Middlemen, such as pharmacy benefit managers, group purchasing organizations, third party administrators and health insurance brokers, play a central role in connecting stakeholders across healthcare, but their influence is increasingly under scrutiny for contributing to financial waste. Explore how healthcare middlemen impact the cost and complexity of the healthcare system:

- What are healthcare middlemen?

- What is the history and legislative background of healthcare middlemen?

- What is the current state of middlemen?

- What is the health economy context?

- How do healthcare middlemen impact health economy stakeholders?

Middlemen are embedded into every part of the U.S. healthcare system, shaping the flow of money, information and goods between manufacturers, providers, payers, employers and patients. They emerged to address market complexity, administrative burdens and efficiency, similar to how platforms like Robinhood simplify access to financial markets or Expedia aggregates travel options. However, over time the scope and influence of healthcare middlemen has expanded beyond these original intended functions. Today, these intermediaries effectively determine which drugs, devices, services and insurance products become available to patients, how much they cost and the conditions under which they are covered by insurance.

Healthcare middlemen aggregate purchasing power, streamline transactions and manage claims, yet their operations also affect transparency, competition and the cost of goods and services. Employers rely on middlemen to navigate health insurance benefits and claims processing, providers depend on them to manage supply chains and revenue cycles, while patients experience the downstream consequences of middlemen in the form of out-of-pocket costs, network access and treatment availability. Collectively, healthcare middlemen influence hundreds of billions of dollars in healthcare transactions annually, making them a powerful – and increasingly scrutinized – component of the health economy.

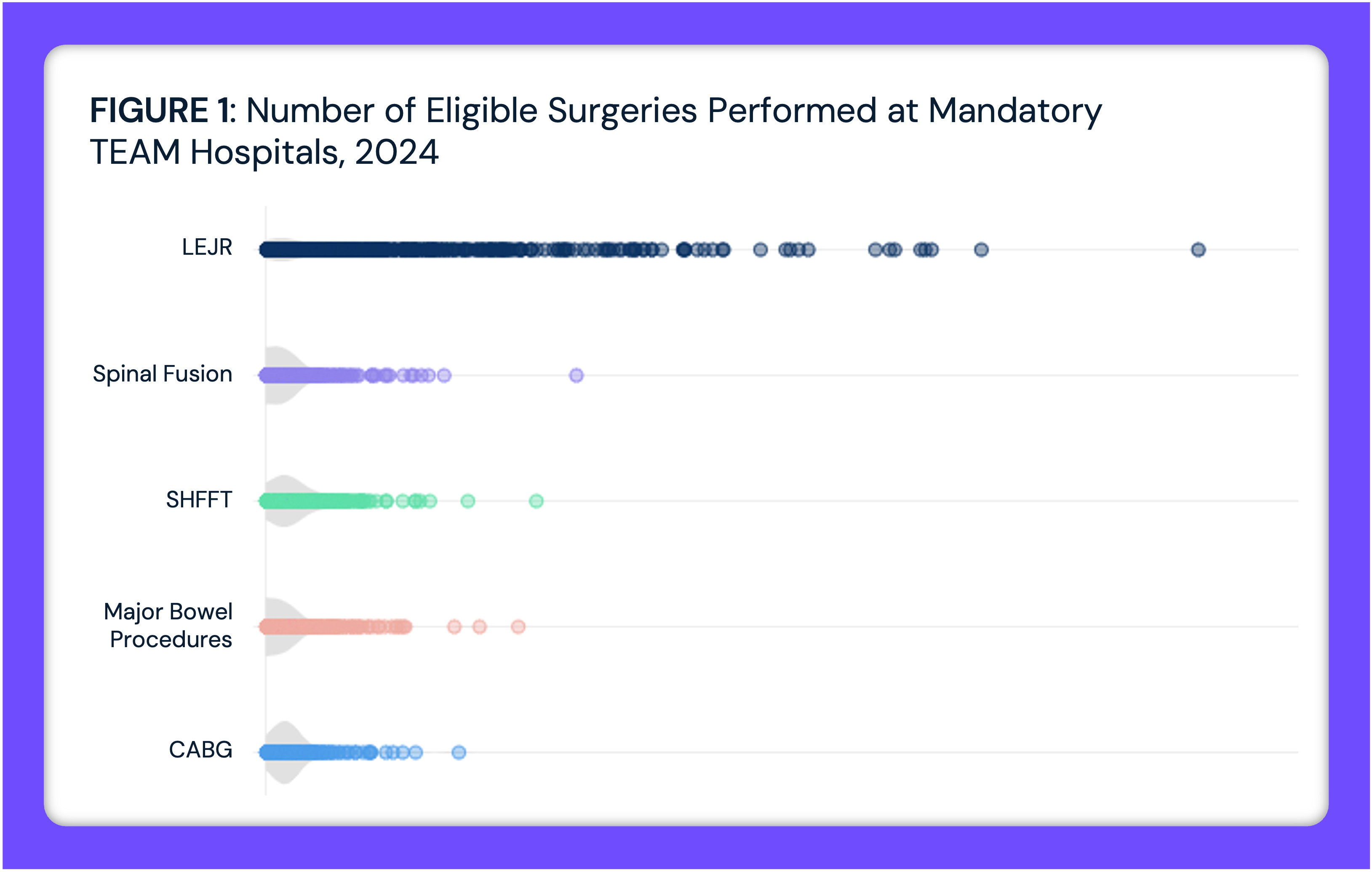

Middlemen also add layers of complexity that make the U.S. healthcare system harder to navigate for employers, providers and patients. Each intermediary introduces its own contracting rules, fee structures and administrative processes, which can obscure the true cost of care and create variation in access. The U.S. healthcare system itself is already defined by unmatched financial, administrative and regulatory complexity, with a maze of stakeholders that makes it difficult for the average American to understand or navigate. Rather than streamlining the system as originally intended, their overlapping roles can fragment decision-making, duplicate administrative work and generate inefficiencies that affect the entire health economy (Figure 1).

While middlemen were designed to streamline transactions and create value, their growing influence has raised scrutiny as some practices prioritize profit over efficiency and patient affordability. Instead of reducing costs, certain arrangements have introduced avoidable layers of complexity and administrative expense, contributing to a system that is less transparent and often misaligned with patient and employer interests. For example, group purchasing organizations (GPOs) leverage scale to negotiate discounts for providers, yet their reliance on vendor-paid fees can create incentives that favor higher-priced products. Pharmacy benefit managers (PBMs) negotiate rebates to lower drug costs but may retain a share of those savings through spread pricing, while brokers and third-party administrators (TPAs) can steer employer decisions in ways that benefit their own revenue streams.1

In an era of increasing price transparency and mounting pressure from employers to demonstrate value for money, healthcare is shifting from value maximization to value optimization – a transition that is both necessary and inevitable. At the same time, declining demand for services and rapid demographic change are reshaping the needs of patients, employers and payers. Anticipating how these forces intersect with the growing influence of middlemen will be critical for policymakers, providers and industry leaders seeking to balance cost, access and sustainability.

What Are Healthcare Middlemen?

Middlemen serve as intermediaries between healthcare product and service suppliers (e.g., drug and medical device manufacturers) and buyers (e.g., payers, providers, employers and patients). Their core functions include contract negotiation, price setting or discounting, claims administration, selecting insurance plans and purchasing leverage (Figure 2).2

Pharmacy Benefit Managers

PBMs are third-party organizations that act as an intermediary between pharmacies, pharmaceutical manufacturers, plan sponsors (i.e., insurance companies and employers) and drug wholesalers (Figure 3). Over time, PBMs have significantly increased their role and influence within the pharmaceutical supply chain through a core set of services: utilization management (e.g., prior authorization, step therapy, quantity limits and drug utilization review), formulary development, price and rebate negotiation with pharmacies, wholesalers and manufacturers, pharmacy network management and mail-order pharmacy operations – often through vertically integrated services.3 This vertical integration means that PBMs not only design and manage drug benefits but also dispense medications through their affiliated mail-order and specialty pharmacies, allowing them to capture revenue at multiple stages of the drug distribution chain.

PBMs manage prescription drug programs for several plan sponsors including commercial health insurers, self-insured employers, Medicare Part D plans, the Federal Employees Health Benefits Program and state employee plans. As of 2024, the three largest PBMs – CVS Caremark, Express Scripts and OptumRx – collectively processed nearly 80% of all prescription claims, covering close to 275M Americans and influencing a market approaching $600B.4

Group Purchasing Organizations

GPOs are collaborative networks that combine the purchasing power of healthcare providers such as hospitals, nursing homes and home health agencies (Figure 4). By aggregating purchasing volume, GPOs negotiate discounts with manufacturers, distributors and other vendors to secure lower prices on medical supplies, devices, pharmaceuticals and other goods. In addition to negotiating contracts, GPOs may offer supply chain analytics, product standardization support and assistance with vendor management.5 Notably, however, GPOs do not own medical products, but instead focus on minimizing transaction costs and securing lower prices for supplies through economies of scale in negotiations, which would be challenging for individual providers to achieve independently. By consolidating purchasing power and utilizing their influence to negotiate discounts with manufacturers, distributors and other suppliers, GPOs can generate cost savings and operational efficiency for the providers they serve.6 One study found that GPOs save providers an average of 10%-18% on products and services.7

This said, GPOs collect administrative fees from vendors, often based on a percentage of purchasing volume. While permitted under Federal safe harbor rules, many stakeholders have argued that these fees create conflicts of interest by incentivizing GPOs to favor higher-priced products or larger contracts, rather than maximizing savings for providers, and ultimately patients.

Health Insurance Brokers

Health insurance brokers act as licensed intermediaries between health insurance companies and buyers such as employers, individuals and organizations, representing the customer rather than the health insurer (Figure 5). Brokers assess client needs, identify coverage options and negotiate plan terms with insurers, often assisting with enrollment, compliance with regulatory requirements and ongoing benefits management. Broker compensation is typically provided through commissions from insurers, though some brokers may also charge consulting fees.8 However, brokers can also introduce complexity and conflicts of interest, as their compensation structures may create incentives that do not always align with patient needs. Recent scrutiny of Medicare Advantage and Marketplace brokers has highlighted concerns about plan steering, unauthorized enrollments and the potential for financial arrangements that prioritize broker benefit over consumer choice.9,10

Third-Party Administrators

TPAs are typically utilized by self-funded employer plans. In fully insured employer-based health insurance arrangements, employers pay a premium determined at the company level and the health insurance company assumes full risk (Figure 6). In self-funded employer plans, the employer takes on the risk and pays for out-of-pocket expenses as they are incurred, rather than paying a fixed premium. The risk is limited by a financial safeguard of stop-loss coverage, which means the stop-loss insurer pays once the claims hit a certain dollar amount.11 TPAs assist employers in administrative tasks such as claims processing, billing and network management.

What Is the History and Legislative Background of Healthcare Middlemen?

Pharmacy Benefit Managers

PBMs were initially created to coordinate payer negotiations on drug access and pricing, since no Federal price controls existed to regulate costs.12 The first PBM in the U.S., PAID Prescriptions, was founded in 1965 and reimbursed pharmacies at customary rates based on each pharmacy’s own cash price. In 1968, PAID started setting its own reimbursement rates for pharmacists that wanted to wanted to enter PAID’s pharmacy network.13 PBMs saw vertical and horizontal integration in the 1970s, but further vertical integration happened in the early 1990s between drug manufacturers – Merck merged with Medco and Eli Lilly acquired Pharmaceutical Card System (PCS) from McKesson. In the late 1990s, national pharmacy chains started acquiring PBMs. Rite Aid bought PCS, CVS acquired Caremark, Express Scripts acquired Medco and UnitedHealth Group acquired PacifiCare, which was rebranded as OptumRx. Throughout their history, PBMs have been monitored by Federal antitrust authorities.14 Since the early 2000s, the Federal Trade Commission (FTC) and Congress have investigated PBMs for anticompetition practices. In 2005 the FTC published a report investigating PBM ownership of mail-order pharmacies.15 In 2024 and 2025, they released reports revealing how PBMs profit by inflating drug costs of specialty generic drugs.16,17 Today, scrutiny of PBMs has become a bipartisan issue, with lawmakers across the political spectrum calling for greater transparency as concerns over affordability and competition continue to grow.

Group Purchasing Organizations

GPOs first emerged in the early 20th century – specifically in 1910, when New York’s Hospital Bureau of Standards and Supplies established the first model for collective purchasing in healthcare. GPO growth remained modest until around the mid-1970s, when the expansion of Medicare and Medicaid catalyzed the growth and necessity of GPOs – with 40 companies established by 1974. In 1983, Medicare’s prospective payment system (PPS) was established, introducing fixed payments for patient care based on diagnosis-related groups. This change created strong incentives for hospitals to control costs, which in turn heightened demand for GPO services. By aggregating purchasing volume, GPOs enabled hospitals to reduce supply expenses and operate more efficiently within PPS reimbursement limits, solidifying their role as a cost-management partner for providers. In 1986 Congress granted GPOs a “safe harbor” from Anti-Kickback statutes, permitting them to receive vendor administrative fees – a change HHS formalized in 1991, alongside fee transparency requirements for arrangements over 3%.18,19 As of 2018, 96-98% of hospitals use at least one GPO.20

Health Insurance Brokers

Brokers expanded alongside the broader employer-based health insurance market in the post–World War II era, aiding employers in selecting health plans and carriers. The enactment of the Employee Retirement Income Security Act (ERISA) of 1974 was a turning point, establishing Federally uniform standards for employer-sponsored benefits and encouraging the rise of self-funded plans, which in turn increased demand for third-party benefits advisors and brokers.21

Third-Party Administrators

TPAs originated in response to the growing administrative complexity and cost of managing employer-sponsored benefit plans. Emerging in the 1970s and 1980s, TPAs offered outsourced claims processing, benefits administration and network contracting for self-funded plans.22

What Is the Current State of Middlemen?

Pharmacy Benefit Managers

Limited competition among PBMs has allowed six PBMs to account for 96% of prescription drug claims, with the three largest – CVS Caremark, LLC, Express Scripts, Inc. and OptumRx, Inc. – capturing 79% of market volume (Figure 7).23

In January 2025, the FTC released a second interim report on PBMs, demonstrating how the “Big Three” (i.e., CVS Caremark, Express Scripts and OptumRx, Inc.) marked up several specialty generic drugs dispensed at their affiliated pharmacies by hundreds or thousands of percent above the estimated acquisition cost. These dispensing patterns suggest PBMs may steer highly profitable prescriptions to their own affiliated pharmacies compared to unaffiliated pharmacies. These markups have allowed the “Big Three” PBMs and their affiliated specialty pharmacies to generate $7.3B in revenue from 2017 through 2022. Meanwhile, patients and employers have faced increased drug prices.24 A previous iteration of the FTC’s middlemen report from July 2024 found that pharmacies affiliated with the Big Three PBMs received 68% of the dispensing revenue generated by specialty drugs, compared to only 54% in 2016 (Figure 8).25 Additionally, the Big Three PBMs produced $1.4B in revenue from spread pricing, by billing their plan sponsor clients more than they reimburse pharmacies for drugs.

Group Purchasing Organizations

Today, between 96% and 98% of hospitals in the U.S. use GPOs to purchase medications, devices and supplies.26 There are over 600 GPOs in the U.S., 30 of which are large and negotiate sizeable contracts, some of which represent up to $100B in annual purchasing volume.27,28 GPO market leaders include Vizient, Premier Inc. and HealthTrust Performance Group – which collectively represent around 80% of staffed beds (Figure 9). It is estimated that GPOs save the hospitals and nursing homes $34.1B annually and will save the healthcare industry $456.6B between 2017 and 2026. Medicare is estimated to account for over 25% ($116.3B) and Medicaid 20% ($90.2B) of these cost savings. Despite these savings, the function of GPOs produces administrative fees that totaled $2.3B in 2012.29

Broader healthcare consolidation is also reshaping the GPO market, with organizations pursuing acquisitions in niche sectors like specialty pharmacy. For example, in 2024 Cardinal Health purchased Specialty Networks, a multi-specialty GPO and practice enhancement company, for $1.2B. At the same time, some are streamlining through divestitures, such as Premier Inc.’s 2023 sale of its non-GPO business to Omnia Partners for $800M to concentrate on its core healthcare offerings.30

Health Insurance Brokers

The U.S. health insurance brokerage sector – part of an $80B national insurance brokerage market – is undergoing rapid transformation as employer demands, technology and industry consolidation reshape the need for health insurance services.31 Market leaders such as Marsh McLennan, Aon, Arthur J. Gallagher and Willis Towers Watson maintain significant scale, but mid-sized firms are expanding faster.32 Large acquisitions, including Arthur J. Gallagher’s $13.5B purchase of AssuredPartners and Brown & Brown’s $9.8B acquisition of Accession Risk Management, underscore the trend toward consolidation and broader service offerings.33

Although brokers exist to facilitate negotiations or purchasing and streamline operations, they pose the risk of adding complexity or introducing financial barriers that benefit themselves, rather than the patient. Broker commissions can increase costs, potentially leading to higher premiums, in turn leading to inefficiencies and raising administrative expenses. For example, in the Pacific region of the U.S., brokers would receive $10.9M in commission for a self-insured employer with 50,000 employees (Figure 10).

The introduction of health plan price transparency requirements – such as the Transparency in Coverage (TiC) rule and Health Plan Price Transparency (HPPT) provisions – may broaden brokers’ roles, as employers look to them to interpret cost data, evaluate network value and guide employees toward more cost-effective care choices.34 At the same time, digital transformation fueled by “Insurtech” – the use of advanced technologies such as artificial intelligence, data analytics and digital platforms – has enabled innovations such as automatic, predictive analytics and self-service tools, all of which streamline operations, enhance client engagement and improve risk assessment. These advancements enable brokers to navigate complex regulatory requirements, tailor products to diverse populations and support clients in managing rising healthcare costs.

Third-Party Administrators

In 2024, the health insurance TPA market size was valued at $100.6B and is expected to grow to $129.1B in 2030, a 28.4% increase (Figure 11). TPAs play a growing role in today’s evolving health insurance market, driven by the shift from fee-for-service to value-based payment models that prioritize outcomes and cost efficiency. TPAs help health plans, employers and government programs streamline administrative functions – from claims processing and provider network management to member enrollment – enabling payers to focus more on care delivery and quality improvement. The rapid enrollment growth in Medicare Advantage and Medicaid managed care has further expanded opportunities for TPAs to support growing and medically complex populations. Many TPAs are increasingly leveraging Insurtech to reduce administrative burden, improve accuracy, detect fraud and enhance member engagement. This adoption of intelligent technologies is allowing TPAs to operate more efficiently while delivering more personalized, data-driven services in a highly competitive market.35

What Is the Health Economy Context?

Middlemen Capture a Growing Share of Healthcare Dollars

Middlemen such PBMs, GPOs, TPAs and health insurance brokers play a central role in connecting stakeholders across healthcare, but their influence is increasingly under scrutiny for contributing to financial waste. PBMs negotiate drug prices and manage formularies, yet practices such as spread pricing and retained rebates have led to concerns that patients and payers do not always benefit fully from cost reductions. For example, a drug that could profitably be priced at $600 per month is instead listed at $1,000, with the manufacturer offering a $400 rebate to a PBM. The PBM may then pass along $300 in savings to employers while keeping $100 as profit – even though the original price would have been $600.36 As rebate flows expanded, PBMs’ share of total prescription drug spending grew steadily, while brokers and consultants captured increasing commissions from insurers. GPOs provide leverage in reducing supply costs, but their administrative fees totaled $2.3B in 2012 – a figure that raises concerns about whether savings are offset by significant added costs and market concentration limiting competition.37 TPAs and brokers streamline administration and benefits design, yet questions remain about whether their fees and operational costs create inefficiencies that outweigh the value they provide. As a result, state legislatures are beginning to implement measures to increase transparency and hold PBMs accountable. While these middlemen help navigate a complex system and deliver some operational efficiencies, their overall financial impact is ambiguous, raising questions about who ultimately benefits and whether the system favors profit over affordability.

Heightened Scrutiny of MIddlemen is Emerging at the State and Federal Levels

Bipartisan policy proposals aim to curb spread pricing, restrict opaque fee arrangements and mandate greater transparency. At the same time, new entrants – from transparent PBMs to direct contracting platforms – seek to disrupt traditional models. In 2024, key policy and regulatory developments centered on prescription drug pricing, competition and access – exploring the roles of PBMs and GPOs in inflating drug prices, addressing anticompetitive practices among life sciences companies and leveraging negotiation to reduce prices. PBMs and GPOs were the subject of both regulatory and congressional action. Congress conducted multiple hearings on PBMs, revealing bipartisan apprehension about market concentration, vertical integration, lack of transparency and the extent to which PBMs contribute to escalating drug prices and reduced competition.38,39 The FTC and HHS also issued a request for information to investigate the roles of GPOs and wholesalers in drug shortages.40 Despite these efforts, nothing has since been signed into Federal law.

In the absence of Federal PBM reporting and practice requirements, state legislatures have become the primary governing body regarding how PBMs interact with insurers, pharmacies and drug manufacturers. In 2025, state policymakers continued efforts to regulate PBMs with varying approaches in proposed legislation. Many of these policy proposals were in response to concerns about prescription drug affordability, a lack of transparency in PBM operations and contracting practices that some argue disadvantage pharmacies, patients and health plans. Several of these policy proposals were signed into law during 2025 state legislative sessions. The new laws vary but generally seek to regulate PBM business practices more closely – including how they negotiate rebates, reimburse pharmacies and disclose financial relationships.

Some of the policy proposals signed into law during 2025 state legislative sessions include Arkansas (HB 1150), which prohibits PBMs from owning or operating pharmacies in the state.41 The law also prevents PBMs from holding a controlling interest in any pharmacy that dispenses prescriptions to Arkansas residents. Lawmakers who supported the bill said it was designed to reduce the risk of PBMs favoring their own pharmacies in network inclusion and pricing decisions. Colorado (HB 1094) passed a law that prohibits PBMs from earning income based on the cost of a prescription drug, effectively banning spread pricing.42 Texas (SB 493) passed a law that prohibits contracts or policies that restrict pharmacists or pharmacies from informing enrollees about potential cost differences between using their insurance and paying out-of-pocket for prescription drugs.43

How Do Healthcare Middlemen Impact Health Economy Stakeholders?

Middlemen shape the flow of money, information and decision-making across the health economy, but their activities can introduce both efficiencies and hidden costs. PBMs influence pharmaceutical spending and utilization patterns, yet opaque pricing practices have sparked concern over excess expenditures. GPOs provide hospitals and physician groups with purchasing leverage, but market concentration and administrative fees may limit competition. TPAs and brokers support insurers and employers in managing complex benefit programs, including the shift from fee-for-service to value-based care, though their fees and service layers can add friction and increase costs. These intermediaries impact spending, operational efficiency and access to care – yet the benefits are not always clear, highlighting the tension between their functional value and the potential for financial inefficiency in the healthcare system.

Reflection Points

How can policymakers and payers ensure that middlemen truly deliver cost savings to patients and providers? Could increased transparency or regulation reduce waste while preserving necessary administrative functions? What lessons can be drawn from other industries where intermediaries sometimes add costs without improving outcomes?

How much of PBM and GPO savings are actually passed to patients or payers? Could healthcare spending be more efficient without certain middleman practices? Are current state and Federal regulations sufficient to prevent excessive financial waste?

Do PBM rebate structures truly reduce drug costs for patients, or do they incentivize higher list prices and steer utilization toward drugs with the largest rebates? Do vendor-paid administrative fees for GPOs align with the goal of lowering provider costs, or do they create incentives to favor higher-priced products?

Are TPAs creating real value for employers through efficient benefit administration, or are layered service fees eroding the savings self-funded plans intended to achieve?

Understanding how middlemen impact different stakeholders is key to evaluating whether they deliver value to the health economy or contribute to rising costs and inefficiencies. For payers and employers, middlemen can offer expertise in benefit design and purchasing, yet their fees and opaque rebate structures may dilute savings. Providers gain access to negotiated pricing and outsourced administrative services, may end up in arrangements that reduce flexibility or favor higher-priced products. For life sciences companies, PBMs and GPOs effectively act as gatekeepers, influencing which drugs and devices achieve favorable placement and market access. For patients, these downstream effects translate into out-of-pocket costs, coverage restrictions and network design. The central tension is whether middlemen are creating net value across these stakeholders or capturing value for themselves.

Reflection Points

Are intermediaries ultimately helping stakeholders achieve their goals, or do they perpetuate a system where each participant absorbs more cost without clear improvement in value?

For payers and employers, do middlemen create efficiencies in managing benefits, or do they erode savings through layered service fees and opaque pricing?

For providers, do negotiated contracts and group purchasing arrangements reduce costs, or do they restrict flexibility and favor higher-priced products?

For life sciences companies, do rebate and formulary structures ensure access, or do they distort competition and hinder innovation?

For patients, do middlemen reduce out-of-pocket costs and improve access, or do they exacerbate affordability challenges and coverage barriers?

- Fundamentals

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)