Studies Archive

Differentiating Between Inpatient vs. Outpatient Market Share Reveals Variable Intra-Market Concentration

July 17, 2022In last week’s edition of The Compass and throughout the recently published SimilarityIndex™ | Markets Report, we have discussed the increasing importance of evidence-based benchmarking in healthcare decision making.1,2 Market benchmarking is commonly used to inform M&A activity. Health economy stakeholders from health systems and health plans to academic researchers and think tanks routinely measure market-level competitiveness and concentration to identify scale opportunities, inform capital allocation, and assess provider and insurer consolidation, to name a few.3,4,5

Background

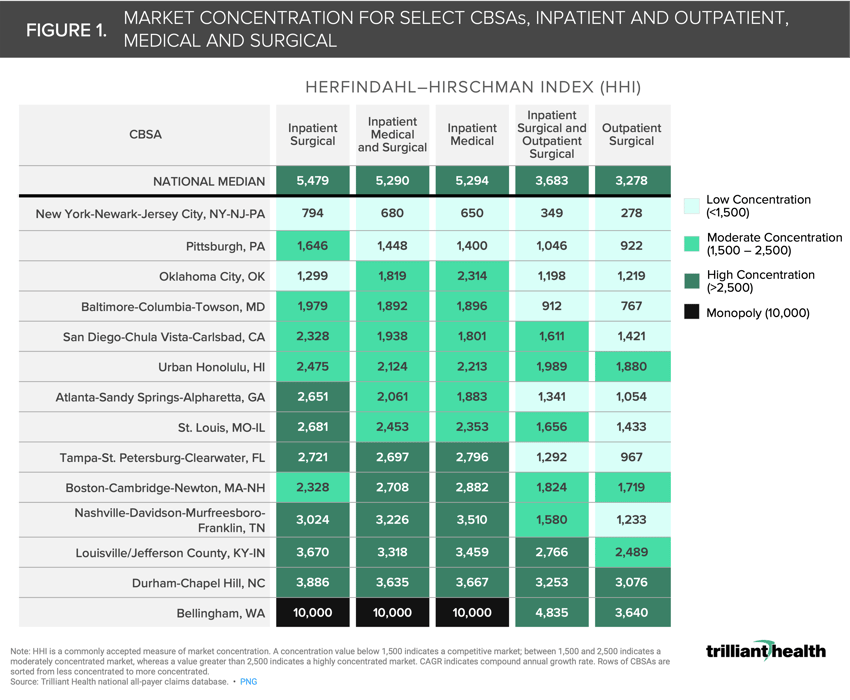

The Federal government utilizes the Herfindahl-Hirschman Index (HHI) as the standard measure of market concentration. HHI is calculated by squaring the market share of each firm competing in a market and then summing the resulting numbers. It approaches zero when a market is occupied by several firms of relatively equal size and reaches its maximum value (10,000) when a market is controlled by a single firm (i.e., monopoly). HHI increases both as the number of firms in the market decreases and as the disparity in size between those firms increases. The U.S. Department of Justice (DOJ) and Federal Trade Commission (FTC) generally consider markets in which the HHI is between 1,500 and 2,500 points to be moderately concentrated and consider markets in which the HHI is in excess of 2,500 points to be highly concentrated. According to DOJ and FTC guidelines, “transactions that increase the HHI by more than 200 points in highly concentrated markets are presumed likely to enhance market power…”6

Traditionally in healthcare, HHI has focused on hospitals. Specifically, the American Hospital Association Annual Survey database (i.e., inpatient survey) is often cited as the data source for hospital market HHI calculations.7 The Health Care Cost Institute also annually calculates inpatient hospital HHI at the market level, using medical claims for employer-sponsored commercial lives.8 Given the majority of healthcare encounters occur outside of the hospital setting, we calculated market-level HHI using data from both the inpatient and outpatient setting.

Analytic Approach

HHI was calculated using all-payer claims in the following ways: individually for inpatient medical, inpatient surgical, outpatient surgical; and, in aggregate, for the combination of outpatient and inpatient surgical and also for the combination of inpatient medical and inpatient surgical (excluding in every surgical calculation integumentary, ocular, dermatology, pain management, and podiatry service lines). Data was sourced from Trilliant Health’s national all-payer claims database and provider directory.

Findings

When segmenting sites of care (inpatient vs. outpatient) and type of care (medical vs. surgical), HHI changes within a market, often significantly, with a single market being concentrated for one type or site of care and competitive in another. For example, while New York City is considered a competitive market, regardless of the type and location of medical services, Atlanta has varying levels of concentration depending on HHI methodology (Figure 1). Atlanta’s inpatient surgical market is considered highly concentrated (2,651), while its outpatient surgical market has low concentration (1,054), indicating competition. When factoring both inpatient and outpatient surgical services into the HHI, Atlanta’s surgical market is considered competitive (1,341).

While one or two health systems may possess significant market share for inpatient medical and surgical care in a given market, the variation reflected in the analysis reveals how outpatient care dynamics rarely align with inpatient competition. Markets like Durham-Chapel Hill, NC have almost identical HHIs across type and sites of care, given the strong market presence that UNC Health has for both inpatient and outpatient care. However, Tampa’s inpatient market is highly concentrated, but its outpatient surgical (and overall surgical market) is not concentrated, thus highly competitive. While HCA, BayCare, and Tampa General Hospital control most of the inpatient market share in Tampa, outpatient market share is dispersed across health-system-owned and independently owned outpatient facilities alike.

While one or two health systems may possess significant market share for inpatient medical and surgical care in a given market, the variation reflected in the analysis reveals how outpatient care dynamics rarely align with inpatient competition. Markets like Durham-Chapel Hill, NC have almost identical HHIs across type and sites of care, given the strong market presence that UNC Health has for both inpatient and outpatient care. However, Tampa’s inpatient market is highly concentrated, but its outpatient surgical (and overall surgical market) is not concentrated, thus highly competitive. While HCA, BayCare, and Tampa General Hospital control most of the inpatient market share in Tampa, outpatient market share is dispersed across health-system-owned and independently owned outpatient facilities alike.

How patients seek care is constantly evolving, and thus their provider loyalty is often being challenged. Expanding beyond the traditional inpatient inputs for calculating HHI by analyzing outpatient volumes provides a more complete assessment of competition within a market. With that knowledge, health economy stakeholders can make more informed decisions about market expansion or new market entry.

Thanks to Katie Patton, Kelly Boyce, and Alli Oakes for their research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)