Studies Archive

Healthcare Utilization Patterns Suggest Health Status Will Continue To Decline

October 20, 2024Study Takeaways

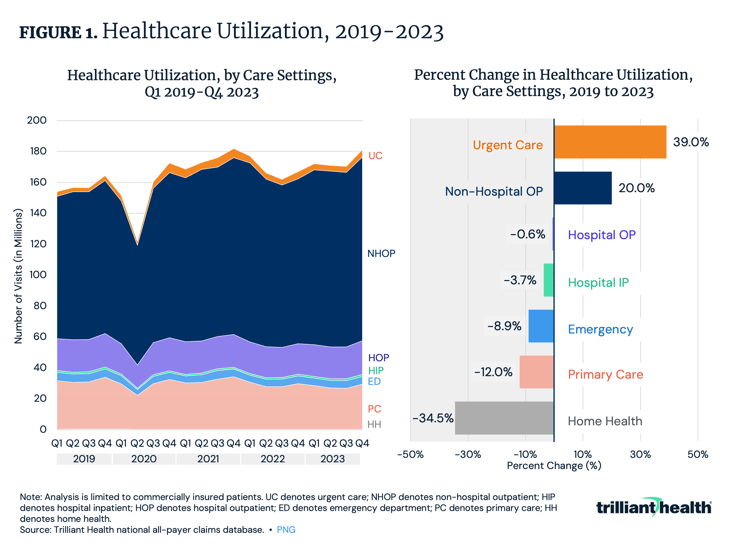

- Care utilization decreased from 2019 to 2023 across most care settings, such as home health (-34.5%) and primary care (-12.0%). However, urgent care utilization was comparatively up 39.0%.

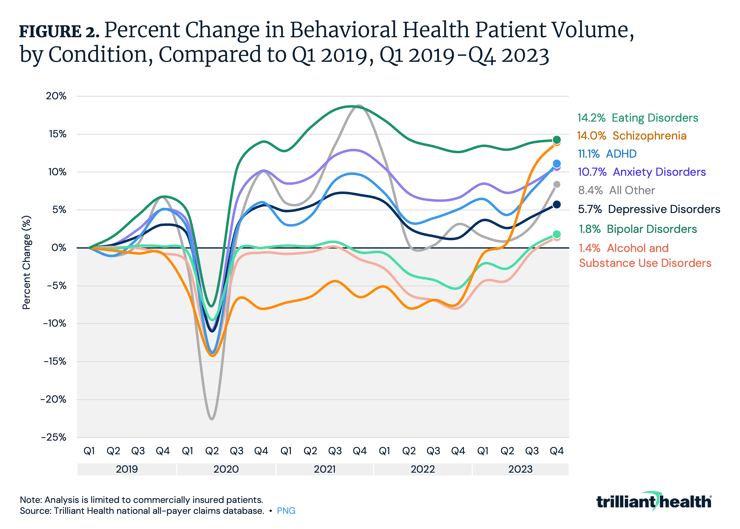

- Demand for behavioral health services has grown year-over-year since 2019, despite an inadequate supply of behavioral health providers, increasing by 39.8% from 2019 to 2023.

- Despite a declining birth rate, patient volume for fertility-related care has risen from Q4 2019 to Q4 2023, with significant increases in encounters for procreative management (+46.8%), recurrent pregnancy loss (+27.9%), menopausal and perimenopausal disorders (+18.9%), and female infertility (+18.0%).

As discussed in our analysis of Trend 1 of the 2024 Trends Shaping the Health Economy Report, the U.S. healthcare system is disproportionately expensive and does not promote health.1 The lack of health promotion provides the backdrop for this week’s trend: healthcare utilization patterns suggest that Americans' health status is on a downward trajectory (Trend 2 of 8).

Relative to pre-pandemic levels, healthcare utilization patterns stabilized in 2023, but utilization is increasingly shifting away from traditional care settings. Growth is concentrated in non-hospital outpatient and urgent care facilities, while primary care volume has declined through 2022 and 2023, following a brief uptick in 2021. Behavioral health demand continues to rise, reflecting persistent mental health challenges across the population.

These shifting patterns and the steady rise in healthcare costs call into question whether the U.S. is receiving value from the substantial investments made into the healthcare system, particularly when health outcomes and care utilization patterns continue to suggest declining health across the population.

Relative to Pre-Pandemic Volume, Aggregate Care Utilization Stabilized in 2023 With Meaningful Variation Across Care Settings

Excluding COVID-19 and behavioral health, overall care utilization increased by 3.0% in 2023 compared to 2019.2 However, care utilization decreased across most care settings: home health (-34.5%), primary care (-12.0%), emergency department (-8.9%), inpatient (-3.7%) and hospital outpatient (-0.6%) (Figure 1).

In contrast, non-hospital outpatient and urgent care volumes rose substantially, by 20.0% and 39.0%, respectively. The shift toward urgent care and the reduced utilization of traditional primary care suggest that Americans are changing how they access preventive and low-acuity care, influenced by factors like supply constraints, evolving consumer preferences and declining trust in the healthcare system. Despite a worsening disease burden and an aging population, inpatient hospital utilization continues to decline and volumes in outpatient hospital settings are flat.

Behavioral Health Demand Has Increased Across Conditions

Demand for behavioral health services has grown year-over-year since 2019, despite an inadequate supply of behavioral health providers, increasing by 39.8% from 2019 to 2023.3 Patient volumes for eating disorders (14.2%), schizophrenia (14.0%), ADHD (11.1%), anxiety disorders (10.7%), depressive disorders (5.7%), bipolar disorders (1.8%) and alcohol and substance use disorders (1.4%) in Q4 2023 have shown a consistent upward trend since Q1 2019, except for a decline in Q2 2020 corresponding with the onset of the COVID-19 pandemic (Figure 2). Reduced levels of primary care, coupled with increasing demand for behavioral health services, will inevitably contribute to greater morbidity and mortality.

Although behavioral health demand has increased across the U.S. population, the rate of change varies by age group. From 2019 to 2023, behavioral health utilization rose among all age groups: ages 0-17 (17.0%), 18-44 (42.1%), 45-64 (14.5%) and 65+ (14.9%) (Figure 3). Similarly, the decline in primary care utilization differs by age group: ages 0-17 (-13.7%), 18-44 (-13.6%), 45-64 (-22.1%) and 65+ (-17.1%). These trends highlight shifting care patterns that may have implications for long-term health outcomes across all demographic segments.

U.S. Birth and Fertility Rates Are Down; Patient Volume Has Increased for Select Fertility-Related Care

From 2007 to 2022, the birth rate declined by 23.1% from 14.3 to 11.0 per 1,000 population and the fertility rate declined by 19.2% from 69.3 to 56.0 per 1,000 population (Figure 3). Amid stagnating demand for obstetric care and intensified competition for a shrinking number of births, many health systems have closed their obstetric units altogether. These closures, often attributed to declining rates of labor and delivery patients, further widen access gaps for those in low-demand areas – both urban and rural - who still require care.

Although the birth rate has declined, patient volume has increased for select fertility-related care. From Q4 2019 to Q4 2023, patient volume increased for several reproductive health conditions, with the greatest increases observed for encounters for procreative management (46.8%), recurrent pregnancy loss (27.9%), menopausal and other perimenopausal disorders (18.9%) and female infertility (18.0%).

Conclusion

Every stakeholder in the health economy will be impacted by stagnant or declining demand, which threatens the stability of traditional U.S. healthcare delivery. As patients have more options for where, how and when they receive care, providers face a critical choice: adapt to meet evolving patient needs or risk volume declines and the associated economic consequences. The continued declining utilization of traditional primary care limits early diagnosis of high-acuity conditions, likely resulting in increased morbidity and mortality. In turn, a sicker population becomes more costly and labor-intensive to manage.

With decreasing primary care utilization and a growing reliance on non-traditional sources for health information, the challenge remains: how can providers ensure that patients receive timely preventive care? Can payer business models – which have historically depended on a relatively healthy, young population to offset the costs of utilization by older and sicker populations – survive as the population becomes increasingly sicker at younger ages?

For individual patients, healthcare value is often tied to personal health outcomes and quality of life. Yet, as healthcare costs continue to increase, patients seem to be receiving less value in return, experiencing poorer outcomes and greater disease burden. Healthcare stakeholders focused solely on maximizing revenue without considering the total cost of care or the quality of less expensive alternatives ultimately fail to deliver true 'value for money' in healthcare. A shift towards value-centered strategies is essential to improve both societal and individual outcomes.

Update: for the latest trends, read our 2025 Trends Shaping the Health Economy Report.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)