See more with Compass+

You are currently viewing the free version of this study. To access the full study and more leading research on the health economy, subscribe to Compass+.

Sign Up for Compass+

Develop Service Line Strategies

Analyze the Competitive Landscape

Anticipate Future Patient Needs

Identify Sites To Capture Demand

Drive Loyalty Across the Patient Journey

Leverage Price Transparency Insights

Retain Patients in Your Network

Match Provider Supply to Demand

Acquire Commercial Patients

Capture Outpatient Demand

Target High-Value HCPs

Strengthen Provider Networks

We collect and organize the industry’s most comprehensive healthcare datasets.

See demand, supply and yield across the U.S. health economy

Validated Data for 2.9M Practitioners

Episodes of Care for 300M Patients

Negotiated Rates for Any Service at Any Location

Flexible solutions to fit your specific needs and workflow

Free resources to help health economy stakeholders use our products and data

Answer Key Questions in Seconds

Health Economy Survival Strategies

Custom Enterprise-Level Analyses

Product Guides and Feature Releases

Exclusive Health Economy Insights

How We Tackle Technical Problems

Data-Driven Benchmarking Tool

Strategic guidance and commentary from our CEO, Hal Andrews

Annual fact-based analysis of trends shaping the health economy

An essential resource to survive healthcare’s negative-sum game

Develop Service Line Strategies

Analyze the Competitive Landscape

Anticipate Future Patient Needs

Identify Sites To Capture Demand

Drive Loyalty Across the Patient Journey

Leverage Price Transparency Insights

Retain Patients in Your Network

Match Provider Supply to Demand

Acquire Commercial Patients

Capture Outpatient Demand

Target High-Value HCPs

Strengthen Provider Networks

We collect and organize the industry’s most comprehensive healthcare datasets.

See demand, supply and yield across the U.S. health economy

Validated Data for 2.9M Practitioners

Episodes of Care for 300M Patients

Negotiated Rates for Any Service at Any Location

Flexible solutions to fit your specific needs and workflow

Answer Key Questions in Seconds

Custom Enterprise-Level Analyses

Exclusive Health Economy Insights

Free resources to help health economy stakeholders use our products and data

Health Economy Survival Strategies

Product Guides and Feature Releases

How We Tackle Technical Problems

Data-Driven Benchmarking Tool

Strategic guidance and commentary from our CEO, Hal Andrews

Annual fact-based analysis of trends shaping the health economy

An essential resource to survive healthcare’s negative-sum game

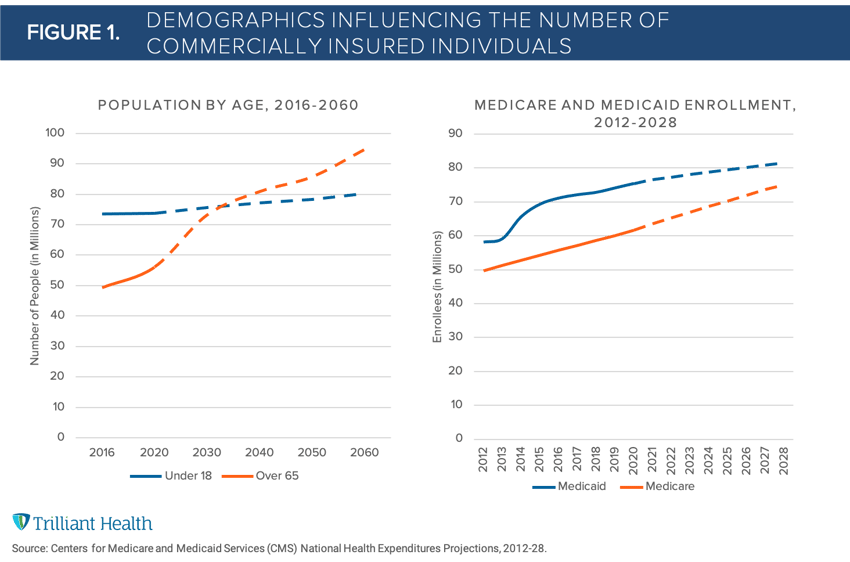

Last week, CMS released its latest Medicaid enrollment numbers reporting a record number of enrollees during the pandemic. An additional 9.7M individuals enrolled in Medicaid from February 2020 to January 2021 totaling approximately 73.8M Medicaid beneficiaries at the beginning of 2021. The projected growth in the nation’s safety net program compounded by more Baby Boomers aging into Medicare will significantly reduce the share of patients covered by commercial insurance (Figure 1).

The declining number of commercially insured individuals, however, was a trend even prior to COVID-19. On average, 50% of total revenues of the largest health systems were attributed to government payments pre-pandemic. To offset the lower reimbursements attributed to caring for Medicare and Medicaid patients, health systems have historically relied on revenue from their commercially insured patients to subsidize.

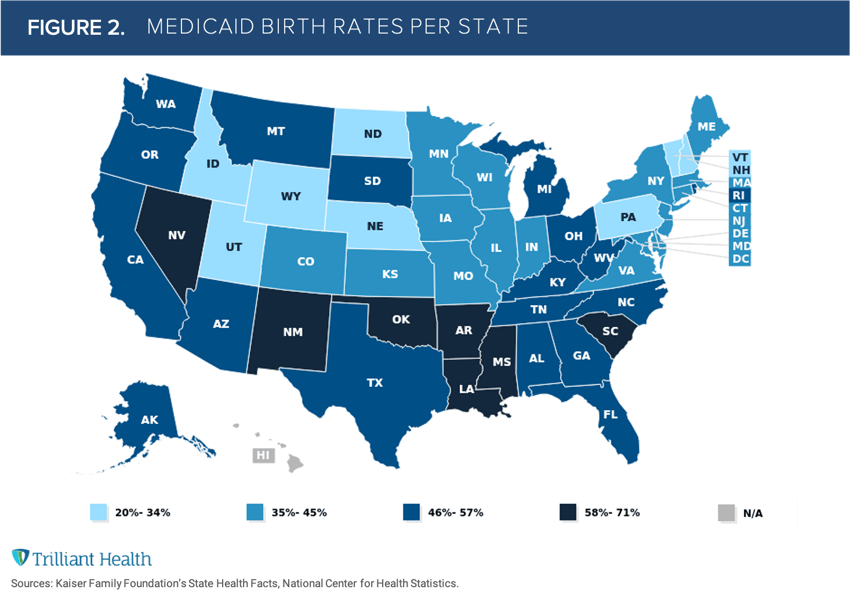

The number of projected births is insufficient to outpace the increase in Medicare enrollment from the Baby Boomers. Moreover, nearly 50% of new births are financed by Medicaid with the fastest growing states (the Sunbelt region) representing above average Medicaid birth rates (Figure 2). Thus, the post-pandemic health economy will be defined by an even smaller commercially insured population, forcing health systems to re-evaluate their longstanding growth strategies.

As more suppliers enter the care delivery market, a greater number of providers will be competing for an even smaller share of “target” patients. Brands like Walmart will make the competition for health systems even more difficult, not only in terms of scale of “consumer stickiness” but on price.

Whereas traditional providers have operated in a health economy with prices and reimbursements varying by market and payer type, new players like Walmart are opting for a simpler, low-cost model. As previously shown, Medicaid is no longer setting the floor for primary care visits. Inevitably, these market dynamics will create even greater downward pressure on commercial rates.

As post-pandemic realities accelerate the growth in the number of publicly insured individuals, health systems that can effectively leverage psychographic and consumer loyalty data to both increase current share of care from existing commercial patients, and identify which individuals have the potential to split their share of commercial care across more brands will maintain a competitive advantage.

You are currently viewing a free preview of our premium studies. To receive new studies weekly, upgrade to Compass+.

Sign UpYou are currently viewing the free version of this study. To access the full study and more leading research on the health economy, subscribe to Compass+.

Sign Up for Compass+