Research

2025 Labor and Delivery Closures Disproportionately Affect Smaller Hospitals Serving Roughly One-Third of Local Births

November 10, 2025Study Takeaways

- Births continue to decline nationally, with a 15.9% decrease in total births between 2007 and 2024 – a trend most pronounced in rural and micropolitan areas where declines reached approximately 18%.

- Hospitals with 2025 labor and delivery closures exhibited variation in financial performance, with operating profit margins ranging from –18% at Coffey County Hospital to 29% at ThedaCare Medical Center Waupaca.

- In aggregate, the market share of births among a cohort of hospitals that closed labor and delivery departments in 2025 remained relatively stable between 2018 and 2024, from 37.8% to 37.6%, indicating a declining market share did not precede the closures.

Labor and delivery (L&D) unit closures stem from the same financial challenges affecting all hospital services, including inadequate reimbursement rates, rising operational costs and uneven distribution of healthcare resources. The strain for L&D units is exacerbated by slowing population growth, declining birth rates and the limited scalability of smaller, low-volume hospitals. Understanding the financial and operating pressures behind these closures is essential to anticipating where future access risks may emerge.

Background

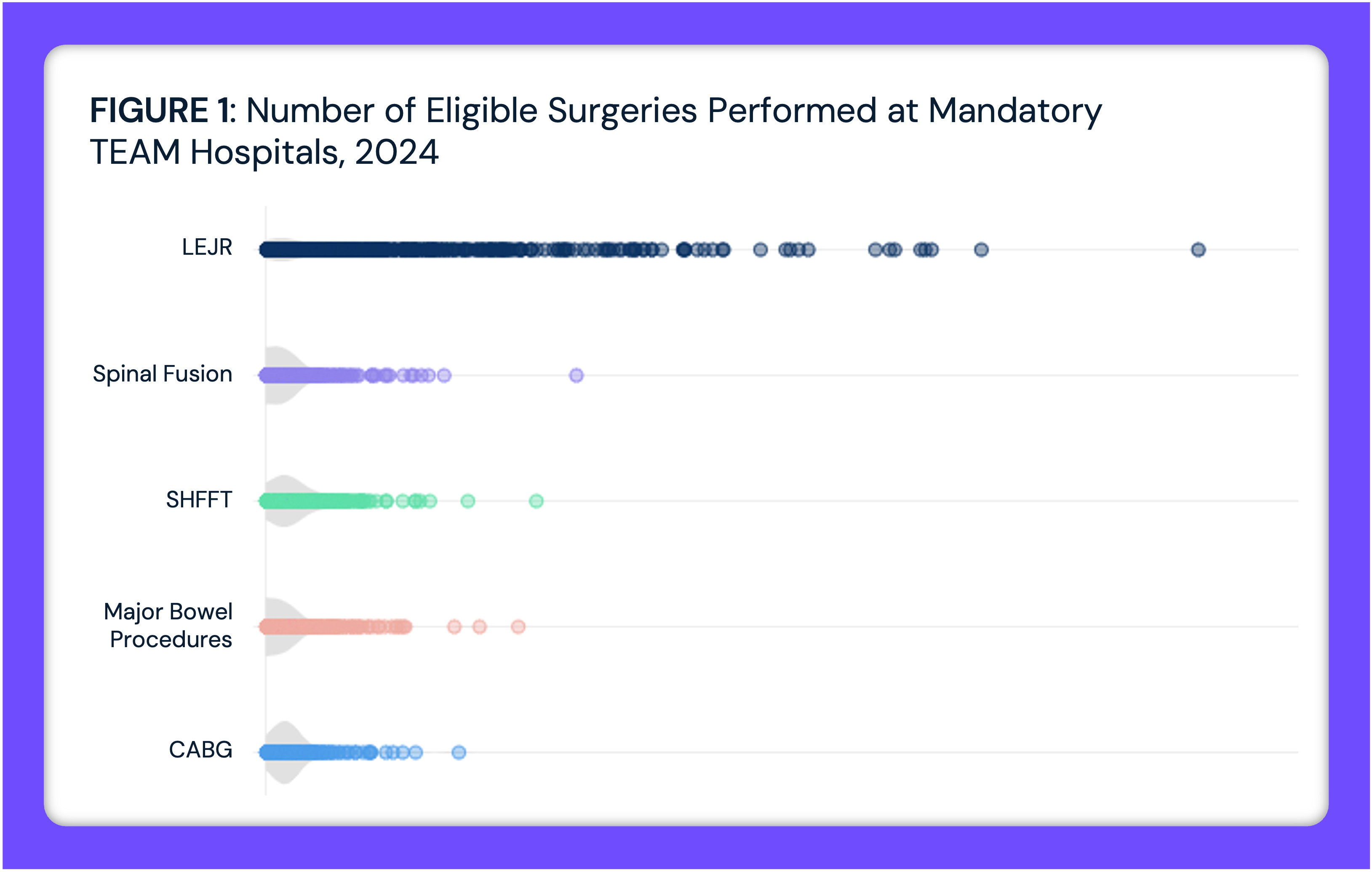

L&D care is a critical indicator of local health system capacity and access. Maternity services require specialized staffing, 24-hour clinical coverage and consistent patient volumes to remain financially viable.1 In many communities, the L&D unit also serves as an anchor for broader hospital operations, helping to establish hospital reputation and increase patient loyalty. However, as fertility rates have fallen and financial pressures on hospitals have intensified, more facilities have struggled to maintain obstetric services. Between 2007 and 2024, the number of annual births fell 15.9% nationally, with the greatest decrease in rural areas (-18.5%), followed by micropolitan areas (-18.1%) (Figure 1). With less demand for L&D services, many hospitals are forced to close or consolidate their L&D units. In the first ten months of 2025, there have been at least 25 maternity closures.2

Access to L&D services is declining, particularly in rural areas.3 As of 2022, less than half (47.6%) of rural U.S. hospitals have a maternity ward – and this number continues to decline (Figure 2). In addition to decreasing sites of service across the country, the supply of OB/GYNs is expected to be insufficient to meet future demand. The National Center for Health Workforce Analysis (NCHWA) projects a shortage of 9,890 full-time equivalent (FTE) OB/GYNs by 2037.4 While OB/GYNs are projected to have a 10% deficit by 2030, certified nurse midwives (CNMs) and physicians assistants (PAs) are projected to have a surplus of 26% and 51%, respectively – leaving them well-positioned to offset this shortage in terms of supply.5 However, the system is not necessarily designed for them to directly replace physicians due to scope of practice rules and licensing.6

L&D closures pose a public health threat by restricting access to care, which in turn puts maternal health at risk. A 2020 study found that women living in maternity care deserts faced a significantly higher risk of pregnancy-associated mortality compared to those with better geographic access. Nationally, pregnancy-related deaths in the U.S. have risen significantly over the past few decades – from 7.2 deaths per 100,000 live births in 1987 to 19.0 in 2023, a 90.1% increase.7 A lack of appropriate obstetric care puts both mothers and infants at greater risk for complications and threatens to worsen the existing maternal mortality crisis.8

To explore the underlying pressures contributing to these closures, this analysis evaluates the financial and operational profiles of hospitals that have recently discontinued L&D services – highlighting where the system may be most at risk for future loss of maternal care access.

Analytic Approach

The analysis includes a cohort of 23 hospitals with L&D closures in 2025.9 To analyze hospital-level operating metrics – including profit margin, revenue payer share, bed size and discharge volume – data were obtained from Centers for Medicare and Medicaid Services Healthcare Cost Report Information System (HCRIS), the National Academy for State Health Policy (NASHP) Hospital Cost Tool and the Agency for Healthcare Research and Quality (AHRQ) Compendium of U.S. Health Systems. Leveraging national all-payer claims data and Provider Directory, the volume of births and all-cause visits per hospital was obtained, as well as the corresponding county-level volumes where each hospital is located. Market share of births and all-cause healthcare visits was calculated for hospitals with L&D closures and all hospitals within their respective counties. Additional secondary data were drawn from publicly available sources, including peer-reviewed publications and reports from the United States Census Bureau and Centers for Disease Control and Prevention (CDC).

Findings

Of the cohort of 23 hospitals with L&D unit closures in 2025, most are small, community-based facilities located in lower-density areas, with a median county-level population of 41,337 residents (Figure 3). Of the 23 hospitals with L&D closures that could be identified in the AHRQ Compendium and Medicare Cost Report data, 13 of the hospitals are located in rural areas, while nine are located in a core-based statistical area (CBSA). These hospitals have a median bed size of 25 and an average of 1,003 annual discharges. Despite their small size, the average operating margin was 9.0%, which is notably higher than the 2023 national average of 5.2%.10 However, operating margins varied widely, ranging from -18% at Coffey County Hospital (Coffey, KS) and -7% at Biloxi Regional Medical Center (Harrison, MS) to 26% at Arkansas Valley Regional Medical Center (Otero, CO) and 29% at ThedaCare Medical Center (Waupaca, WI). This wide variation demonstrates that closures can occur at both financially stable and unstable hospitals. The revenue share by payer ranged from 15.4% to 59.1% from commercially insured patients, 14.6% to 47.3% from Medicare, 6.7% to 41.6% from Medicaid and 0.3% to 7.3% coming from uninsured patients. The hospital with the highest Medicaid revenue share was Arkansas Valley Regional Medical Center (Otero, CO) at 41.6% and the hospital with the lowest Medicaid share was Leesburg Regional Lake Medical Center (Lake, FL) at 6.7%. The hospital with the highest revenue share coming from commercial payers was Delta County Memorial Hospital (Delta, CO) at 59.1% and the hospital with the lowest commercial share was Mayo Clinic Health System (Martin, MN) at 15.4%.

The median county age among this cohort was 45.0 years (ranging from 37.8 to 53.3 years), compared to the national average of 41.9 years, indicating that affected areas tend to have relatively older populations, but with substantial variation in population age structures across markets. On average, the share of reproductive-age women (15-44 years) in the cohort was 16.8% (ranging from 13.5% to 22.7%), compared to the national average of 17.5%. Martin Medical Center in Martin, FL had the highest median age of 53.3, with just 13.5% of the population composed of women of reproductive age, followed by Aspirus Ironwood Hospital in Gogebic, MI (median age: 52 years; 14.2% women of reproductive age). In contrast, St. Patrick Hospital in Missoula, MT (median age: 37.8; 22.7% women of reproductive age) and St. Mary’s Sacred Heart Hospital in Franklin, GA (median age: 39.2; 20.0% women of reproductive age) had the lowest median ages.

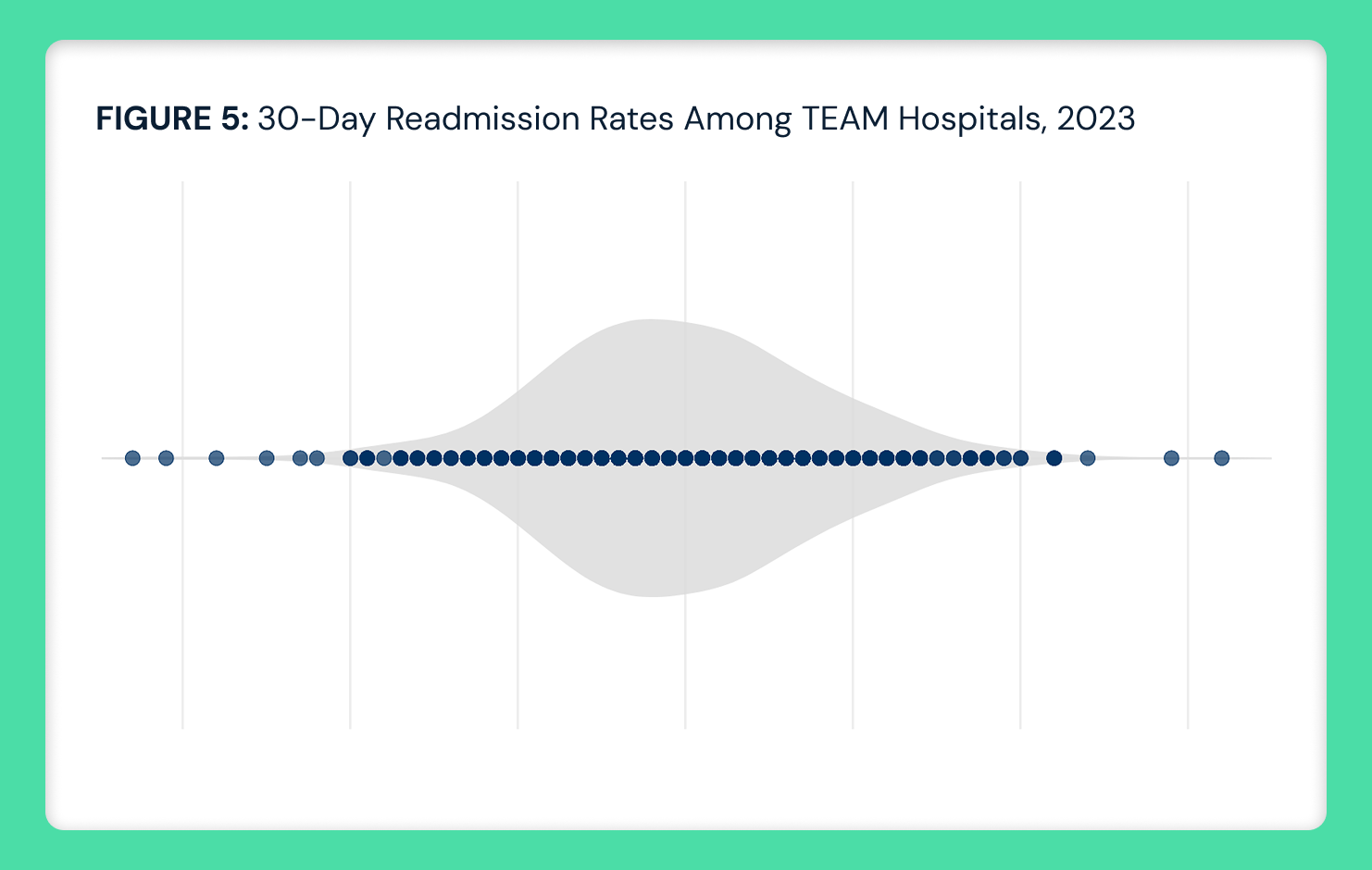

Among the cohort, 12 of the 23 hospitals analyzed were the only L&D unit in their respective county. At the county level, the cohort’s aggregate share of births remained relatively stable from 37.8% in 2018 to 37.6% in 2024 (Figure 4). Their share of all-cause visit volumes in the healthcare market also held steady from 18.9% in 2018 to 19.4% in 2024 (Figure 4).

Among the cohort, 12 of the 23 hospitals analyzed were the only L&D unit in their respective county. At the county level, the cohort’s aggregate share of births remained relatively stable from 37.8% in 2018 to 37.6% in 2024 (Figure 4). Their share of all-cause visit volumes in the healthcare market also held steady from 18.9% in 2018 to 19.4% in 2024 (Figure 4).

Conclusion

The findings suggest that recent L&D unit closures are a result of declining birth volumes and the limited scalability of obstetric services in low-volume markets, rather than financial distress alone or loss of local market share. While some hospitals with L&D closures were relatively stable or even profitable, others had negative operating margins. Some closures may have been preemptive, based on projected demand, staffing challenges or system-level consolidation strategies, reflecting strategic, rather than solely operational or financial considerations. Consistent with Regina Herzlinger’s “focused factory” framework, some hospitals may be intentionally concentrating resources on services they can deliver most efficiently and effectively, rather than attempting to maintain all service lines.11 This suggests that closing lower-volume L&D units may represent a deliberate approach to improve a hospital’s overall quality and sustainability.

Although reimbursement pressures varied, differences in revenue share did not account for the pattern of L&D unit closures in 2025. Instead, closures likely reflect broader shifts in service line viability and utilization. Hospitals in this cohort tended to be small and rural, with limited economies of scale, and likely struggled to sustain obstetric services amid broader rural trends of declining birth volume and persistent staffing shortages.

Demographic composition appears to further constrain obstetric demand among these hospitals. The median age and proportion of reproductive-aged women among this cohort were slightly older than the national average, though this varied by county. It is axiomatic that healthcare is local, meaning that market demographic characteristics impact demand for certain healthcare services. As such, smaller markets with older populations and smaller shares of reproductive-age women will have fewer births than most markets, reducing the long-term viability of maintaining an L&D unit. Over time, that cycle – fewer births in a smaller community leading to fewer reproductive-age women – will inevitably reduce demand for obstetric services, which represents a material fixed cost for hospitals. Whether hospitals respond by permanently eliminating those fixed costs or by reallocating resources to service lines with steadier demand, such as outpatient care (i.e., lab and radiology services, rural health clinics) and occupational therapy, depends on numerous factors.12

Despite the financial reality that makes the closure of L&D services inevitable in some markets, the health policy implications are amplified. While policymakers know that every L&D closure widens existing disparities in maternal outcomes, particularly among lower-income and racially diverse populations, meaningful policy solutions are scarce. Longstanding physician recruitment programs have not, and perhaps cannot, meaningfully addressed the issue. In short, the smaller the OB practice, the more likely that the OB would be a sole practitioner, leaving that physician on call 24/7, 365 days per year.

While increasing births are the obvious solution to the declining populations in rural communities, it is unreasonable to expect that expectant mothers will willingly remain in communities that are 30 or 50 or 100 miles from a hospital providing L&D services. That reality is the most troubling aspect of the trend in L&D closures, an accelerant to the “hollowing” of many rural communities. In turn, L&D closures may foreshadow other oft-discussed but yet unresolved issues of healthcare service delivery in rural communities. For policymakers, the findings highlight the urgent need for coordinated Federal and state action to stabilize rural healthcare, including but not limited to solutions like regionalized obstetric care networks or targeted funding for low-volume markets.

- Studies

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)