Key Takeaways:

-

Cancer Incidence and Mortality Trends: Over the past two decades, cancer cases have steadily increased in the U.S. Although national cancer mortality rates have generally declined over time, there is meaningful variation by age group. Concerns persist for 2024 and beyond regarding worsening trends, particularly in lung and bronchus and cancers of other and unspecified sites.

-

Impact of COVID-19 Pandemic on Cancer Burden: The COVID-19 pandemic has catalyzed trends in chronic conditions, shifts in lifestyle habits and changes in dietary patterns, all of which contribute to the evolving landscape of cancer burden. These factors, alongside missed screenings and decreased utilization of primary care, pose multifaceted challenges in cancer prevention, early detection and management, emphasizing the importance of holistic approaches to mitigate the impact on public health.

-

Economic Indicators and Cancer Care: The rising Producer Price Index for neoplasms may in part signal increasing demand for and complexity of cancer-related healthcare services, potentially reflecting the growing burden of cancer. The combination of accelerating costs, forecasts of increasing disease incidence, trends in M&A activity for oncology-focused life sciences firms and other oncology-focused investments highlights the importance of understanding economic dynamics of cancer prevalence and treatment.

Cancer is a significant global health challenge, and cancer prevalence is projected to increase over the next two decades.1 These trends were well established before the COVID-19 pandemic, which disrupted cancer screenings and delayed diagnosis and treatment globally. In the U.S., where cancer ranks as the second-leading cause of death, pandemic-induced disruptions have raised concerns regarding potential increases in advanced-stage cancer diagnoses and mortality rates.2

In December 2022, I wrote an article in The Hill outlining how cancer is the next public health crisis. While cancer has always been a clinical area of great focus, data signals suggest that COVID-19 has accelerated shifting acuity. We sought to analyze the various factors influencing cancer incidence, prevalence and mortality in the U.S., encompassing healthcare, environmental and behavioral aspects.

Examination of the relevant factors and the potential acceleration of underlying trends related to the COVID-19 pandemic can provide insight into the urgent need for heightened efforts to mitigate the impact of cancer on Americans of every age.

U.S. Cancer Trends Through 2019 and Projections for 2024

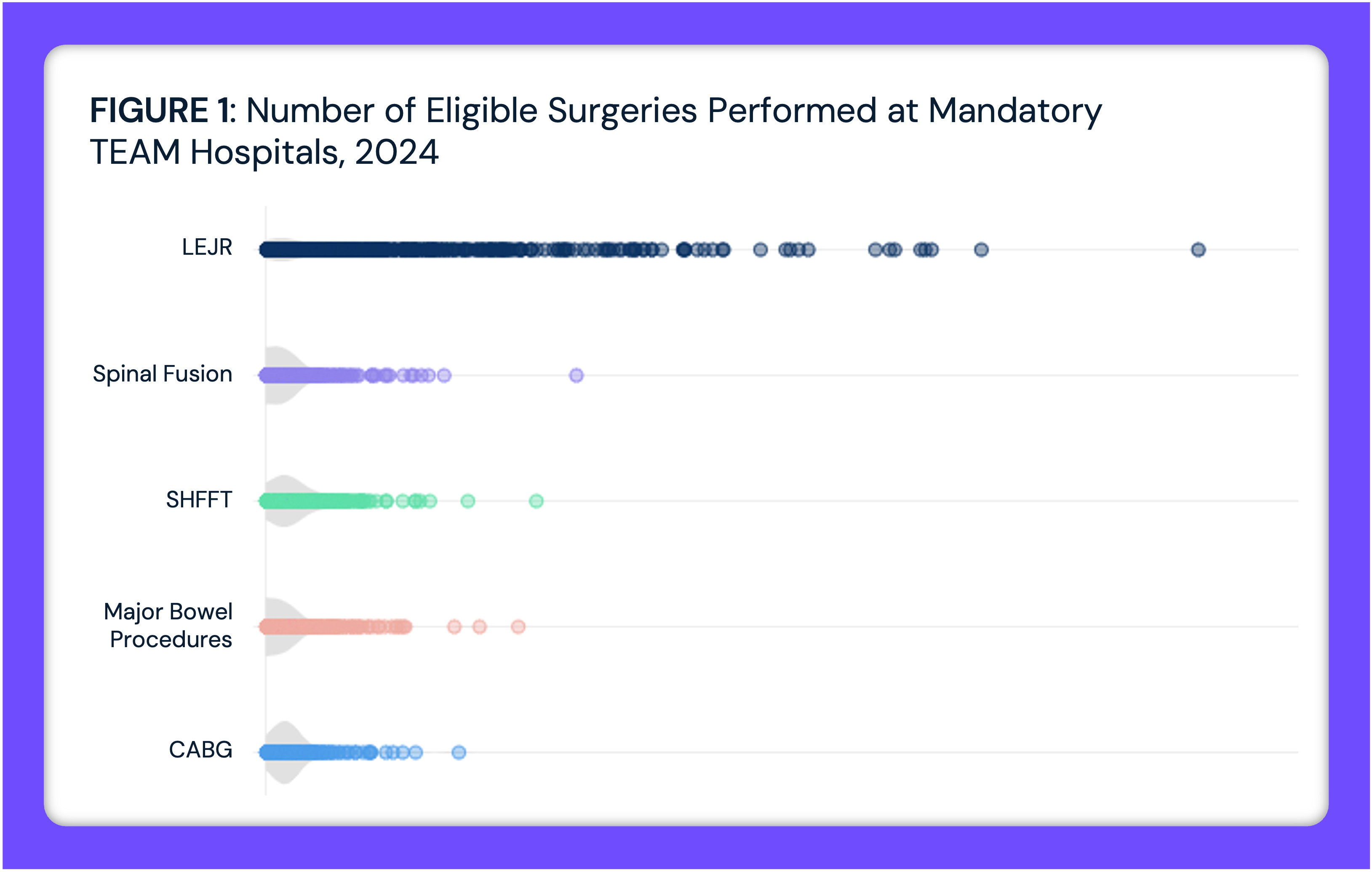

The number of new cancer cases in the U.S. has increased steadily from 1999 through 2019, from 1.3M to 1.8M, highlighting the growing burden of cancer (Figure 1). Controlling for growth of the population, the cancer incidence rate has declined slightly but fluctuated from year to year, ranging from 450 to 491 per 100K (Figure 2). However, there are meaningful differences in the incidence rate by cancer type. Over the same timeframe, the incidence rates for cancers of the corpus and uterus, kidney, pancreas and melanomas increased, while rates of prostate, lung, colon and bladder cancers declined (Figure 3). Rates for breast cancer and non-Hodgkin lymphoma remained relatively unchanged.

Although national cancer mortality rates have generally declined over time, there is meaningful variation by age group.3 From 2018 to 2022, deaths from malignant neoplasms increased by 5.0% among individuals ages 35-44. Younger age groups historically are less affected by many cancers as reflected in current cancer screening guidelines (Figure 4). Conversely, malignant neoplasm deaths have decreased year-over-year for older age groups, specifically ages 45-54 and 55-64.

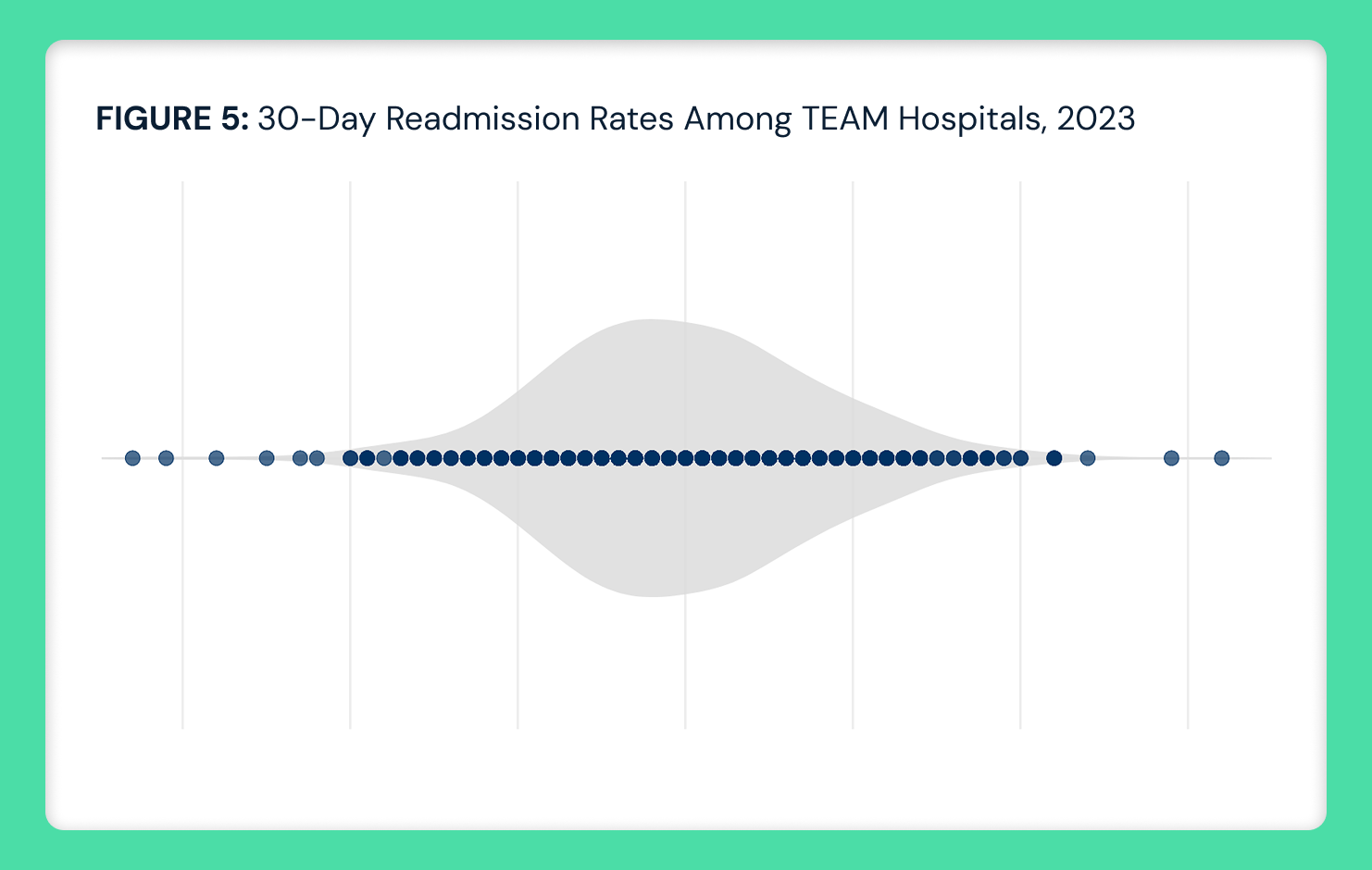

Increasing acuity in younger Americans without pre-existing conditions in tandem with the projected cancer incidence and mortality rates underscore concerns about worsening acuity and incidence since the COVID-19 pandemic. In 2024, the American Cancer Society estimates that there will be 2.0M new cancer cases and 611K cancer deaths in the U.S.4 Notably, lung and bronchus cancers are projected to have the highest number of deaths (125K), while breast cancer is estimated to have the highest number of new cases (313K) (Figure 5). Additionally, colorectal cancer presents a significant burden, with an estimated 153K new cases and 53K deaths anticipated in 2024. Cancers of other and unspecified primary sites are the only cancer type where estimated deaths are projected to exceed new cases, underscoring the need for research into cases of unknown sites. Despite advancements in screening and treatment, these figures emphasize the need for novel research and increased investment to improve outcomes for these cancers.

Figures 1-5.

Trends Impacting Cancer Burden Catalyzed by or Continuing Following the COVID-19 Pandemic

- While missed cancer screenings due to care avoidance during the COVID-19 pandemic will undoubtedly have an impact on detection and mortality reduction, it is important to note that cancer screening is not uniformly concordant with evidence-based guidelines. The U.S. Preventive Services Task Force has made guideline changes to certain cancer screenings with A or B grades in recent years. For example, an adjustment to cervical cancer screening guidelines to add a five-year screening period was followed by expected lower screening rates, while lowering the colorectal screening recommendation age to 45 has not yet changed the volume trajectory (Figure 6). Conversely, prostate cancer screening is not broadly recommended, but screening rates have remained consistently high. To what extent are providers adjusting their practice patterns to treat patients using the latest screening guidelines?

- As expected with observed lower cancer screenings, primary and preventive care has not returned to pre-pandemic levels despite increased access to convenient care options (e.g., retail clinics, telehealth). From 2019 to 2022, primary care volumes declined by 8.4%, while behavioral health demand increased by 20.1% (Figure 7).

- Projections indicate that the supply of hematologists and oncologists will fall below 100% adequacy, meaning projected physician supply is insufficient to meet demand (Figure 8). These projections are based on historical data, and the extent of undersupply may vary depending on potential changes in cancer incidence. If more complex cancers are detected at later stages and become more prevalent, the undersupply issue could be exacerbated.

- Investment and merger and acquisition (M&A) activity within the life sciences industry often serve as signals for anticipated shifts in disease burden. In recent years, life sciences M&A activity has been heavily concentrated in oncology and rare diseases. Since 2021, Pfizer has significantly invested in building their footprint in oncology, immunology and rare diseases, with investments totaling $62.3B (Figure 9). Across therapeutic areas, oncology has seen the highest dollar value investments. Between 2010 and 2018, Pfizer acquired one oncology-focused company for $14B. From 2019 to 2024, Pfizer acquired three oncology-focused companies for a total of $56.6B – 4X more than the oncology acquisition spend between 2010 and 2018. In 2023, Pfizer completed its acquisition of Seagen, which has a portfolio of cancer medicines, for $43B and in 2024 Novartis announced its acquisition of oncology biopharmaceutical company, Morphosys, for $2.9B.5,6 To what extent are these M&A decisions based on signals suggesting an increase in patient need — or demand — for cancer care versus improving existing treatments?

- Chronic conditions like obesity and diabetes are risk factors for developing cancer. Obesity is associated with at least 13 types of cancer (e.g., uterine cancer, breast cancer, colorectal cancer, etc.), and type 2 diabetes is a risk factor for developing several cancers (e.g., pancreatic cancer, liver cancer, colon cancer, breast cancer and uterine cancer).7,8 The adult prevalence of obesity and diabetes has increased over the last 10-20 years across all age bands and regions of the U.S. The South consistently exhibits the highest obesity rates compared to other regions, with prevalence increasing from 30.0% in 2011 to 36.3% in 2022 (Figure 10). Nationally, prevalence of obesity increased from 27.7% in 2011 to 33.3% in 2022. Additionally, the share of adults diagnosed with diabetes increased from 6.0% in 2000, peaking at 9.1% in 2018, and totaling 8.4% of adults in 2022 (Figure 11). Notably, an estimated 23% of adults with diabetes are undiagnosed.9

- Several social, lifestyle and environmental factors have been correlated with cancer risk in recent years. While e-cigarette vaping has not been demonstrated as a causal factor in cancer, the use of e-cigarettes became increasingly common among young people over the last decade and the long-term effects are not yet fully understood.10 Notably, in 2018 20.8% of U.S. high school students reported e-cigarette use, up from just 1.5% in 2011 (Figure 12).11 The American diet has also become increasingly processed. Evidence from a limited number of observational studies suggest that diets high in ultra-processed foods are associated with an increased risk of hypertension, cancer, type 2 diabetes, depression and premature death. Consumption of ultra-processed food grew from 53.5% of calories in 2001-2002 to 57.0% by 2017-2018 (Figure 13).12

- Mainstream public interest in a topic can serve as a signal of areas with growing attention from the broader population. Since 2020, Google searches for “cancer incidence” have generally trended upwards, reaching the highest volume of searches at the end of 2022 and the beginning of 2023 (Figure 14).

Figures 6-14.

Foreseeing Signals for Changing Cancer Incidence, Prevalence and Mortality

The increasing incidence of early-onset cancer (i.e., diagnosis for people younger than age 50) will likely continue. Rates of early-onset cancers are growing, especially for adults ages 30-39, for whom incidence increased by almost 20% between 2010 and 2019 (Figure 15).13 Most cancer screening occurs in primary care settings, for which volumes declined by 6.3% from 2021 to 2022.

Logically, the likelihood of diagnosing early-onset cancer has dropped and will likely manifest in later stage diagnosis and increased mortality. It will be critical to not only analyze trends in early-onset cancer, but also trends in late-stage diagnosis following system-wide care disruptions during the COVID-19 pandemic.

Even prior to the pandemic, rates of new cases of late-stage cancers were growing for rectal cancer, cervical cancer and prostate cancer.14 Early-stage cancer diagnoses decreased by roughly 20% in 2020, and emerging studies have concluded that patients are more likely to get diagnosed at stage four (i.e., metastatic) — across nearly all cancer types.15

While screenings, diagnoses and mortality serve as critical indicators for changes in cancer incidence and prevalence, economic factors can also provide signals of emerging trends. The Producer Price Index (PPI) measures the average change over time in the prices domestic producers receive for their output. Analyzing the PPI for general medical and surgical hospitals by service line can reveal dynamics in supply and demand for healthcare services.

Across all service lines, PPI has trended upwards since 2019, with PPI for neoplasms (i.e., cancers) increasing from 105.3 in December 2019 to 130.2 in December 2023 (Figure 16). Although PPI has increased since 2019 for all service lines (e.g., digestive, endocrine), the rate of change by service line is variable. In comparing the average 2019 PPI to the average 2023 PPI, the change ranged from 7.7% (nervous system) to 23.6% (neoplasms) (Figure 17).

The factors that influence PPI are myriad, such as demand for services, provider supply, drug and device shortages, supply chain disruptions, high – and growing – cost of cancer therapies and complexity of treating cancer patients. However, the relative increase in PPI for neoplasms is noteworthy and can serve as an additional signal when studying the worsening acuity and increasing disease burden of cancer.

Figures 15-17.

The analysis of factors influencing cancer incidence, prevalence, and mortality in the U.S. underscores the persistent challenges and emerging complexities of curbing disease burden. The steady rise in cancer incidence over the past two decades, coupled with projections indicating further increases, underscores the urgent need for proactive measures.

The disruptions caused by the COVID-19 pandemic have exacerbated existing issues, such as missed screenings and delayed diagnoses, amplifying concerns about advanced-stage presentations and mortality rates.

Beyond clinical and human health indicators, economic indicators, such as the rising PPI for neoplasms, provide further insight into the evolving dynamics of cancer care delivery and demand.

The rate of change among these various factors makes it clear that the next decade in cancer care should be cause for concern and will require more aggressive prevention, detection and treatment strategies.

Thanks to Katie Patton for her research support.

- Studies

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)