Research

How Regression to the Mean in Commercial Rates Would Impact Healthcare Costs

October 13, 2025Key Takeaways

- Negotiated rates for identical procedures vary between payers at the same hospital. For colonoscopy (CPT 45378), Aetna pays Thomas Jefferson University Hospital $9,256 while UHC pays $2,493. For hip replacement (CPT 27130), Aetna pays Yale New Haven Hospital $31,788, while UHC pays $17,741.

- While Thomas Jefferson University Hospital has negotiated rates above the market median, Vanderbilt University Medical Center has negotiated rates below the market median across payers.

- Although the hospital with the highest market share had the highest UHC rate, its Aetna rate was lower than two hospitals with lower market share.

Hospital and health plan price transparency regulations have revealed what was previously suspected but, for legal and technical reasons, unknowable: the price of a medical service or procedure depends on where it is done and who is paying for it. Two commercially insured patients receiving identical medical care at the same facility on the same day can incur very different costs, entirely dependent on their plan’s negotiated rates with that hospital. If healthcare value is defined as the relationship between the health outcomes achieved and the cost of delivering those outcomes, then by logic, variation in healthcare prices for the same service at the same hospital is an example of waste. With 49% of the population reporting issues with healthcare affordability, reducing variation in commercial negotiated rates has the potential to reduce cost without impacting quality or access.

Background

In October 2020, the longstanding information asymmetry between health insurers, providers, employers and consumers began to shift with the announcement of CMS’s Transparency in Coverage (TiC) final rule, a regulation intended to “drive innovation, support informed, price-conscious decision-making, and promote competition in the health care industry” (CMS, 2020). The publicly posted TiC files include data about the negotiated rate between individual health plans and individual providers for individual procedure codes. Although it is difficult to transform the raw data into accurate insights, doing so reveals inexplicable variation in commercial negotiated rates. Employers and employees absorb the financial consequences of this variation, through higher premiums, out-of-pocket costs and reduced wage growth.

Extreme variation in commercial negotiated rates is a tangible example of market inefficiency, where identical services command different prices not based on quality, which should be the primary determinant of pricing, as it is in all other industries. The analytic insights derived from the health plan price transparency files should transform rate negotiations and pricing strategies between providers and payers. In turn, employers and third-party administrators should logically implement significant changes to benefit and network design.

This study examines the magnitude and patterns of negotiated rate variation by payer, facility and market share to examine the factors that drive the wide variation in commercial negotiated rates.

Analytic Approach

Leveraging Trilliant Health’s national health plan price transparency dataset, commercial negotiated rates were analyzed for CPT 45378 (colonoscopy, flexible; diagnostic, including collection of specimen(s) by brushing or washing) and CPT 27130 (arthroplasty, acetabular and proximal femoral prosthetic replacement (total hip arthroplasty), with or without autograft or allograft). Commercial negotiated rates for Aetna and UnitedHealthcare (UHC) were analyzed across hospitals in four metropolitan CBSAs – Thomas Jefferson University Hospital (Philadelphia-Camden-Wilmington, PA-NJ-DE-MD), Yale New Haven Hospital (New Haven, CT), The Mount Sinai Hospital (New York-Newark-Jersey City, NY-NJ) and Vanderbilt University Medical Center (Nashville-Davidson-Murfreesboro-Franklin, TN). Furthermore, national all-payer claims were used to assess hospital market share for each procedure.

Findings

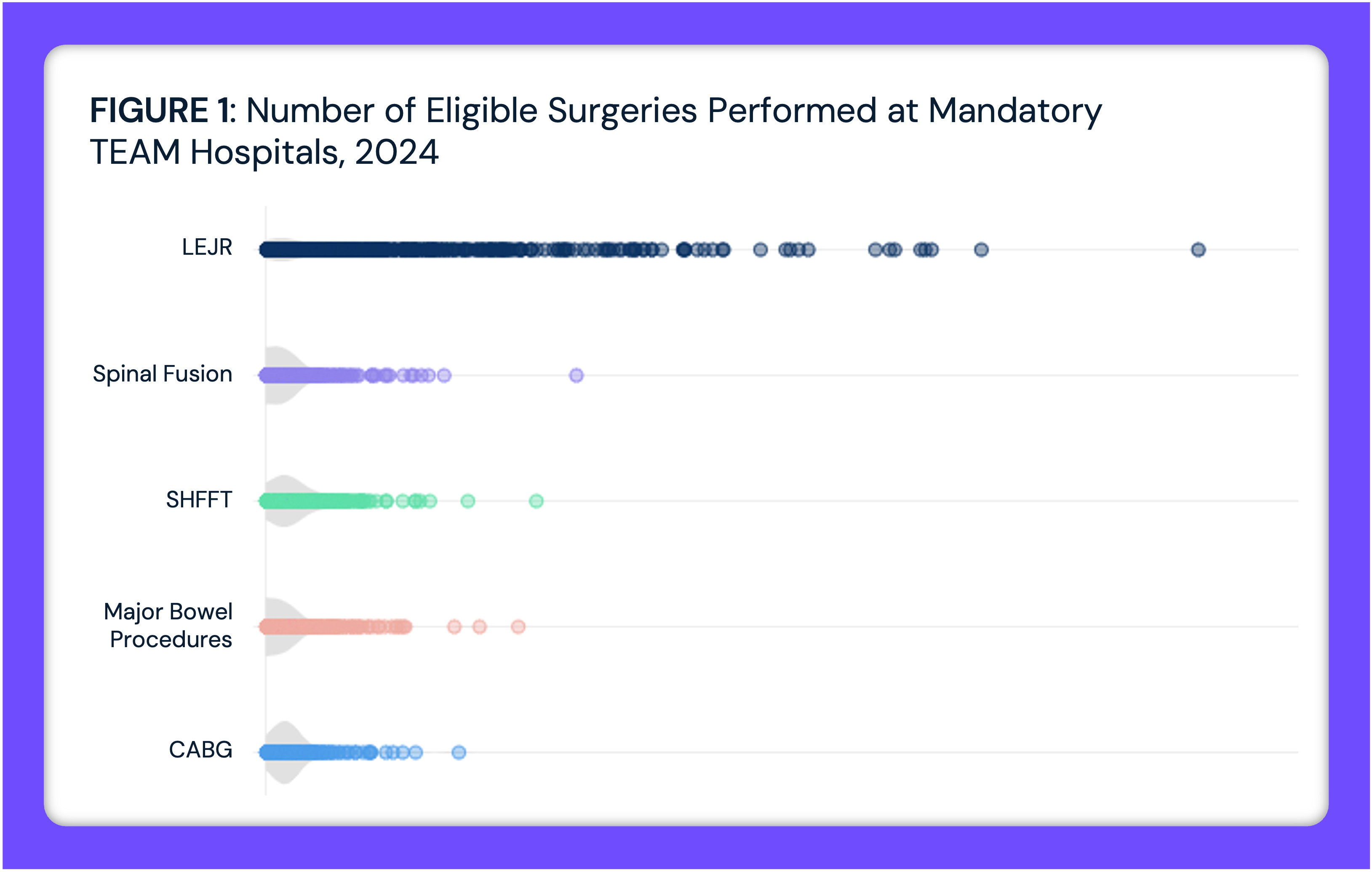

Negotiated rates vary widely across hospitals. For CPT 45378, negotiated rates range from $2,493 at Thomas Jefferson University Hospital to $11,405 at Yale New Haven Hospital (Figure 1). For CPT 27130, negotiated rates range from $17,349 at Vanderbilt University Medical Center to $37,355 at The Mount Sinai Hospital.

Variation also exists within hospitals depending on the payer. At Thomas Jefferson University Hospital, Aetna pays nearly four times more than UHC for CPT 45378 ($9,256 vs. $2,493). At Yale New Haven Hospital, UHC pays more than Aetna ($11,405 vs. $8,963). Vanderbilt shows the most similar rates, $3,025 for Aetna and $2,415 for UHC. However, at Mount Sinai, UHC pays nearly 50% more than Aetna ($8,028 vs. $5,411). For CPT 27130, Aetna pays significantly more than UHC at Yale New Haven Hospital ($31,788 vs. $17,741), while UHC pays more at Vanderbilt ($24,103 vs. $17,349). At Mount Sinai, Aetna’s rate is double that of UHC ($37,355 vs. $17,688).

In analyzing negotiated rates for CPT 27130 and CPT 45378, even more variation is observed within the markets analyzed. Thomas Jefferson University Hospital has negotiated rates above the market median across payers, including 1.3x higher than the median Aetna rate for both CPT 45378 and CPT 27130 (Figure 2). However, Vanderbilt University Medical Center has negotiated rates below the market median across payers. Yale New Haven represents the market median rate across payers – $31,788 for CPT 27130 for Aetna. For Mount Sinai, there is variation in its position to the market median, with its UHC rate for CPT 45378 1.6x above the median and its CPT 21730 representing 0.7x of the median.

In analyzing negotiated rates for CPT 27130 and CPT 45378, even more variation is observed within the markets analyzed. Thomas Jefferson University Hospital has negotiated rates above the market median across payers, including 1.3x higher than the median Aetna rate for both CPT 45378 and CPT 27130 (Figure 2). However, Vanderbilt University Medical Center has negotiated rates below the market median across payers. Yale New Haven represents the market median rate across payers – $31,788 for CPT 27130 for Aetna. For Mount Sinai, there is variation in its position to the market median, with its UHC rate for CPT 45378 1.6x above the median and its CPT 21730 representing 0.7x of the median.

While market share is often assumed to provide pricing leverage, market position and negotiated rate were not perfectly correlated and differed by payer. Using the New York-Newark-Jersey City, NY-NJ CBSA as an example, although the hospital with the most market share had the highest UHC rate, its Aetna rate was only third highest in the market. For Mount Sinai specifically, despite being sixth in market share, its Aetna rate was higher than two hospitals with greater market share.

Conclusion

The data examined here represent a narrow segment of the healthcare market: two common procedures in four metropolitan areas. Yet the patterns revealed are consistent with broader analyses of commercial price variation. This variation is not incidental or marginal. Differences of 200-300% for identical services at the same facility are common, not the exception.

While hospitals with substantial market share should conceptually command higher rates across payers, even this relationship proves inconsistent, suggesting that negotiating leverage depends on factors beyond simple market share calculations. Market power matters, but the translation of that power into specific negotiated rates depends on the dynamics of each payer-provider relationship.

Despite the transparency that now exists, negotiated rates continue to remain largely invisible at the point of care. Patients selecting a provider or site of service rarely know the negotiated rate their plan has established with that facility. Employers purchasing health insurance can seldom determine whether their plan has negotiated competitive rates at the facilities their employees utilize most frequently. Additionally, providers themselves often lack visibility into the full spectrum of rates they have agreed to across their payer contracts. The result is a market where prices exist but price competition remains constrained, demonstrating that transparency has not yet translated into the market corrections that economic principles would predict.

Having identified market median rates, it is easy to project how the statistical concept of regression to the mean would substantially shift commercial spending. Market medians are not theoretical constructs but instead represent price signals akin to a “fair market value” for a specific service in a specific market. As in any distribution, outliers to the median – both below and above – reflect some other factor other than value for money. In free markets, price and quality are generally correlated, with a lower price associated with lower quality or utility.

Ultimately, every health economy stakeholder must deliver value for money in one of three ways: better-than-average quality at a price at or near the median, average quality at a price below the median or better-than-average quality at a price below the median, but not below-average quality paired with above-median rates.

For employers, the fiduciary duty to manage health benefits in the best interest of employees compels them to use transparency data to inform plan design and purchasing decisions. Utilizing detailed pricing information will inevitably cause employers to question the value that brokers are delivering, which logically would cause brokers to make recommendations in the interest of their client instead of out of self-interest. In turn, brokers would demand that payers deliver provider networks that deliver value for money.

In the event that employers fail to demand value for money from brokers, payers and providers, it will be left to policymakers to “solve” the persistence of wide price variation needed to bend the cost curve. In 2022, the Congressional Budget Office recommended price controls, and several states have followed or are attempting to implement price controls based on that guidance. Whether regression to the mean for commercially negotiated rates happens through the operation of free market principles or by government coercion is a question that every health economy stakeholder should consider.

- Studies

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)