Studies Archive

Telehealth’s Total Addressable Market is Smaller Than Advertised and Continues to Decline

March 6, 2022Every business is ultimately beholden to the total addressable market (TAM), regardless of the nature of the good or service. Given that healthcare is the largest sector of the U.S. economy, TAM is an important construct in contextualizing health economy trends, especially in emerging sectors like telehealth.

Over the last two years, health economy stakeholders from policymakers and investors to health systems and retailers have aggressively pursued telehealth expansion, influenced by the widely held perception that the COVID-19 pandemic would catalyze long-term telehealth adoption. This was further reinforced by a variety of small sample, survey findings concluding that patients and providers alike unequivocally “love” telehealth. In reality, 46% of telehealth patients in 2020 and 2021 only used it once, meaning that the surge of new market entrants like Amazon and Walmart are competing with a number of established telehealth providers for a small and declining number of healthcare consumers.

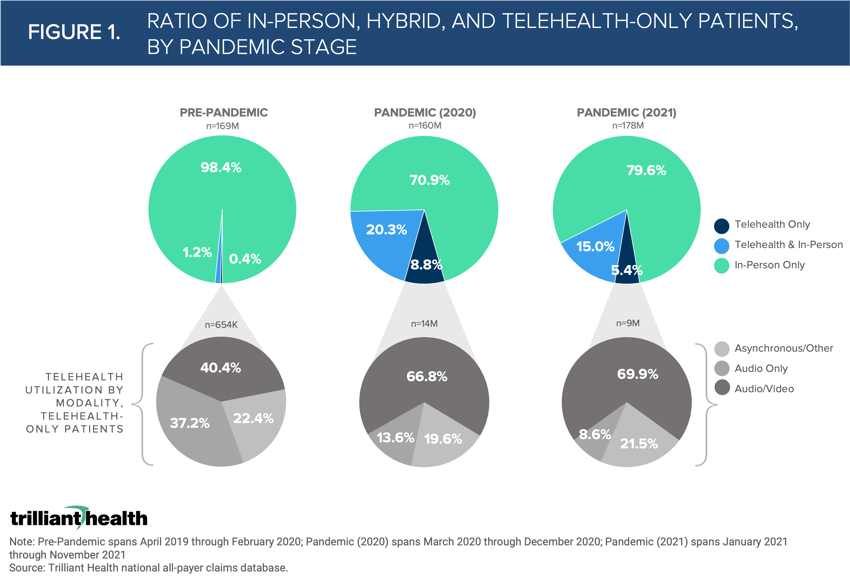

Patients engaged in “hybrid” care, or a combination of in-person and telehealth, represented 20.3% of the population in March through December of 2020, but that segment has decreased by 25%, with only 15% of patients engaged in hybrid care in 2021 (Figure 1). Given the gradual return to in-person care, rather than a widening transition to virtual care, it can be concluded that telehealth is not a preferred substitute for in-person care, except for Behavioral Health.

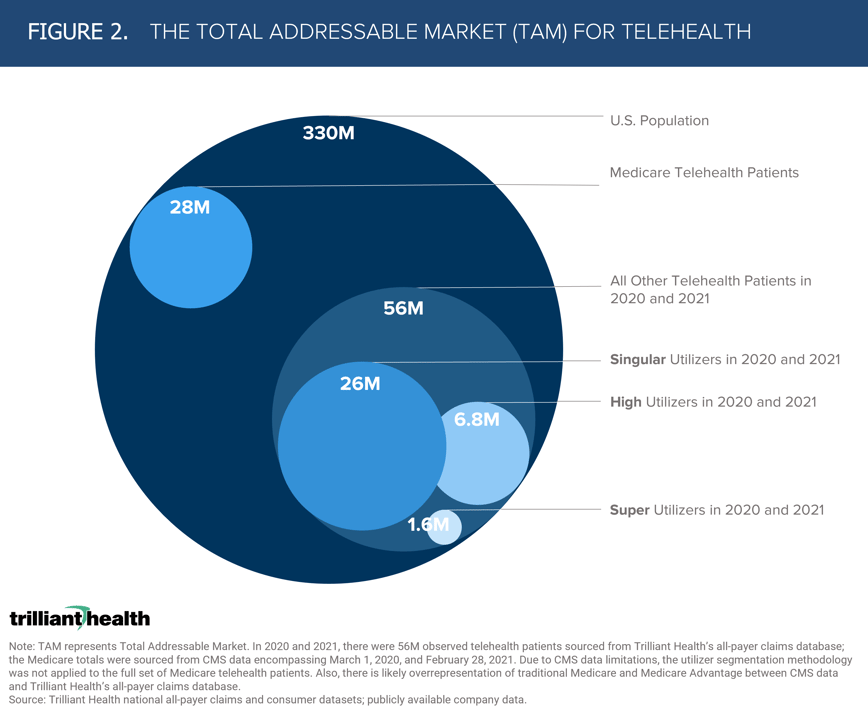

While 330M Americans could have used telehealth over the last two years, almost 75% did not. Given the numerous incentives to use telehealth during the pandemic, it is reasonable to wonder whether the 84M Americans who did utilize telehealth (28M Medicare beneficiaries and 56M Americans with other health coverage) represent the peak of potential telehealth patients (Figure 2).

Of the 84M individuals who utilized telehealth between January 2020 and November 2021, 26M used telehealth only once (Singular Utilizers), suggesting a low likelihood of integrating telehealth into their future healthcare utilization. Whether the size of the telehealth market shrinks to mirror luxury brands with niche markets or will ultimately expand, utilization patterns observed during the COVID-19 pandemic are unlikely to return following the end of the public health emergency.

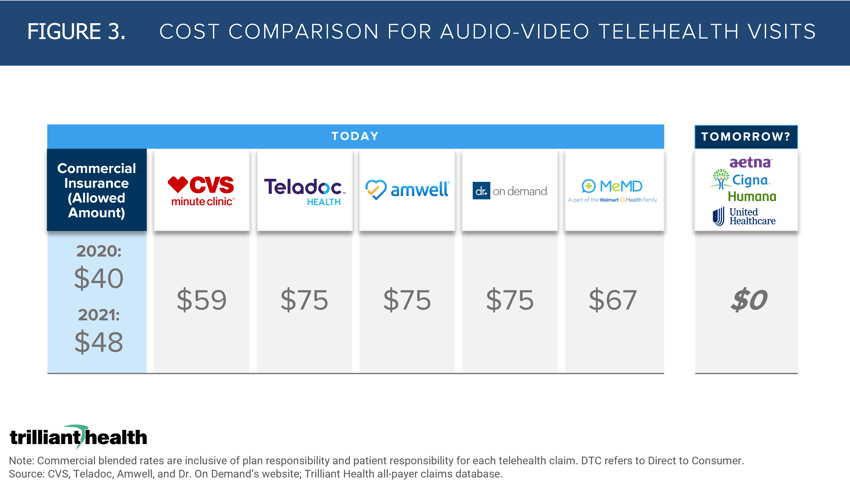

What is clear today is that demand is declining, and supply is increasing, which principles of economics suggest will result in the price of telehealth gradually declining. The marginal cost of delivering telehealth for large suppliers is approaching $0, especially for commercial payers that are incentivized to offer telehealth as a benefit at no additional cost beyond monthly premiums. Suppliers charging $50-$75 for telehealth visits will not be viable competitors long term, especially as lower cost and potentially no-cost options provided by payers become more prevalent (Figure 3). In the current market, the best-case scenario for TAM would take the patient visit cost—such as the $67 Walmart visit—multiplied by the number of consumers—the 84M telehealth patients across payer types in 2020 and 2021—multiplied by the average number of visits (5), bringing the TAM to $28.1B. However, even if every single one of those patients continued using telehealth, the TAM would be $0 if telehealth becomes an essentially zero-cost option under commercial insurance.

As the cost of telehealth for the commercially insured approaches $0, retail prices (e.g., Walmart, CVS, Amazon) will inevitably decline as well. If retail prices approach $0, what is the future of an industry with essentially a $0 TAM?

Thanks to Kelly Boyce and Katie Patton for their research support.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)