Counterpoint

Hal Andrews | January 10, 2023The Need for More Focus on the Factory

|

When Professor Regina Herzlinger published Market Driven Health Care in 1997, more attention was paid to her emphasis on “focus” and less to her use of the word “factory.” To consider a hospital as a “factory” has long been uncouth, with the inevitable implications that patients are widgets on an assembly line. Even so, one of the most important and least considered aspects of the U.S. health system is the reality that a majority of America’s hospitals are ill-equipped to deliver 21st century care efficiently. The only day that everything is new in a hospital is the day that it opens. After that, keeping the age of the property, plant and equipment (PP&E) “current” requires a hospital to make annual capital investments in its PP&E equal to ~5-7% of its annual net revenue. Since the founding of Pennsylvania Hospital in 1751, there have been four “eras” of hospital construction:

Planners have understood the inefficiency of hospital PP&E since the 1950s: “Planners recognized, first, that the long-term operating costs of new plant and equipment would vastly exceed the original capital investments and would have to be paid by corporate-sponsored insurance and, second, that a physical plant ill suited to its use (because of conversion from a prior use, a poor original design, or superannuation resulting from technological advance or population growth) constituted a drain on operating funds that could be avoided by proper initial design or remediated by the eventual modernization (if not outright replacement) of physical plant.” 4 What hospital planners did not anticipate in the 1950s was the major clinical breakthrough that occurred when the first laparoscopic gallbladder surgery was performed in 1985, reducing an 8-day inpatient stay to an 8-hour ambulatory stay.5 Since then, the development of diagnostic and therapeutic innovations that eliminate or reduce the need for lengthy inpatient stays have dramatically changed the ways in which healthcare is delivered in the United States. The result? Most of the hospitals in the country were designed before technology revolutionized healthcare delivery, making most of our nation’s healthcare factories completely and hopelessly inefficient from an operating cost perspective. There are not any “bad hospitals” per se, just hundreds of aging and inefficient healthcare factories in challenged markets that require a different footprint to deliver more efficiently the majority of care that today’s consumers need. However, there are fewer than 100 “good” healthcare markets in the United States, and there is no way for anyone – whether a strategist or operator or government agency – to fix a “bad” market. Only one healthcare system has navigated this technological and demographic evolution skillfully while staying true to its roots as a hospital operator: HCA. It is perhaps not a surprise that Dr. Thomas F. Frist, Jr., a co-founder of HCA, bought dozens of copies of Professor Herzlinger’s book and handed them out to his friends and colleagues in 1997. What HCA has done better than any other system is to identify – and then exit – the markets in which HCA would ultimately be unable to attain leading market share or generate margins sufficient to keep the hospital PP&E current. In contrast to HCA, most health systems are motivated to grow by increasing the number of hospitals they operate or expanding into new markets, which is why there is always a buyer when HCA decides to sell. In turn, most health systems hold on to aging hospital factories in challenged markets far too long, trying to generate as much cash flow as possible with as little capital investment in PP&E as possible. HCA’s focus on “portfolio management” has been a core strategy for five decades, beginning in 1987 with the “spin-off” of Healthtrust, through which HCA exited markets like Huntsville, Alabama and Tucson, Arizona. Over the last 35 years, HCA has exited more than 100 markets. |

.png?upscale=true&width=560&name=Long%20form%20HCA%20graphic%20(1).png) |

|

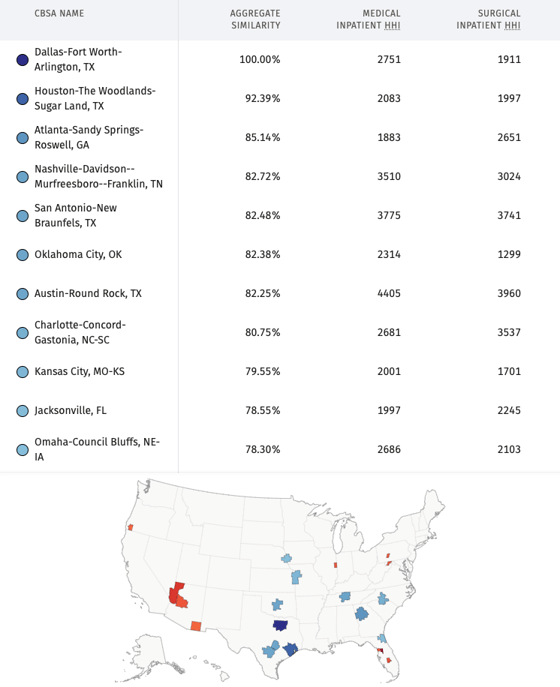

The results of HCA’s strategy are two-fold. First, after five decades of “focusing on its factories” by focusing on its markets, it is not surprising that HCA operates almost exclusively in “good” markets with similar demographic characteristics. |

|

|

Source: Trilliant Health SimilarityIndex™ | Markets, 2022 |

|

HCA operates dozens of hospitals and other healthcare facilities in Dallas-Fort Worth, as well as in six of the 10 markets most similar to Dallas-Fort Worth (highlighted in blue on the map). Of course, not every health system can exit markets with the flexibility of HCA. Faith-based organizations, whose market decisions are often subject to approval of a religious body, are usually the last providers to exit challenged markets, a point seemingly lost on reporters from The New York Times and The Wall Street Journal. But every health system can – and should – think about markets like HCA does, recognizing that not every market and certainly not every hospital can generate sufficient margins to keep PP&E current because of the inherent inefficiencies of hospital plants designed and constructed before 1985. Second, HCA has a focused – and disciplined – operating model, which is manifest in this chart: |

|

|

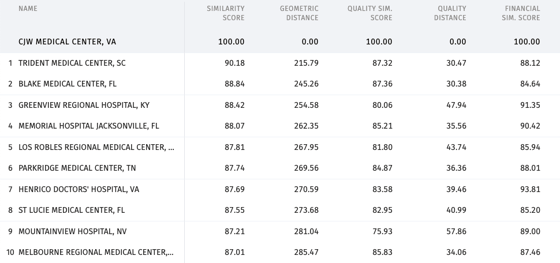

Source: Trilliant Health SimilarityIndex™ | Hospitals, 2022 |

|

Based upon a comparison of more than 2,000 hospitals using publicly available data, nine of the ten hospitals that are most similar to HCA’s CJW Medical Center in Richmond, VA are other HCA hospitals. The issue is not whether the “HCA way” of operating is optimal for every health system. Instead, the challenge is for every health system to have its own “way” and then to execute that operating model as consistently as HCA does. Notably, the “HCA way” generates ~20% EBITDA margins, which is 3X what is required to keep the PP&E of their factories current. To the extent that health systems will not or cannot emulate HCA’s market discipline, it is even more important to emulate their operating discipline in order to “hold on” in challenged markets with aging and inefficient factories. Whether you are a health system or payer or medical device company, these are the questions you need to consider:

If you are a health system:

Healthcare in the United States is a “negative-sum game,” and a key element of winning a “negative-sum” game is cutting your losses. HCA is certain that they can win in their markets. Are you? |

|

The year ahead will continue to challenge all stakeholders, with hospitals and health systems facing the greatest pressures. Surviving, let alone thriving, will require thinking differently and then executing relentlessly. Feel free to email me directly at hal.andrews@trillianthealth.com if you have any questions about how this framework may be applied to your organization in the current health economy. |

|

|

Hal Andrews, President & CEO, Trilliant Health |

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)