Key Takeaways

-

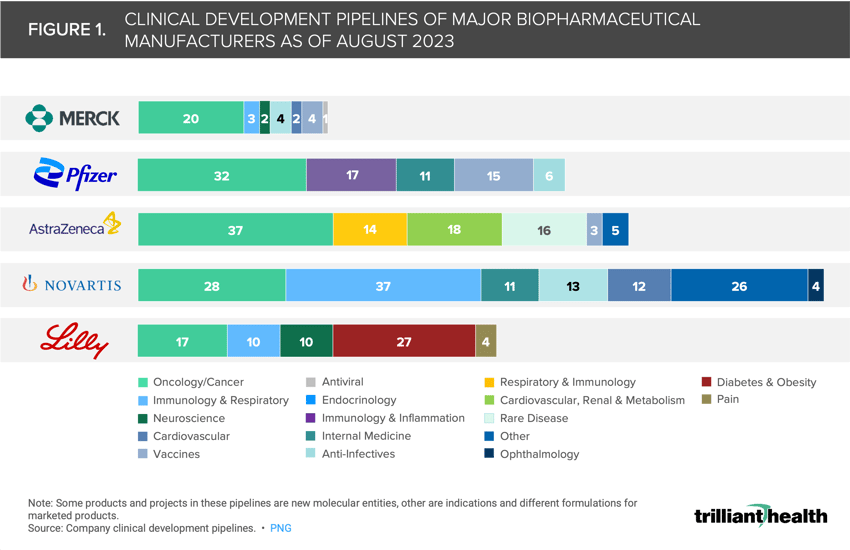

Oncology drugs comprise more than 39% of the clinical development pipelines of Merck, Pfizer and AstraZeneca, while immunology is a larger focus for Novartis and Eli Lilly.

-

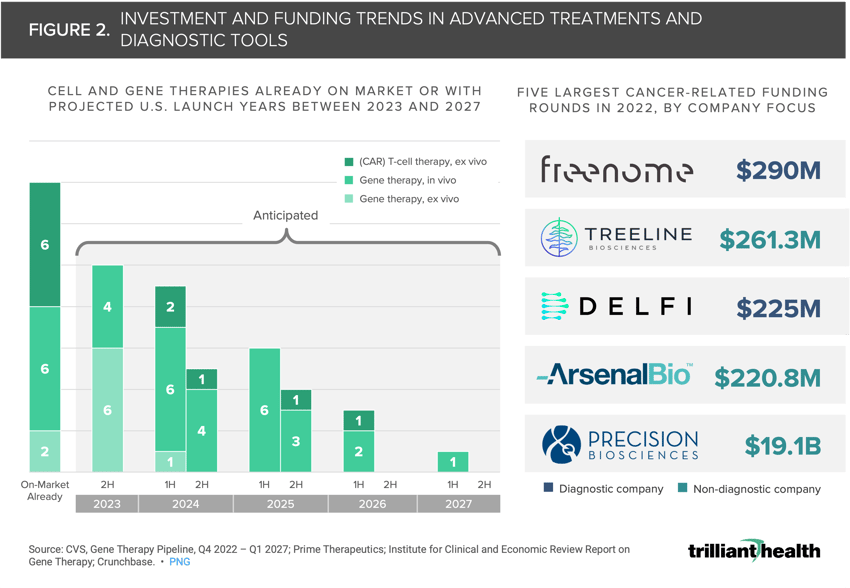

In the next five years, 79% of cell and gene therapies expected to launch in the U.S. will be indicated for the treatment of rare diseases and genetic conditions.

-

In 2022, two of the largest cancer-related funding rounds were for diagnostic test makers, procuring a combined $515M.

As the physical and mental health status of Americans unravels, patient diagnosis and treatment needs will intensify. The exact specifications of these needs will emerge over time, but the biopharmaceutical industry is uniquely positioned to adapt to the signals of changing disease burden, given their combination of clinical trial data, payer partnerships, health economics outcomes research business units and substantial research and development budgets. While biopharmaceutical companies typically invest and make acquisitions in therapeutic areas in which they have a strong existing market presence, changes in burden of disease (e.g., cancer, cardiovascular disease) can also influence decisions underlying research and development investments, partnerships and pipeline expansion.

Analysis of investment activity and the clinical development pipelines of prominent life sciences companies foreshadow an increasing incidence and disease burden in oncology, immunology and rare diseases – trends that are already manifesting as we have previously discussed – as well as growing demand for novel diagnostic technologies and treatments.1

Manufacturer Pipelines are Concentrated in Oncology, Immunology and Rare Disease

As of August 2023, the clinical development pipelines of five of the top biopharmaceutical manufacturers by 2022 revenue – Pfizer (#1), Merck (#4), AstraZeneca (#9), Novartis (#6) and Eli Lilly (#12) – were primarily comprised of therapies for cancers, immunological conditions and rare disease.2 Oncology drugs account for 55% of Merck’s pipeline and over 39% of Pfizer’s and AstraZeneca’s pipelines (Figure 1). Novartis and Eli Lilly are also investing in oncology, but 28% and 15% of their clinical development pipeline, respectively, is dedicated to immunology treatments.

The Markets for Cell and Gene Therapies and Early Cancer Detection Are Expanding

Innovative treatments are a significant focus across the life sciences industry, including cell and gene therapies (CGT) and new tests for early diagnosis and treatment of high acuity conditions like cancer. CGT manufacturers historically focused on cancer are diversifying their pipelines to diseases like Wilson’s disease and diabetic peripheral neuropathy. Of the 14 CGTs currently on market, six are Chimeric Antigen Receptor T-cell (CAR-T) therapies, which combat cancer by modifying immune cells to express specific receptors that recognize and attack cancer cells more effectively (Figure 2). However, in the next five years, 79% of the CGTs expected to launch in the U.S. will be indicated for the treatment of rare diseases and genetic conditions.

Even as investments in CGT cancer therapeutics are declining, investments in cancer diagnostic companies are accelerating. Two of the largest cancer-related funding rounds in 2022 were for cancer diagnostics companies (e.g., Freenome, Treeline Biosciences), procuring a combined $515M (Figure 2). Over the next ten years, the global market for breast cancer liquid biopsy is projected to grow at a compound annual growth rate of 22.5%, with the North American region representing a 35% share of the total global market.3 Given the substantial North American share of the total global market for breast cancer liquid biopsies, continued investments are likely.

While there is no singular trend observed across the business strategies of these select life sciences companies, in aggregate they suggest an increasing burden of disease for cancer, immunological diseases and rare diseases. These findings are consistent with our prior observations about the declining health status of Americans, including the younger population. To what extent were any of the life sciences investments in oncology made in anticipation of the fact that cancer mortality in younger adults is increasing? What data signals, if any, were these decisions predicated upon? What proportion of these business decisions are attributed to improving the standard of care for existing conditions and their patient populations versus emerging conditions or newly affected patient populations?

Demand for healthcare services is a function of incidence of disease and population characteristics. As a result, identifying trends emerging from the activities of biopharmaceutical manufacturers is a meaningful – and early – data point to inform growth strategies for health economy stakeholders. In future research, we will explore the other side of the demand equation – population characteristics – and how despite a growing burden of disease, demand is projected to remain tepid.

Beyond oncology, immunology and rare disease, the data also suggest a significant increase in the demand for GLP-1s. What does GLP-1 utilization reveal about the characteristics of who is prescribed these drugs? How does utilization vary by drug or market?

Update: for the latest on trends including clinical development pipelines, CGT, GLP-1s and direct-to-consumer prescribing and diagnostics, read our 2025 Trends Shaping the Health Economy report.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)