Studies Archive

The Different Demographics and Motivations of Women Without a Primary Care Relationship

January 15, 2022In our most recent analysis characterizing patients without a primary care relationship, we found that over the last three years 12.1% of adults sought healthcare services without visiting a primary care provider (PCP). Of this population, women accounted for a higher percent (53.5%) of individuals without a PCP interaction than men (46.5%).

Research from the Kaiser Family Foundation (KFF) details the variation in women’s healthcare utilization by provider type, payment source, and socio-demographics. While KFF found that 93% of women ages 18-64 saw a healthcare provider within two years of the survey, just 73% of women had a general wellness visit, typically obtained through a PCP. Moreover, younger age cohorts were even less likely to report a wellness visit, with only 59% and 69% of women between 18-25 and 26-35, respectively, doing so. Of the women that reported receiving wellness visits, younger women (ages 18-35) were more likely than older women to obtain these services via an OB/GYN instead of a PCP/general practitioner. Uninsured women and those covered by Medicaid were more likely to visit walk-in clinics (e.g., urgent care center), 30% and 23% respectively, when obtaining healthcare services than at a traditional medical office than privately insured women (13%).

General demographic categories such as age and insurance status are revealing but ultimately insufficient to develop strategies that can meaningfully address the gap. Knowing that an individual’s psychology and behaviors are more predictive than demographics, we sought to further examine the behavioral characteristics of the women in our original analysis that lacked an established primary care relationship.

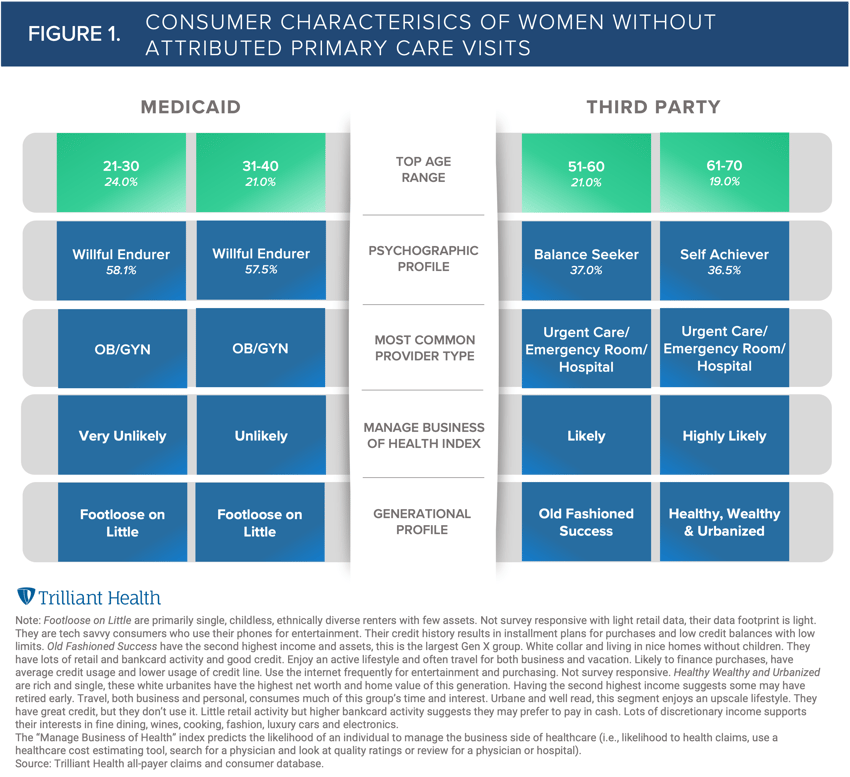

Given the utilization differences between commercially insured and Medicaid-covered women, we analyzed these groups separately to characterize each age segment by psychographics, propensity to manage the “business of their health,” and generational profile. We also identified the most common provider types among these groups, given the lack of a PCP relationship. We find that the highest proportion of commercially insured women without a PCP relationship fell into the 51-60 (21%) and 61-70 (19%) age brackets, while the highest proportion of women with Medicaid coverage were of childbearing age: 21-30 (24%) and 31-40 (21%) (Figure 1).

Women without PCP relationships who do not have annual wellness visits may not be receiving the full spectrum of recommended preventive services, though their reasoning and motivations for foregoing this care varies on an individual basis. For example, knowing that half of all U.S. births are financed by Medicaid and that OB/GYNs are also the most common provider type for the 21–40-year-old non-PCP Medicaid segment further explains why this segment is prioritizing reproductive services over general primary care visits. However, in the states that have not expanded Medicaid under the Affordable Care Act, new mothers may lose eligibility 60 days following childbirth due to income eligibility changes for parents of dependent children, which does not facilitate fostering a long-term primary care relationship. Also, their low health management index indicates a lower likelihood of being proactive about their health.

The consumer profile of the commercially insured segment is starkly different than the Medicaid population, so influencing health behaviors for commercially insured women requires a completely different approach. Intuitively, the higher incomes reflected in the generational profiles and high likelihood for managing their health would indicate a propensity to pursue primary care. However, Balance Seekers (a top psychographic profile for this segment of patients) view healthcare professionals as one of many helpful resources for leading a healthy life. Additionally, older, high-income consumers with a variety of health conditions are more prone to rely on a broad group of specialists serving as a “collective PCP.”

Amid recent investment growth in women’s health companies, new entrants such as Tia and Maven Clinic have business models designed to reduce these gaps in care. Being able to precisely target the women who lack PCP relationships and critical preventive services is a key factor for these companies, which are homing in on the different journeys of women as healthcare consumers. For example, Maven Clinic expressed plans to expand its business model beyond the commercial market into Medicaid. However, their approach to mapping the patient journey will need to evolve to address the needs of the Medicaid population, rather than applying their commercial market strategy to a very different set of patients. Understanding the motivations and preferences of women lacking PCP relationships at the individual level will better equip these companies with the tools to close these gaps in care.

Thanks to Kelly Boyce and Katie Patton for their research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)