Studies Archive

Allied Health Professionals Treat an Increasing Proportion of Type 2 Diabetes Patients

February 11, 2024Key Takeaways

-

Patients with chronic conditions such as type 2 diabetes have abundant options for care management, ranging from primary care providers (PCPs), specialists like endocrinologists and allied health professionals, in a variety of care settings ranging from traditional physician clinics to retail and virtual care settings offered by newer entrants like Amazon and Walmart.

-

While nationally PCPs are the main prescribers of type 2 diabetes drugs, there is variation across states in terms of which providers prescribe the highest proportion of these medications.

-

Compass+ Exclusive: Analyzing Changes in the Share of Providers Treating Type 2 Diabetes Patients and Changes in Share of Providers Prescribing Ozempic®.

Patients with chronic conditions like type 2 diabetes have abundant options for care management. Effective chronic condition management relies heavily on established patient-provider relationships that allow for personalized treatment adjustments and individualized patient education. These relationships are essential for ensuring optimal outcomes.1,2,3

Historically, primary care providers (PCPs) and endocrinologists managed diabetes treatment through in-person engagement. However, in recent years, retail and virtually enabled new entrants (e.g., Walmart, CVS, Amazon) have introduced chronic condition management platforms. These platforms are often overseen by allied health professionals (e.g., nurse practitioners (NPs), physician assistants (PAs)), providing both synchronous and asynchronous care.

Effective cost management of chronic conditions requires consistent and predictable access to preventive care and continuous, personalized treatment. While new entrants have expanded omni-channel options for chronic condition management, the increasing access introduces the risk of fragmented care.4 As the well-documented workforce shortages among primary care physicians persists while the supply of NPs and PAs increases, understanding how these trends are impacting diabetes care is important.5,6,7 As a result, we were interested in comparing the difference in the types of providers treating type 2 diabetes patients by state, how this distribution has shifted over time and if the distribution of providers prescribing Ozempic® has shifted over time.

Background

The U.S. prevalence of chronic conditions (e.g., hypertension, arthritis, chronic lung disease) is rising, underscoring the need for improved care management.8,9 In particular, the rate of type 2 diabetes is growing among individuals younger than age 60.10 The Centers for Disease Control and Prevention estimates that in 2022, 37.3M Americans (11.3%) had diabetes, 22.8% of which (8.5M) were undiagnosed.11

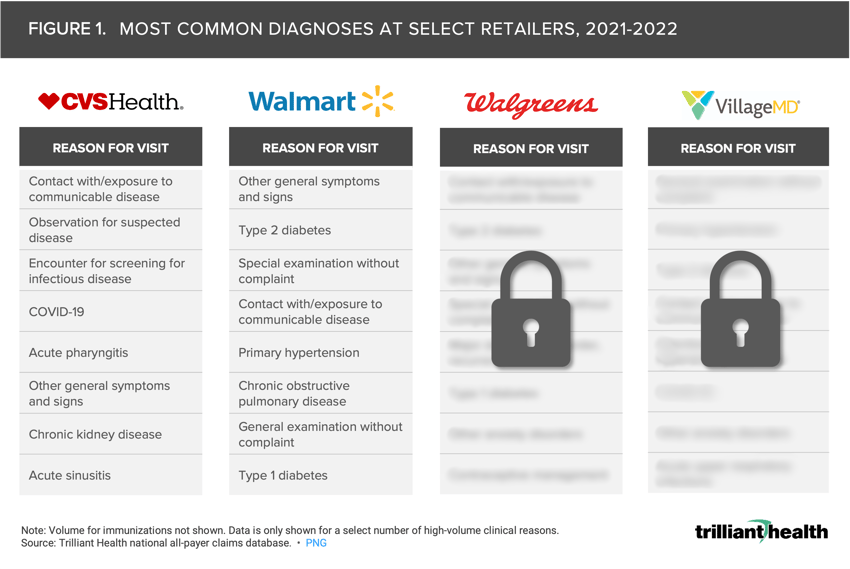

Among U.S. adults with diabetes, 78.8% report having at least one usual source of diabetes care, including endocrinologists, PCPs, other specialists and new entrants.12 Endocrinologists, PCPs and other specialists typically provide in-person examinations, disease progression monitoring and treatment of diabetes-related complications. In contrast, new entrants have developed platforms for chronic condition management, offering telehealth, remote monitoring of symptoms and vital signs and in-person consultations at pharmacy- and clinic-enabled retail locations.13 Treatment for type 2 diabetes is one of the top diagnoses for patients accessing care at retailers like Walmart, but where diabetes management falls in the list of top reasons for visits varies by individual retailer (Figure 1).

To explore common diagnoses at Walgreens and VillageMD, log in to Compass+.

While the types of prescriptions or lab tests ordered at new entrants may not differ from those at traditional providers, the care pathways can vary depending on the platform patients choose to utilize. Although not all patients with type 2 diabetes are treated with medication, diabetes management medication prescription volume is a useful proxy to identify providers treating type 2 diabetes patients.

Analytic Approach

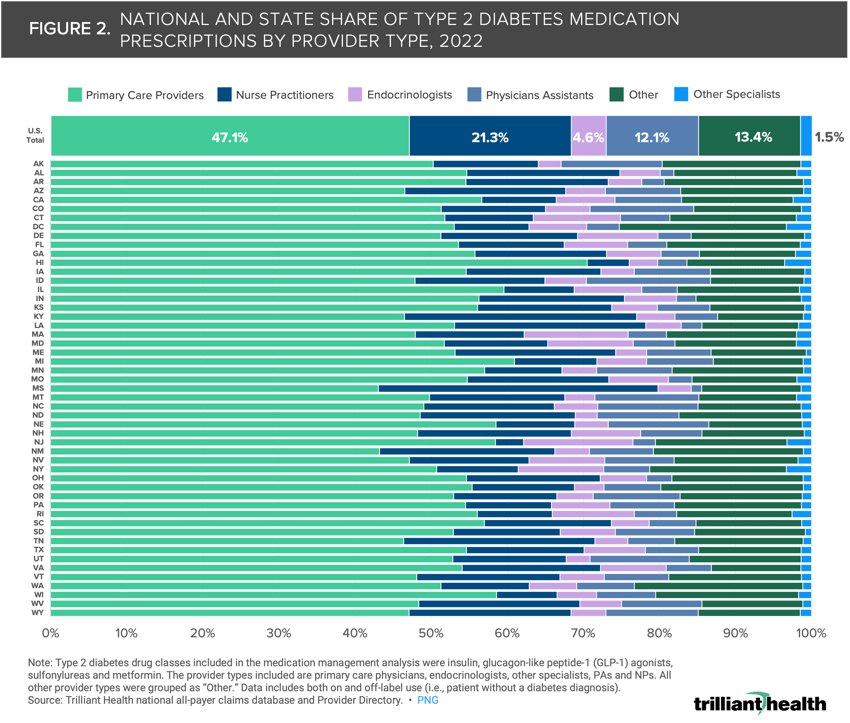

Leveraging our national all-payer claims database and Provider Directory, we analyzed type 2 diabetes medication management patterns across different provider types, both geographically and longitudinally. The type 2 diabetes drug classes included in the medication management analysis were insulin, glucagon-like peptide-1 (GLP-1) agonists, sulfonylureas and metformin. The provider types included are primary care physicians, endocrinologists, other specialists, PAs and NPs. All other provider types were grouped as “Other.” We examined prescribing trends annually from 2017 to 2022, and the provider distribution by state in 2022. Additionally, we examined the proportion of Ozempic® prescriptions by provider type from 2017 and 2022.

Findings

In 2022, PCPs rendered the most diabetes prescriptions (47.1%), followed by NPs (21.3%), PAs (12.1%) and other providers (13.4%) (Figure 2). Endocrinologists prescribed type 2 diabetes drugs least frequently, accounting for only 4.6% of prescriptions. While PCPs prescribe most type 2 diabetes drugs, the share of prescriptions written by PCPs in each state varied, ranging from 70.5% in Rhode Island to 43.1% in Mississippi. Mississippi also had the highest share of diabetes medication prescriptions rendered by NPs (36.7%), while Massachusetts had the lowest share (3.7%). This variation can be attributed in part to state licensures laws dictating whether NPs and PAs can evaluate patients, make diagnoses, order and interpret tests or initiate and manage treatment without physician supervision or collaboration.14 Interestingly, Mississippi had the highest share of diabetes medication prescriptions rendered by NPs but has moderately restrictive NP scope of practice laws (i.e., requiring collaboration with another provider to deliver patient care).15 In contrast, Massachusetts had the lowest share of prescriptions rendered by NPs but allows NPs to practice at the top of their license.16 Multiple factors beyond regulation will inevitably influence prescribing patterns at the local level.

Compass+ Exclusive: Analyzing Changes in the Share of Providers Treating Type 2 Diabetes Patients Over Time and Changes in Share of Providers Prescribing Ozempic®

Unlock the complete analysis with Compass+

While PCPs provide most type 2 diabetes care management, the share of allied health professionals treating these patients is increasing steadily, driven primarily by growing healthcare consumerism and physician shortages. As we have published previously, patients are increasingly seeking non-emergent care at retail pharmacies and other new entrants, while primary care utilization is trending downwards. As patient preferences for accessing preventive care changes, so might their preferences for treatment of chronic conditions. Are prescription volumes changes driven by patient preference for sites of care or rather by behavior changes based on provider availability?

Because NPs and PAs receive lower reimbursement rates than physicians and are often more accessible to patients, it is possible to increase access to diabetes care at a lower cost.21,22 With the rising prevalence of type 2 diabetes and ongoing primary care shortage, accessible and affordable care is crucial for managing chronic conditions more effectively. However, NPs and PAs, especially within a new entrant models like Walmart or Amazon, may face challenges in establishing long-term relationships with patients and providing comprehensive monitoring and treatment, traditionally considered essential for successful type 2 diabetes management.

The changes to management of diabetes patients implicate numerous health economy stakeholders. Will payors change policies to incentivize chronic condition management from specific provider types? As more comorbid Americans age into Medicare, how will that affect which providers deliver care? What are the clinical implications for patients receiving “transactional” care in the form of prescriptions as opposed to longitudinal care management with established providers? Are patients seeing multiple providers to treat their type 2 diabetes, introducing the potential for duplication and fragmentation? Could total cost of diabetes care decline if payors directed patients to lower-cost providers? Will population health improve, or worsen, if additional access points for type 2 diabetes care are opened but more fragmentation is introduced?

Thanks to Austin Miller and Sarah Millender for their research support.

- New Entrants

- Specialty Care

- Healthcare Consumerism

- Healthcare Workforce

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)