We previously discussed how health systems can address declining patient volumes, which is partially attributable to patients continuing to delay care (e.g., annual recommended screenings, well visits) since CMS’s March 2020 guidance to delay non-essential care.1,2 Since March 2020, the dynamics of healthcare demand, supply and yield have changed for all stakeholders in the health economy. The downstream effect of continuing care delays, changing benefit design, and inflation will likely materialize in the form of premium hikes and more expensive healthcare, particularly in the commercial market.

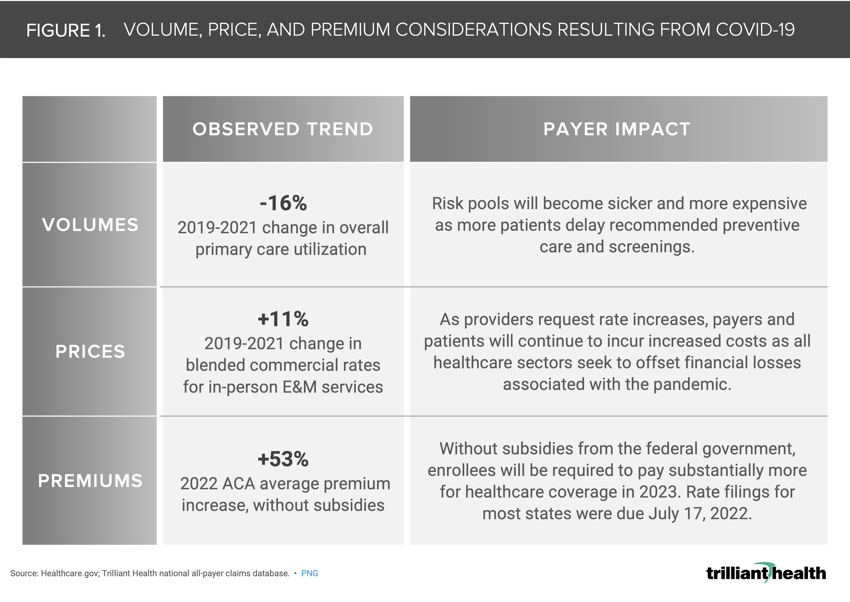

Our research has demonstrated that consumers have been slow to return to primary care settings and, as a result, recommended preventive screenings.3,4,5 Despite a nationally observed trend of females ages 20-49 consuming more primary care, cervical cancer screenings declined 26.5% from 2019 to 2020.6 Overall primary care volumes were down 16% in 2021 from 2019 (Figure 1). Forgone preventive care, especially for patients with predispositions for certain cancers or chronic illnesses, inevitably prevents early intervention and diagnosis, often resulting in accelerated disease progression.

The resulting pool of sicker patients enrolled in a given health plan, particularly in the commercial market, will be more expensive to manage. As payers attempt to recoup costs associated with “free” testing for COVID-19 and the current and projected impact of inflation throughout the healthcare supply chain, premium increases are certain, as evidenced in the individual and group commercial markets (+53% 2022 premium hike). These rate increases have been partially offset through federally available subsidies during the public health emergency (Figure 1), which Congress will likely extend through 2025 for those purchasing coverage via Affordable Care Act subsidies.7,8,9 However, this near-term fix will not be a final solution.

Pre-pandemic trends in benefit design and additional changes resulting from the pandemic have also negatively affected healthcare costs for consumers (i.e., out-of-pocket costs) and payers through disproportionate medical loss ratio (MLR). For years, the number of commercially insured patients in the U.S. has been in secular decline as a percentage of U.S. population, with an increasing Medicare-eligible population and a declining birth rate. To offset lower reimbursement rates in the growing Medicare program, healthcare providers will continue to negotiate higher commercial reimbursement, the impact of which disproportionately affects consumers with high deductible health plans. Between 2019 and 2021, the blended commercial cost of a standard, in-person evaluation and management (E&M) service increased 11% (Figure 1). The impact of increasing costs, continuing coverage churn between employer-sponsored insurance, individual insurance, and Medicaid, and eligibility shifts due to the pandemic has created an even more fragmented system.

In the aftermath of the pandemic, Americans have yet to return to pre-pandemic healthcare utilization volumes. Despite survey research indicating patients are eager to return to traditional care settings,10,11 delays in care are likely to continue due to economic forces and reduced trust in the healthcare system. With inflation recently reaching 9.1%, consumers are stretched thin, which could result in more delaying of necessary care to avoid out-of-pocket healthcare spending.12 With 53% of privately insured Americans enrolled in employer-sponsored high deductible health plans (HDHPs), healthcare is more likely to be cut from consumers’ budgets compared to the 2008-09 recession when just 8% were enrolled in HDHPs.13,14

Ultimately, every stakeholder in the health economy has a stake in developing strategies to encourage and incentivize Americans to utilize primary care in a consistent and timely manner. Given utilization trends of the last 24 months, creative approaches and new collaborations among provider, payers and employers may be required to ensure that delays in care do not create a population with increasing morbidity and mortality.

Thanks to Katie Patton and Kelly Boyce for their research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)