Key Takeaways

-

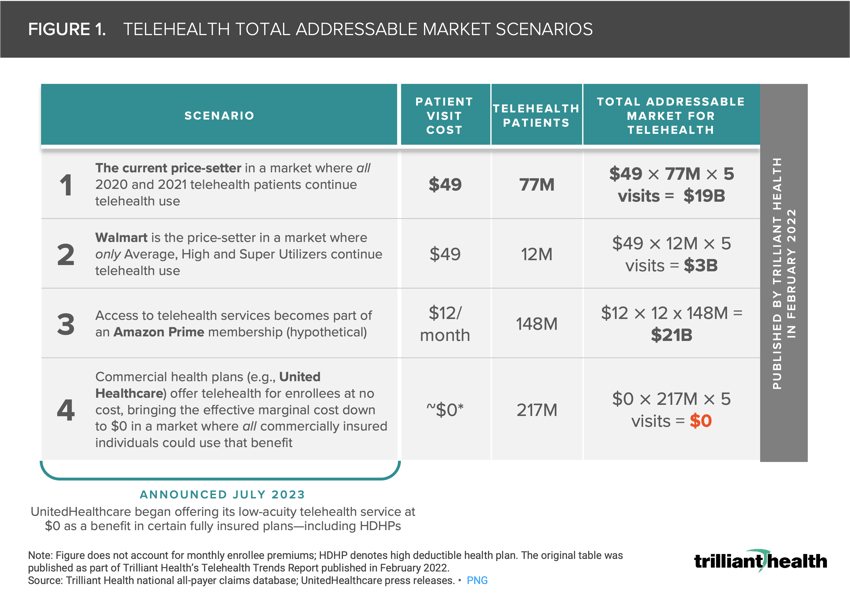

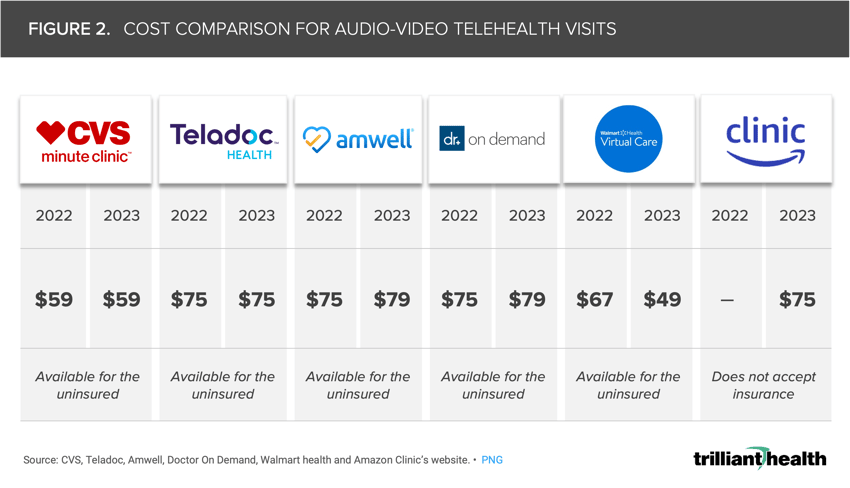

From 2022 to 2023, Walmart reduced their price per virtual visit from $67 to $49—equivalent to a $7B decrease in the total addressable market for telehealth.

-

As of July 1, 2023, UnitedHealthcare offers its low-acuity telehealth service at $0 to certain fully insured plans, which suggests the telehealth TAM is approaching $0.

-

Health economy stakeholders must prepare for the ramifications of reduced yield in the telehealth market.

Previously, we examined how virtually enabled new entrants are disintermediating the traditional healthcare journey.1 While direct-to-consumer and retail telehealth providers such as Amazon Clinic have broadened access to specific low-acuity services for certain patient demographics, their closed loop model disintermediates traditional patient care journeys originating with primary care physicians, in turn creating fragmentation for traditional providers.

The future of telehealth suppliers will be determined at least as much by cost-effectiveness as by the impact on patient care journeys. Similarly, the extent to which telehealth is viewed as a commodity will impact the total addressable market (TAM) for telehealth services.

Background

Digital health utilization, notably telehealth, increased exponentially during the initial stages of the COVID-19 pandemic.2 Three years later, it is evident that some digital health trends were a temporary function of “forced adoption,” while others indicate long-term behavior change.

The increased number of telehealth suppliers over the past three years is largely attributable to the forced adoption of telehealth during the COVID-19 pandemic, creating a saturated market where differentiation is difficult to achieve. To the patient or consumer of telehealth, price is an important factor in a market that includes established consumer brands like Walmart and Amazon, which are without peers in their scale and reach.

Implications of Telehealth TAM Reaching $0

To date, most research has been limited to analysis of aggregate telehealth volumes, as opposed to assessing how changes in price and reimbursement have shaped the telehealth market’s growth trajectory. In our overview of telehealth trends published in February 2022, we proposed that health economy stakeholders should prepare for the implications of reduced telehealth market yield and the potential of its TAM nearing $0, which seems increasingly likely (Figure 1).3

As of July 1, 2023, UnitedHealthcare is offering its low-acuity telehealth service at $0 to certain fully insured plans, including high-deductible health plans.4 While this does not impact every American, it has a substantial impact as it would affect the fully insured proportion of UnitedHealthcare’s 27.1M employer and individual insured lives.5

The laws of economics teach that when supply exceeds demand, as is true for telehealth in 2023, price declines. As price declines, the TAM will slowly approach $0 in the commercially insured market. In addition to UnitedHealthcare’s decision to provide telehealth at no cost to the consumer, Walmart has in the last 12 months reduced the price per virtual visit from $67 to $49—equivalent to a $7B decrease in the TAM.

Currently, the retail price for a synchronous audio-video telehealth visit ranges from $49 at Walmart to $79 at Amwell and Doctor On Demand (Figure 2), while Amazon Clinic’s synchronous messaging service is offered at as low as $35. Compared to 2022, prices have fluctuated depending on the supplier, perhaps in response to the number of new entrants and retail suppliers offering telehealth.

In any event, telehealth is indicative of the power of price transparency in healthcare. Health plan price transparency should promote even more competition among the growing number of virtually enabled suppliers, and UnitedHealthcare‘s introduction of no-cost telehealth marks a pivotal shift in healthcare delivery. With the cost of telehealth for a large share of the commercially insured now at $0, retail prices (e.g., Walmart, CVS, Amazon) will inevitably decline as well.

As retail prices for telehealth visits approach $0, what is the future of an industry with essentially a $0 TAM? The ramifications of reduced yield in the telehealth market will extend beyond economics. How will growing employer skepticism of the value of telehealth change benefit design and partnerships with existing telehealth providers? To what extent will large tele-providers want to roll up smaller non-retail tele-providers? How will patient utilization of “zero-cost” telehealth change other types of primary care access? Will changes in corresponding patient behaviors result in more fragmentation? These are just a few of the many questions that all health economy stakeholders should begin to consider. In addition to the declining TAM from an economic lens, undoubtedly the decisions made by the nation’s largest payer and employer of physicians will have downstream implications for others.

Thanks to Katie Patton for her research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)