Formally trained as a health economist, I have been primed to think about healthcare from the lens of supply, demand, and yield. Even though markets for healthcare services deviate from what we economists would call the ideal market, the core principles offer a valuable framework for decision making.

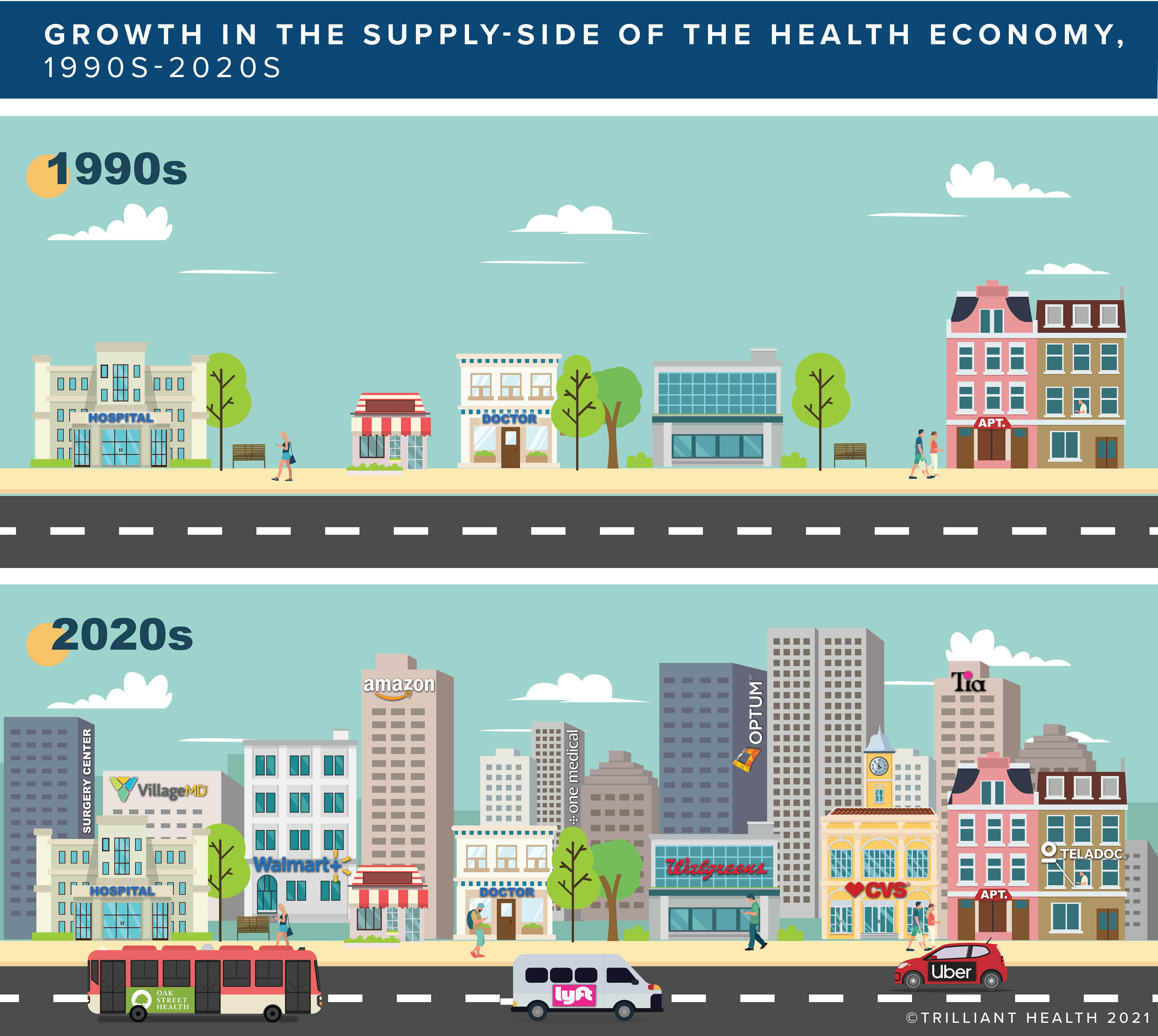

The supply-side of the equation refers to all the providers of health services ranging from hospitals and physician practices to retail pharmacies, new entrants (e.g., Walmart, Amazon), and virtual care platforms. Demand refers to both the exogenous and endogenous factors that influence consumer preferences (e.g., location, price) and need (e.g., genetic predisposition) for services; the intersection of the two informs the expected yield, which is also influenced by market dynamics such as regulations and reimbursement incentives.

A common misconception is that healthcare supply is going down, and demand is going up. It is true that the burden of disease is increasing, but it is merely one component underlying demand. When you analyze the data at the health economy level, it is clear supply is increasing while demand is relatively flat or even declining (the intricacies of which we will explore in the weeks to come).

In fact, the supply of health services providers has increased significantly over the last 30 years. Long gone are the days when the consumer was limited to receiving care at a physician practice or hospital, with choice often defined by narrow networks.

In the last two decades, consumers have adapted their lifestyles around services like Amazon Prime and Uber/Lyft. This shift has fundamentally changed what they expect as it relates to how they access and receive care. Today’s healthcare consumer has an array of choices, from CVS Minute Clinics and home delivery for prescriptions to hospital-at-home and virtual services. With emerging omni-channel models from Galileo to Tia, it is only inevitable that consumers will have even more choices in the years ahead.

In the rest of the economy, two things decline when supply increases: price and consumer loyalty. For healthcare providers, both economic principles are critically important. Providers have felt price pressures for decades but are less prepared to engage with patients as consumers.

Every healthcare consumer is biologically, demographically, and behaviorally different. As a result, no single provider or setting of care is likely to meet the preferences and needs of every individual or household. Consumers will inevitably split where they receive care based on a host of personal preferences. Some consumer segments visit their primary care doctor for every need, while others utilize the hospital emergency department unnecessarily, while others will split between an urgent care, walk-in retail, and their established primary care doctor depending on the situation.

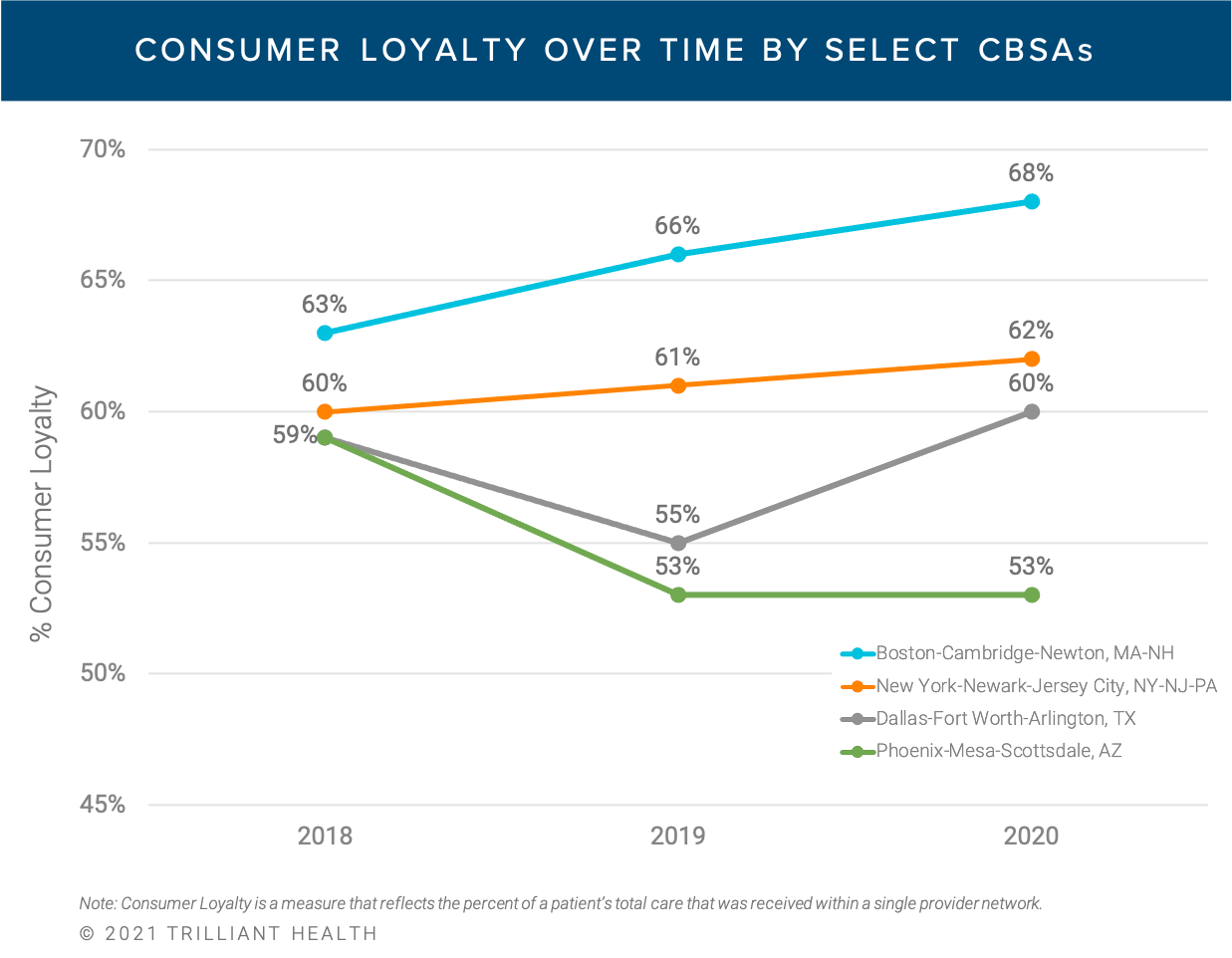

Nationally, we find that consumer loyalty averages 60%. In effect, this means that 60% of the healthcare services are consumed in settings aligned to a single provider network. When we account for the fact that healthcare is highly local, visibility into consumer behaviors at the individual market level is more revealing. In our analysis of four of the largest 12 CBSAs, we see that consumer loyalty has decreased in some markets while maintained steady or slightly grown in others. The variation in loyalty is a function of changes in the actual supply and demand within each market.

For example, Phoenix is a market with more “splitting behavior” – a six-percentage point decrease from 2018 to 2020 - relative to the other CBSAs due to population migration and a greater influx of new provider entities. Conversely, the five-percentage point increase in loyalty within the Boston market can be attributed to consolidation activities resulting in stickier integrated networks.

As more entrants begin to stack the supply-side of the economic equation, earning the consumer’s loyalty will be both increasingly important and challenging. The more precisely we understand the psychographics and demographics of our respective consumers, the more effective we will be in building stronger provider-patient relationships.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)