Studies Archive

Appropriately Matching Supply to Projected Behavioral Health Demand Requires Localized Analysis

October 24, 2021It is well documented that the current supply of behavioral health providers does not meet current or projected demand for services. The provider shortage is further compounded by COVID-19’s exacerbation of many conditions, with anxiety and depression in U.S. adults alone having increased four times that of pre-pandemic levels. Additionally, mental health status has worsened for over 20% of school-aged children in the U.S since the onset of the pandemic.

At the outset, it is important to distinguish between mental health, which refers to an individual’s psychological state, and behavioral health encompasses an individual’s state of mind and their physical condition. To better meet the needs of individuals requiring behavioral health services, we must first understand the where and the why. How does demand for behavioral health services vary regionally, and what are the primary forces driving that subsequent demand?

Generally speaking, there are significant shortages in behavioral health services throughout the U.S. The Bureau of Health Workforce, Health Resources and Services Administration’s Health Professional Shortage Area (HPSA) designation identifies behavioral health provider shortages, among other specialties. The defined population to provider ratio for behavioral health shortages is 30K to one or 20K to one in high-need areas. For mental health HPSAs, the percent of provider need being met varies from as low as 3.7% in Missouri to 69.8% in New Jersey. This wide range underscores the regional variation associated with provider access, compounded by barriers such as coverage source and sociodemographic factors.

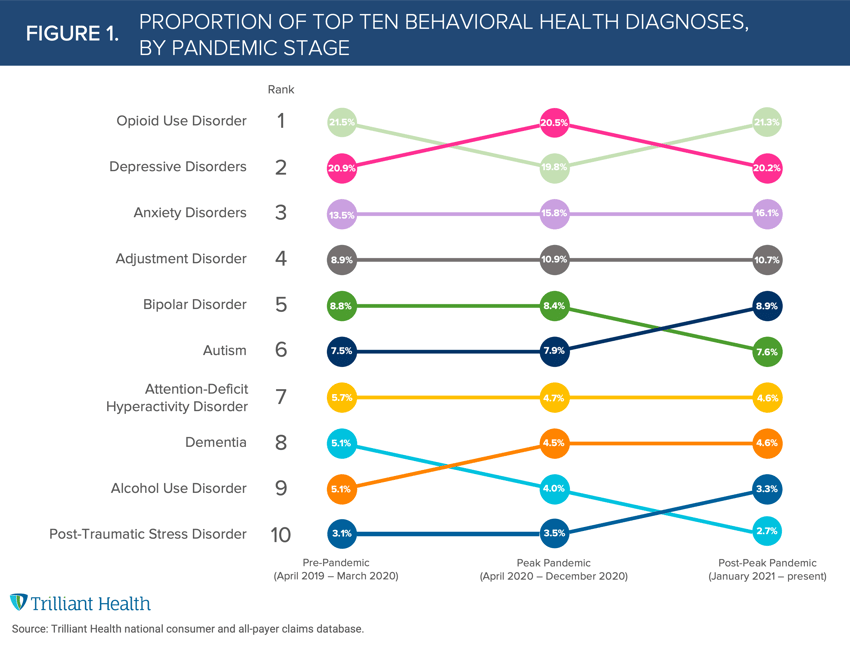

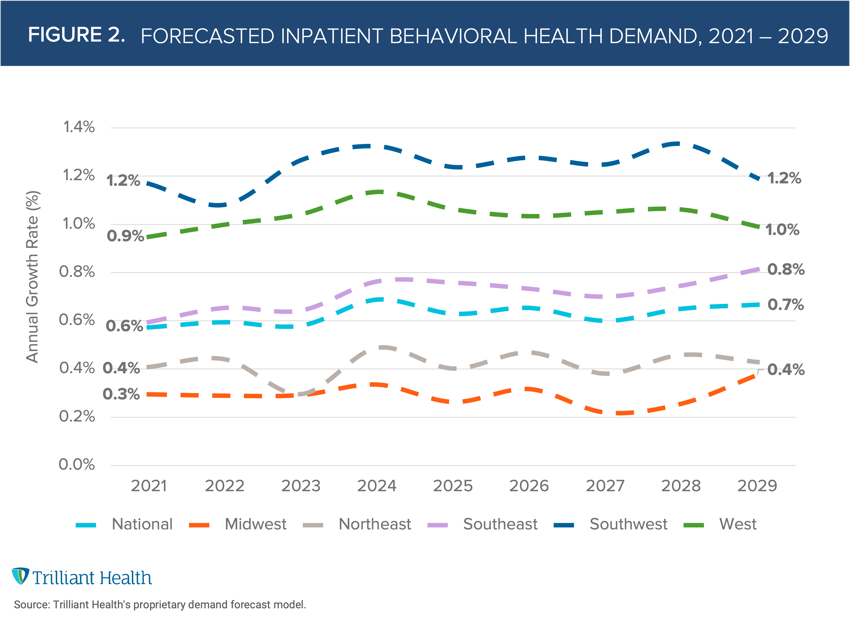

Forecasting future demand at the regional and local level is critical for appropriately allocating necessary provider supply. As a starting point, we analyzed the highest volume of behavioral health diagnoses from 2017 to 2021. Next, we also projected the annual growth of demand for inpatient behavioral health services from 2021 to 2029.

The primary diagnoses driving demand vary when examined by pandemic stage (pre-pandemic, peak pandemic, and post-peak-pandemic). Opioid use disorder, depression, and anxiety remained the top three diagnoses throughout the COVID-19 pandemic, whereas depression increased from the second most common diagnosis pre-pandemic (20.9%) to the top diagnosis during peak-pandemic (20.5%) (Figure 1).

Future inpatient behavioral health demand is projected to increase nationally at an average annual growth of 0.7% through 2029 (Figure 2). However, since healthcare is local, projected demand growth will inevitably vary regionally, both with respect to the rate of change and the average growth rate, with demand in the Southwest more than three times as high as in the Midwest. Moreover, our analysis also reveals wide variation in age-segmented projected demand. Demand by volume is projected to increase for age groups 0-24, 25-44, and 65-84, but slightly decrease for 45-64 and 85+. Insight into the diagnoses driving this demand will further inform how to adequately treat regional and local patient populations.

Understanding demand regionally and locally, especially at the diagnosis level, will help “match” supply nationwide. Given that the supply of psychiatrists is projected to decline over the next decade, meeting the demand for behavioral health will require other providers (e.g., physician assistants, clinical social workers) to treat behavioral health patients. Virtual care solutions can play an important role in working to meet behavioral health demand, especially given telehealth is primarily used to treat behavioral health conditions, and investments in teletherapy increasing by 169% from Q2 2020 to Q2 2021, but technology is only one part of the solution. Even with widespread adoption of technology, barriers such as payment, reimbursement, and coverage amount persist among both insured and uninsured individuals. How supply will change across behavioral health provider types will inevitably vary regionally, which we will continue to explore in subsequent research.

Thanks to Kelly Boyce and Katie Patton for their research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)