Studies Archive

Patients are Consumers, and Consumers are not Loyal: An Overview of Loyalty in Healthcare vs. Other Industries

June 6, 2021Underlying many executive leadership and board discussions over the last few years has been the core question of “how can we be more consumer focused as an organization?” Every stakeholder from health systems to pharma companies is enacting strategies to shift our historically physician-centric healthcare system to one that is built around the individual.

The fact that delivery systems have historically focused on developing and maintaining positive relationships with physicians is unintentionally revealing of a core misconception: the notion that patients are loyal. But patient engagement is not the same as consumer engagement, and developing consumer-focused strategies requires an evolution in our norms for measuring consumer engagement.

As an industry we – from academically-trained researchers, like myself, to corporate executives – have been primed to measure “consumer centricity” using longstanding, self-reported metrics such as HCAPHS and net promoter scores (NPS) based on random, small samples. Rather, if we leveraged measures that reflected the actual choices (or purchase decisions) consumers made we would have a more accurate view of an organization’s influence on individual consumers.

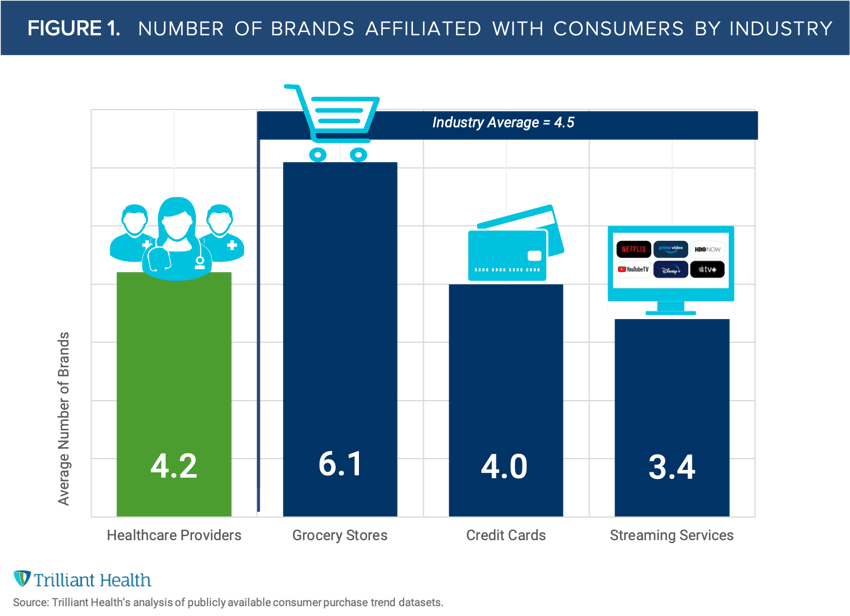

Consumer loyalty, defined as the percent of services that are consumed within a single brand or network, is one such measure. As I’ve previously written, U.S. healthcare consumers are 60% loyal. In other words, among individuals who had five or more healthcare visits in a year, consumers split where they received care across an average of 4.2 different brands or provider networks. As expectations for how consumers want to engage with healthcare services increasingly mirror individual preferences for other services (the “Amazon Prime” effect), we thought it was valuable to benchmark healthcare loyalty to loyalty in other industries in which consumer choice is abundant. As compared to other industries (average = 4.5) such as grocery stores, credit cards, and streaming services (e.g., Netflix, Hulu), loyalty to healthcare providers is on par (Figure 1).

Consumers are inherently “splitters”, even in healthcare. For providers seeking to build stronger relationships with consumers in their markets, the question then becomes, even if an individual interacted with your brand for a single visit and reported a great experience (e.g., HCAPHS), are they still seeking out other brands for similar services? Are there opportunities to influence those decisions so that more of their choices (and subsequently spend) are affiliated with your brand versus others?

Simply said, if I buy my basic groceries from Publix on a weekly basis and alternate between Trader Joe’s and Whole Foods monthly for specialty items, my loyalty is still greater to the Publix brand given my total spend per brand each month. There are several factors that influence my decision to interact with Trader Joe’s vs. Whole Foods – from location and price to specific product offerings. In any given month, I may be splitting between two or three grocery brands, but my choices are susceptible to change even though I favor all three brands. If Trader Joe’s and Whole Foods both opened within 5 miles of my house (instead of the current 20 miles), I would certainly visit both stores more often. Would I substitute either brand with Publix for buying my basic groceries? Probably not. Are there strategies those specialty brands could deploy that would increase my current spend in their stores? Absolutely.

But the key insight is this: Publix, Trader Joe’s and Whole Foods know that I am a splitter. Each knows what is in my basket of goods, which informs how each of them develops messages that are targeted to my preferences to encourage me to buy adjacent goods. At the same time, each of them knows what I do not buy from them, which provides insight about how the competition is succeeding in winning part of my business.

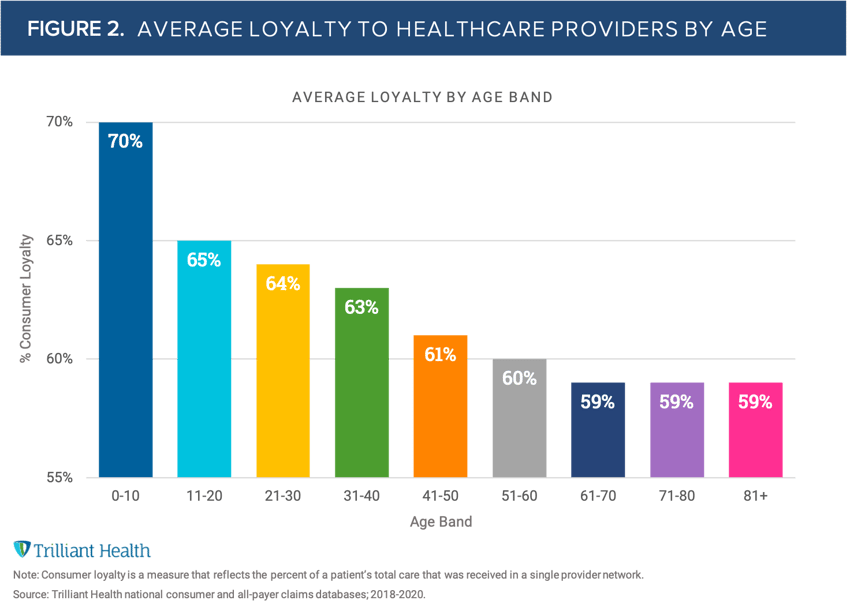

Industry data also suggests that younger consumers tend to be more loyal to specific grocery brands than older consumers. One reason is that younger individuals choose primarily on unit price, whereas older consumers are influenced by perceived value for money. We observe a similar age trend with healthcare loyalty (Figure 2).

We see the highest loyalty (70%) among newborns to children 10 years of age, which indicates most families are very loyal to their pediatrician, with the occasional after-hours emergency to urgent care. As consumers age and reach 60+ however, loyalty begins to fall below 60%. This decline is largely attributed to the increase in care needs inevitable with aging. It is well established that the prevalence of multiple chronic conditions increases with age. The CDC reports that approximately 23% of adults ages 65+ have three or more chronic conditions (which is 8.7 percentage points greater than among adults ages 55-64), suggesting older adults have a higher number of total care visits spread across a greater number of care providers. Even so, there are opportunities for Medicare and MA plans to improve loyalty among their patient populations.

Each of us has unique preferences and needs that influence where we “shop”. Healthcare is no exception. Some individuals prefer to go to the local urgent care for every case of the flu because it’s more convenient than trying to schedule an appointment with the PCP; others alternate between urgent care and PCP. There are many reasons why each of us affiliate with certain brands. The more that provider organizations understand those preferences and behaviors, the more likely they are to influence consumer decisions. Ultimately, visibility into measures like consumer loyalty that can quantify those decisions will underly winning consumer engagement strategies.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)