With Americans delaying, and in many cases foregoing, preventive and acute care (e.g., non-emergent surgeries) for an extended period due to the COVID-19 pandemic, an increasing burden of disease is likely. While the magnitude of the pandemic’s impact on downstream health outcomes (e.g., cancers diagnosed at later stages) will not be fully revealed for many years, current indications warrant near-term interventions.

Many survey-, claims- and EHR-based studies have attempted to quantify the delays of certain preventive screenings.1,2,3,4,5,6 For example, the National Cancer Institute projects an excess of 10,000 deaths attributable to colorectal and breast cancer from 2020 to 2030.7 However, current research has been limited (i.e., reliance on survey data alone, limited population segment, singular market or coverage source, and incomplete view of screening types) in its study scope.

Analytic Approach

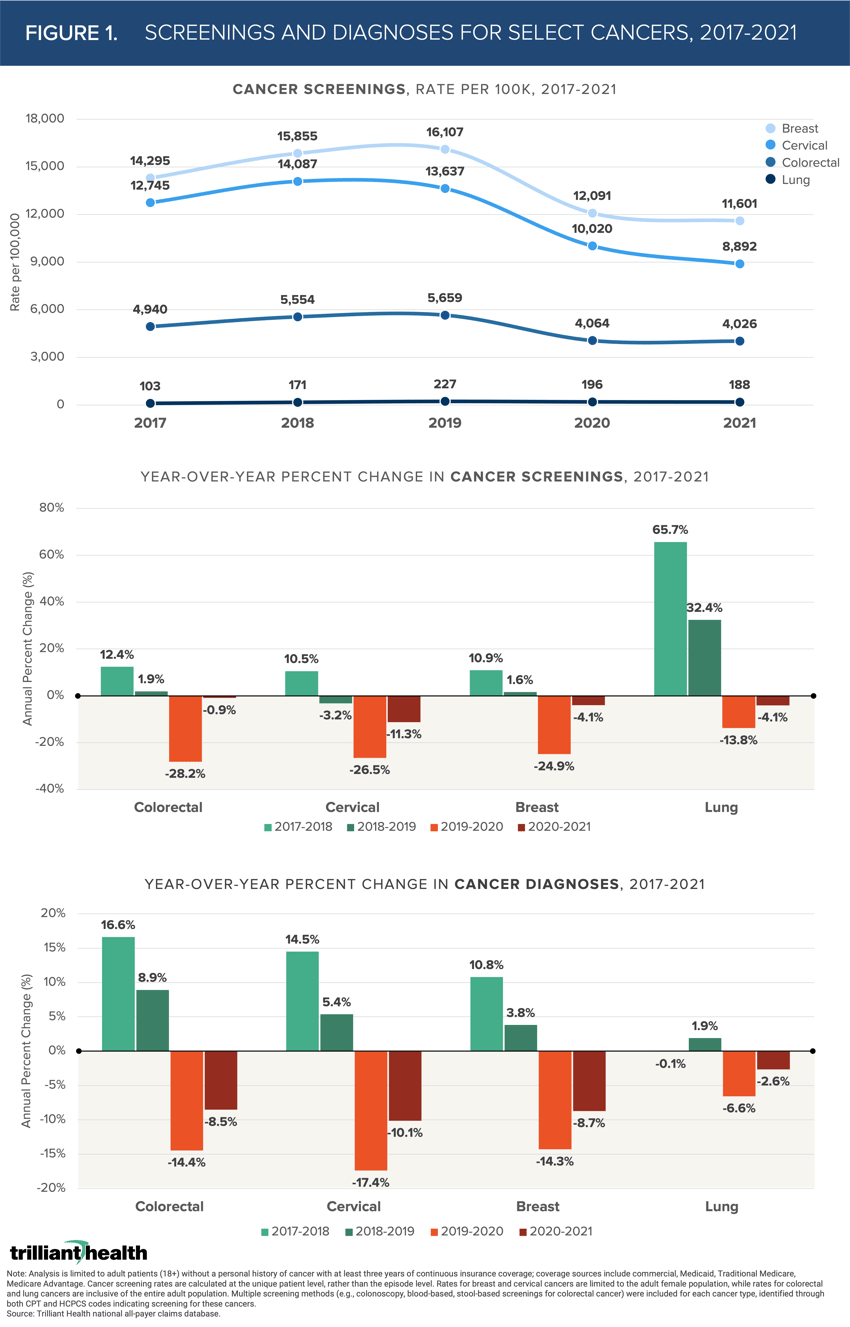

The importance of preventive measures in detecting and treating cancer is well established. To determine the extent to which Americans delayed cancer screenings, we examined cancer screenings recommended by the U.S. Preventive Services Task Force (USPSTF) for certain adult populations for the following cancers: lung, colorectal, breast, and cervical.8,9,10,11,12 We limited the analysis to patients ages 18 and older without a personal history of cancer and with at least three years of continuous insurance coverage. For this patient cohort, we calculated the annual utilization rate of the recommended screening types (e.g., colonoscopy, blood-based screenings, and stool-based screenings for colorectal cancer) for each distinct cancer between 2017 and 2021. We then calculated percent change in new cancer diagnoses within the same period.

Findings

Screenings for these four cancer types declined in volume from 2019 to 2020, and again from 2020 to 2021 (Figure 1). Despite a nationally observed trend of females ages 20-49 consuming more primary care, cervical cancer screenings, which are recommended for females ages 21 to 65, declined most dramatically from 2019 to 2020 (-26.5%) and continued to decline from 2020 to 2021 (-11.3%). Consistent with these findings, cervical cancer diagnoses also declined more than the other three cancer types, reflecting the magnitude of female patients remaining undiagnosed.

Conversely, lung cancer screenings and diagnoses declined the least during pandemic years. Of note, the recommended population for lung screenings is more limited, spanning adults ages 50 to 80 with a maximum 15-year smoking history. While the analysis was limited to lung cancer screenings via low dose computed tomography, we separately observed minimal declines in general chest x-ray volumes (-6% in 2020 and -3% in 2021). Therefore, the smaller decline in lung cancer diagnoses could likely be correlated with x-rays performed for non-screening purposes (e.g., pneumonia, COVID-19, chest injury, etc.). While screenings for all four cancer types declined from 2019 to 2020 and again from 2020 to 2021, colorectal cancer screenings declined the least in 2021 (–0.9%).

Developing an effective response to the national decline in cancer screenings requires market-level analysis to understand which patients in which markets are most likely to have delay screenings. This information will enable providers to assess shifts in incidence of disease, and corresponding changes in service demand, which are the cornerstone of effective resource allocation. Demand trends paired with insight into the demographics, psychographics, preferences, and motivations of patients who have foregone preventive screenings is crucial to successful re-engagement. Industry stakeholders who fail to develop dynamic demand forecasting capabilities to assess the impact of deferred care, excess deaths in younger populations, population migration, and shifting delivery preferences on a continual basis will be unprepared to thrive in the post-pandemic health economy.

Developing an effective response to the national decline in cancer screenings requires market-level analysis to understand which patients in which markets are most likely to have delay screenings. This information will enable providers to assess shifts in incidence of disease, and corresponding changes in service demand, which are the cornerstone of effective resource allocation. Demand trends paired with insight into the demographics, psychographics, preferences, and motivations of patients who have foregone preventive screenings is crucial to successful re-engagement. Industry stakeholders who fail to develop dynamic demand forecasting capabilities to assess the impact of deferred care, excess deaths in younger populations, population migration, and shifting delivery preferences on a continual basis will be unprepared to thrive in the post-pandemic health economy.

Thanks to Kelly Boyce and Katie Patton for their research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)