As consumer choice increases with the increase in provider supply, consumers will increasingly "split" their healthcare consumption across a number of brands. Healthcare providers that understand the psychology underlying the consumer’s decision-making process will be better positioned to earn the loyalty of healthcare consumers with abundant choices.

While demographics (e.g., age, gender, income) and utilization history can be useful dimensions of understanding what the healthcare consumer does, it does not explain why the consumer made the decision they did. Only by understanding why consumers make choices can a provider influence what the consumer chooses, which is the only predictable way to grow share of care and anticipate demand for services.

Understanding the why behind consumer choice decisions is a competency that we as a health economy have historically lacked. In studying other economies that have mastered the art of leveraging behavioral insights to build brand loyalty, the psychographics methodology developed by Proctor & Gamble is highly relevant. For decades, leading consumer goods companies such as Apple and Walmart have used psychographic segmentation to understand consumer motivations in order to create products, marketing strategies and consumer experiences that influence purchase decisions.

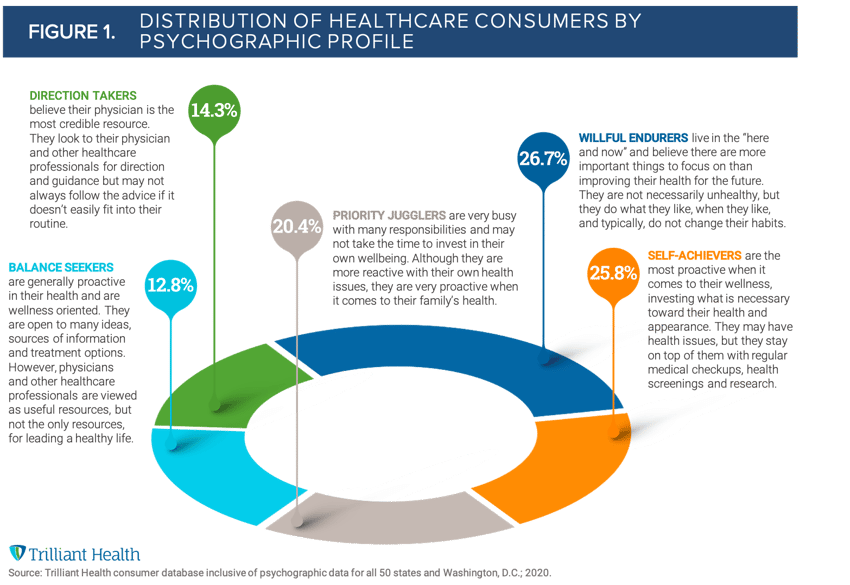

The term "psychographics" refers to individual attitudes, values, and personalities that motivate healthcare decisions. Healthcare consumers can be classified into one of five psychographic profiles: self-achievers (25.8%), balance seekers (12.8%), priority jugglers (20.4%), direction takers (14.3%), and willful endurers (26.7%). On one end of the continuum are self-achievers who are highly proactive and health-conscious individuals; on the other are willful endurers who live in the “here and now” and only see a provider when absolutely necessary. In between are priority jugglers who, although they may not take the time to invest in their own wellbeing, are highly proactive when it comes to the health of their family and loved ones (see Figure 1).

Moreover, psychographics (i.e., psychology) transcend demographics (i.e., segmentations based on observable attributes). As a result, consumers in each psychographic segment span all ages, ethnicities, payer type (e.g., Medicaid, commercial), income-levels, neighborhoods, etc. Since an individual’s psychology of consumption is fully formed by the age of 18, that mindset persists in their consumer behaviors throughout their life (with a few rare exceptions for specific diagnoses such as cancer).

Gaining the loyalty of consumers requires a personalized strategy for each psychographic segment. For instance, the 20.4% of all healthcare consumers that are priority jugglers are more likely to engage with brand-related messaging (e.g., media campaigns, billboards) than the 14.3% who are direction takers and are swayed by information provided directly by their primary care provider and/or credentialed educational material.

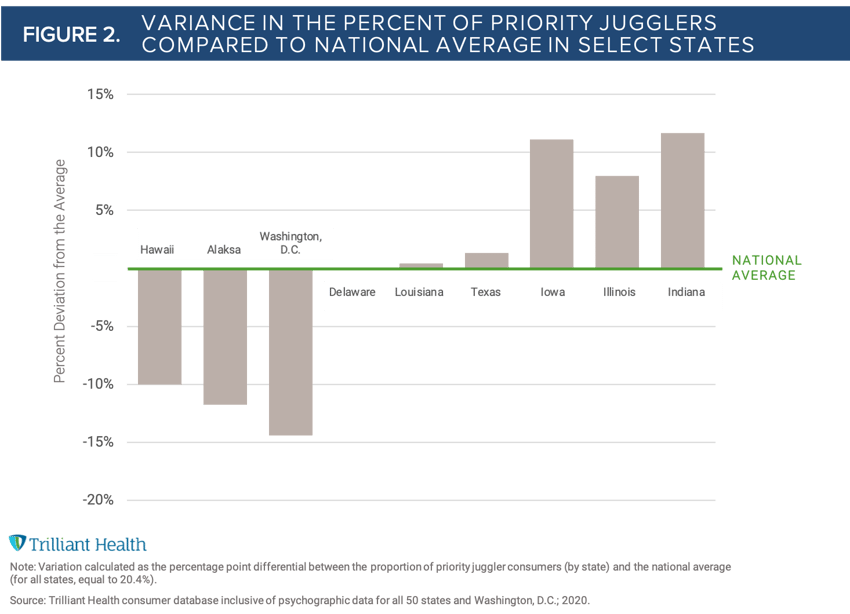

As provider organizations think about optimizing ROI for messaging strategies that target the priority juggler who is influenced by branding campaigns, it is critical to have an accurate view of the relative proportions of these individuals in different geographies. For example, as shown in Figure 2, areas such as Hawaii and Washington, D.C., have a much lower percentage of priority jugglers compared to the national average. Conversely, the number of priority jugglers in Illinois and Indiana is much higher than the national average.

The combination of the short-term effects of migration of Americans attributed to the pandemic and the long-term migration trends revealed in the 2020 Census data suggest significant changes in the psychographic profiles of consumers in numerous cities and states. Those on the supply-side of the health economy that can both dynamically measure these shifts in consumer psychographic segments, and subsequently develop targeted strategies to influence care choices, will be those that maintain a competitive advantage in building strong consumer loyalty.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)