Studies Archive

Life Science Investments Signal a Recent Focus on Cardiovascular and Oncology

April 24, 2022Substantial access to healthcare data to support strategic decision-making continues to be an obstacle in the healthcare industry, due to privacy and data-sharing requirements, data gaps, nonrepresentative sources, etc. Most healthcare organizations lack the resources and/or skill to collect, filter, synthesize and interpret the volume of information required to develop evidence-based strategies, with 84% of C-suite and Board healthcare leaders reporting "limited or minimal” use of data to inform decision-making and strategic planning .1 Therefore, decisions are often made in siloes with non-specific, incomplete context and information.

The biopharmaceutical industry, on the other hand, is uniquely positioned leverage data to inform strategy. The combination of clinical trial data, payer partnerships, health economics and outcomes research business units, and substantial research and development budgets for data investments enables valuable insights and, in many cases, first-mover advantage. While health systems focus on patients at the market level, biopharmaceutical companies have a global perspective.

Visibility into M&A, investments, exits, and strategic partnerships throughout the health economy provides insight into imminent clinical, technological, and operational changes. But to what extent do specific stakeholders, such as hospitals and health systems, track, process, and act on these signals from other health economy stakeholders like biopharmaceutical manufacturers? While biopharmaceutical companies typically invest and make acquisitions in therapeutic areas where they have a strong market presence, changes in burden of disease (e.g., cancer, cardiovascular disease) can also influence M&A decisions. Notably, Merck recently announced it will shift focus and build out its cardiovascular pipeline through seeking several new FDA approvals through 2030.2

Analytic Approach

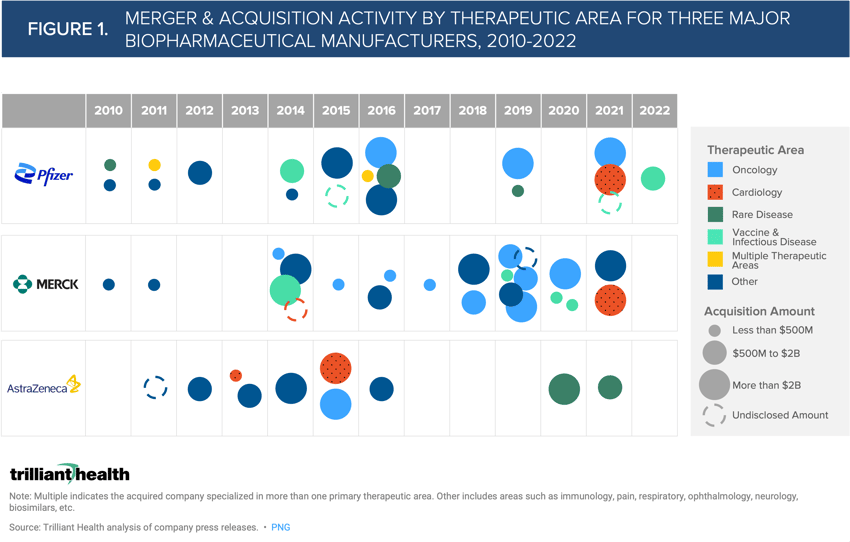

To better understand the longer-term M&A trends in the biopharmaceutical industry, we selected three major pharmaceutical companies with overlapping therapeutic areas of focus (e.g., cardiology, oncology and vaccines) – Merck, Pfizer, and AstraZeneca. To characterize the therapeutic areas these companies prioritized year-over-year, we analyzed acquisitions made by these companies between 2010 and 2022 using publicly available data sources (e.g., press releases).

Findings

Aligning with Merck’s statement of intent to prioritize innovation in cardiology, the company completed its acquisition of Acceleron, a cardiovascular-focused pharmaceutical company, for $11.5B in 2021. Merck focused on bolstering its immuno-oncology business line from 2014 to 2020 before shifting to cardiology with the second largest pharma M&A transaction of 2021.3 Similarly, Pfizer’s M&A transactions through 2020 reflect efforts to strengthen its oncology, immunology, and rare disease business lines. A marked shift occurred in 2021 with its $6.7B acquisition of Arena Pharmaceuticals (fourth largest M&A transaction that year), bolstering its cardiology, gastroenterology, and dermatology portfolios (Figure 1).4 Alternatively, AstraZeneca prioritized its cardiovascular and respiratory business lines between 2013 and 2016, before shifting focus to rare disease, notably with its $39B acquisition of Alexion Pharmaceuticals in 2021, the largest pharma deal that year.5

The M&A activity of these select biopharmaceutical manufacturers indicate strategic shifts within these organizations. While there is no singular trend observed across the entire industry, it is notable that two of the four largest M&A transactions in 2021 were focused on cardiovascular disease, which has not been the case in recent years, especially with the recent decline in cardiovascular research and development.6,7 There were eight active interventional cardiovascular clinical trials funded by industry with a start date in 2010, compared to 55 in 2020.8

Logic suggests that capital market activities by established stakeholders with robust data and analytics capabilities are useful to identify emerging trends, and monitoring activity in different sectors of the health economy allows stakeholders to identify product, service line, and partnership opportunities to inform investments in growth strategies. Recent M&A transactions in the biopharmaceutical industry suggest that those companies anticipate a material and enduring change in the clinical burden of disease in cardiology and oncology, the demand for which is of interest to numerous other stakeholders in the health economy. In future research, we will explore the importance of predictive analytics to understand the nature, scope and locations of that future disease burden both nationally and locally.

Thanks to Katie Patton for her research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)