Studies Archive

Provider Burnout Will Continue to Exacerbate the Long-Standing Physician Supply Shortage in 2023

December 11, 2022Key Takeaways

-

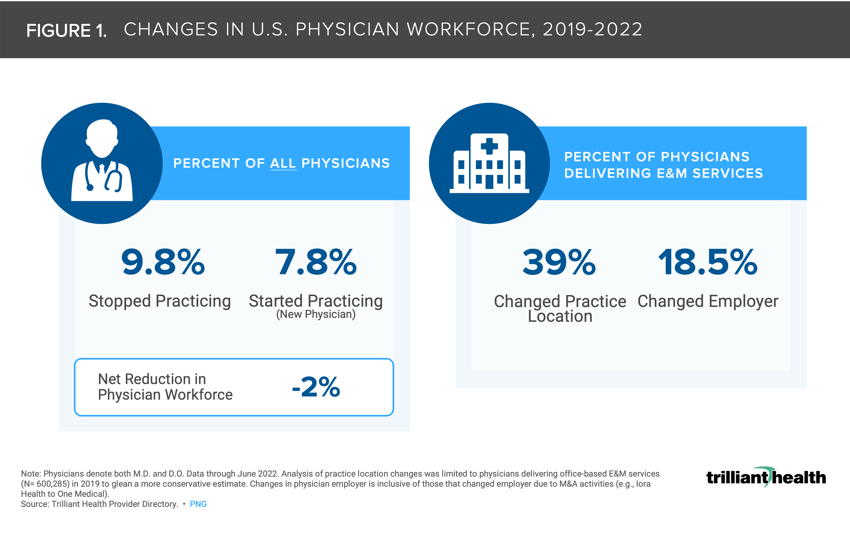

The net number of physicians starting and stopping practice from 2019 to 2022 led to a 2.0% workforce reduction.

-

Among practicing physicians delivering E&M services across the country, 18.5% of physicians changed employer organization or type.

-

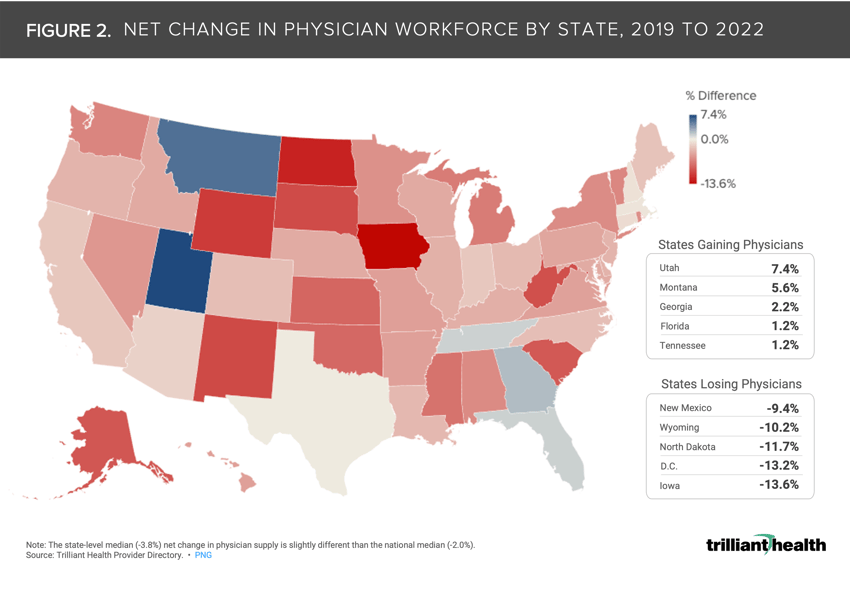

At the state level, the median net change – reflective of retirements, new graduates, and relocation – to the physician workforce was -3.8%. Utah and Montana gained the most physicians, while Iowa and D.C. lost the most physicians.

Background

Previous research explored market-level variation in the supply of providers, and how that is often mismatched to current and projected demand for healthcare services.1 The national healthcare labor shortage stemming from pandemic-related burnout, the Great Resignation, and an aging provider workforce is not likely to improve in 2023. While the effects of the pandemic have exposed the severity of workforce challenges, provider burnout has been increasing for a litany of societal, cultural, organizational, and personal and patient safety (e.g., violence against healthcare workers) reasons.2

Physician shortages and decreased demand amid increasing inflation have already started to result in unit closures, ongoing capacity constraints for elective procedures, and overflowing and understaffed emergency departments.3,4,5

Analytic Approach

Leveraging our Provider Directory, we identified changes in national and state-level physician practice patterns from 2019 to 2022 (e.g., retirement, location, employment changes). The analysis reflects data through June 2022 and includes physicians with both M.D. and D.O. credentials. Practice location changes were limited to physicians delivering office-based evaluation and management (E&M) services (N= 600,285) in 2019 to glean a more conservative estimate. Changes in physician employer is inclusive of those that changed employer due to M&A activities (e.g., Iora Health to One Medical).

Findings

The net number of physicians starting and stopping practice from 2019 to 2022 resulted in a 2.0% workforce reduction (Figure 1). Among practicing physicians delivering E&M services, 18.5% of physicians changed employer organization or type (e.g., hospital, new entrant). The pandemic effect compounded with long-standing burnout resulted in 9.8% of physicians “retiring.”

The net change in physician workforce from 2019 to 2022 varies by state. At the state level, the median net change – reflective of retirements, new graduates, and relocation - to the physician workforce was -3.8%. Utah and Montana gained the most physicians, while Iowa and D.C. lost the most physicians. Notably, the state-level median (-3.8%) net change in physician supply is slightly different than the national median (-2.0%). This aligns with overall population growth trends, as Utah’s largest metropolitan area (Salt Lake City) is projected to grow 4% by 2027, while D.C. will grow at a slower rate (1.6%).

According to the Association of American Medical Colleges (AAMC), by 2034 the projected physician gap is projected to range from 37.8K (25th percentile) to 124K (75th percentile).6 However, in a hypothetical future scenario where prices are capped for hospital and physician services, per a recent Congressional Budget Office policy report, the downstream impact on physician compensation could amplify supply shortages.7

Health systems must address prolonged staff burnout in order to survive in the current environment, characterized by low operating margins, waning federal financial support, and pending federal reimbursement reductions.8,9 Additionally, recent survey data indicate that feelings of burnout are not limited to providers, with 92% of executives believing more can be done at the organizational level to prevent leadership burnout.10

As health system executives consider strategies such as telehealth as an extender of traditional care to mitigate the current situation, it is unclear whether those interim solutions will meet expectations for patient quality and satisfaction. Additionally, health system executives must consider long-term consequences for service-line strategies if the supply of physicians, nurses and other caregivers continues to decline.

The reality of provider burnout is undeniable, but the reasons are myriad. How much dissatisfaction is related to burdensome regulatory and/or administrative documentation requirements? What other aspects of the U.S. healthcare system are so distasteful to drive people who have devoted their careers to healing to walk away from such a noble profession? What policies and incentives are needed to re-engage the workforce and build a pipeline for the future? Answering these questions are imperative for all health economy stakeholders.

This analysis is part of our deep-dive series into the 2022 Trends Shaping the Health Economy report.

For updated trend analysis, explore the 2025 edition of the Trends Report.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)