Counterpoint

Hal Andrews | February 7, 2024Why the Mark Cuban Cost Plus Drug Company Is a Boon for the Pharmaceutical Industry

Perhaps the most stunning development in the health economy is the enthusiasm for the modestly named Mark Cuban Cost Plus Drug Company. How is it that so many politicians, policymakers and pundits are enamored of a start-up founded by a billionaire whose net worth derives fundamentally from his passion for basketball?

The mission of the Mark Cuban Cost Plus Drug Company is this:

“We started Mark Cuban Cost Plus Drug Company because every American should have access to safe, affordable medicines… Every product we sell is priced exactly the same way: our cost plus 15%, plus the pharmacy fee, if any…We started this company as an effort to disrupt the drug industry and to do our best to end ridiculous drug prices.”1

The question for every health economy stakeholder is not whether Mark Cuban understands healthcare well enough to exploit its many flaws or instead has channeled Howard Beale in his frustration about the healthcare costs of his investment portfolio. The question is why CVS and Walgreens are fast followers. As Fierce Healthcare recently reported:

“CVS announced in December it was overhauling the way it reimburses its pharmacies for prescription medications as the healthcare industry faces increased scrutiny for high drug prices. Under a new "cost-plus" pricing model, CVS will shift to fixed rates for reimbursements from pharmacy benefit managers (PBMs), the company said.

The country's largest PBM, Wentworth's former company, also is taking a page out of Mark Cuban's book. Express Scripts is launching of its new pharmacy network option, ClearNetwork, which operates under a cost-plus model. In this approach, clients pay a "straightforward" acquisition cost for individual drugs as well as a small markup that covers dispensing and service costs.

Walgreens, in turn, recently launched a new digital marketplace, called Rx Savings Finder, designed to help customers save money on prescription medications.

Wentworth said he sees momentum toward ‘cost plus’ models. ‘If you look at the innovation and reimbursement in pharmacy that's likely to evolve, it's likely to evolve in such a way that the margin per drug is going to be largely based on how much service do we provide to patients that's receiving it,’ Wentworth told analysts during a Q&A on the earnings call.”2

The notion that a cost-plus business model is innovative is curious, unless by “innovative” one means extraordinarily profitable. No business model in the history of capitalism has done less to reduce costs than the cost-plus model, as the very name suggests.

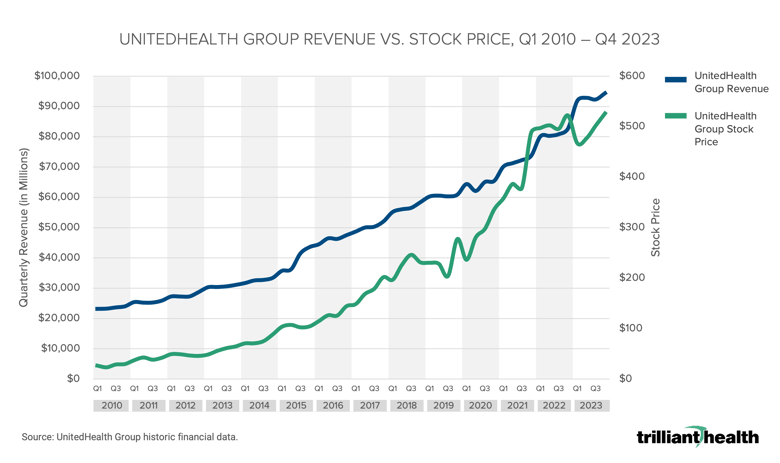

In turn, nothing has facilitated the development of the healthcare-industrial complex than cost-plus business models. HCA is the largest and most valuable health system in the United States. From its founding in 1968 until 1987, HCA grew from one hospital to 266, almost all of which were acquired or developed before CMS eliminated most cost-plus reimbursement with the introduction of DRGs in 1983.3 As we have previously written, the passage of the Affordable Care Act in 2010 ushered in an era of cost-plus health insurance. This graph shows the growth of UnitedHealthcare since then:

Cost-plus business models produced $14,000 toilet plate lids for the Pentagon and $18 baby aspirin tablets.4,5 What are the “costs” of Mark Cuban Cost Plus Drug Company’s suppliers, and their suppliers, and their suppliers? For legacy pharmaceutical industry stakeholders, Mark Cuban Cost Plus Drug Company’s business model is akin to an Air Force squadron laying ground fire to clear the advance for Army and Marine battalions, as well as a potential buttress against CMS’s attempt to negotiate drug prices.

While the skepticism among employers and Congress about PBMs is well-founded, the focus on price transparency as the panacea to rising drug costs masks a more critical development: the emerging – and existential – battle pitting life sciences firms against health economy stakeholders whose business models depend on “hands on” interventional and procedural medicine delivered in acute and ambulatory settings.

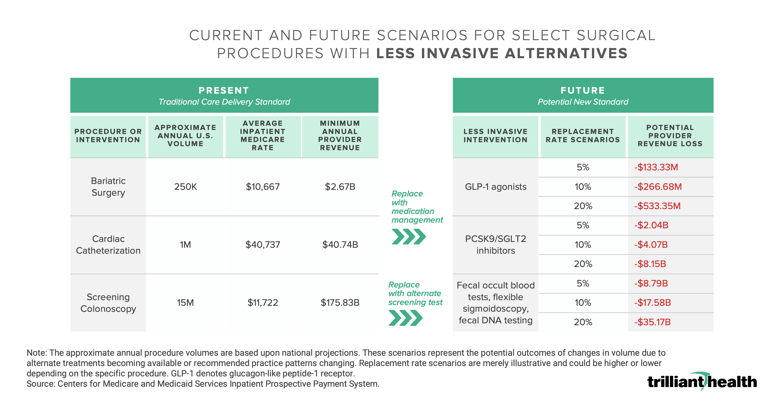

In our 2023 Trends Shaping the Health Economy Report, we highlighted the potential of therapeutic interventions to become what economists call “substitute goods” for longstanding surgical interventions.

Last week, I followed my internist’s recommendation to undergo a colonoscopy, even though I understand the findings of the NordICC trial. My internist, who is employed by a health system, referred me to a GI surgeon in his practice to undergo the procedure in a hospital outpatient department. Since I have not yet met my $6,000 deductible, I didn’t ask my internist for a referral to another surgeon who would perform the procedure at an ambulatory surgery center.

My acquiescence to undergoing a surgical procedure that does not impact mortality in a more costly hospital-based setting is rooted in my “Direction Taker” psychographic profile, which I share with 17.6% of Americans. As a Direction Taker, I am inclined to follow physician guidance, in contrast to a “Self Achiever” (23.3% of Americans) who might opt to utilize Cologuard®. While I am not inclined to utilize Cologuard’s decidedly non-invasive solution, I would prefer Medtronic’s PillCam™ to a screening colonoscopy, but my internist did not offer that as an alternative.

If my internist had recommended the PillCam™, my antipathy for the required colonoscopy “prep” would likely have changed my acquiescence to do what my internist’s employer prefers: an in-network referral to a higher cost hospital outpatient department for a surgical procedure. Instead, I would have inquired about the cost of the PillCam™ as compared to the cost of a screening colonoscopy; if my out-of-pocket costs were similar, I might have decided to pay cash for the PillCam™. As a consumer, I would prefer the PillCam™, in which case Medtronic would benefit to the detriment of my internist’s employer. And, as a consumer, I might be willing to undergo a less invasive form of screening more frequently than every five years.

An increasing number of health economy stakeholders want “customers for life,” the hallmark of every consumer-focused business. Just as large retailers like Amazon want to disintermediate primary care by delivering every healthcare product or service that it offers – PillPack, One Medical, etc. – to its customers, life sciences firms want to deliver as many “substitute goods” as possible, like PillCam™ in place of a screening colonoscopy or like GLP-1s in place of bariatric surgery.

It is staggering to consider the implications of an “innovation” in reimbursing pharmaceutical companies on a cost-plus basis for delivering therapeutic alternatives to “interventional” medicine by “converting” millions of “one-time” surgical procedures into “lifetime prescription subscriptions.” Having seen the industry’s fawning reception to the Mark Cuban Cost Plus Drug Company, it is unsurprising that market leaders like CVS and Walgreens would be enthusiastic supporters of a growing business with guaranteed margins.

By analogy, imagine that Netflix’s subscription rate was based on a 15% markup of its aggregate production costs. Actors, producers and studios would have no incentive to control salaries or production costs, and neither would Netflix. But Netflix doesn’t represent $406B of U.S. GDP, as prescription drug spending does.6

Only Medicaid spending is increasing at a higher rate than prescription drug spending, and an industrywide adoption of cost-plus business models for pharmaceuticals would eliminate any constraints on future growth. In the short-term, consumer preference for noninvasive or less invasive therapeutics in place of surgical interventions might lower costs, but the cost of a lifetime prescription subscription would ultimately be higher. While employers are ill-suited to differentiate between “substitute” clinical interventions, they would be equally ill-advised not to do so. At a minimum, cost considerations would require employers to evaluate splitting the medical benefit from the pharmacy benefit.

Therein lies the dilemma for the employer. The employer – and every American – needs health economy stakeholders to deliver value for money. As we have written, in Delaware, directors and officers of corporations owe a fiduciary duty of care to the corporation and its stockholders, which requires them “to make informed business decisions” based on “the information that is material to the decision” and “to review the information critically.”7,8 Healthcare benefits costs are a material expense for almost every employer, and health plan price transparency data makes it possible to understand value for money. If employers don't do it for themselves, then they should expect more lawsuits like this one.

Whether substituting a lifetime prescription subscription to a therapeutic in lieu of occasional surgical interventions delivers value for money to employers is an open question that should be determined by the comparative efficacy and cost of the competing treatments. The answer to that question is potentially detrimental to providers of healthcare services.

Whether cost-plus business models deliver value for money is a rhetorical question, the answer to which is “No.” Every cost-plus business model is an anathema to delivering value for money.

Anyone who can build a cost-plus business model based on marketing that touts how they will benefit is brilliant, if cynical. Anyone who does that is also part of the problem. Health economy stakeholders must eventually stop treating employers like Jimmy Buffett’s protagonist: “fins to the left, fins to the right, and you’re the only bait in town.”