendations: Use market share data to support strategic recommendations to your executive team and board.

- Assess physician network strength: Map referral patterns to assess network integrity and which physician relationships need strengthening. This functionality is not available in Market Explorer but can be accessed in Network Explorer, which is the platform that serves as the next step in your strategic planning.

Key Takeaways

By following this guide, you now have the tools to assess and analyze your market share with confidence. Keep in mind the key insights that will help you effectively assess and leverage your market share for strategic success:

- Market share is more complex than it seems: Traditional market share analysis often overlooks the growing influence of nontraditional competitors, such as ambulatory surgery centers and independent physician groups, making it essential to broaden your competitive lens.

- High-level market share trends don’t tell the full story: A service line’s overall market share may appear stable, but underlying shifts – such as one procedure type growing while another declines – can significantly impact your competitive position.

- A complete competitive view is critical: To defend your position, capture high-value opportunities and grow strategically, you need visibility into all competitors, where your cases are going, and what’s driving shifts in patient volume.

Related Resources

Market Explorer: Try It for FreeA Field Guide To Survive Healthcare’s Negative-Sum Game: Market Share

Study: Quantifying Share of Care for Patients as Consumers

Study: Differentiating IP and OP Market Share

Need help applying these insights to improve your health system’s service line strategies? Schedule a consultation with our analytics team.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)