Addressing the data gaps hindering accurate healthcare workforce planning with our Provider Needs Assessments

Table of Contents:

- Why Compliance-Driven Provider Needs Assessments Fall Short

- Common Data Challenges in Workforce Planning

- Our Methodology: Guiding Principles

- Impact Across Strategy, Recruitment and Operations

- Explore Related Resources

Limitations of Compliance-Based Provider Needs Assessments in Strategic Planning

Compliance-driven assessments may meet basic regulatory standards, but they lack the precision required for strategic workforce planning. They overlook local market dynamics and rely on outdated data, potentially leading to costly mistakes – overbuilding in saturated markets and missing opportunities to serve unmet demand.

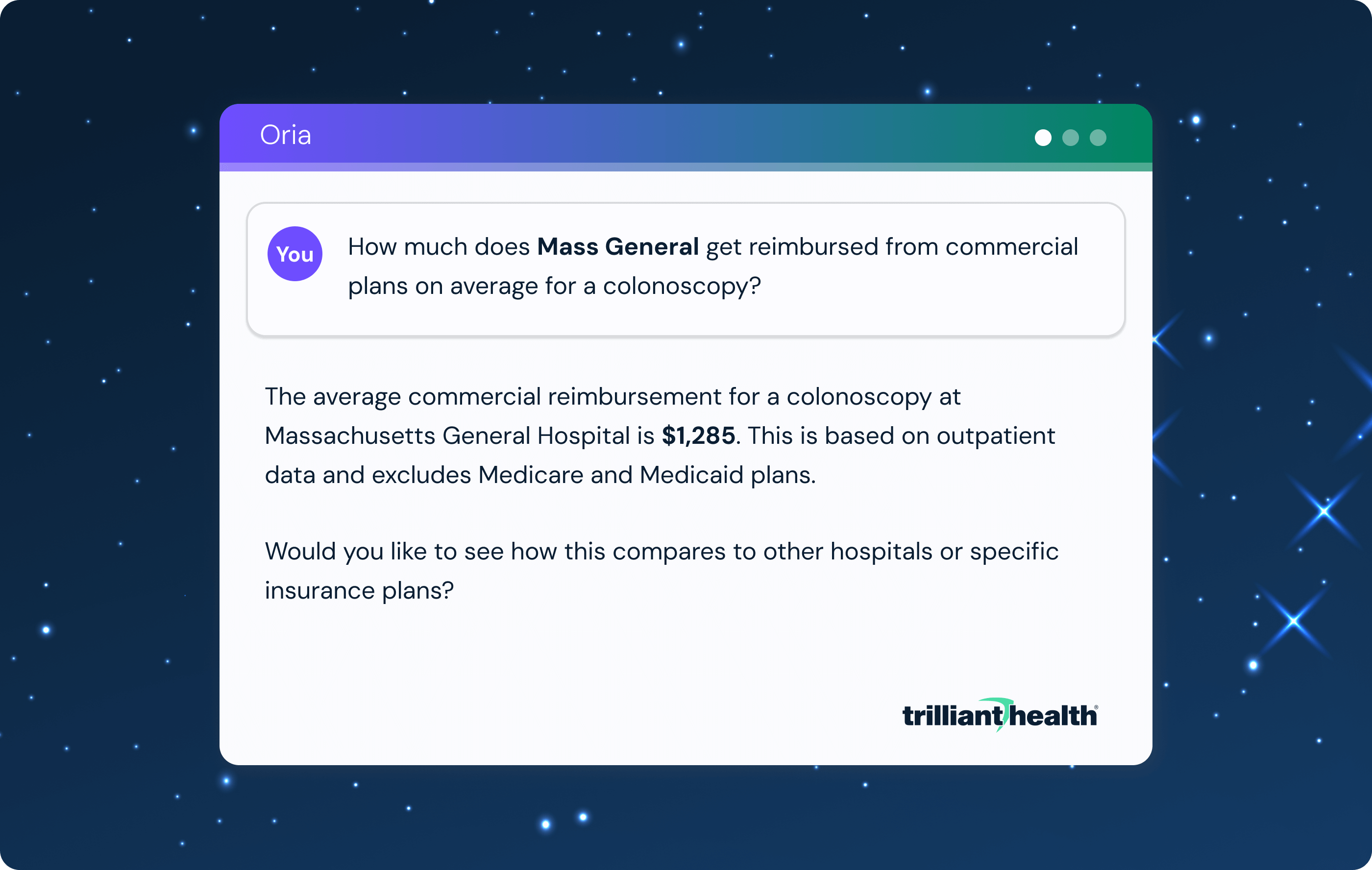

Our Provider Needs Assessment rectifies the flaws of traditional approaches. By leveraging near real-time all-payer claims data and a more accurate provider directory, we give healthcare leaders localized, market-level intelligence to align provider supply with actual demand – equipping them to make data-driven decisions about growth, recruitment and competitive positioning.

Data Gaps Hindering Accurate Healthcare Workforce Planning

| Challenge | Traditional Approach |

Our Approach |

| Limited Visibility Into Utilization | Sparse Utilization Data Most traditional models rely on NPPES, provider rosters and external market research, which oversimplify market supply and demand dynamics. |

All-Payer Utilization Data We use all-payer claims to capture care delivered across inpatient and outpatient sites of service. |

| Misclassified Specialties | Static Taxonomies Many traditional models use standard sources like NPPES, which is often outdated and represents taxonomies at varied levels of granularity. |

Practicing Specialties We infer current specialty from recent claims, producing more accurate categorization, particularly for subspecialists. |

| Incorrect Affiliations | Self-Reported Affiliations Many traditional models rely on directories like Care Compare, which are often stale and unreliable for network attribution. |

Behavior-Based Affiliations We derive affiliations from observed clinical behavior – shared patients, referrals and site of service – to offer a dynamic view of provider alignment. |

| Crude Headcounts | Flat FTE per Provider Many traditional models treat each provider as a full FTE, regardless of age or productivity. |

Age-Adjusted FTEs We calculate Full-Time Equivalents (FTEs) based on provider age, reflecting typical declines in productivity near retirement. |

| Inaccurate Locations | Single Address Attribution Many traditional models assign a provider to a single administrative or billing location. |

Multiple Practice Locations We assign practice locations based on recent care delivery locations, weighted across primary, secondary and tertiary sites. |

| Generic Benchmarks | One-Size-Fits-All Ratios Many traditional models apply benchmarks uniformly, without considering local dynamics. |

Market-Calibrated Benchmarking We stratify provider-to-population ratios by specialty and market type. |

The Guiding Principles Behind Trilliant Health’s Provider Needs Assessments

To address common data limitations, our methodology is based upon five core principles:

1. We define practicing specialties based on the care providers deliver, not static directories.

Our approach reflects the care that a provider delivers, improving accuracy in supply estimates, especially for subspecialists.

Traditional sources like NPPES or CMS taxonomies are often outdated, overly granular or inconsistently applied, leading to misclassification, especially in broad categories like internal medicine.

We infer specialty from recent claims and group providers into curated categories, supporting strategic aggregation while preserving subspecialty-level insight.

| Rendering Provider Specialty | Specialty Group |

| Internal Medicine Physician | Primary Care |

| Family Medicine Physician | Primary Care |

| General Practice Physician | Primary Care |

2. We determine provider affiliations from actual clinical activity, not outdated physician rosters.

We analyze where providers deliver care, make referrals and share patients over a trailing twelve-month period.

This interaction-based approach surfaces real-world affiliations, often missed by traditional datasets. The result: a more accurate view of network alignment and competitive dynamics.

3. We use age-adjusted FTEs to estimate a provider’s capacity.

Claims alone are not a reliable measure of provider capacity – coverage varies widely at the individual provider level based on differences in practice and billing patterns. However, failing to adjust at all is equally flawed: not every provider has the same clinical capacity.

Our approach strikes a balance. We start with a standardized FTE baseline and apply age-based adjustments to reflect typical changes in productivity over a provider’s career. This approach produces a more realistic estimate of available capacity across the workforce.

| Provider Age | Assigned FTE |

| Under 60 | 1.0 |

| 60-65 | 0.75 |

| 65-70 | 0.5 |

| Over 70 | 0.25 |

4. We attribute providers across multiple practice locations for a more nuanced view of supply.

Assigning providers to a single administrative or billing address misrepresents where care is delivered and skews workforce estimates.

We use claims-derived sites of service to attribute practice locations based on where the provider renders care. If a provider sees patients at multiple sites, we weight each location by the volume of non-telehealth, non-lab encounters. Practice location attribution is updated monthly using near real-time utilization data, enabling us to reflect provider movement and evolving market behavior.

This dynamic methodology offers a more accurate and current view of where care occurs and reduces the manual burden on users to maintain provider rosters. The result is a more precise understanding of provider supply, grounded in actual patient access patterns.

| Provider Name | Total FTE | Practice Address | Practice FTE |

| Bob Smith, M.D. | 1.0 | 123 Main St. | 0.72 |

| 456 Oak St. | 0.28 |

5. We calibrate provider-to-population benchmarks to match local conditions.

National benchmarks assume uniform demand for healthcare services across all types of markets.

We segment U.S. markets into five types based on population and apply provider-to-population ratios by market type: major metro, urban, suburban, rural and non-CBSA. Demand for specialists in a rural town differs significantly from that in a dense metro area, and we adjust benchmarks to support localized, defensible decisions about medical staffing.

| Market Sizes |

| Major Metro (>1M) |

| Urban (300K-999K) |

| Suburban (100K-299K) |

| Rural (<100K) |

| Non-CBSA |

User Impact: How Healthcare Leaders Can Utilize a More Accurate Provider Needs Assessment

Trilliant Health’s provider needs assessment methodology equips healthcare leaders with actionable intelligence to inform planning and execution.

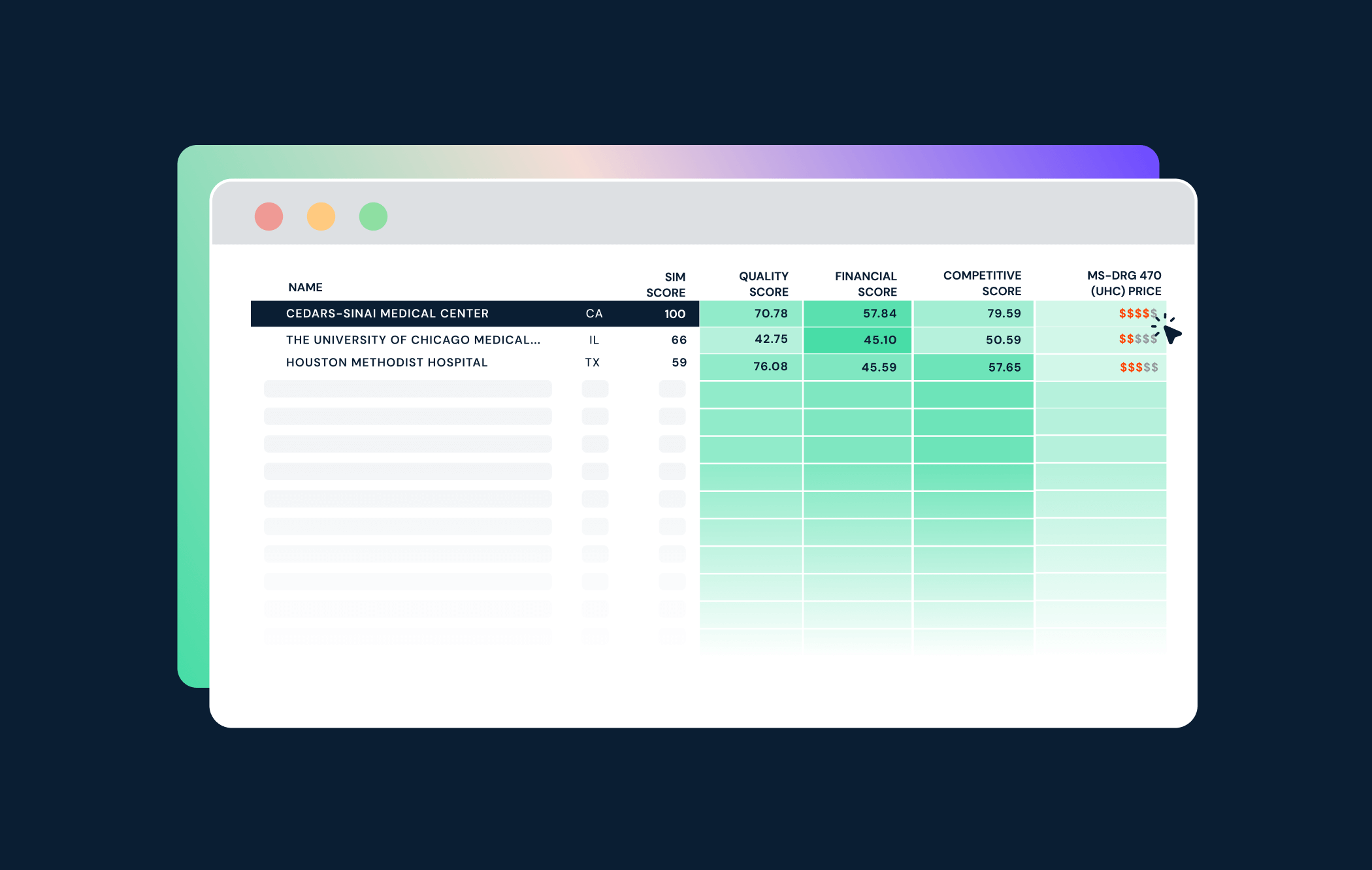

- Strategy teams gain a more accurate view of specialty coverage gaps, supporting targeted service line expansion and market development based on measurable need. Affiliation intelligence provides visibility into the geographic footprints of competitors to support stronger positioning and increasing network integrity.

- Physician recruiters can prioritize high-need geographies and specialties, avoiding oversaturated markets and building data-backed cases for new hires.

- Operations leaders benefit from a precise view of provider capacity, informed by age-adjusted FTEs and utilization-based location attribution to improve resource allocation and workforce planning.

By aligning provider supply with demand at the market level, Trilliant Health’s methodology supports more precise and defensible decisions – from strategic planning to frontline execution.

Related Resources:

- Provider Directory: Try It for Free

- Measuring Physician Supply and Market Demand: A Step-by-Step Guide to Provider Needs Assessments

- A Field Guide To Survive Healthcare’s Negative-Sum Game: Physician Strategies

- Study: Oversupply or Undersupply Is Defined by Market-Level Characteristics

Need help applying these insights to improve your health system’s provider needs assessments? Schedule a consultation with our analytics team.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)