Studies Archive

Narrowing Primary Care Gap Requires Predicting Demand and Consumer Behavior

November 21, 2021According to the Association of American Medical Colleges’ (AAMC) most recent Physician Workforce Projections, the primary care physician (PCP) shortage is projected to reach between 17,800 - 48,000 physicians by 2034. The reasons that the current supply of physicians is unable to meet demand for primary care services could be attributed to several factors, such as inefficiency, physician preference (e.g., location, practice hours), and geographic mismatch of supply and demand. Other contributing factors could include primary care entrants (e.g., One Medical, Tia) and retail players (e.g., CVS, Walgreens, Walmart), which are leveraging allied health professionals to deliver primary care services.

Knowing that primary care is not a profitable service line for health systems, several health system executives have recently asked me whether these newer primary care players are in fact competitive to the health system model. This question belies a larger issue for health systems, namely the fact that every health system overestimates their market share because they underestimate the number of providers in the market, especially suppliers of primary care services. Health systems are already losing to these new competitors, with consumers increasingly obtaining primary care services outside of the health system network. Low consumer loyalty to health systems makes it even more difficult to integrate the primary care “front door” with higher-margin, higher acuity services across the care continuum.

Developing an effective primary care supply strategy requires understanding both where demand is projected to grow and the consumer preferences and health behaviors that will influence primary care utilization.

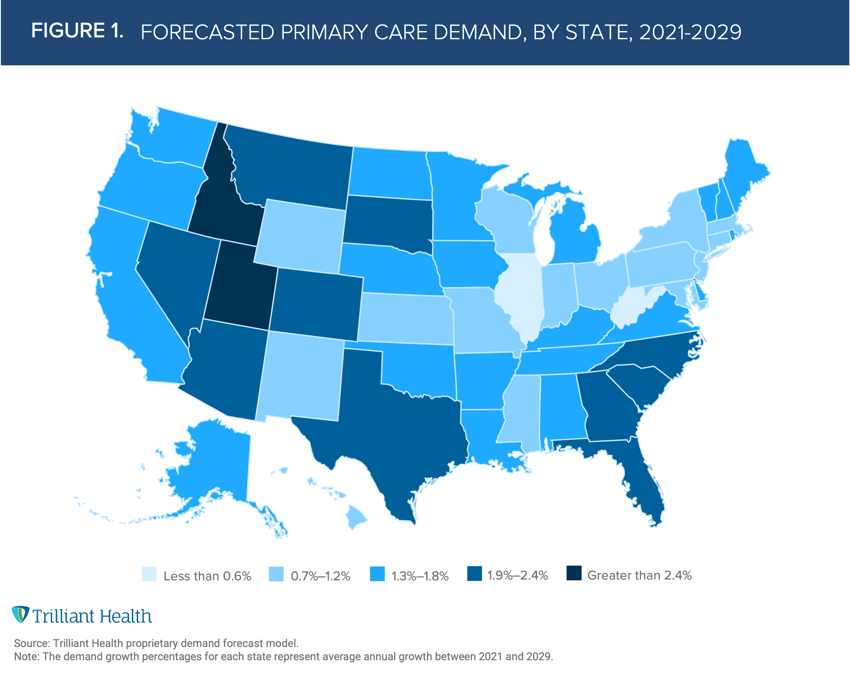

Nationally, average demand for primary care services is projected to increase by 1.4% annually from 2021 to 2029. However, demand varies by state, ranging from 0.2% (West Virginia) to 2.6% (Idaho), influenced by factors such as population demographics, channel preferences, and migration patterns (Figure 1).

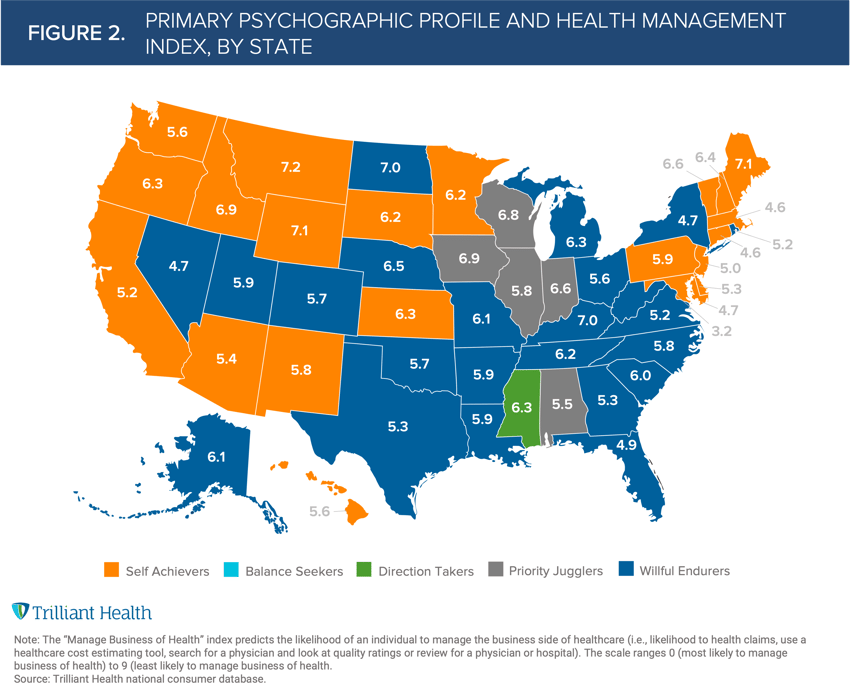

As we know, burden of disease does not equal demand. Future demand for primary care services depends upon several factors (e.g., localized incidence of disease, consumer preference, migration and, increasingly, affordability). To understand this in more detail, we leveraged our consumer index that measures how individuals “manage the business of their health.” This index predicts the likelihood of an individual to manage certain aspects of healthcare (e.g., likelihood to review health claims, use a healthcare cost estimating tool, search for a physician and look at quality ratings). The scale ranges from 0 (most likely to manage the business of health) to 9 (least likely to manage the business of health).

We then combined the “business of health index” to every state with the dominant psychographic profile in each state. We found that residents of Washington, D.C., with an index score of 3.2, are most likely to manage their health, while residents of Montana, with a score of 7.2, were least likely. (Figure 2).

This approach confirms the principle that healthcare is local. For example, West Virginia has the lowest projected growth in demand for primary care services, a health management index of 7.0 and a high proportion of Willful Endurers (individuals who are more likely to seek care as a last resort in an urgent care or emergency department setting). These data suggest that consumers in West Virginia will utilize primary care services less frequently than most Americans.

As new models of primary care services increase in an industry with inherently low consumer loyalty, effective primary care strategies will require quantifying future demand and characterizing local populations to determine appropriate channels for primary and preventive care.

Thanks to Kelly Boyce and Katie Patton for their research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)