Studies Archive

The Total Available Market of Commercially Insured Patients is Shrinking

October 23, 2022Key Takeaways

-

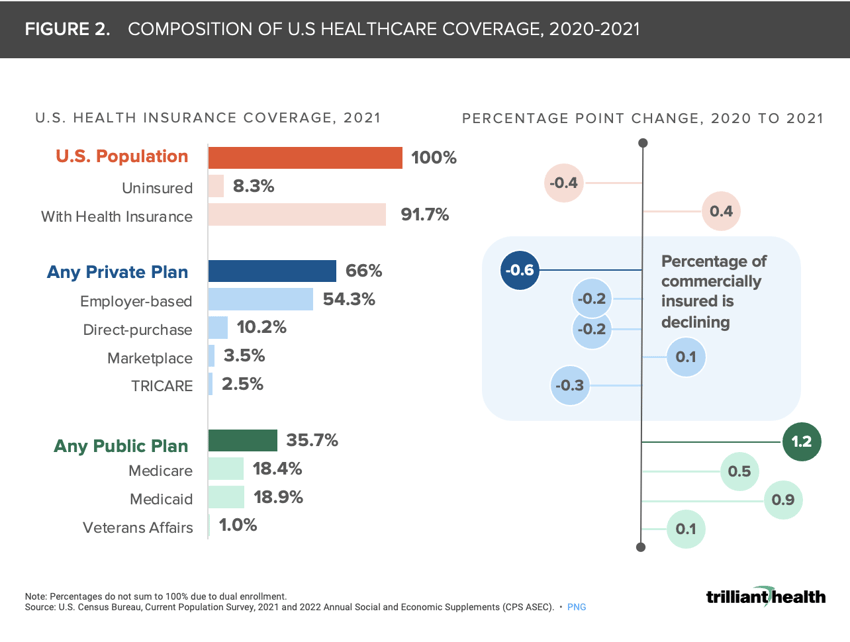

The overall share of commercially insured Americans dropped 0.6 percentage points from 2020 to 2021.

-

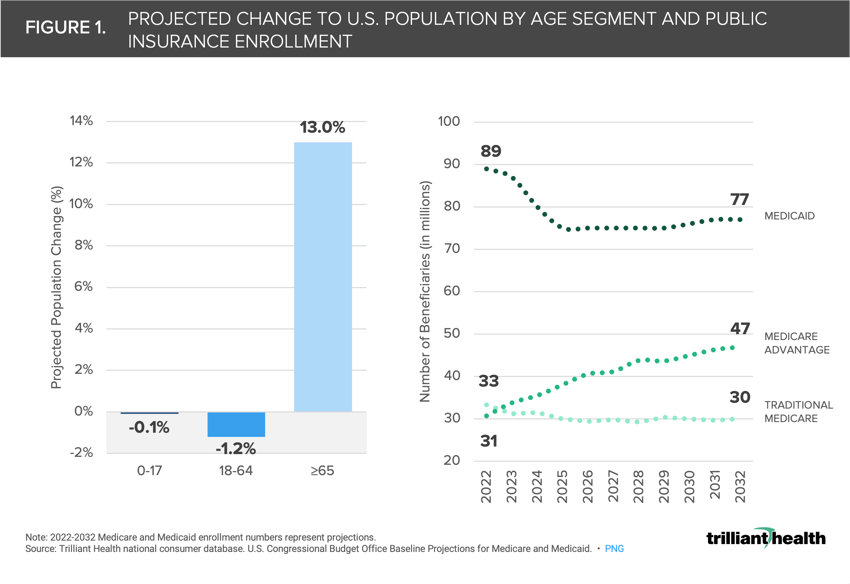

Between 2022 and 2027, the under 18 population is projected to decline by 0.1% and the working-age adult population (i.e., age 18-64) is projected to decline by 1.2%. However, the 65+ population is expected to increase by 13% during the same time period.

-

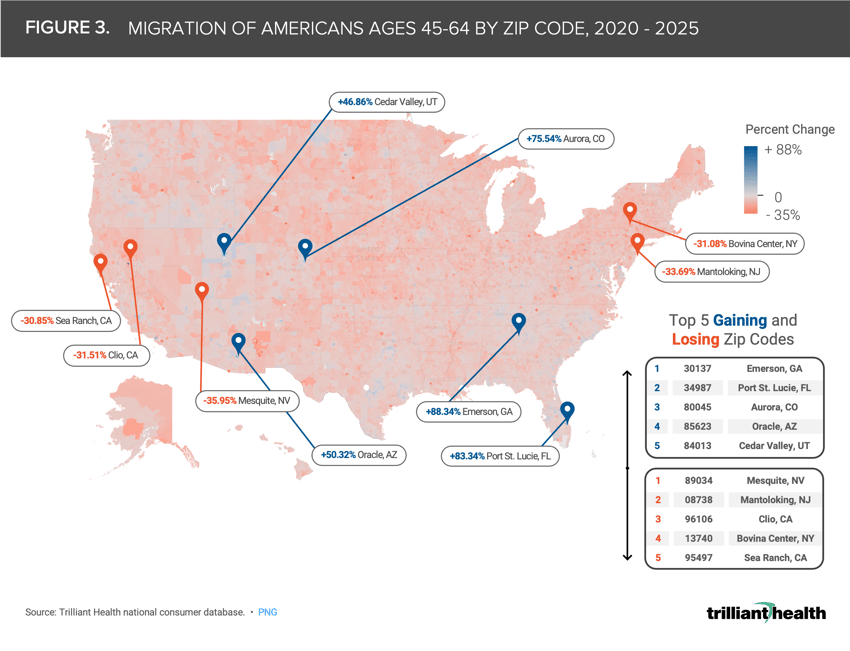

Over the next five years, high growth in the 45-64 population is expected in the Carolinas, Orlando, Houston, Austin, Dallas-Ft Worth, and Phoenix because of population migration, rather than underlying population growth.

Healthcare is the largest sector in the largest economy in the world, and commercially insured Americans account for the majority of profitable revenue for virtually every health economy stakeholder. However, the number of commercially insured Americans is declining due to several interconnected factors:

- The American population is aging.

- Enrollment in public programs (i.e., Medicare and Medicaid) is outpacing enrollment in commercial insurance.

- Excess mortality amid the COVID-19 pandemic disproportionately impacted young and working-age adults (ages 15-64), many of whom are traditional commercially insured age cohorts.

- Commercially insured adults in the 45-64 age cohort are migrating from California and states in the Northeast to states like Colorado, Florida, Georgia, North Carolina, Utah and Texas.

The American Population Is Aging

Although U.S. life expectancy declined substantially amid the COVID-19 pandemic, the U.S. population is still aging in terms of average age and age cohorts.1 Between 2022 and 2027, the under 18 population is projected to decline by 0.1%, and the working-age adult population (i.e., ages 18-64) is projected to decline by 1.2% (Figure 1). However, the 65+ population is expected to increase by 13% during the same time period. In turn, Medicare enrollment is projected to grow 20.3% over the next 10 years. Of the projected 77M Medicare beneficiaries in 2023, the majority (47M) are expected to be enrolled in Medicare Advantage.

Enrollment in Public Programs Is Outpacing Commercial Insurance

The overall share of commercially insured Americans dropped 0.6 percentage points from 2020 to 2021 (Figure 2). Of this cohort, individuals insured via Marketplace (i.e., Healthcare.gov coverage) increased by 0.1 percentage points from 2020 to 2021. While much of this decline is correlated with the aging population and excess mortality, the Great Resignation also had a sustained impact on the employer-sponsored insurance market.2

Migration of Older Commercially Insured Adults Is Concentrated in Certain Geographies

Migration of Older Commercially Insured Adults Is Concentrated in Certain Geographies

Commercially insured patients that tend to need the most medical care fall between ages 45-64. Reimbursement rates for this age cohort inevitably are higher than Medicare rates for similar services. However, like many other Americans, individuals ages 45-64 are migrating to other areas of the country. Migration patterns of this particular age cohort, which are increasingly concentrated in the Sunbelt region, foreshadow changes in healthcare demand. Over the next five years, high growth in the 45-64 population is expected in the Carolinas, Orlando, Houston, Austin, Dallas-Ft Worth, and Phoenix due to population migration patterns, rather than underlying population growth (Figure 3).

While the decline of commercially insured patients has negative implications for all stakeholders in the health economy, those whose businesses are concentrated in markets from which Americans aged 45-64 are migrating likely face the greatest financial impact as the revenue mix of their book of business becomes less profitable. The long-term implications of these trends remain to be seen, but every stakeholder knows that healthcare is local, and understanding how markets differ in demand and supply will inevitably impact the yield from each of those markets.

While the decline of commercially insured patients has negative implications for all stakeholders in the health economy, those whose businesses are concentrated in markets from which Americans aged 45-64 are migrating likely face the greatest financial impact as the revenue mix of their book of business becomes less profitable. The long-term implications of these trends remain to be seen, but every stakeholder knows that healthcare is local, and understanding how markets differ in demand and supply will inevitably impact the yield from each of those markets.

.png)

.png?width=171&height=239&name=2025%20Trends%20Report%20Nav%20(1).png)