Studies Archive

High Proportion of Behavioral Health Services Rendered by Primary Care Providers Underscores Lack of Sufficient Specialized Supply

October 31, 2021In our most recent analysis, we examined the most common diagnoses driving behavioral health demand and projected national inpatient demand to grow annually by 0.7% through 2029. We found that demand for behavioral services varies both geographically and by age. Specifically, inpatient behavioral health demand is projected to change across age groups in terms of compound annual growth: 0-24 (1.0%), 25-44 (1.0%),

45-64 (-0.5%) 65-84 (2.0%), and 85+ (-0.75%).

Understanding the subtleties of future demand is key to “matching” behavioral health supply where supply of behavioral health providers is not growing at a sufficient rate to meet current or future demand for services. Notably, the Bureau of Health Workforce, Health Resources and Services Administration (HRSA) projects the supply of psychiatrists is forecasted to drop by 20% between 2017 and 2030, and that decline will not be offset by the projected increase in supply of psychiatric nurse practitioners and physician assistants. HRSA specifically projects that supply of social workers to grow substantially by 114% in 2030, though the proportion that pursue a clinical/behavioral health scope of practice remains unclear. Whether an increase in licensed clinical social workers could help further efforts to integrate behavioral healthcare into primary care remains to be seen.

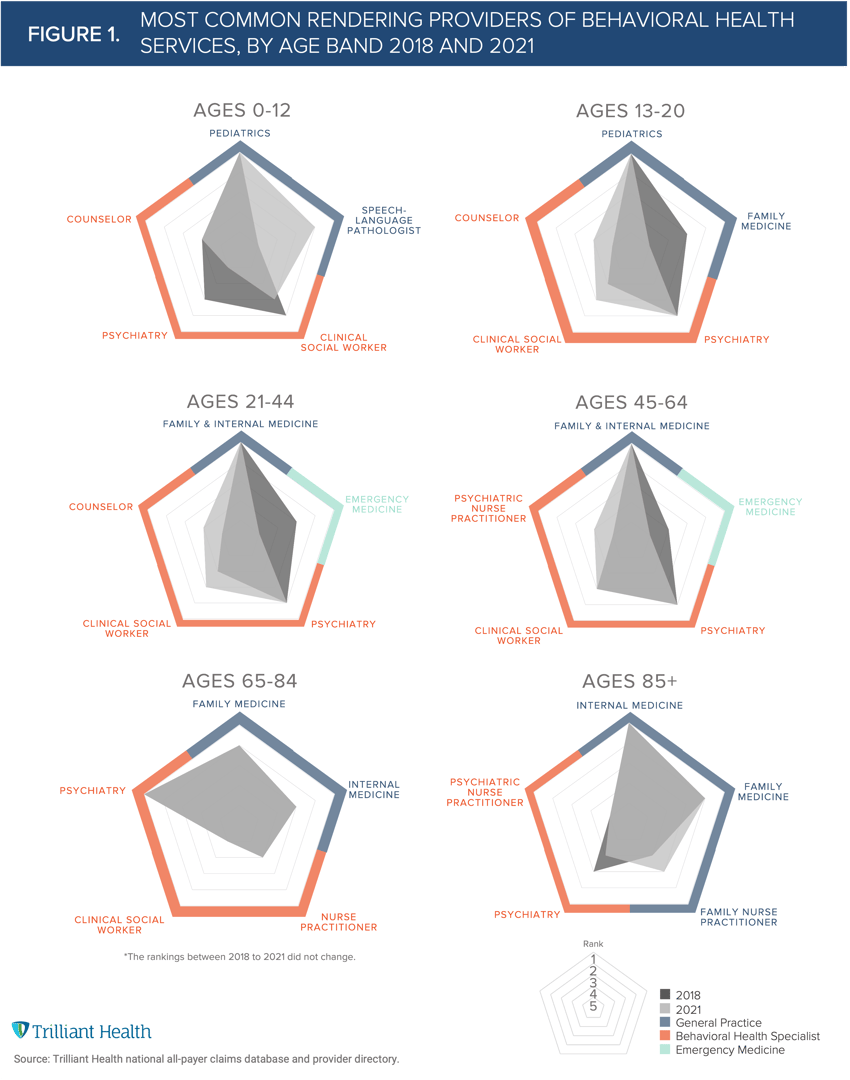

We analyzed the most common provider types (behavioral health providers vs. primary care providers (PCPs) and emergency medicine providers) rendering behavioral health services by age group between 2017 and 2021. Overall, children (ages 0-12) more commonly saw a specialized behavioral health provider (e.g., psychiatrist, counselor, clinical social worker), compared to the adult age groups (age 21+), which had higher instances of episodes with PCPs and emergency medicine providers for behavioral health visits (Figure 1). Psychiatrists are the most common behavioral health provider treating adults 45-64 and 65-84. Ensuring this age group continues to receive necessary care will require finding alternative behavioral health providers to render care.

Effectively managing behavioral health conditions requires synchronization between primary care and behavioral health providers. The shortage of behavioral health providers often results in care delays between the initial primary care visit and the downstream behavioral health visit, which in turn can lead to poor health outcomes. Research has shown that barriers to specialized treatment are reduced and more effective disease management is possible when behavioral health is integrated with primary care services.

Telehealth and virtual care also can play an important role in providing increased behavioral health supply, especially given telehealth’s use for behavioral health conditions, both pre- and post-pandemic. Investments in teletherapy have skyrocketed, with telehealth investments topping $5B in Q2 2021, representing a 169% increase from Q2 2020. While telehealth and virtual care platforms create the ability to reach more patients, barriers such as payment, reimbursement, and coverage amount persist among both insured and uninsured individuals.

Thanks to Kelly Boyce and Katie Patton for their research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)