Key Takeaways

-

The increase of later-stage chronic kidney disease (CKD) in younger populations, which is markedly different than CKD disease stage in Medicare populations, requires a paradigm shift in disease management to stem rising mortality.

-

Early signals of renal protection from a recent clinical trial of Ozempic® could portend a paradigm shift in CKD treatment, opening new avenues beyond existing treatments and therapies.

-

Compass+ Exclusive: Analyzing CKD Patient Severity by Age

For health economy stakeholders and millions of American consumers, 2023 was the "year of Ozempic." Every aspect of the proliferation of these medications—including utilization, costs, off-label use, patient characteristics, side effects, shortages and potential future clinical indications—has been increasingly examined by the media, clinicians, researchers and academics.1

While the clinical indications for semaglutide are primarily for type 2 diabetes (e.g., Ozempic®) or weight management (e.g., Wegovy®), emerging research suggests that the clinical benefits may extend beyond these longstanding indications.2 Conversely, other research validates the well-documented, if less frequently reported, side effects, a topic we will revisit in future research.3,4

As to the newly discovered benefits, a clinical trial evaluating the effect of semaglutide, specifically Ozempic®, on kidney outcomes in participants with type 2 diabetes and chronic kidney disease (CKD) ended prematurely in October 2023 due to early evidence of renal protection.5,6 While the full trial results are expected in the first half of 2024, we sought to examine the CKD population that could be affected by a potential new treatment option.

Background

CKD poses a significant public health challenge in the U.S. Estimates indicate that more than 35.5M, or 14%, of American adults have CKD, of whom almost 90% are undiagnosed. Of that undiagnosed population, nearly one-third have severe CKD.7 Because type 2 diabetes and high blood pressure are the predominant risk factors for developing CKD, approximately one-third of adults with type 2 diabetes may also have CKD, amplifying the need for increased awareness and targeted treatment. Additionally, increasing obesity prevalence poses significant challenges to curbing CKD disease burden. In 2022, state-level obesity prevalence ranged from 24.3% in Washington, DC to 41.0% in Wyoming, averaging 33.7%.8

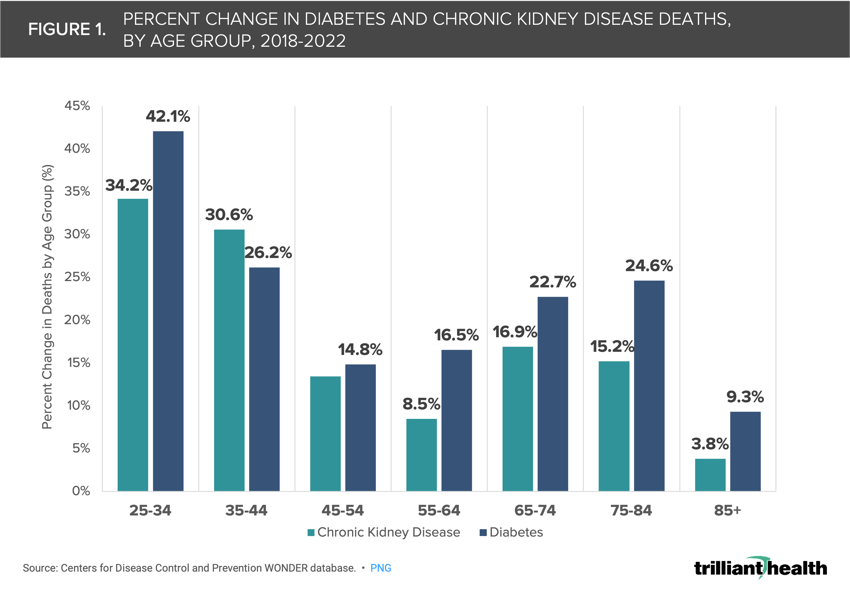

From 2018 to 2022, mortality associated with both diabetes and CKD increased across age groups but manifested differently (Figure 1). While most diabetes-related deaths occurred among individuals aged 65-74, and most CKD-related deaths were observed in individuals over the age of 85, the most significant increase in mortality rates was recorded in the 25-34 age group, with a substantial surge of 42.1% for diabetes and 34.2% for CKD. This concerning trend highlights the urgent need for a paradigm shift in diabetes and CKD disease management to stem rising mortality in younger populations.

Analytic Approach

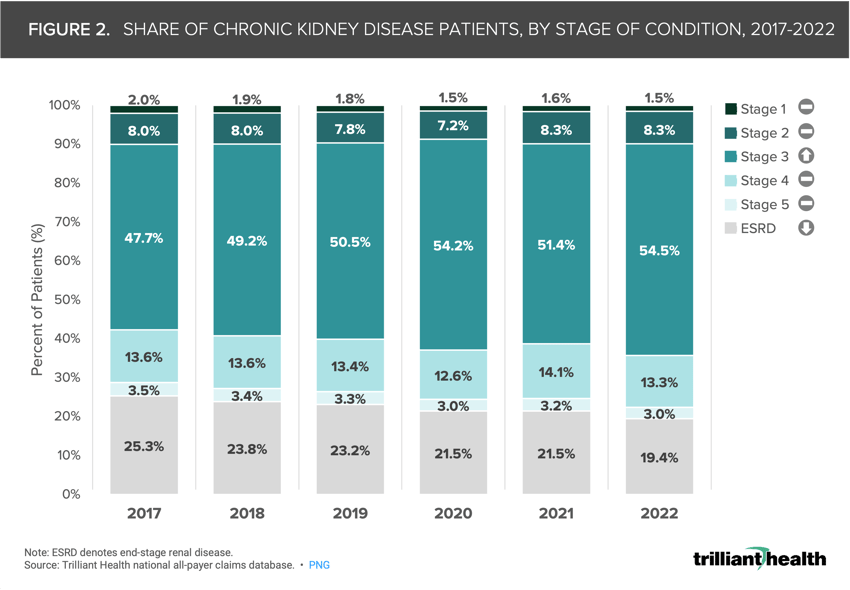

We utilized national all-payer claims to examine the annual distribution of CKD patients according to stage of condition – stages one to five and end-stage renal disease (ESRD) – from 2017 to 2022. Additionally, we conducted an analysis of patients within distinct age bands – ages 18-44, 45-65 and 65+ – over the same time frame.

Findings

While nearly half of all CKD patients were in stage three (47.7%) in 2017, there has been a noticeable shift in the distribution in subsequent years (Figure 2). Stage three consistently remained the predominant stage, comprising 54.5% of CKD patients in 2022. However, there was a notable decrease in the share of CKD patients with ESRD from 2017 (25.3%) to 2022 (19.4%). The significant changes in the stage of disease within this population highlights the importance of ongoing monitoring and targeted interventions to address specific stages and mitigation of CKD progression.

Compass+ Exclusive: Analyzing CKD Patient Severity by Age

You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? (Figure 3). You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization?

You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization? (Figure 4). You can only unlock premium content on Compass+, a subscription-based research platform for data-driven insights into trends shaping the health economy. Ready to learn how the latest trends will impact your organization?

The growing mortality and increasing severity among CKD patients compels the consideration of new clinical interventions, which explains the enthusiasm for the potential of new clinical indications for GLP-1 and semaglutide drugs. The emergence of new therapies often triggers shifts in practice patterns, including medication management.10 While waiting for the full clinical trial results regarding the potential renal protection offered by Ozempic® in participants with type 2 diabetes and CKD, health economy stakeholders should consider the downstream implications on existing treatment paradigms.

Slowing CKD disease progression should lead to improved patient outcomes, consequently reducing the demand for higher-acuity treatments such as kidney transplants and dialysis. How will healthcare providers respond to declines in patient volume and the corresponding revenue losses associated with replacement therapies that enhance health status and impede disease progression? At the same time, new therapies, despite their proven benefits, introduce uncertainties. The first GLP-1 drug was approved in 2005, and its risk profile for current use cases, along with the semaglutide drugs that have followed, is well established.11 What potential downsides or adverse events might be revealed for these new clinical indications in the long term?

The healthcare system has become increasingly fragmented, and patients have not returned to a pre-pandemic level of primary care.12,13 With a high proportion of younger patients in later-stage CKD, how will providers re-engage younger demographics to ensure utilization of primary and preventive care to detect potential health issues at the earliest stage? The worsening patient acuity and mortality rates among younger patients underscore the urgent need for providers and the healthcare system overall to adjust their approach in helping younger patients stay proactive in managing their health status.

Thanks to Colin Macon and Katie Patton for their research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)