Research

Local Analysis of Nonalcoholic Steatohepatitis Underscores Need for Targeted Treatment

Feb 4, 2024 12:01:00 AMKey Takeaways

-

Despite estimates that 27.8% of U.S. adults have nonalcoholic fatty liver disease (NAFLD), there are currently no approved medicines to treat any form of the condition and research into the condition is limited.

-

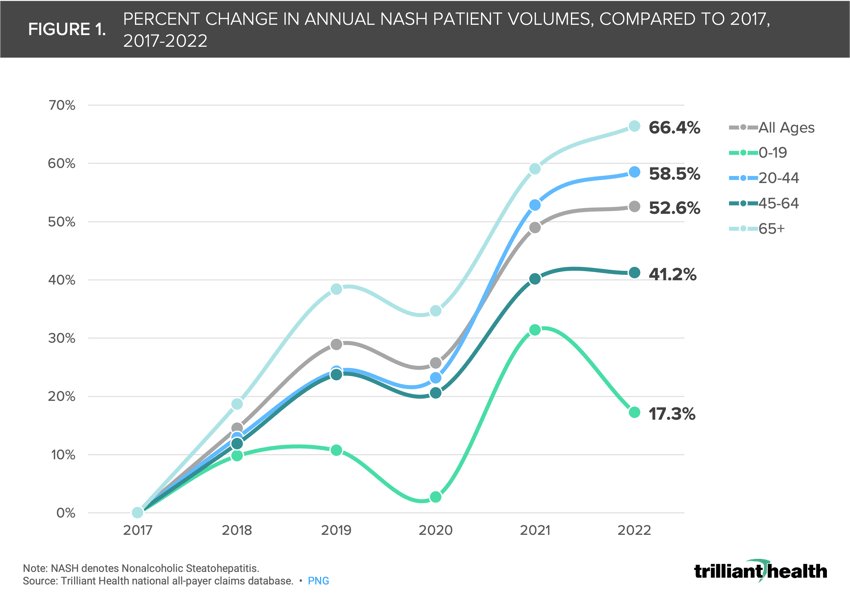

Prevalence of nonalcoholic steatohepatitis (NASH) increased significantly in the U.S. from 2017 to 2022, most notably in the 65 and older age cohort (66.4%) and the 20-44 age cohort (58.5%).

In previous research, we explored the potential of new clinical indications for GLP-1 and semaglutide drugs in the context of chronic kidney disease (CKD).1 Additionally, clinical research presented at The Liver Meeting 2023 from the American Association for the Study of Liver Diseases found that Eli Lilly’s retatrutide – a GIP, GLP-1 and glucagon receptor currently in Phase III clinical development for obesity – could have favorable impacts on steatosis.2,3,4 Despite estimates that 27.8% of U.S. adults have nonalcoholic fatty liver disease (NAFLD), there are currently no approved medicines to treat any form of the condition, and research into the condition is limited.5

Background

NAFLD is a condition in which fat builds up in the liver, with chronic conditions like obesity, metabolic syndrome and type 2 diabetes being the most common risk factors. Notably in 2022, state-level obesity prevalence ranged from 24.3% in Washington, D.C. to 41.0% in West Virginia, averaging 33.7%.6 Although adults are most affected, studies suggest that as many as 10% of children may have NAFLD, attributable in part to rising childhood obesity.7 While people with NAFLD can develop liver complications or other health problems, nonalcoholic steatohepatitis (NASH), which can lead to cirrhosis and liver cancer, is the most severe form of NAFLD, affecting between 1.5% to 6.5% U.S. adults.8 While NAFLD occurs in people of all races and ethnicities, it is most common among Hispanic individuals.9

Biopharmaceutical investments to develop targeted therapies for the untreated and rapidly growing prevalence of NASH have faced regulatory and clinical efficacy challenges. As of February 2024, five therapies for NASH are in Phase III clinical trials, with aggregate 2029 sales forecasted at $2.3B.10 Experts have also raised cost-effectiveness concerns for NASH treatments, citing questions around long-term efficacy, side effects and net healthcare system costs.11

The prevalence of NAFLD is projected to increase among U.S. adults from 27.8% in 2020 to 34.3% by 2050, with the proportion of NASH projected to increase from 20.0% to 21.8%.12 Given the worsening disease burden of NAFLD – particularly for NASH – and the importance of tailoring public health strategies regionally, we were interested in establishing a baseline by quantifying current prevalence of NASH trends.

Analytic Approach

We utilized national all-payer claims to examine 1) the rate of change in patients diagnosed with NASH by age segments and 2) rate of patients diagnosed with NASH per 100K population in CBSAs with populations over 500K, between 2017 and 2022.

Findings

Nationally, volumes for patients with a NASH diagnosis have risen annually since 2017, most notably in the 65 and older age cohort, up 66.4% in 2022 from 2017, and the 20-44 age cohort, up 58.5% during the same period (Figure 1).

Geographic Analysis of Diagnosed NASH Patients

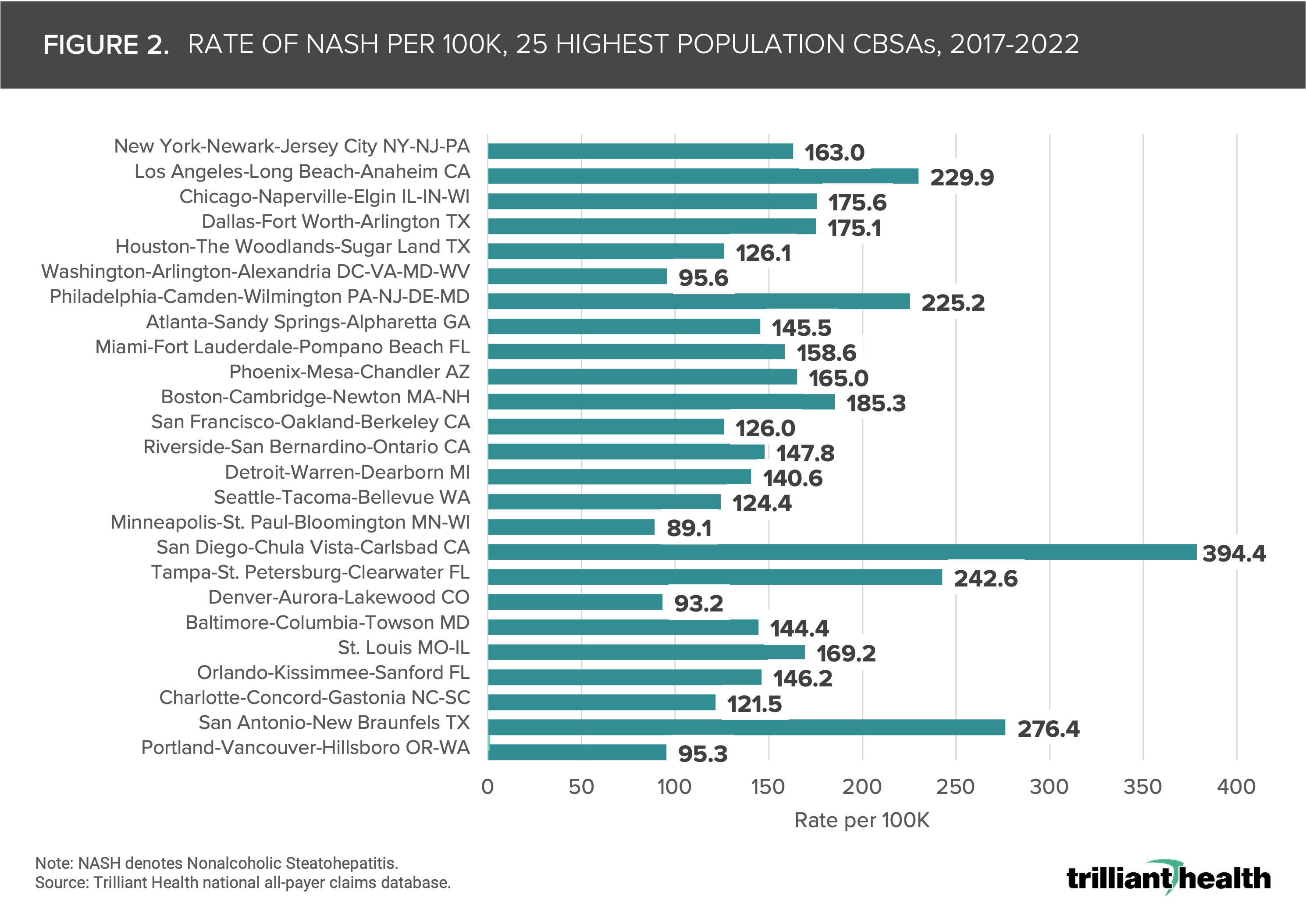

Analyzing the highest-population CBSAs in 2022, the rate of patients with a NASH diagnosis ranges from 89.1 per 100K (Minneapolis-St. Paul-Bloomington MN-WI) to 394.4 per 100K (San Diego-Chula Vista-Carlsbad, CA) (Figure 2). Of the CBSAs with a 2022 population over 500K, the average rate was 189.7 per 100K. (Figure 2).

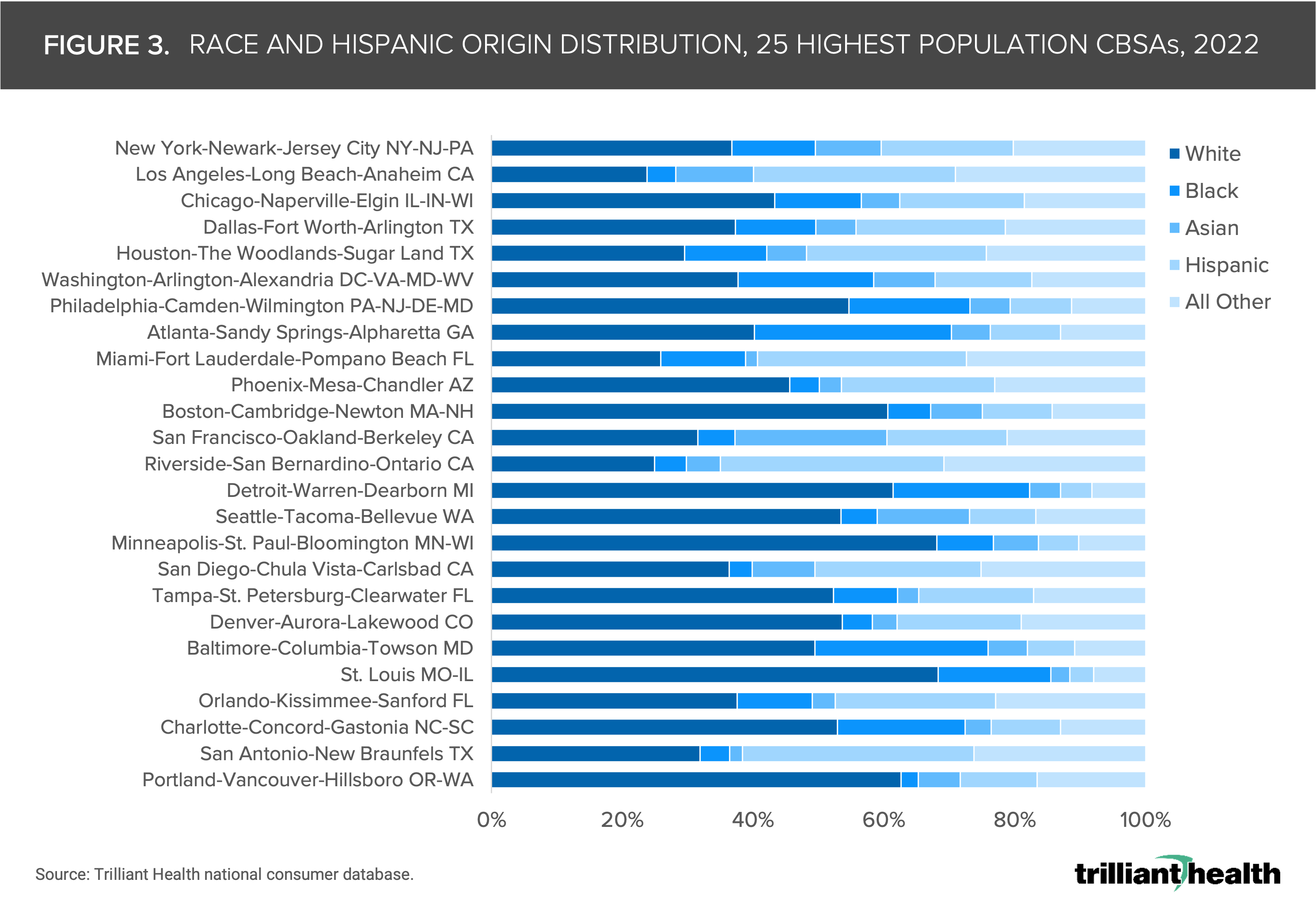

Given the well-known impact of race and ethnicity as potential risk factors for NAFLD and NASH, we analyzed the racial and ethnic distributions of the CBSAs in the analysis. Notably, the rate of patients with a NASH diagnosis in 100K San Antonio-New Braunfels, TX is 276.4 per 100K – the second highest rate among analyzed CBSAs. San Antonio-New Braunfels, TX also has the largest Hispanic population (35.4%) – who are disproportionately affected by NAFLD and NASH – of the CBSAs analyzed (Figure 3). Conversely, Minneapolis-St. Paul-Bloomington MN-WI has the lowest rate of NASH (89.1 per 100K) and the third lowest Hispanic population (6.2%) of the CBSAs analyzed.

Access to primary care and overall health literacy is critical for NASH and NAFLD patients to treat and manage their conditions. Therefore, we analyzed the poverty rates in the CBSAs included in the analysis. With San Antonio-New Braunfels, TX having one of the highest poverty rates (14.2%) and NASH rates of the CBSAs surveyed, patients in the San Antonio CBSA are at a higher risk for NASH and NAFLD but are less likely to access necessary treatment (Figure 4).

Access to primary care and overall health literacy is critical for NASH and NAFLD patients to treat and manage their conditions. Therefore, we analyzed the poverty rates in the CBSAs included in the analysis. With San Antonio-New Braunfels, TX having one of the highest poverty rates (14.2%) and NASH rates of the CBSAs surveyed, patients in the San Antonio CBSA are at a higher risk for NASH and NAFLD but are less likely to access necessary treatment (Figure 4). While recent findings suggesting potential efficacy of Eli Lilly's retatrutide in addressing NASH and NAFLD, patient options for treatment will continue to be limited absent FDA approval. The absence of approved medications for these conditions underscores the significance of market-level analyses to understand the disproportionate impact of NASH on populations. Given the first-line treatment protocol for NAFLD is weight management, diet and exercise, access to primary care and general health literacy is critical for diagnosing, treating and reversing the impacts of the condition. The correlation of NASH prevalence, racial distribution and poverty rates indicate that areas with the highest rates of NASH have less access to treatment and primary care.

While recent findings suggesting potential efficacy of Eli Lilly's retatrutide in addressing NASH and NAFLD, patient options for treatment will continue to be limited absent FDA approval. The absence of approved medications for these conditions underscores the significance of market-level analyses to understand the disproportionate impact of NASH on populations. Given the first-line treatment protocol for NAFLD is weight management, diet and exercise, access to primary care and general health literacy is critical for diagnosing, treating and reversing the impacts of the condition. The correlation of NASH prevalence, racial distribution and poverty rates indicate that areas with the highest rates of NASH have less access to treatment and primary care.

While the ongoing clinical pipeline holds promise, healthcare providers must explore innovative strategies – both to prevent and slow disease progression – to manage the increasing incidence of NAFLD and NASH. Monitoring clinical findings regarding the efficacy of GLP-1s in reducing the effects of NAFLD and NASH is important. If GLP-1s are demonstrated to be efficacious, or if a targeted NASH therapy is approved, prioritizing access to affordable treatment in markets with high-prevalence populations is essential. GLP-1s are already in limited supply for the patients that need them, and the projected drug prices of targeted therapies have raised questions for cost-effectiveness researchers.

Additionally, with the rising incidence of NAFLD in the pediatric population, early intervention strategies to combat NAFLD and its associated negative health outcomes for pediatricians is perhaps most important. The interrelation of risk factors, such as obesity and diabetes, underscores this need. Healthcare providers should adopt proactive measures to address this concerning trend and mitigate potential long-term complications. As consumers report delaying care because of costs, health economy stakeholders need to devise and implement new strategies to encourage individuals to prioritize their health.

Thanks to Austin Miller, Katie Patton and Sarah Millender for their research support.

- Studies

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)