Studies Archive

Variation in Downstream Share of Care Suggests Need for Greater Care Coordination Across Access Points

October 10, 2021The most important question for a health system to consider is whether its goal is to be in the hospital business, or rather to be in the healthcare delivery business. Offering integrated and accessible healthcare entry points can foster consumer loyalty, coordinated care, and improved health outcomes.

As discussed in prior research, we examined the association within and outside one of the nation’s largest health systems between telehealth encounters and the share of downstream care, by revenue. Overall low rates of downstream care from telehealth suggest the “digital front door” may not be as effective as is commonly perceived. In fact, the “digital front door” may serve to exacerbate the disintermediation of the traditional provider-patient relationship because of the vast array of information now available online.

Primary care and urgent care, typically considered low-margin services, are often, in traditional consumer terminology, "loss leaders.” Consumer-focused enterprises understand that the key to developing a long-term relationship with a consumer is first to engage them. Once engaged, a consumer is willing to listen to and trust the “brand story.” Healthcare executives implicitly understand this concept, which in healthcare is called the “referral.” Every health system executive knows that primary care is not profitable as a business line; instead, it is a “loss leader” for acute care services that generate margins.

The issue of increasing competition for primary care services is not the loss of margin, but the disruption of the traditional referral relationships between “known” primary care providers and specialty care. As a result, health systems need to quantify the effectiveness of access points into their system to ensure continuity and quality of care for patients.

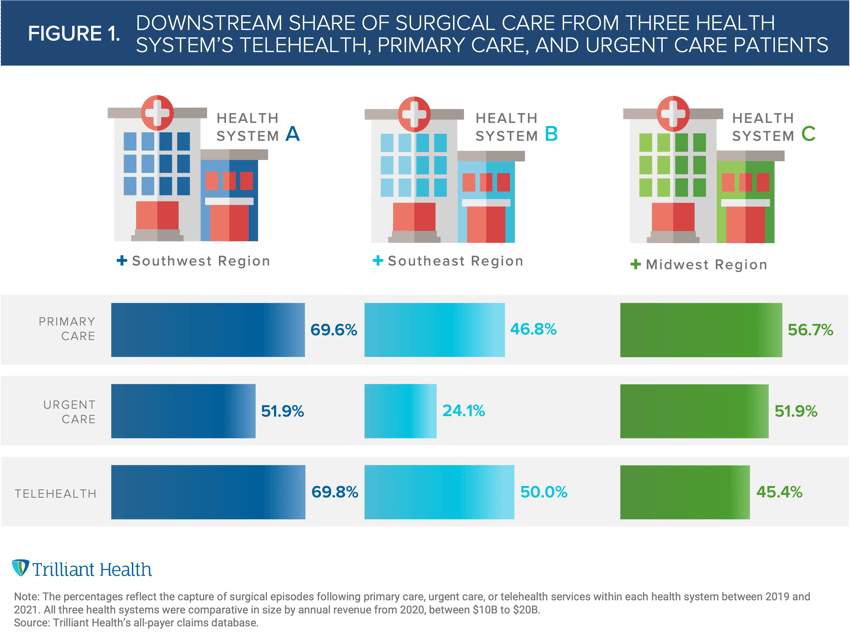

To explore this concept, we examined the association within and outside three of the nation’s largest health systems (all with annual revenue > $10B) between primary care, urgent care, and telehealth encounters and downstream share of surgical episodes as a three-year average from 2019-2021. Since consumer loyalty is lowest among the commercial population, we limited our analysis to commercially insured individuals in the system’s primary market (by state).

The most effective access point (telehealth, primary care, urgent care) for capturing downstream surgical care (based on patient volume) varied across the three systems. Even so, the uncaptured downstream surgical care from any primary care offering, whether primary care, urgent care, or telehealth ranges from 30% to 75%.

Primary care and telehealth showed the highest, almost equal surgical capture rate in Health System A (69.6% and 69.8%, respectively) and Health System B (46.8% and 50%, respectively) (Figure 1). Urgent care was least effective in Health System A (51.9%) and Health System B (24.1%). However, telehealth was the least effective in Health System C (45.4%). Health Systems A and C had relatively comparable rates of in-system downstream surgical care, but strikingly more than 50% of the patients who sought primary care of any sort (telehealth, primary care, or urgent care) at Health System B sought subsequent surgical services outside of the system.

With non-traditional entrants heightening competitive pressures for share of primary and urgent care (e.g., Amazon, Walmart, One Medical), significant opportunity remains for health systems to more effectively coordinate – and capture – follow-up care by understanding and meeting their needs and preferences. Alternatively, for patients utilizing care from new entrants that cannot deliver more complex services (e.g., radiology, surgery), health system executives must consider new partnerships to ensure those, often inevitable, services flow into their health system.

Seamless integration of low-margin and high-margin services will be critical for health systems to remain or become competitive market leaders. Accomplishing this requires investing in resources to better understand the consumer preferences and attitudes of a system’s total addressable market.

Thanks to Katie Patton and Kelly Boyce, and Jason Nardella for their research support.

- Primary Care

- Virtual Care

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)