Studies Archive

Downstream Share of Care from Telehealth Does Not Suggest Strong Consumer Loyalty

August 22, 2021The recent growth in telehealth utilization is largely attributable to the law of small numbers, with utilization already beginning to taper. These trends are reinforced by quarterly reports from publicly traded telehealth companies, which is further reason to evaluate the notion that telehealth is a “digital front door.”

In theory, the “digital front door” is a consumer-friendly and low-acuity engagement that provides an opportunity to earn a greater share of an individual’s loyalty to the health system for downstream services. In developing telehealth strategies, health systems should consider not only payment parity and competition by new entrants (e.g., Amazon) but also understand which service lines are the primary drivers for telehealth utilization.

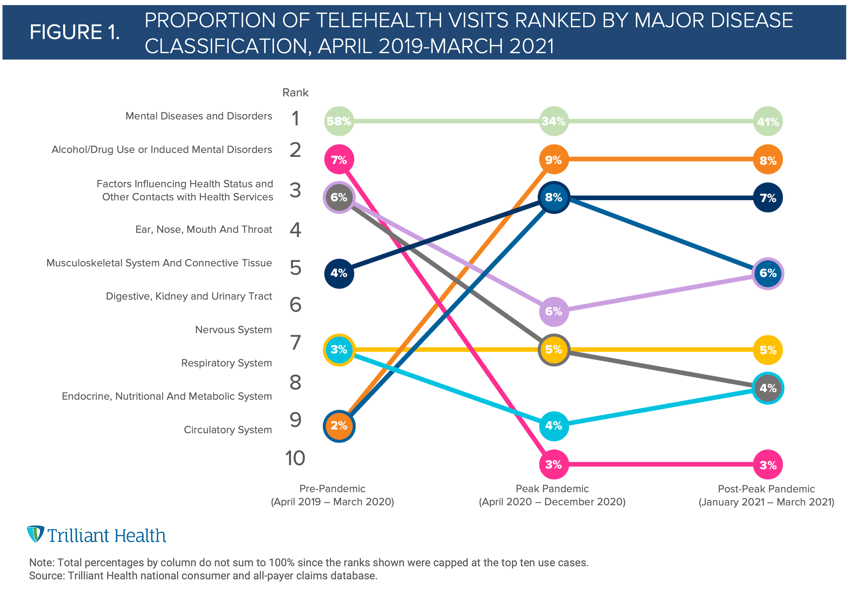

Telehealth has always been primarily used to treat behavioral health conditions, both pre- and post-pandemic (Figure 1). Using the post-peak pandemic data as a signal for the “new normal,” among the 12% of Americans who used telehealth (excluding traditional Medicare) nationally, less than 8% of all visits are attributed to non-behavioral health related disease classifications. If telehealth’s use is favored for a limited set of clinical services, to what extent is telehealth the digital front door?

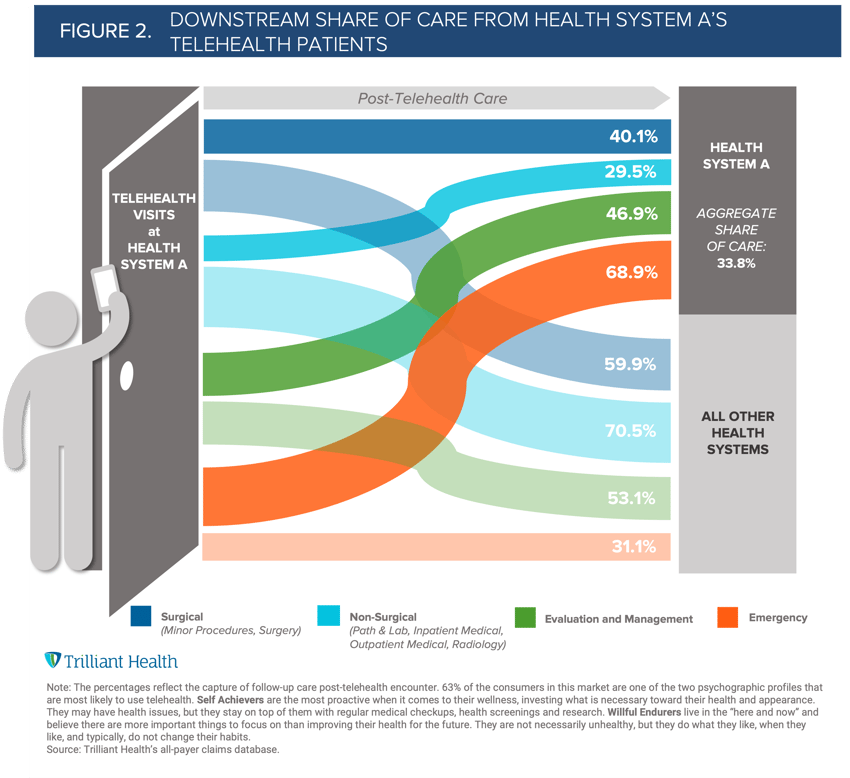

To explore this question, we examined the association within and outside one of the nation’s largest health systems between telehealth encounters and the share of downstream care. We limited our analysis to commercially insured individuals in a single market, with a high (>50% of consumers) propensity for telehealth use, within the health system (“Health System A”). Of Health System A’s total addressable market (TAM) of approximately 2.7M consumers, the market is comprised of 43% Willful Endurers and 20% Self Achievers – the two psychographic profiles with the highest likelihood of utilizing telehealth.

Consistent with national trends, approximately 13% of individuals accessed telehealth within this market at least once in 2020. Among the individuals that utilized telehealth via Health System A, the downstream aggregate share of care (based on revenue) for the health systems’ telehealth patients was only 33.8%. Even with an additional 7% capture rate of individuals using telehealth services outside of Health System A, the overall low share of care for Health System A reflects an opportunity to capture more than 65% of follow-up care prompted by the “front door” interaction (Figure 2).

Further segmenting the consumer’s follow-up care pathway by type of service, Health System A has the highest capture rate in the Emergency Department (68.9%). Given the overall low capture rate, the data suggest the digital front door may not be as effective as is commonly perceived.

Although this is just one market’s story, our study of health systems across the country reveals downstream capture from telehealth as the digital front door may not generate a return on the sizable investments being made in this modality. For telehealth strategies to be successful, health systems must measure where telehealth patients are pursuing care (both within and outside the health system) to quantify loyalty. As more competitors enter an already oversupplied telehealth market, gaining consumer loyalty will likely be even harder.

Thanks to Katie Patton for her research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)