In forecasting primary care demand, we found that the average demand for primary care services is projected to increase by 1.4% annually from 2021 to 2029. However, demand varies by state, ranging from 0.2% (West Virginia) to 2.6% (Idaho), and is influenced by factors such as population demographics, consumer preferences, and migration patterns.

Developing an effective primary care supply strategy requires understanding both where demand is projected to grow and the consumer preferences and health behaviors influencing primary care utilization. As the proportion of Americans with an identified primary care physician (PCP) declines, it is important to understand who these individuals are, what factors (e.g., demographics, psychographics, consumer preferences) influence their decisions, and the extent to which certain consumer cohorts are inclined to utilize primary care services.

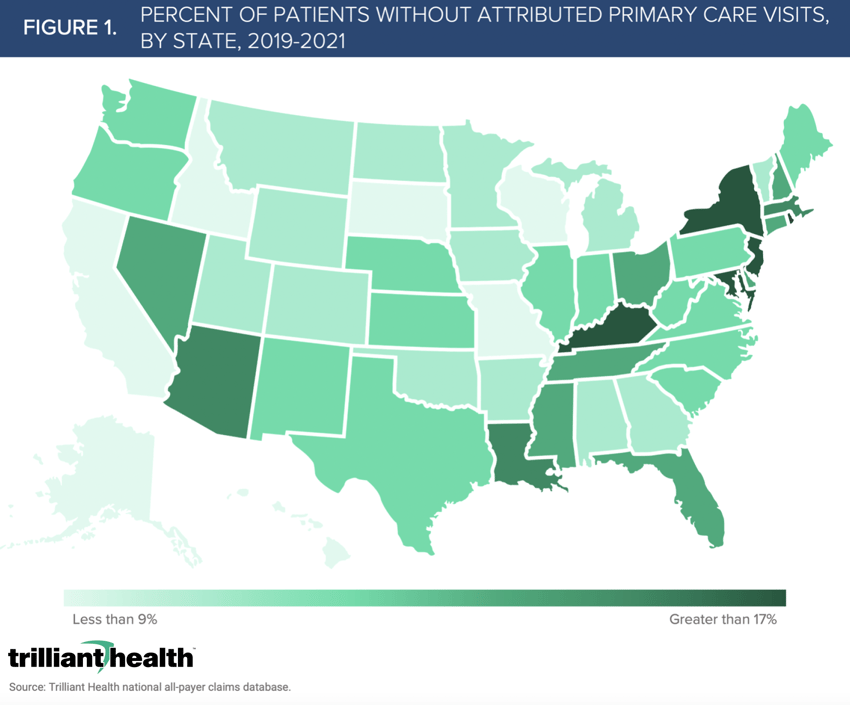

Leveraging our demand forecasts, we identified the proportion of patients in each state that sought care between 2019 and 2021 but did not see a PCP during that period. Nationally, the average proportion of the population that sought healthcare services without visiting a PCP between 2019 and 2021 is 12.1%. Inevitably, there is wide variation across states, ranging from 7.4% (Missouri) to 20.9% (New Jersey), influenced by factors such as population demographics, consumer preferences, and migration patterns (Figure 1).

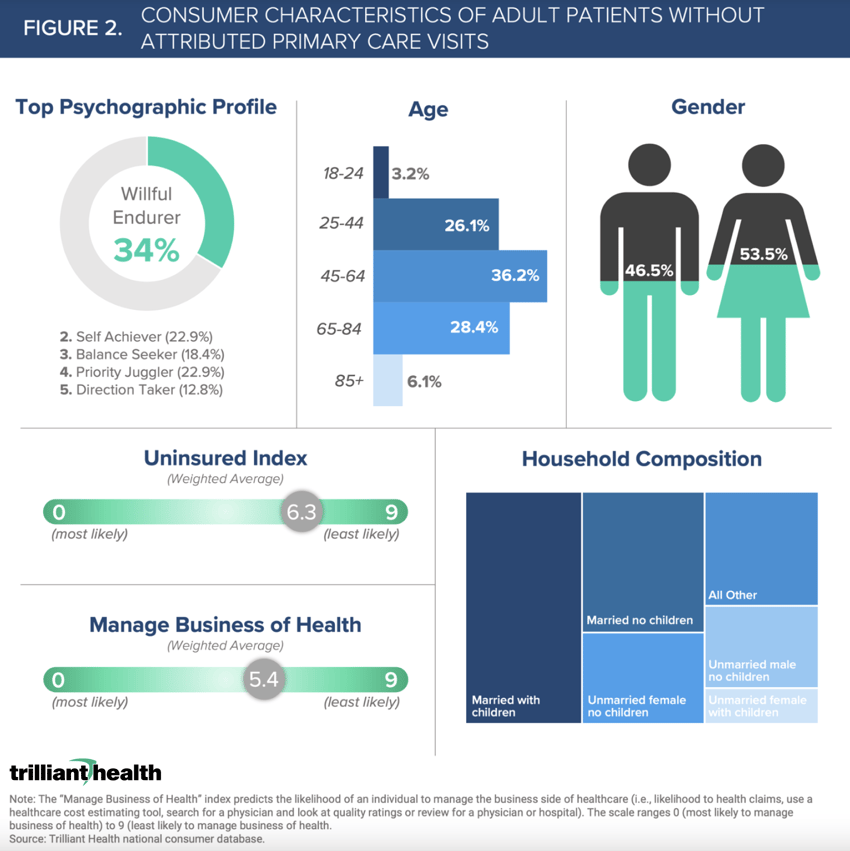

To further characterize patients without attributed primary care visits, we assessed their consumer attributes including age, race, gender, psychographics, uninsured index, propensity to manage the “business of their health,” and household composition (Figure 2). This patient segment’s primary psychographic profile is Willful Endurers (34%), which is characterized by living in the “here and now,” rather than remaining proactive about their health. We leveraged our consumer index that predicts an individual’s (age 18-64) uninsured status, with 9 indicating low likelihood and 0 indicating high likelihood. On average across this patient segment, the index has a weighted average of 6.3.

Reasons for avoiding primary care will undoubtedly vary across individuals. For example, Willful Endurers might have a propensity to consume healthcare in an urgent care or retail setting, rather than in traditional office-based settings. However, other individuals in this population segment may want to obtain primary care services but would require better insurance access to afford services. Additionally, the higher proportion of women foregoing primary care reinforces how women are less loyal to provider networks and reflects women, as typically the “Chief Health Officer” of their families, tend to prioritize the health of their dependents before their own.

The preferences and behaviors of consumers often maps to the way in which they want to access care and their preferred modality of primary care services. Regardless, traditional health systems, new primary care entrants, and retail health companies would all benefit in different ways by understanding who is currently not receiving primary care and why. As supply continues to increase, primary care will splinter, which will further strain traditional referral relationships. As health systems evaluate their primary care strategies, consideration should also be given to developing referral networks beyond local physicians/practices to include retail and corporate providers.

Thanks to Kelly Boyce and Katie Patton for their research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)