Many have speculated about whether care that was delayed during the COVID-19 pandemic was temporarily delayed or permanently lost, with estimates from the CDC and Johns Hopkins Bloomberg School of Public Health that 40% of adults delayed medical care from March to June/July of 2020. An analysis of data from January 2020 through December 2021 suggests that the preponderance of “delayed” primary care was permanently lost, with one observed notable exception.

Upon further review of data underlying our 2021 Health Economy Trends Report, we see that care avoidance behaviors began in February, not March, of 2020. Two years later, the aggregate utilization of primary care services has yet to return to pre-pandemic volumes, but segmentation of specific patient cohorts reveals interesting shifts in demand.

Primary care serves as the traditional front door to the healthcare delivery system, facilitating preventive care and screenings and often acting as the gatekeeper to specialty care. Thus, understanding who is over- and under-utilizing primary care services as compared to pre-pandemic utilization patterns is necessary to distinguish care that was temporarily delayed or entirely lost.

To investigate changes in primary care utilization, we compared primary care volumes for females ages 20-49 to all other gender and age groups between April 2019 and November 2021. We isolated this specific cohort, which represents approximately 20% of the U.S. population, given our understanding of their broader healthcare behaviors (e.g., telehealth use, likelihood to use a wearable), which we will explore in greater detail in forthcoming research.

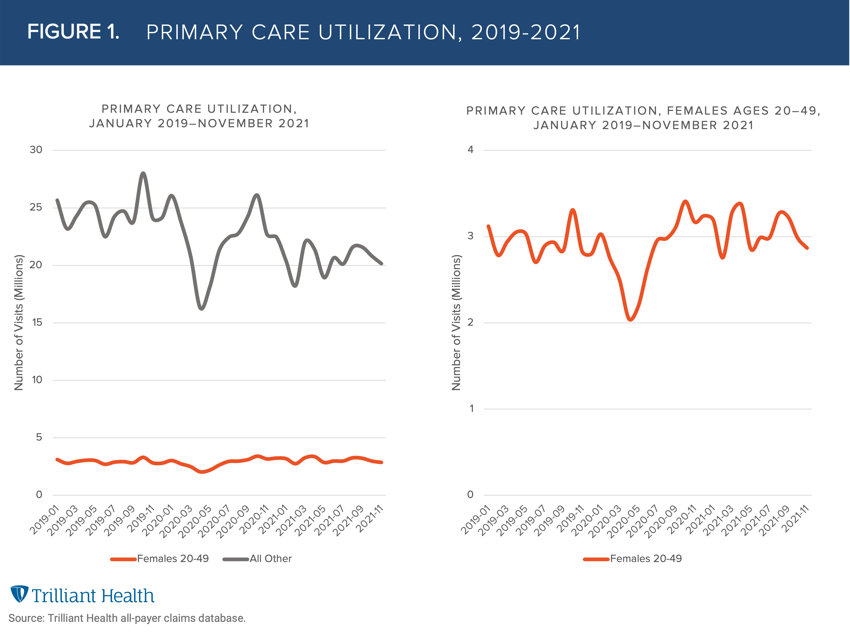

The data reveals primary care volumes for all population segments declined at the onset of the pandemic, with the nadir in April 2020 (Figure 1). Compared to April 2019 volumes, primary care utilization for females ages 20-49 declined 33% in April 2020, while the decline for all other gender and age groups dropped 36%. By April 2021, primary care volume for females 20-49 was 10.3% higher than April 2019 levels, while primary care utilization by the remaining cohorts was 16% lower than April 2019 levels. During the period surveyed, total primary care utilization peaked in October 2019, and aggregate volume in October 2021 was 24% lower than the peak. However, primary care utilization by females aged 20-49 in October 2021 had increased by 7% since October 2019.

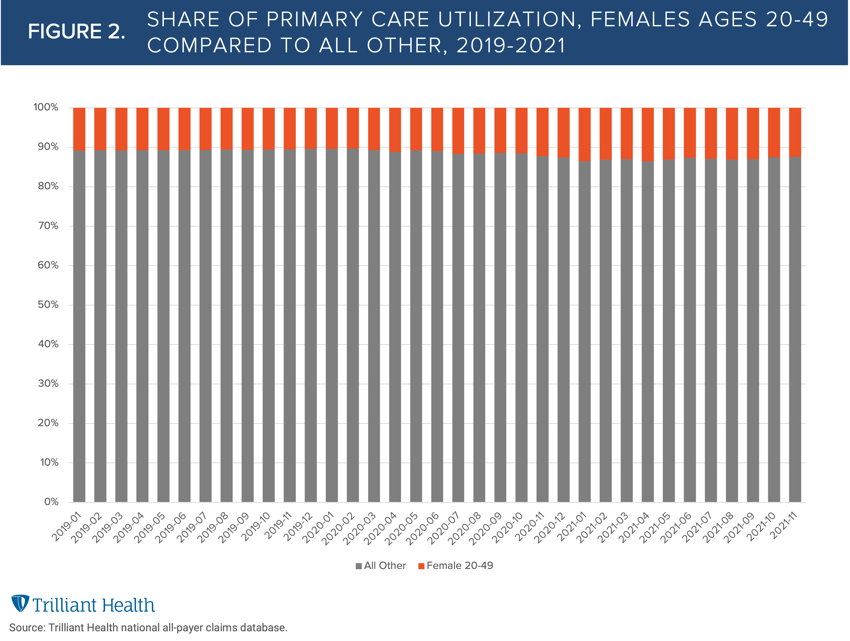

Females ages 20-49 increased their utilization of primary care services following the pandemic-induced drop, reflecting more individuals in this age segment “making up” for lost care. In contrast, the vast majority of Americans have not “caught up” from their lack of primary care utilization during the pandemic. As a result, primary care utilization by females ages 20-49 has increased from 10.7% of aggregate utilization in 2019 to 13% in 2021 (Figure 2).

Nationally, the average proportion of the population that sought healthcare services without visiting a PCP between 2019 and 2021 is 12.1%, with some states as high as 20%. The combination of this trend with the reality that most Americans (with an exception for females ages 20-49) continue to forego primary care in the wake of the COVID-19 pandemic is cause for concern. Logic and history indicate that delays in the initial diagnosis of more serious conditions (e.g., cancers that that were detected too late) often result in suboptimal clinical outcomes.

Thanks to Kelly Boyce and Katie Patton for their research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)